House Passes Trump Tax Bill: Key Changes And Implications

Table of Contents

Individual Income Tax Changes

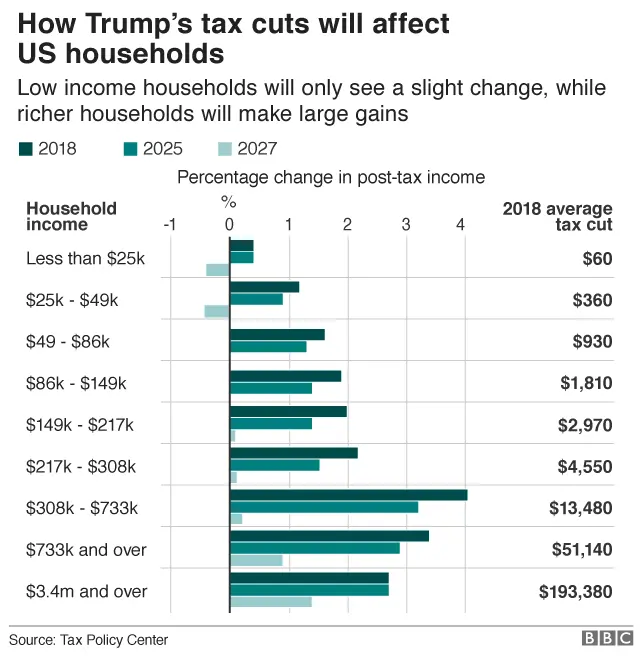

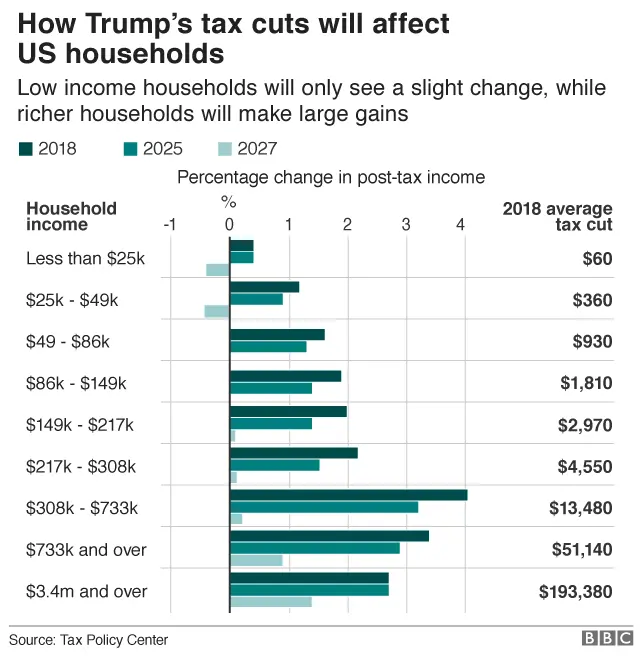

The Trump Tax Bill brought about substantial changes to individual income taxes, impacting taxpayers across different income brackets.

Lower Tax Rates

The bill reduced individual income tax rates. Here's a comparison of pre- and post-Tax Cuts and Jobs Act (TCJA) rates:

- Pre-TCJA: Higher tax brackets and rates existed, resulting in a larger tax burden for higher earners.

- Post-TCJA: The number of tax brackets was reduced, and rates were lowered across the board. For example, the top individual income tax rate dropped from 39.6% to 37%.

This simplification aimed to stimulate economic activity by leaving more money in the hands of taxpayers. However, the impact varied significantly based on income level and individual circumstances.

Standard Deduction Increases

The Trump Tax Bill significantly increased the standard deduction. This change made it less advantageous for many taxpayers to itemize deductions.

- Increased Standard Deduction: This meant more taxpayers could benefit from a simpler tax filing process by taking the standard deduction instead of itemizing.

- Impact on Itemizing: The higher standard deduction effectively reduced the number of people who itemized, simplifying tax preparation for many.

This change benefited many middle- and lower-income families, simplifying their tax filings and resulting in potential tax savings.

Changes to Personal Exemptions

The TCJA eliminated personal and dependent exemptions, a major shift from previous tax law.

- Elimination of Personal Exemptions: This change removed the deduction for each taxpayer and dependent.

- Impact on Family Tax Burdens: While the increased standard deduction offered some offsetting benefit, families with multiple dependents might have experienced a net increase in their tax burden depending on their specific circumstances.

This alteration impacted family tax planning strategies, requiring adjustments to account for the loss of these deductions.

Child Tax Credit Expansion

The Trump Tax Bill expanded the Child Tax Credit (CTC), making it more generous and accessible to more families.

- Increased Credit Amount: The maximum credit amount increased.

- Expanded Refundability: A portion of the credit became refundable, meaning taxpayers could receive a refund even if their tax liability was zero.

This expansion provided significant tax relief for families with children, reducing their tax burden and potentially boosting their disposable income.

Corporate Tax Rate Reduction

One of the most significant changes introduced by the Trump Tax Bill was a dramatic reduction in the corporate tax rate.

Lower Corporate Tax Rate

The corporate tax rate was slashed from 35% to 21%.

- Impact on Corporate Profits: This substantial reduction significantly increased corporate profits and potentially boosted investment.

- Intended Economic Effects: Proponents argued this would spur economic growth through increased business investment and job creation.

The lower rate aimed to enhance the competitiveness of American businesses on the global stage.

Impact on Business Investment

The lower corporate tax rate was projected to stimulate business investment.

- Increased Capital Expenditures: Businesses were expected to allocate more capital towards expansion, modernization, and research & development.

- Job Creation Potential: This increased investment was anticipated to lead to job creation and overall economic growth.

However, the actual impact of this provision on business investment and job creation remained a subject of ongoing debate and economic analysis.

International Tax Implications

The Trump Tax Bill also altered international tax rules, affecting multinational corporations.

- Changes to Foreign Tax Credits: Modifications were made to foreign tax credits, impacting how companies could offset foreign taxes paid against their US tax liability.

- Taxation of Foreign Income: Rules regarding the taxation of foreign income were revised, impacting how profits earned abroad were treated for tax purposes.

These changes aimed to encourage the repatriation of profits held overseas while also addressing concerns about tax avoidance by multinational companies.

Other Key Changes and Implications

The Trump Tax Bill included several other notable provisions with far-reaching consequences.

Pass-Through Businesses

The legislation introduced a new deduction for pass-through businesses, like partnerships and S corporations.

- Qualified Business Income (QBI) Deduction: This deduction allowed owners of pass-through entities to deduct a portion of their qualified business income, reducing their tax liability.

- Impact on Small Business Owners: This provision provided significant tax relief for many small business owners and entrepreneurs.

However, complexities in the QBI deduction's rules and limitations created challenges for some taxpayers.

Estate and Gift Taxes

The Trump Tax Bill made changes to estate and gift taxes.

- Increased Exemption Amounts: The exemption amounts for estate and gift taxes were significantly increased, meaning fewer estates were subject to these taxes.

- Impact on Wealth Transfer: This change had a substantial impact on wealth transfer planning, benefiting high-net-worth individuals.

These adjustments eased the tax burden on inherited wealth.

Affordable Care Act (ACA) Implications

The Trump Tax Bill included provisions affecting the Affordable Care Act (ACA).

- Individual Mandate Penalty Repeal: The individual mandate penalty, a key component of the ACA, was repealed. This impacted the number of individuals with health insurance.

- Impact on Healthcare Costs and Access: The long-term consequences of this repeal on healthcare costs and access remained a subject of ongoing discussion and analysis.

This change had significant implications for healthcare coverage and affordability in the United States.

Conclusion

The Trump Tax Bill introduced a wide range of significant changes to the US tax system. These modifications impacted individual taxpayers, businesses, and various sectors of the economy. From lower individual and corporate tax rates to alterations in deductions and credits, the bill reshaped the tax landscape. Understanding these changes is critical for effective tax planning and compliance. To ensure you understand the implications of the Trump Tax Bill and plan your taxes effectively under the new law, consult a tax advisor for personalized advice tailored to your specific financial situation. Learn more about the Trump Tax Bill changes and how they affect you by speaking to a qualified tax professional. Don't delay; understand the implications of the Trump Tax Bill today!

Featured Posts

-

Big Rig Rock Report 3 12 99 7 The Foxs Trucking Update

May 23, 2025

Big Rig Rock Report 3 12 99 7 The Foxs Trucking Update

May 23, 2025 -

The Jonas Brothers Couples Fight And Joes Reaction

May 23, 2025

The Jonas Brothers Couples Fight And Joes Reaction

May 23, 2025 -

Analyzing Jonathan Groffs Chances At A Tony Award For Just In Time

May 23, 2025

Analyzing Jonathan Groffs Chances At A Tony Award For Just In Time

May 23, 2025 -

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025 -

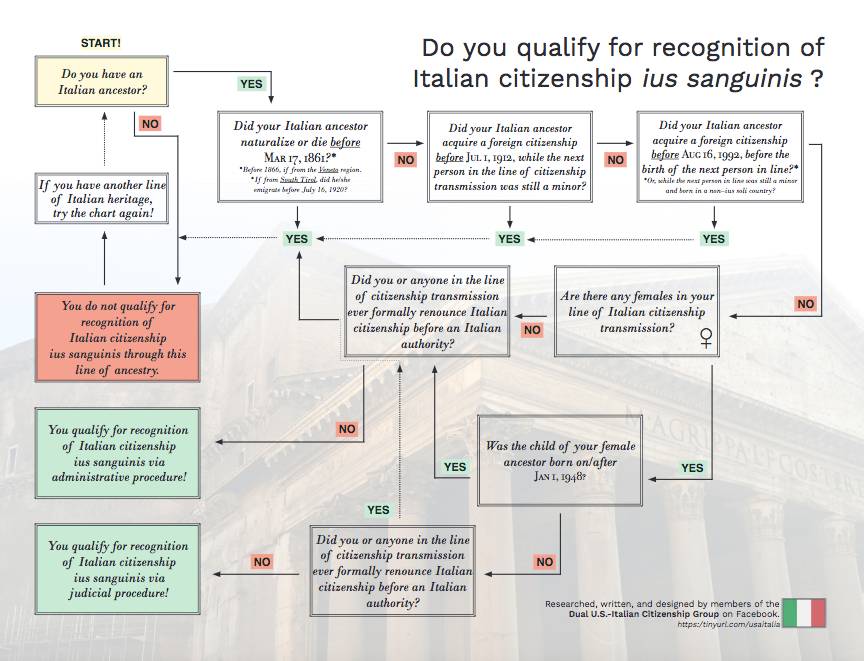

Understanding Italys New Citizenship Law For Great Grandchildren

May 23, 2025

Understanding Italys New Citizenship Law For Great Grandchildren

May 23, 2025