How A Crypto Bro Shorted $TRUMP Coin And Won A White House Dinner

Table of Contents

Understanding the $TRUMP Coin Phenomenon

$TRUMP Coin, a prime example of a meme coin, emerged in the volatile landscape of cryptocurrency. Its creation, fueled by the fervent online support of a particular political figure, led to an initial price surge, attracting investors seeking quick profits. However, the coin's meme-based nature means it lacks intrinsic value, unlike established cryptocurrencies like Bitcoin or Ethereum. Its price is largely driven by speculation, social media trends, and news cycles, making it highly susceptible to manipulation and extreme volatility.

- Rapid price fluctuations: News articles, social media posts, and even tweets from prominent figures could cause dramatic price swings in $TRUMP Coin, creating both opportunities and immense risks for traders.

- High potential for both gains and losses: The coin's erratic behavior presents the chance for significant returns, but also the possibility of catastrophic losses if the market turns against you.

- Lack of intrinsic value: Unlike established cryptocurrencies with underlying technology or use cases, $TRUMP Coin's value is entirely dependent on market sentiment and speculation.

The Crypto Bro's Short-Selling Strategy

Our crypto trader, let's call him "Alex," recognized the inherent risk and volatility of $TRUMP Coin. He employed a short-selling strategy, a sophisticated trading technique where you borrow an asset (in this case, $TRUMP Coin), sell it at the current market price, and hope to buy it back later at a lower price, pocketing the difference as profit. Alex's analysis suggested an impending price drop, perhaps due to waning public interest or negative news cycles.

- Borrowing and selling: Alex borrowed $TRUMP Coin from a cryptocurrency exchange and immediately sold it, capitalizing on its then-high price.

- Anticipating a price drop: His prediction was based on a combination of technical analysis, sentiment analysis of social media, and an understanding of the inherently unstable nature of meme coins.

- Leveraging potential (speculative): While not explicitly stated, it’s likely Alex may have used leverage to amplify his potential profit. This, however, would also magnify his losses if the price moved against his prediction. Leverage is a double-edged sword in the crypto world.

The Unexpected White House Dinner Invitation

This is where the story takes a truly bizarre turn. Alex's successful short-selling strategy, which yielded a considerable profit, unexpectedly led to an invitation to a White House dinner. The connection remains shrouded in mystery, but it's speculated that the dinner was part of a contest or a unique philanthropic initiative involving cryptocurrency investments and political engagement. Regardless of the precise details, the event garnered significant media attention and sparked debates about the intersection of cryptocurrency, politics, and high-stakes finance.

- Circumstances surrounding the invitation: The precise details remain unclear, adding to the intrigue and speculation surrounding the event. Several theories circulate online, including a private competition involving crypto trading profits and a charitable donation element.

- Public reaction: The story generated considerable buzz across social media and news outlets, sparking discussions about the risks and rewards of cryptocurrency investing.

- Speculation on $TRUMP Coin's future: The event has undoubtedly increased the notoriety of $TRUMP Coin, though its long-term viability remains questionable given its volatility and lack of fundamental value.

Lessons Learned from the $TRUMP Coin Short

Alex's experience, while unusual in its outcome, offers valuable lessons for cryptocurrency traders:

- Risk Management: Never invest more than you can afford to lose. Cryptocurrency trading, especially with volatile meme coins, carries significant risk.

- Thorough Research: Always conduct thorough research before investing in any cryptocurrency. Understanding the underlying technology, the project's goals, and the market sentiment is crucial.

- Portfolio Diversification: Diversify your investments across different asset classes to mitigate risk. Don't put all your eggs in one basket, especially a volatile one like $TRUMP Coin.

Conclusion

The story of the crypto trader's successful short selling of $TRUMP Coin and the subsequent, unexpected White House dinner invitation is a fascinating, albeit unusual, tale. It highlights the potential for both significant profits and substantial losses in the volatile world of cryptocurrency trading, particularly with meme coins. While the story of the crypto bro and his White House dinner is unusual, it highlights the importance of understanding the risks and rewards before engaging in any $TRUMP Coin trading. Learn about responsible cryptocurrency investing and risk management strategies before venturing into the world of meme coins.

Featured Posts

-

The New Nike Air Max Dn8 A Detailed Review

May 29, 2025

The New Nike Air Max Dn8 A Detailed Review

May 29, 2025 -

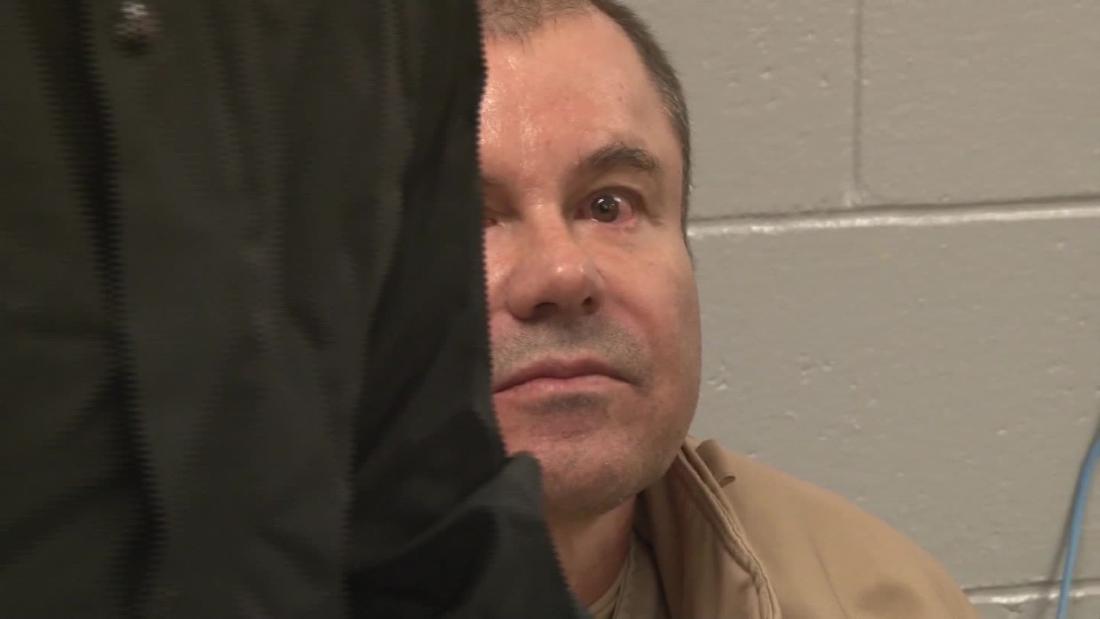

Us Prosecutors Spare El Chapos Son The Death Penalty

May 29, 2025

Us Prosecutors Spare El Chapos Son The Death Penalty

May 29, 2025 -

Fuenf Tage C O Pop Das Erwartet Sie In Koeln

May 29, 2025

Fuenf Tage C O Pop Das Erwartet Sie In Koeln

May 29, 2025 -

Starbase La Ville De Space X Au Texas

May 29, 2025

Starbase La Ville De Space X Au Texas

May 29, 2025 -

Online Shopping Guide For Nike Air Jordan 9 Retro Cool Grey Price And Availability

May 29, 2025

Online Shopping Guide For Nike Air Jordan 9 Retro Cool Grey Price And Availability

May 29, 2025