How Ind AS 117 Is Restructuring India's Insurance Landscape

Table of Contents

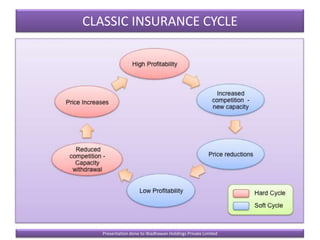

Impact of Ind AS 117 on Financial Reporting in Indian Insurance

Ind AS 117 has brought about sweeping changes to the financial reporting practices of Indian insurance companies. Understanding these changes is crucial for investors, regulators, and insurers alike.

Changes in Revenue Recognition

Ind AS 117 mandates a significant shift from the previous revenue recognition practices prevalent under previous Indian GAAP. This impacts how premiums are accounted for and recognized over the policy period. Key changes include:

- Shift from upfront recognition to recognizing revenue over the contract period: Instead of recognizing the entire premium upfront, insurers now recognize revenue gradually over the policy's life, aligning with the service provided. This requires a more nuanced understanding of the insurance contract's terms and conditions.

- Increased complexity in revenue allocation based on risk and time: Allocating revenue accurately necessitates a more sophisticated approach, considering the risk profile of each contract and the time period over which the insurer provides coverage. This requires advanced actuarial modeling.

- Impact on profitability metrics and financial statement presentation: The shift in revenue recognition directly impacts profitability metrics. Financial statements need to be restructured to reflect this change, leading to a more accurate representation of the insurer's financial health. Comparative analysis of financial statements becomes more complex, necessitating adjustments for the impact of Ind AS 117.

Impact on Liability Measurement

Ind AS 117 introduces a more complex methodology for measuring insurance liabilities. This necessitates a greater degree of actuarial expertise and sophisticated modeling capabilities.

- Need for sophisticated models to estimate future cash flows: Accurately estimating future cash flows requires the use of advanced actuarial models that consider various factors, including mortality rates, lapse rates, and investment returns.

- Increased sensitivity to changes in interest rates, mortality rates, and lapse rates: Changes in these key factors directly impact the estimation of insurance liabilities, making financial reporting more sensitive to market fluctuations.

- Implications for solvency and capital adequacy requirements: Accurate liability measurement is crucial for determining solvency and meeting capital adequacy requirements. Ind AS 117's stricter liability measurement rules impact capital planning and risk management strategies.

Operational Changes Driven by Ind AS 117 Implementation in the Indian Insurance Sector

The implementation of Ind AS 117 has forced Indian insurers to adapt their operational practices to ensure compliance.

Enhanced Risk Management

Ind AS 117 demands a more robust risk management framework. This ensures accurate assessment and accounting for risks inherent in insurance contracts. Key improvements include:

- Improved data management and analytical capabilities: Effective risk management requires accurate data collection, processing, and analysis. Insurers are investing in robust data management systems to support this process.

- More rigorous risk assessment and pricing methodologies: The adoption of Ind AS 117 has forced insurers to refine their risk assessment and pricing methodologies to ensure adequate risk provisioning.

- Better monitoring and control of underwriting performance: Real-time monitoring of underwriting performance is crucial for identifying and mitigating potential risks. Ind AS 117 has spurred improvements in this area.

Investment in Technology and Infrastructure

Compliance with Ind AS 117 requires significant investment in technology and infrastructure. This handles the increased data requirements and complexities.

- Adoption of advanced actuarial software and systems: Sophisticated actuarial software is essential for accurate liability measurement and revenue recognition.

- Enhanced data analytics and reporting capabilities: Data analytics play a critical role in risk management and compliance. Insurers are investing in advanced analytical tools to improve data insights.

- Investments in IT infrastructure to support the new accounting processes: The new accounting processes require robust IT infrastructure capable of handling large volumes of data and complex calculations.

Competitive Landscape and Consolidation within the Indian Insurance Market

Ind AS 117's implementation is reshaping the competitive landscape of the Indian insurance market.

Increased Compliance Costs

The cost of complying with Ind AS 117 varies depending on the insurer's size and complexity. This cost can significantly impact competitiveness.

- Impact on smaller insurers facing higher compliance burdens: Smaller insurers may find it more challenging to absorb the compliance costs, potentially leading to consolidation.

- Potential for consolidation as smaller players struggle to adapt: The increased compliance costs could drive mergers and acquisitions as smaller players seek to leverage the resources of larger firms.

- Opportunities for larger insurers with robust systems and resources: Larger insurers with established IT infrastructure and actuarial expertise are better positioned to navigate the complexities of Ind AS 117.

Restructuring of Insurance Products and Services

Insurers are adapting their product offerings and service delivery models to align with Ind AS 117's requirements.

- Re-design of insurance contracts to simplify accounting: Insurers are streamlining their contract terms to simplify the accounting process and minimize complexities.

- Focus on products with clearer risk profiles: Ind AS 117 emphasizes the importance of clear risk profiles. Insurers are focusing on products with well-defined risks.

- Changes in distribution channels and customer engagement strategies: Insurers are adapting their distribution channels and customer engagement strategies to align with the new accounting requirements.

Conclusion

Ind AS 117 is fundamentally altering the Indian insurance landscape, impacting financial reporting, operational practices, and the competitive dynamics of the market. The transition demands significant investments in technology, expertise, and robust risk management frameworks. While the compliance costs are substantial, the resulting improvements in transparency and accuracy should ultimately lead to a more stable and reliable insurance sector. Understanding the implications of Ind AS 117 is crucial for all stakeholders in the Indian insurance industry. To learn more about navigating the complexities of Ind AS 117 Insurance Contracts and ensuring smooth compliance, contact [Your Company/Resource].

Featured Posts

-

Torrent Freak Report La Liga Pushes For Googles Testimony In Piracy Case

May 15, 2025

Torrent Freak Report La Liga Pushes For Googles Testimony In Piracy Case

May 15, 2025 -

Dzho Bayden Na Vistavi Ta Inavguratsiyi Analiz Yogo Zovnishnogo Viglyadu

May 15, 2025

Dzho Bayden Na Vistavi Ta Inavguratsiyi Analiz Yogo Zovnishnogo Viglyadu

May 15, 2025 -

Limited Time Offer Boston Celtics Finals Gear For Less Than 20

May 15, 2025

Limited Time Offer Boston Celtics Finals Gear For Less Than 20

May 15, 2025 -

Boston Celtics Suffer Historic Game 1 Defeat Against Knicks

May 15, 2025

Boston Celtics Suffer Historic Game 1 Defeat Against Knicks

May 15, 2025 -

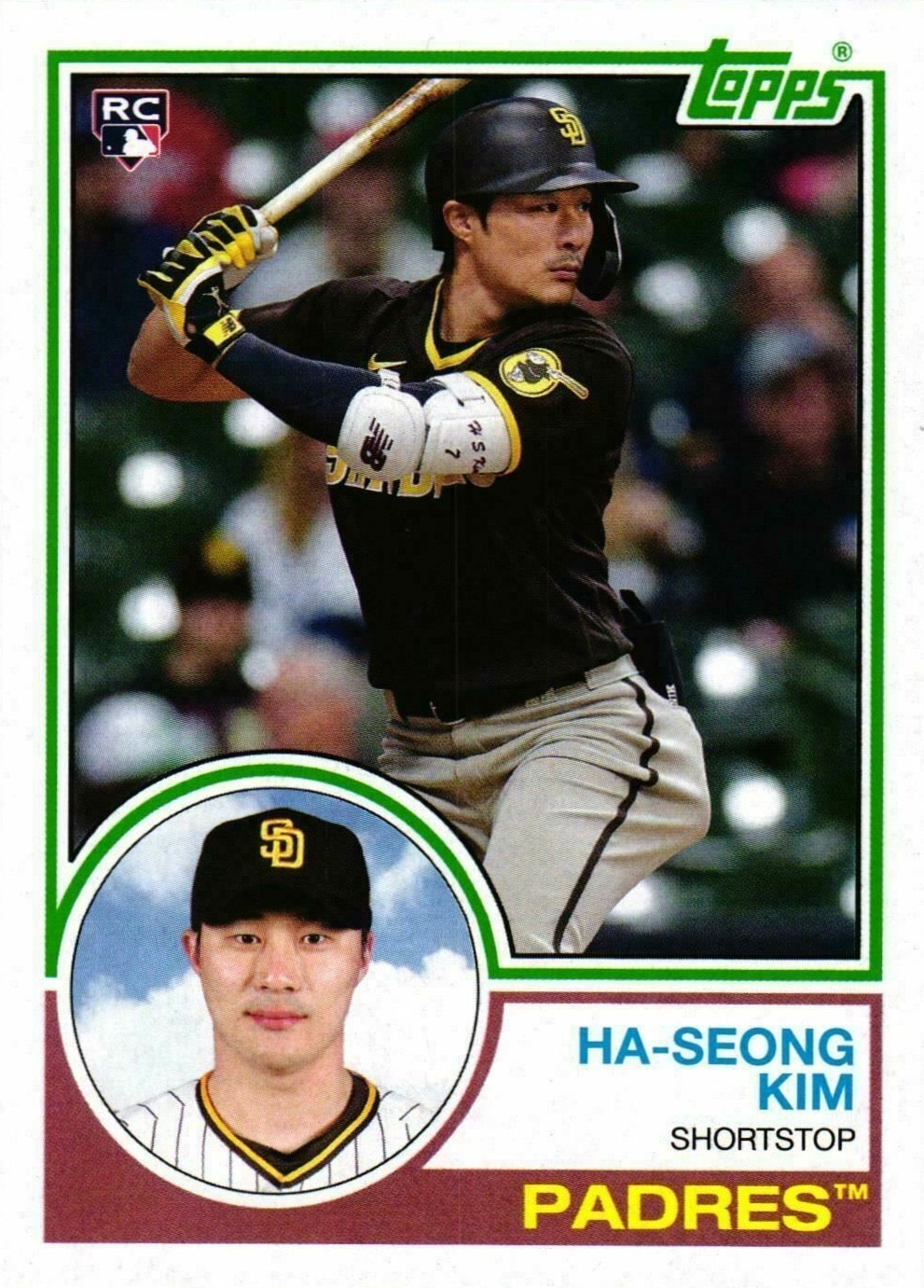

Navigating Mlb How Ha Seong Kim Benefits From His Friendship With Blake Snell

May 15, 2025

Navigating Mlb How Ha Seong Kim Benefits From His Friendship With Blake Snell

May 15, 2025