How JazzCash And KTrade Are Democratizing Stock Trading In Pakistan

Table of Contents

JazzCash's Role in Expanding Stock Market Access

JazzCash, a leading mobile financial service provider, has played a pivotal role in democratizing stock trading in Pakistan. Its innovative approach focuses on simplicity, accessibility, and security, making stock investment a possibility for previously excluded segments of the population.

Ease of Use and Accessibility

JazzCash’s investment platform boasts a remarkably user-friendly interface, requiring minimal technical expertise. This ease of use is a game-changer.

- Simple account creation: Setting up an account is straightforward, requiring minimal information.

- Low minimum investment amounts: JazzCash removes the barrier of high entry costs, allowing individuals to start investing with small amounts.

- Integration with existing mobile wallets: The seamless integration with existing JazzCash accounts means users can leverage their existing funds, eliminating the need to open separate brokerage accounts.

- Using existing JazzCash balances: Users can directly utilize their existing JazzCash balance for investments, streamlining the process significantly.

This intuitive design significantly lowers the barrier to entry, encouraging more people to participate in the stock market.

Reaching Underserved Populations

JazzCash's extensive network across Pakistan, particularly in rural areas, is instrumental in extending investment opportunities to previously underserved populations.

- Improved financial inclusion: It bridges the financial inclusion gap by bringing investment opportunities to those with limited access to traditional banking services.

- Increased participation from women and younger investors: The simplified process empowers women and young adults, who may have been hesitant to engage with traditional brokerage firms, to participate in the market.

- Positive impact on financial literacy: By providing simple, accessible investment options, JazzCash indirectly promotes financial literacy and awareness.

This widespread reach is vital in fostering financial inclusion and empowering marginalized communities.

Security and Trust

Security is paramount in any financial transaction. JazzCash leverages its established reputation and robust security measures to build investor confidence.

- Encryption protocols: Industry-standard encryption protocols protect user data and transactions.

- Regulatory compliance: Adherence to all relevant regulatory guidelines ensures a secure and trustworthy environment.

- Customer support channels: Dedicated customer support channels address user queries and concerns, providing peace of mind.

These security measures ensure a safe and reliable platform for stock trading.

KTrade's Contribution to a More Inclusive Stock Market

KTrade, a technologically advanced platform, complements JazzCash’s efforts, further democratizing stock trading in Pakistan through its innovative approach.

Technology-Driven Approach

KTrade's modern technology simplifies the complexities of stock trading, making it accessible to a broader audience.

- User-friendly app: The intuitive mobile app design makes navigating the platform and executing trades incredibly easy.

- Real-time market data: Access to real-time market data empowers informed decision-making.

- Educational resources: KTrade provides numerous resources, including tutorials and educational content, catering specifically to beginner investors.

- Beginner-friendly features: The platform incorporates features that specifically cater to beginner investors, guiding them through the process.

This technology-driven approach significantly reduces the learning curve associated with stock trading.

Lower Transaction Costs

KTrade's competitive pricing structure, with low fees and commissions, makes stock trading more affordable.

- Comparison to traditional brokerage fees: KTrade offers significantly lower fees compared to traditional brokerage houses.

- Cost-effectiveness for small investments: This is particularly beneficial for small investors, allowing them to participate without incurring excessive costs.

- Transparent pricing structure: Clear and transparent pricing ensures users understand all associated costs.

By minimizing transaction costs, KTrade enables more people to participate, regardless of their financial capacity.

Investment Education and Resources

KTrade actively promotes financial literacy through various educational initiatives.

- Online tutorials: Easy-to-follow online tutorials demystify the complexities of stock trading.

- Webinars: Regular webinars provide further insights and guidance on investment strategies.

- Educational materials: A wealth of educational materials is available to enhance understanding of the stock market.

- Accessible information on market trends: The platform provides easy access to information regarding market trends.

This commitment to education is crucial for empowering investors to make informed decisions.

The Overall Impact on the Pakistani Economy

The combined efforts of JazzCash and KTrade are having a significant positive impact on the Pakistani economy.

Increased Market Participation

The increased accessibility to stock trading is leading to higher market participation.

- Higher liquidity: A larger pool of investors leads to increased market liquidity, making trading smoother and more efficient.

- Greater capital formation: More participation translates to greater capital formation, which fuels economic growth.

- Potential for economic growth: Increased investment in the stock market can stimulate economic growth and development.

This broader participation creates a more robust and dynamic market.

Financial Inclusion and Empowerment

Democratizing stock trading has significant societal implications.

- Improved financial well-being: Access to investment opportunities can lead to improved financial well-being for individuals and families.

- Potential for wealth creation: Successful investment can create wealth and improve financial security.

- Reduced economic inequality: Increased participation from previously excluded segments can help reduce economic inequality.

This empowerment fosters economic growth and improves the overall financial health of the nation.

Empowering Pakistan Through Accessible Stock Trading

JazzCash and KTrade are revolutionizing the Pakistani stock market by making it accessible to a significantly wider population. Their combined efforts are driving increased market participation, improving financial inclusion, and fostering economic growth. The positive economic and social impacts are undeniable. Start your investment journey with JazzCash and KTrade today! Democratize your finances – explore the opportunities with JazzCash and KTrade for accessible stock trading in Pakistan. Research and utilize these platforms to participate in Pakistan's growing economy.

Featured Posts

-

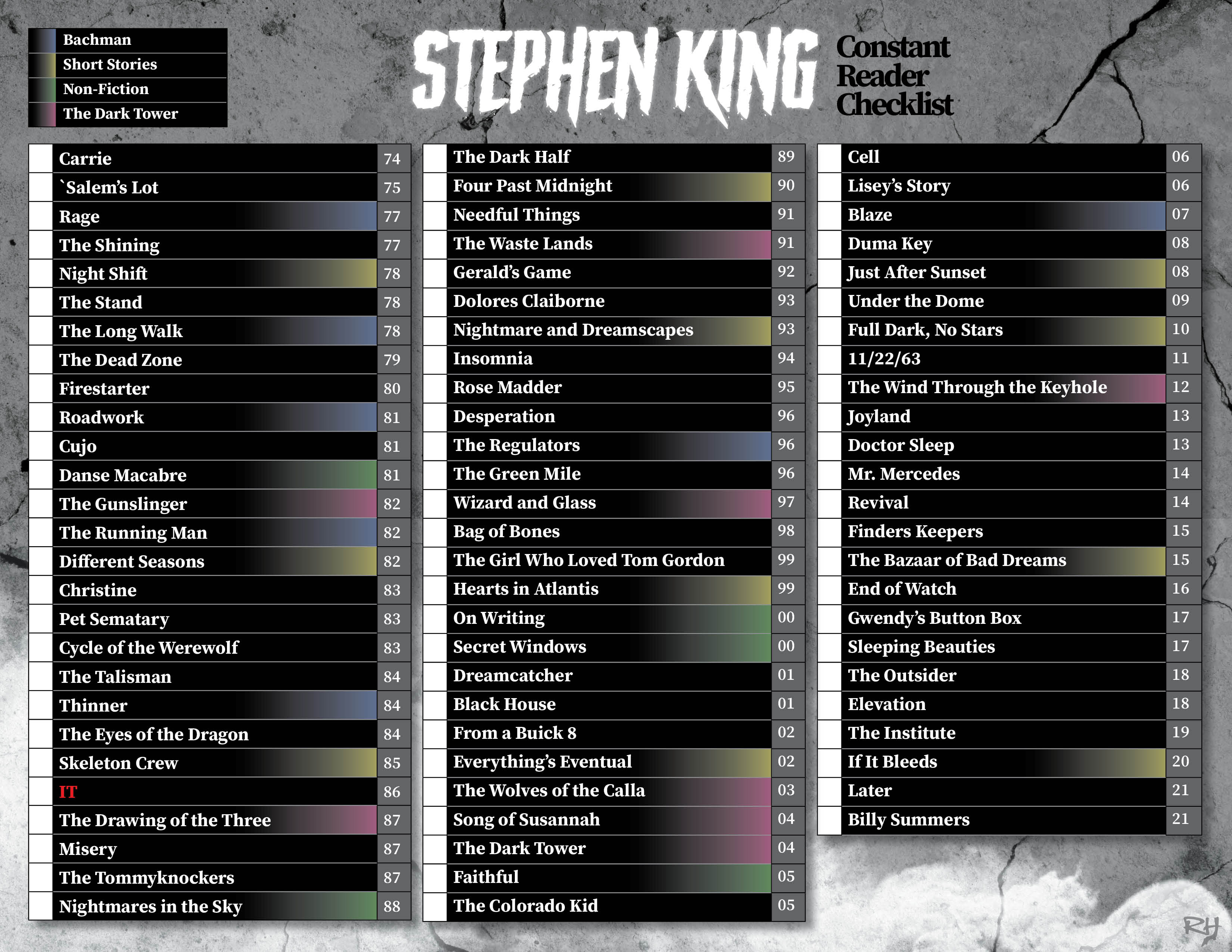

The Ultimate Stephen King Reading List 5 Books You Cant Miss

May 09, 2025

The Ultimate Stephen King Reading List 5 Books You Cant Miss

May 09, 2025 -

Analysis Of Pam Bondis Comments Regarding The Death Of American Citizens

May 09, 2025

Analysis Of Pam Bondis Comments Regarding The Death Of American Citizens

May 09, 2025 -

Analyzing The Link Between The Fentanyl Crisis And U S China Trade

May 09, 2025

Analyzing The Link Between The Fentanyl Crisis And U S China Trade

May 09, 2025 -

Vegas Golden Knights Defeat Minnesota Wild In Overtime Barbashevs Game Winner

May 09, 2025

Vegas Golden Knights Defeat Minnesota Wild In Overtime Barbashevs Game Winner

May 09, 2025 -

New Canola Sources For China A Look At The Post Canada Landscape

May 09, 2025

New Canola Sources For China A Look At The Post Canada Landscape

May 09, 2025

Latest Posts

-

Otsutstvie Soyuznikov Na Prazdnovanii V Kieve 9 Maya

May 09, 2025

Otsutstvie Soyuznikov Na Prazdnovanii V Kieve 9 Maya

May 09, 2025 -

Dijon Un Boxeur Convoque Au Tribunal Pour Violences Conjugales

May 09, 2025

Dijon Un Boxeur Convoque Au Tribunal Pour Violences Conjugales

May 09, 2025 -

Affaire Bilel Latreche Audience Pour Violences Conjugales A Dijon En Aout

May 09, 2025

Affaire Bilel Latreche Audience Pour Violences Conjugales A Dijon En Aout

May 09, 2025 -

Nepolniy Sostav Soyuznikov Otsutstvie Nekotorykh Na Prazdnovanii V Kieve 9 Maya

May 09, 2025

Nepolniy Sostav Soyuznikov Otsutstvie Nekotorykh Na Prazdnovanii V Kieve 9 Maya

May 09, 2025 -

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 09, 2025

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 09, 2025