How Luxury Real Estate Offers Stability Amidst Market Volatility For High-Net-Worth Individuals

Table of Contents

Luxury Real Estate as a Hedge Against Inflation

Luxury real estate offers a compelling hedge against inflation for several key reasons. It provides tangible asset value and significant rental income potential, both of which are particularly attractive during inflationary periods.

Tangible Asset Value

Luxury properties represent a tangible asset, unlike stocks or cryptocurrencies which are subject to significant price swings. Their inherent value is often tied to land appreciation and scarcity, making them a more stable investment.

- Land is a finite resource: Prime locations in desirable areas are limited, driving up the value of luxury properties over time. This inherent scarcity acts as a natural buffer against inflation.

- Luxury properties appreciate in value: Even during periods of economic uncertainty, high-end properties often maintain or increase their value, thanks to consistent demand and limited supply.

- Physical ownership provides security: Owning a physical asset provides a sense of security and control that other investments, such as digital assets, often lack. This tangible ownership offers peace of mind during market volatility.

Rental Income Potential

High-end properties generate substantial rental income, providing a consistent cash flow stream that can help offset inflation. This passive income stream can be a significant advantage during periods of economic uncertainty.

- High demand for luxury rentals: The demand for luxury rentals remains relatively high even during economic downturns, ensuring a consistent income stream.

- Portfolio diversification: Rental income from luxury properties contributes significantly to portfolio diversification, reducing overall risk.

- Strategic property management: Working with experienced property managers can maximize rental yields and minimize vacancies, optimizing your return on investment.

Diversification and Portfolio Stability

Investing in luxury real estate offers significant benefits in terms of diversification and overall portfolio stability. Its low correlation with other asset classes provides a crucial buffer against market shocks.

Reduced Correlation with Other Asset Classes

Luxury real estate often demonstrates a low correlation with traditional investment vehicles like stocks and bonds. This means that when stock markets decline, luxury property values often remain relatively stable or even appreciate, creating a natural hedge against market downturns.

- Stable performance during market downturns: Historically, luxury real estate has shown resilience during periods of economic instability, providing a safe haven for investments.

- Market shock buffer: Including luxury real estate in a diversified portfolio acts as a crucial buffer against the negative impacts of market shocks.

- Reduced overall portfolio risk: Diversification across asset classes, including luxury real estate, significantly reduces the overall risk of your investment portfolio.

Long-Term Appreciation Potential

Luxury properties historically demonstrate strong long-term capital appreciation, outperforming many other investment options over extended periods. This long-term growth potential makes it an attractive investment for those with a long-term outlook.

- Prime locations consistently appreciate: Properties located in prime, high-demand areas generally exhibit consistent value growth over time.

- Careful market analysis is crucial: Thorough research and due diligence, including professional guidance, are essential for successful long-term investment.

- Value enhancement through renovations: Strategic renovations and upgrades can further enhance the value of a luxury property over time.

Tax Advantages and Wealth Preservation

While tax laws vary significantly by location, luxury real estate investments can offer various tax advantages. It’s crucial to consult with qualified professionals for personalized guidance.

Tax Benefits (Consult a Professional)

Depending on your location and the specific legal structure of your investment, luxury real estate investments may offer several tax benefits. Disclaimer: This section is for informational purposes only and does not constitute financial or legal advice. Consult with qualified professionals for personalized guidance.

- Mortgage interest deductions (where applicable): In some jurisdictions, mortgage interest payments on luxury properties may be tax-deductible.

- Depreciation allowances (where applicable): Depending on the property's usage, depreciation allowances may be available, reducing your taxable income.

- Capital gains tax implications: Capital gains tax implications vary significantly by jurisdiction and require professional tax advice.

Protecting and Growing Wealth

Luxury real estate acts as a store of value, protecting wealth against inflation and currency devaluation. It's a tangible asset that retains its value even in uncertain economic times.

- Hedge against economic instability: Tangible assets like luxury real estate often provide a hedge against economic instability and inflation.

- Intergenerational wealth transfer: Luxury properties can be passed down through generations, preserving family wealth and legacy.

- Strategic property management safeguards investments: Employing effective property management strategies protects your investment and maximizes its value.

Conclusion

Luxury real estate presents a compelling investment strategy for HNWIs seeking stability and long-term growth amidst market volatility. Its tangible nature, potential for rental income, diversification benefits, and tax advantages (when properly structured and advised upon) make it a robust addition to any well-diversified portfolio. By carefully considering location, property type, and market conditions, HNWIs can leverage the inherent stability of luxury real estate to build and preserve their wealth. To explore how luxury real estate can benefit your investment strategy, contact a specialized real estate advisor today to discuss your unique financial goals and discover the opportunities available in the luxury real estate market.

Featured Posts

-

High Salary Tough Job Market Practical Advice For Career Advancement

May 17, 2025

High Salary Tough Job Market Practical Advice For Career Advancement

May 17, 2025 -

Bridges Asks Thibodeau To Limit Knicks Starters Playing Time

May 17, 2025

Bridges Asks Thibodeau To Limit Knicks Starters Playing Time

May 17, 2025 -

Trumps Middle East Visit May 15 2025 Analysis And News

May 17, 2025

Trumps Middle East Visit May 15 2025 Analysis And News

May 17, 2025 -

F 55 And F 22 Upgrades Evaluating Trumps Vision For Us Military Aircraft

May 17, 2025

F 55 And F 22 Upgrades Evaluating Trumps Vision For Us Military Aircraft

May 17, 2025 -

Deuda Estudiantil El Gobierno Intensifica La Recuperacion De Prestamos

May 17, 2025

Deuda Estudiantil El Gobierno Intensifica La Recuperacion De Prestamos

May 17, 2025

Latest Posts

-

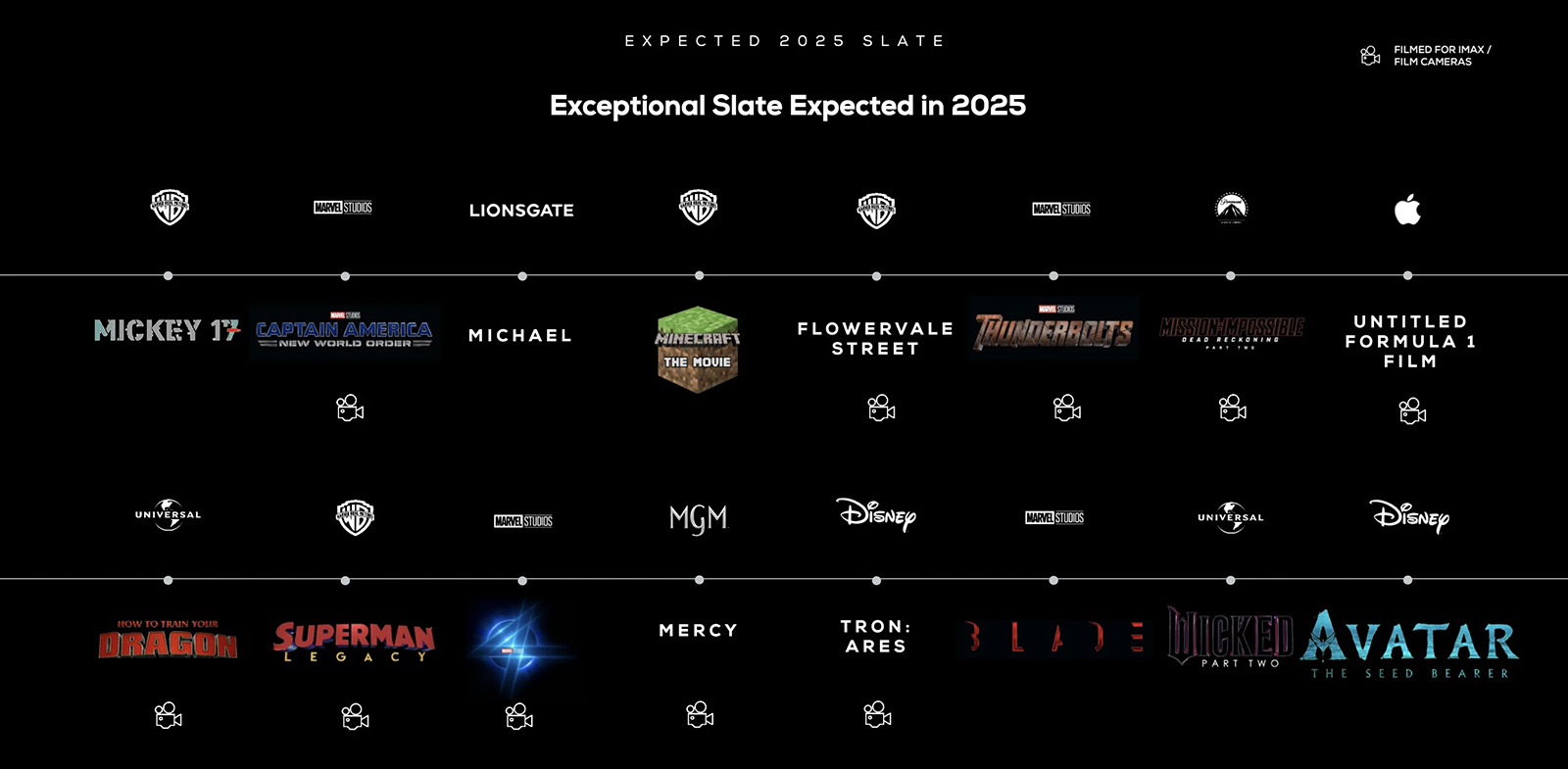

Warner Bros Unveils 2025 Slate At Cinema Con Key Announcements

May 17, 2025

Warner Bros Unveils 2025 Slate At Cinema Con Key Announcements

May 17, 2025 -

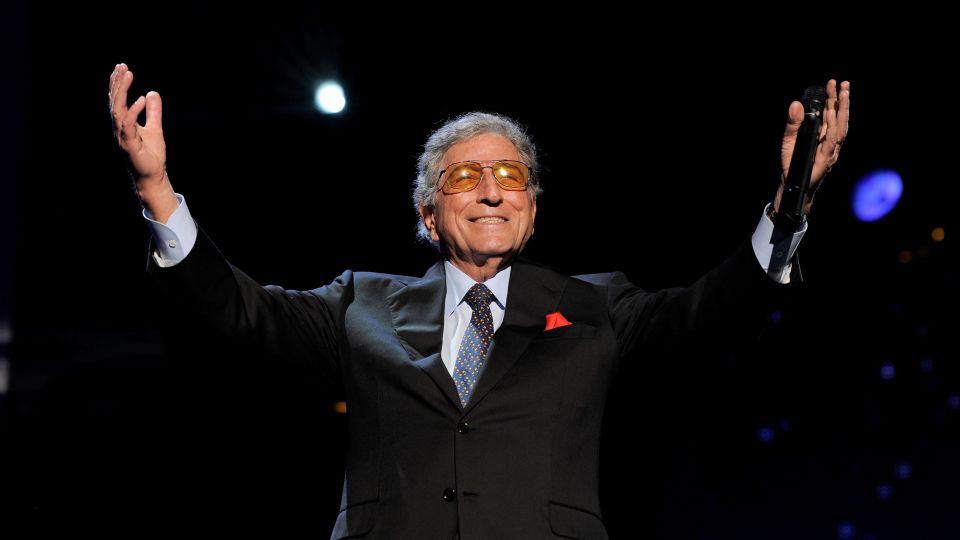

Tony Bennett From Crooner To Cultural Icon

May 17, 2025

Tony Bennett From Crooner To Cultural Icon

May 17, 2025 -

Cinema Con 2025 Highlights From The Warner Bros Pictures Presentation

May 17, 2025

Cinema Con 2025 Highlights From The Warner Bros Pictures Presentation

May 17, 2025 -

The People Behind Tony Bennetts Success

May 17, 2025

The People Behind Tony Bennetts Success

May 17, 2025 -

Warner Bros Pictures At Cinema Con 2025 A Complete Overview

May 17, 2025

Warner Bros Pictures At Cinema Con 2025 A Complete Overview

May 17, 2025