How Much Wealth Did Musk, Bezos, And Zuckerberg Lose After Trump's Inauguration?

Table of Contents

The Impact on Elon Musk's Net Worth Post-Inauguration

Tesla Stock Fluctuations

The performance of Tesla stock following the inauguration provides a clear illustration of the impact of political uncertainty on individual wealth. Policy changes under the new administration significantly influenced investor sentiment and consequently, Tesla's stock price. The early days of the Trump administration were characterized by a focus on deregulation, which initially appeared positive for some sectors. However, inconsistencies and uncertainty surrounding environmental policies, specifically those impacting electric vehicles, created volatility.

- January 2017 - March 2017: Tesla stock experienced a significant drop of approximately 15%, largely attributed to concerns over the potential weakening of environmental regulations and government incentives for electric cars.

- Specific Policy Concerns: Uncertainty around the future of the Clean Power Plan and potential tax changes impacting electric vehicle purchases fueled investor anxiety.

- Market Sentiment: Negative news coverage regarding potential changes to fuel efficiency standards also contributed to the negative stock performance.

SpaceX and Other Ventures

While the impact on SpaceX was less directly observable in terms of immediate financial losses, the changing political landscape could have influenced long-term prospects. Government contracts for space exploration and defense-related technologies could potentially be affected by shifts in national priorities and budget allocations.

- Government Contracts: While SpaceX continued to secure contracts, the overall climate of uncertainty could have resulted in delays or renegotiations, impacting overall profitability.

- Indirect Impacts: Changes in NASA funding or policy shifts in areas like space exploration could indirectly affect SpaceX's future growth and valuation.

Jeff Bezos and Amazon: Navigating the Post-Inauguration Economic Landscape

Amazon Stock Performance

Amazon, a behemoth in e-commerce, faced a complex interplay of factors impacting its stock performance post-inauguration. Trade policies, particularly the implementation of tariffs, posed a significant challenge. Increased regulatory scrutiny concerning antitrust issues also added to the uncertainty.

- Tariff Impacts: The imposition of tariffs on various goods impacted Amazon's supply chains and potentially increased costs for consumers, affecting sales and profitability. Stock prices fluctuated in response to these policy changes.

- Antitrust Scrutiny: Investigations into Amazon's dominance in online retail created uncertainty about future regulatory burdens and the potential for significant fines.

- Consumer Spending: Changes in consumer spending habits due to economic shifts also played a role in Amazon's stock performance.

Other Bezos Holdings

Beyond Amazon, Jeff Bezos's vast portfolio includes investments in various sectors. These assets experienced varying degrees of impact, reflective of broader market trends and specific sector-specific changes brought about by the new administration's policies.

- Blue Origin: Bezos's space exploration company, Blue Origin, could have experienced indirect impacts, mirroring some of the effects felt by SpaceX.

- Washington Post: The Washington Post, owned by Bezos, might have experienced increased scrutiny or changes in readership due to the political climate.

Mark Zuckerberg and Facebook (Meta): Facing Regulatory Scrutiny and Public Backlash

Facebook Stock and the Trump Era

Facebook (now Meta) faced a particularly challenging period following the Trump inauguration. Concerns regarding data privacy, the spread of misinformation, and antitrust investigations significantly impacted investor confidence and the company’s stock price.

- Cambridge Analytica Scandal: The fallout from the Cambridge Analytica scandal, which occurred before and continued during the Trump era, contributed significantly to negative public perception and stock price drops.

- Regulatory Actions: Increased regulatory pressure from the US government and the EU regarding data privacy and antitrust issues resulted in significant uncertainty and financial repercussions.

- Stock Price Fluctuations: Facebook's stock experienced substantial volatility, often dropping in response to negative news related to regulatory actions or public relations crises.

Impact of Political Polarization

The heightened political polarization during this period significantly impacted Facebook’s advertising revenue and user base. The platform became a battleground for political discourse, influencing its business model.

- Misinformation Concerns: The spread of misinformation and "fake news" on Facebook became a major source of controversy, impacting user trust and attracting regulatory scrutiny.

- Advertising Revenue: Advertisers became hesitant to associate with the platform due to concerns about brand safety and negative publicity, affecting revenue streams.

Conclusion

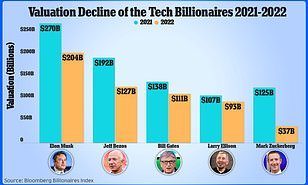

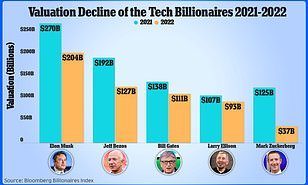

The 2017 inauguration of President Trump had a significant impact on the net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg. While precise calculations of wealth losses are difficult due to the complexity of their diverse holdings and market fluctuations, the analysis shows clear correlations between political events, regulatory changes, and the performance of their key assets. Factors such as policy uncertainty, trade wars, regulatory scrutiny, and shifts in consumer behavior all played crucial roles in the financial repercussions faced by these tech giants. Understanding the interconnectedness of political events and financial markets is crucial.

Call to Action: Further research into the impact of political events on the financial markets and the fortunes of prominent figures is encouraged. Exploring other case studies of wealth fluctuations during periods of political transition will deepen your understanding of this dynamic relationship. Learn more about how political shifts can affect your own investments and the importance of diversification to mitigate risk. Understanding the impact of political events on wealth changes is key to making informed financial decisions.

Featured Posts

-

The History And Evolution Of Celebrity Antiques Road Trip

May 10, 2025

The History And Evolution Of Celebrity Antiques Road Trip

May 10, 2025 -

The Impact Of Trumps Policies On Transgender Rights

May 10, 2025

The Impact Of Trumps Policies On Transgender Rights

May 10, 2025 -

Why The Federal Reserve Remains Hesitant To Lower Interest Rates

May 10, 2025

Why The Federal Reserve Remains Hesitant To Lower Interest Rates

May 10, 2025 -

Trump Team Explores Expedited Nuclear Power Plant Construction Timeline

May 10, 2025

Trump Team Explores Expedited Nuclear Power Plant Construction Timeline

May 10, 2025 -

Greenland Under Us Northern Command Analyzing The Pentagons Proposal And Its Implications

May 10, 2025

Greenland Under Us Northern Command Analyzing The Pentagons Proposal And Its Implications

May 10, 2025