How Nicki Chapman Made £700,000 Investing In A Country Property

Table of Contents

Identifying the Right Country Property: Nicki Chapman's Approach

Choosing the right property is paramount in any successful property investment UK, and Nicki Chapman's journey demonstrates this perfectly. Her approach involved a meticulous consideration of several key factors.

Location, Location, Location: Analyzing the Geographical Factors Influencing Her Choice

The adage "location, location, location" rings truer than ever in the property market. Nicki's success wasn't just about finding a pretty country property; it was about strategic location.

- Proximity to amenities: Access to essential services like shops, healthcare facilities, and public transport is crucial for both rental potential and resale value.

- Transport links: Good road and rail connections increase the property's appeal to a wider pool of potential buyers and tenants.

- Desirable school districts: Properties located near highly-rated schools command higher prices and are in consistently high demand.

- Potential for capital growth: Thorough market research is essential. Identifying areas with a history of strong property price appreciation – potentially driven by regeneration projects or increased infrastructure – is key for long-term returns.

Understanding local property trends and conducting thorough market research are vital for pinpointing areas with significant growth potential. For example, if Nicki invested in an area experiencing an influx of new businesses or infrastructure improvements, this would naturally boost property values over time.

Property Type and Condition: Assessing the Potential for Renovation and Improvement

Nicki Chapman likely considered the property's condition alongside its location. While a move-in ready property offers immediate occupancy, properties requiring renovation often present higher return potential.

- Potential for value-add through renovations: Identifying properties with potential for substantial improvements is critical for maximizing returns.

- Cost analysis of potential upgrades: A detailed budget is essential, factoring in all renovation costs, from materials to labor.

- Importance of structural surveys: Thorough surveys are crucial for identifying potential hidden problems that could escalate costs and delay the project.

Choosing a property needing renovation can be riskier but potentially more rewarding. The ability to strategically renovate and add value is a skill that separates successful property investors from the rest.

Financing the Investment: Securing the Funds

Securing the necessary funding is a crucial step in any property investment UK. Nicki Chapman likely considered several options.

Exploring Funding Options: Mortgages, Savings, or Other?

Multiple avenues exist for financing a property investment. The best option depends on the individual investor’s financial situation.

- Mortgage options available in the UK: Various mortgage products cater to different needs and risk profiles, with interest rates and repayment terms influencing the overall cost.

- Leveraging existing equity: This involves using the value of existing properties to secure additional borrowing for new investments.

- Personal savings contributions: A significant personal investment often reduces reliance on borrowing and minimizes financial risk.

Careful consideration of the pros and cons of each funding option is crucial. Leveraging existing equity can accelerate growth but increases risk, while relying solely on savings offers stability but might limit the scale of investment.

Managing Financial Risk: Protecting the Investment

Mitigating risk is paramount in property investment. Nicki Chapman likely implemented strategies to protect her investment.

- Importance of professional advice: Consulting with financial advisors and solicitors is crucial for sound financial planning and legal protection.

- Insurance considerations: Building insurance, contents insurance, and other relevant policies are crucial to safeguard against unexpected events.

- Contingency planning for unexpected costs: Allocating funds for potential unforeseen repairs or delays is vital for avoiding financial strain.

A well-structured financial plan, including professional advice and thorough risk assessment, is essential for minimizing potential losses and maximizing returns.

The Renovation and Enhancement Process: Maximizing Value

The renovation phase is where the potential for significant value addition lies. Nicki Chapman's success likely hinged on smart renovation choices and effective marketing.

Strategic Renovations: Increasing Property Value

Strategic renovations focused on maximizing the property's appeal and value are crucial.

- Prioritizing high-impact renovations: Investing in key areas like the kitchen and bathroom often yields the highest return on investment.

- Choosing cost-effective materials: Balancing quality with cost-effectiveness is essential for optimizing the budget.

- Employing skilled contractors: Engaging reliable and experienced contractors minimizes the risk of delays and cost overruns.

Smart renovations enhance the property's desirability and ultimately increase its resale value. Focus on improvements that attract a wider pool of buyers.

Marketing and Sales Strategy: Achieving Maximum Profit

The marketing and sales strategy directly impacts the final sale price and the speed of the transaction.

- Choosing the right estate agent: Selecting an experienced agent with a strong track record in the local market is vital.

- Effective property staging: Presenting the property in its best possible light through staging increases its appeal to potential buyers.

- Targeted marketing approach: Utilizing appropriate online and offline channels to reach the ideal buyer is crucial for achieving a quick and profitable sale.

A well-executed marketing strategy can significantly shorten the time on the market and command a premium price, maximizing the overall return on investment.

Key Takeaways from Nicki Chapman's Country Property Investment Success

Nicki Chapman's £700,000 profit demonstrates the rewards of careful planning and execution in country property investment.

- Smart location choice: Identifying areas with growth potential is crucial.

- Strategic renovations: Focusing on high-impact improvements maximizes the return on investment.

- Effective marketing: A strong sales strategy ensures a quick and profitable sale.

- Prudent financial management: Careful planning and risk mitigation are key to long-term success.

Thorough research, meticulous planning, and professional advice are the cornerstones of successful property investment UK.

Conclusion: Unlocking Your Own Country Property Investment Success

Nicki Chapman's journey highlights the significant financial rewards that are possible through successful country property investment. Her story underscores the importance of thorough research, strategic planning, and prudent financial management. By learning from her example and applying these key principles, you can increase your chances of achieving your own profitable country property investment goals. Start your journey to lucrative country property investment today! Research potential areas, consult with professionals, and discover your own success story.

Featured Posts

-

Dr Terrors House Of Horrors Navigating The Frights

May 25, 2025

Dr Terrors House Of Horrors Navigating The Frights

May 25, 2025 -

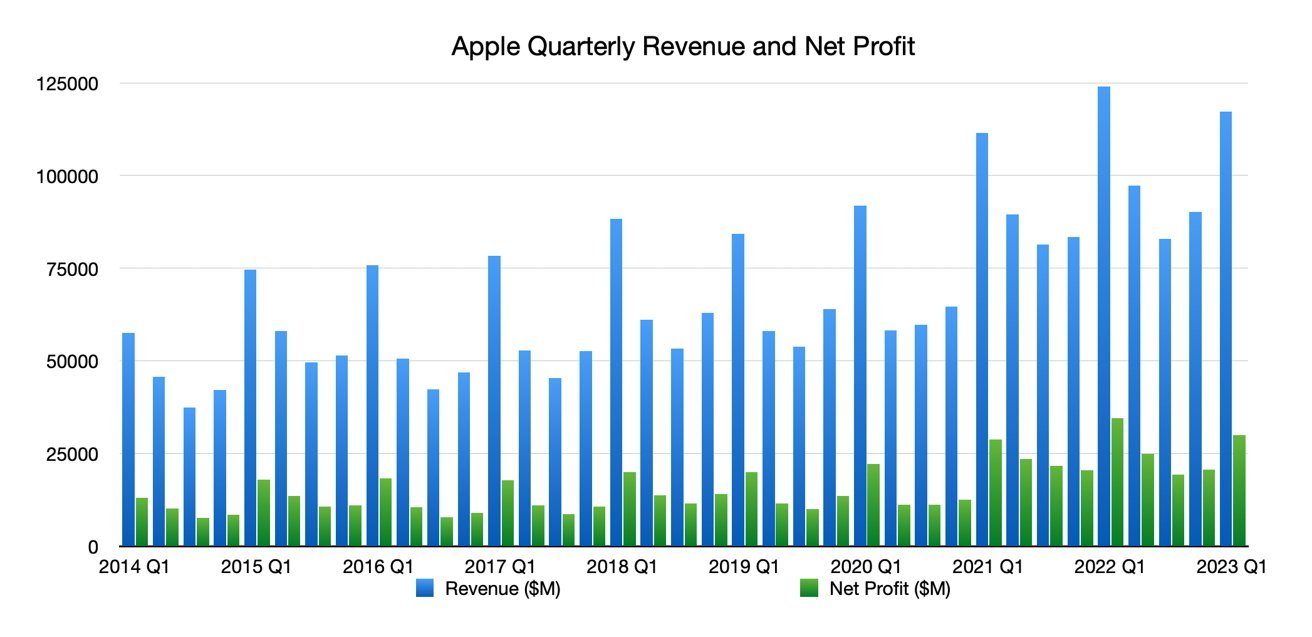

Pre Q2 Earnings Assessing The Current State Of Apple Stock

May 25, 2025

Pre Q2 Earnings Assessing The Current State Of Apple Stock

May 25, 2025 -

Polemique Ardisson Baffie Il Vient Cracher Dans La Soupe Les Dessous D Une Dispute Virulente

May 25, 2025

Polemique Ardisson Baffie Il Vient Cracher Dans La Soupe Les Dessous D Une Dispute Virulente

May 25, 2025 -

Understanding The Hells Angels A Deep Dive

May 25, 2025

Understanding The Hells Angels A Deep Dive

May 25, 2025 -

Naomi Campbell And Anna Wintour Met Gala 2025 Absence Fuels Speculation

May 25, 2025

Naomi Campbell And Anna Wintour Met Gala 2025 Absence Fuels Speculation

May 25, 2025