How Norway's Top Investor, Nicolai Tangen, Responded To Trump's Tariffs

Table of Contents

Understanding the Impact of Trump's Tariffs on NBIM's Portfolio

Trump's trade war unleashed a wave of tariffs, primarily targeting sectors like steel, aluminum, and technology. These tariffs significantly impacted global supply chains and commodity prices, creating ripple effects across various industries. NBIM's massive portfolio, encompassing a vast range of global assets, was inevitably exposed to these risks, both directly and indirectly.

The direct impact stemmed from NBIM's holdings in companies directly affected by the tariffs. For example:

- Steel and Aluminum Producers: NBIM likely held shares in multinational steel and aluminum companies, experiencing reduced profitability due to decreased demand and increased production costs.

- Technology Companies: The tariffs impacted the technology sector, affecting companies reliant on imported components or those facing retaliatory tariffs from other countries. NBIM's holdings in these companies were likely affected.

- Consumer Goods Companies: Companies producing consumer goods, relying on imported materials impacted by tariffs, faced increased costs and potentially lower sales.

Indirect impacts were equally important, stemming from:

- Supply Chain Disruptions: Tariffs disrupted global supply chains, impacting companies across various sectors, even those not directly targeted by tariffs.

- Currency Fluctuations: The trade war created volatility in currency markets, adding another layer of risk to NBIM's globally diversified portfolio.

Tangen's Strategic Adjustments to Mitigate Tariff Risks

Faced with these challenges, Nicolai Tangen and NBIM implemented a multifaceted strategy to mitigate the risks associated with Trump's tariffs. Their proactive approach involved several key adjustments:

- Diversification Strategies: NBIM likely shifted a portion of its portfolio away from sectors most vulnerable to tariffs. This might have involved increasing allocations to less-affected industries or geographies, geographically diversifying investments across more stable economies. For example, they may have increased investments in emerging markets less directly impacted by the US-China trade tensions.

- Hedging Strategies: To protect against potential losses, NBIM likely employed various hedging techniques. This could have included using financial instruments like options or futures contracts to offset potential price declines in affected assets.

- Increased Due Diligence: In the wake of the tariff imposition, NBIM likely implemented a more rigorous due diligence process for future investments. This included a more comprehensive assessment of potential tariff-related risks, focusing on supply chain resilience and geopolitical factors.

The Long-Term Implications of Tangen's Response

The long-term consequences of NBIM's response to the Trump tariffs are still unfolding. While a full assessment requires further analysis, several potential implications stand out:

- Enhanced Resilience: NBIM's proactive risk management and diversification strategies likely enhanced the fund's resilience to future trade disputes and economic shocks. This strengthens its long-term performance.

- Potential Missed Opportunities: While mitigating risk was crucial, the shift in investment strategy might have led to missed opportunities in sectors that eventually recovered or performed exceptionally well despite the initial tariff-related challenges.

- Impact on Norway's Economy: The performance of the sovereign wealth fund directly impacts Norway's economy. The effectiveness of NBIM's response played a significant role in cushioning Norway from the negative impacts of the Trump tariffs.

Conclusion: Lessons Learned from Nicolai Tangen's Response to Trump's Tariffs

Nicolai Tangen's response to the Trump tariffs showcases the importance of proactive risk management and diversification in navigating the complexities of the global economy. His strategic adjustments—diversification, hedging, and enhanced due diligence—demonstrate a commitment to safeguarding the Norwegian sovereign wealth fund. While the full long-term impact is still being assessed, his actions offer valuable lessons for other global investors facing similar economic uncertainty. Learn more about how Nicolai Tangen and NBIM manage global economic risks and explore the impact of trade wars on sovereign wealth fund management to better understand effective strategies for navigating global economic uncertainties.

Featured Posts

-

Bakole Vows To Shock The World Against Parker Fight Preview

May 04, 2025

Bakole Vows To Shock The World Against Parker Fight Preview

May 04, 2025 -

Addressing The Persistent Slow Traffic In Darjeeling

May 04, 2025

Addressing The Persistent Slow Traffic In Darjeeling

May 04, 2025 -

Emma Stooyn Nea Fimi Gia Rimeik Tis Tainias Body Heat

May 04, 2025

Emma Stooyn Nea Fimi Gia Rimeik Tis Tainias Body Heat

May 04, 2025 -

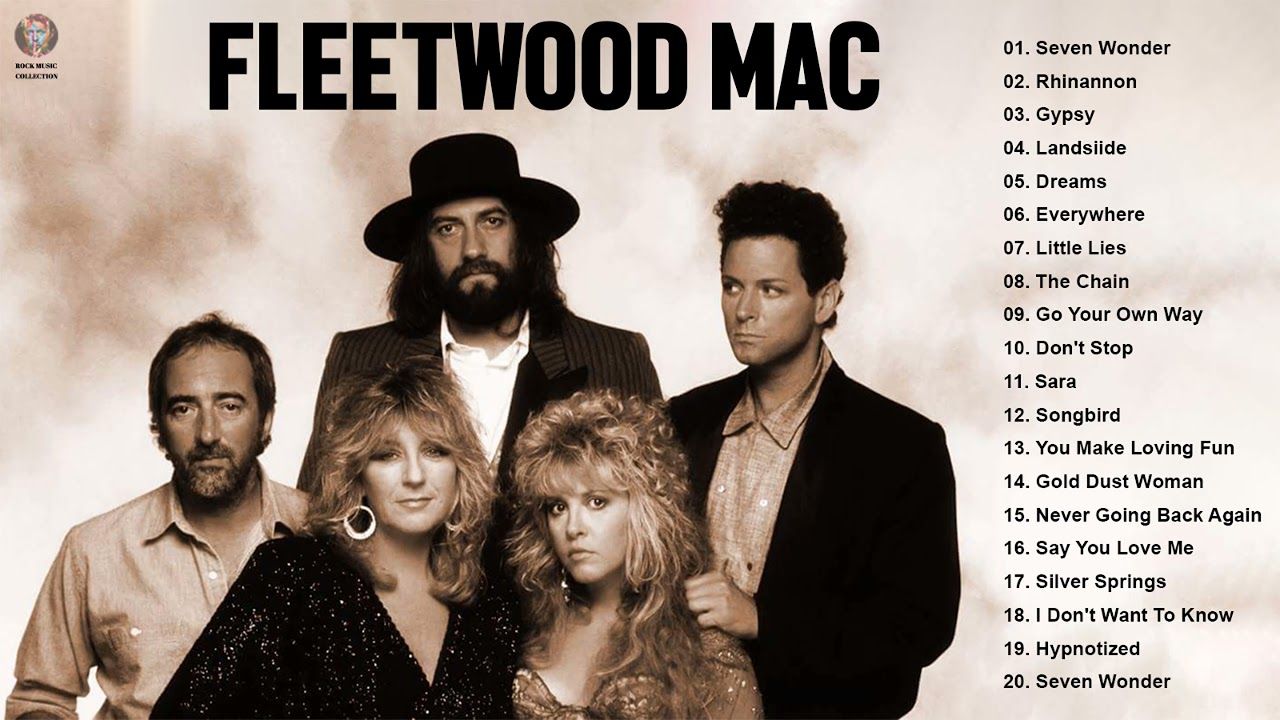

Fleetwood Macs Biggest Hits A Definitive List

May 04, 2025

Fleetwood Macs Biggest Hits A Definitive List

May 04, 2025 -

Britains Got Talent Teddys Rescheduled Act

May 04, 2025

Britains Got Talent Teddys Rescheduled Act

May 04, 2025