How The Student Loan Crisis Will Impact The US Economy

Table of Contents

Reduced Consumer Spending and Economic Growth

The massive burden of student loan repayments directly impacts disposable income. Borrowers often delay major purchases like homes, cars, and starting families, hindering overall consumer spending. This decreased spending power ripples through the economy, impacting various sectors.

- Lower discretionary spending leads to decreased demand for goods and services. This reduced demand forces businesses to cut back on production, potentially leading to job losses and further economic slowdown. The impact is felt across all sectors, from restaurants and entertainment to retail and travel.

- Reduced economic activity translates to slower GDP growth. Lower consumer spending directly translates to a lower Gross Domestic Product, a key indicator of a nation's economic health. Sustained slow growth can lead to stagnation and hinder overall prosperity.

- Impact on retail, housing, and automotive industries. These sectors are particularly vulnerable to decreased consumer spending, as they rely heavily on discretionary purchases. The student loan crisis exacerbates existing economic vulnerabilities in these key areas.

The weight of student loan debt significantly restricts consumer spending power, creating a chain reaction that impacts the entire economy. Data from the Federal Reserve and the Bureau of Economic Analysis consistently demonstrate a strong correlation between rising student loan debt and decreased consumer spending.

Impact on the Housing Market

Student loan debt significantly impacts homeownership rates, a cornerstone of the American Dream. High debt levels make it harder to qualify for mortgages and secure affordable housing. This has profound consequences for the housing market and the broader economy.

- Decreased homeownership rates contribute to a weaker housing market. Fewer people are able to buy homes, leading to lower demand and potentially lower property values. This affects construction companies, real estate agents, and related industries.

- Lower housing demand affects construction and related industries. The construction sector, a major contributor to economic growth, is directly affected by a decline in new home construction. This leads to job losses and decreased investment in this crucial sector.

- Impact on property values and real estate investments. A weakened housing market can lead to lower property values, reducing the net worth of homeowners and impacting the overall value of real estate investments.

The student loan crisis is directly correlated with decreased homeownership, creating a significant drag on the housing market and further contributing to economic instability.

Implications for Small Business Growth

Entrepreneurship is often hindered by substantial student loan repayments. Individuals may delay starting their own businesses due to financial constraints, impacting job creation and economic innovation.

- Reduced business formation impacts job creation and economic innovation. Fewer new businesses mean fewer jobs created and less innovation in the marketplace. This hampers economic growth and limits opportunities for future prosperity.

- Less competition can lead to slower economic growth. A lack of new businesses can lead to reduced competition, potentially leading to higher prices and less choice for consumers.

- Impact on small business loans and access to capital. Individuals struggling with student loan debt may find it more challenging to qualify for small business loans, further hindering entrepreneurship.

The student loan crisis presents a significant obstacle to entrepreneurship and small business growth, limiting economic dynamism and innovation.

The Potential for a Systemic Financial Crisis

The sheer volume of student loan debt raises concerns about potential systemic risk. A widespread default could trigger a financial crisis.

- Default rates are already increasing, potentially escalating in the future. As more borrowers struggle to manage their debt, default rates are likely to increase, posing a significant threat to lenders and the financial system.

- Impact on lenders and the financial system as a whole. Widespread defaults could severely impact the financial health of lenders, potentially triggering a domino effect throughout the financial system.

- The government's role in managing this risk. The government plays a crucial role in managing this risk through loan forgiveness programs and other interventions. However, the effectiveness and sustainability of these interventions are subject to ongoing debate.

The potential for a widespread default on student loans presents a significant systemic risk, underscoring the urgent need for comprehensive policy solutions.

Conclusion

The student loan crisis poses a significant and multifaceted threat to the US economy. From reduced consumer spending and hampered homeownership to its impact on small businesses and the potential for a systemic crisis, the consequences are far-reaching and demand immediate attention. Understanding the full extent of the student loan crisis and its economic implications is crucial for policymakers and individuals alike. Addressing this issue requires a comprehensive strategy that considers both short-term relief measures and long-term solutions to prevent future crises. We need a robust plan to tackle the escalating student loan crisis and ensure a healthy and thriving US economy for years to come. Let's work together to find effective solutions to this pressing student debt crisis.

Featured Posts

-

Eu Action Against Shein Addressing Consumer Protection Concerns

May 28, 2025

Eu Action Against Shein Addressing Consumer Protection Concerns

May 28, 2025 -

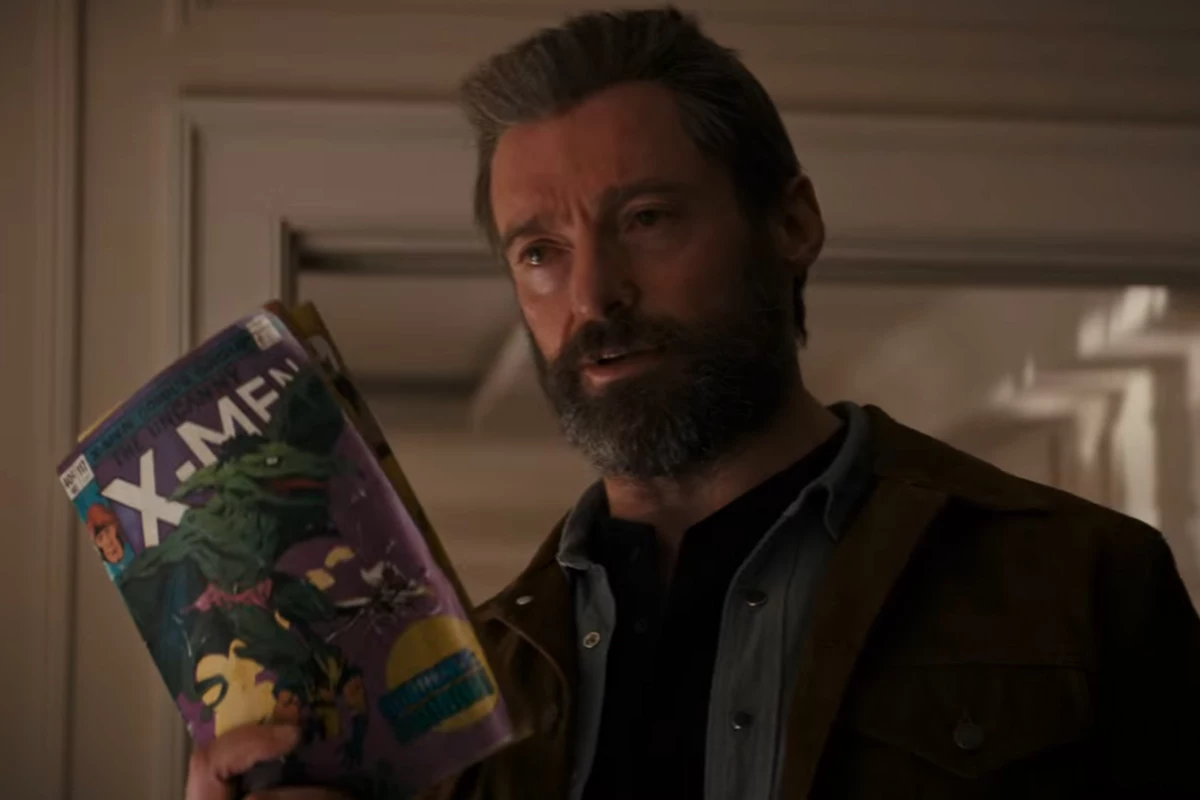

Hugh Jackmans Logan Finds A New Streaming Platform This April

May 28, 2025

Hugh Jackmans Logan Finds A New Streaming Platform This April

May 28, 2025 -

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix 775 E

May 28, 2025

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix 775 E

May 28, 2025 -

Economic Crisis Hits European Car Sales

May 28, 2025

Economic Crisis Hits European Car Sales

May 28, 2025 -

The Rome Champs Post Victory Strategy Maintaining Momentum

May 28, 2025

The Rome Champs Post Victory Strategy Maintaining Momentum

May 28, 2025