How The Trade War Bankrupted A Canadian Aluminum Trader

Table of Contents

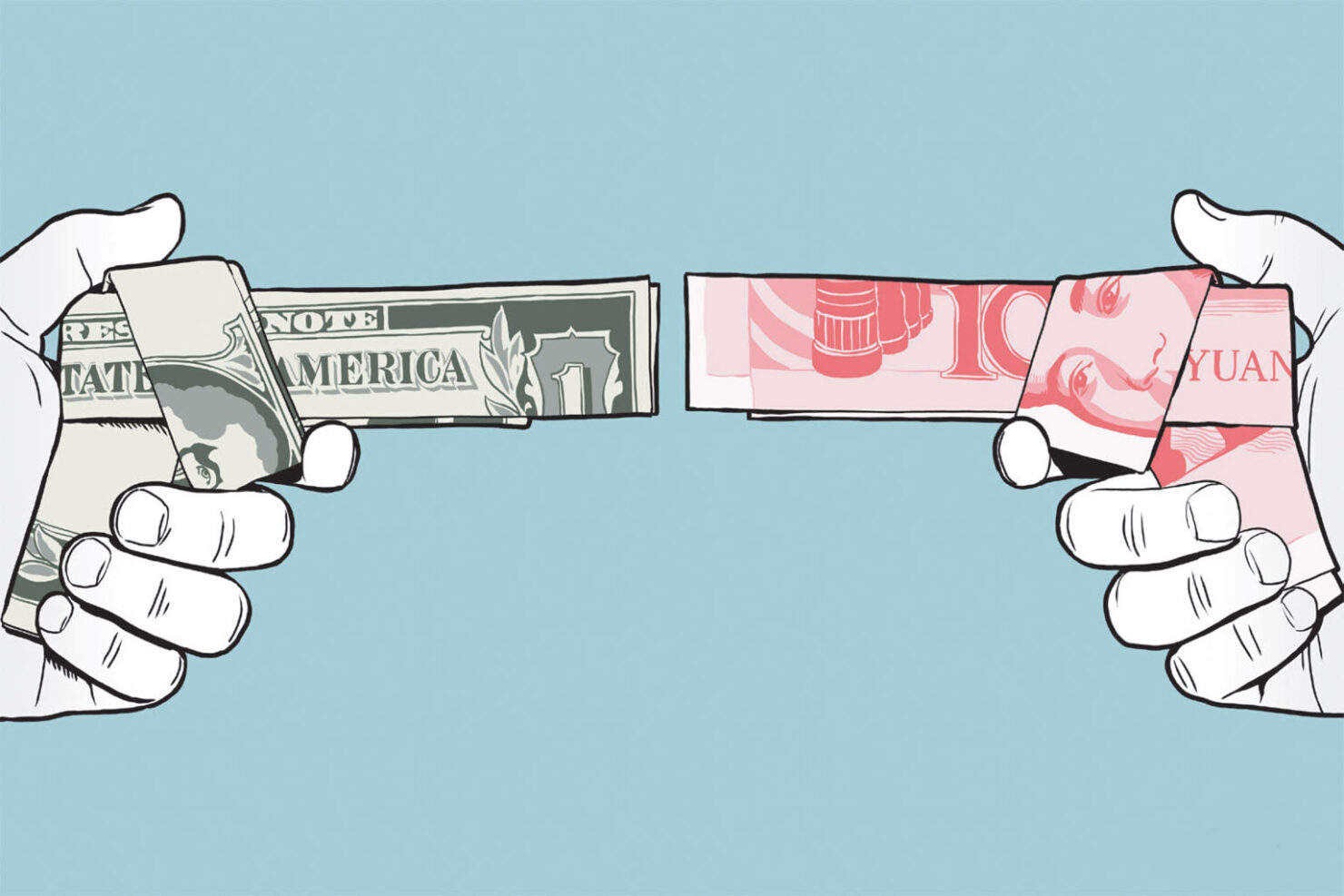

The Escalation of Trade Tensions and Tariffs

The trade war, primarily between the US and China, significantly impacted the global aluminum market. A series of tariff increases created a volatile and unpredictable environment for Canadian aluminum traders.

- July 2018: The US imposed tariffs on aluminum imports from several countries, including Canada.

- August 2018: Retaliatory tariffs were implemented by Canada and other affected nations, further disrupting the market and increasing aluminum prices. These tariffs, initially at 10%, rose to 25% in some cases, causing significant price increases, with aluminum prices reaching their highest levels in several years.

- Ongoing Disputes: The trade conflict continued to evolve, with periods of escalation and de-escalation, creating uncertainty and making long-term planning extremely difficult for businesses in the Canadian aluminum industry.

These tariffs directly impacted the Canadian aluminum trader’s profitability. Increased input costs and reduced competitiveness in the global market squeezed their margins, ultimately hindering their ability to operate sustainably.

The Impact of Reduced Demand on the Canadian Aluminum Market

The trade war not only increased costs but also significantly reduced global demand for aluminum. This had a cascading effect on the Canadian aluminum market.

- Reduced Exports: Key export markets, particularly in the US and Asia, experienced decreased construction and manufacturing activity, directly impacting demand for Canadian aluminum.

- Market Surplus: The reduced demand led to a surplus of aluminum in the Canadian market, forcing prices down further. This price drop severely impacted the trader's already-narrow profit margins.

- Market Dependence: The Canadian aluminum trader’s dependence on specific export markets left them particularly vulnerable to these disruptions, amplifying the negative consequences of the trade war. Their inability to diversify their customer base compounded the problem.

This combination of increased costs and decreased demand created a perfect storm that severely undermined the trader’s financial stability.

The Trader's Financial Strategies and Their Failure in the Face of the Trade War

The Canadian aluminum trader's financial strategies proved inadequate in mitigating the risks presented by the trade war.

- Supply Chain Reliance: The company relied heavily on specific suppliers, making them susceptible to disruptions in the global supply chain. Any issues with their suppliers directly impacted their ability to fulfill contracts.

- Risk Management Shortcomings: Their risk management strategies failed to adequately account for the volatility introduced by the trade war. Insufficient hedging strategies left them exposed to significant price fluctuations.

- Ineffective Financial Instruments: Any attempts to utilize financial instruments, such as futures contracts or options, to hedge against price risk proved insufficient to offset the impact of the tariffs and reduced demand.

The failure of these strategies directly contributed to the trader's inability to navigate the turbulent economic landscape created by the trade war, ultimately leading to bankruptcy.

The Ripple Effect: Impact on the Broader Canadian Aluminum Industry

The bankruptcy of this Canadian aluminum trader had far-reaching consequences for the broader Canadian aluminum industry.

- Job Losses: The closure of the trading company resulted in direct job losses, and ripple effects impacted related industries, such as transportation and logistics.

- SME Impact: Numerous small and medium-sized enterprises (SMEs) within the aluminum supply chain experienced difficulties, facing reduced orders and financial strain.

- Economic Downturn: The trader's failure contributed to a decline in overall economic activity within the sector and had a negative impact on the Canadian economy as a whole.

This case study underscores the vulnerability of the Canadian aluminum industry to geopolitical events and the importance of robust risk management strategies.

Conclusion: Lessons Learned from the Bankruptcy of a Canadian Aluminum Trader

The bankruptcy of this Canadian aluminum trader serves as a stark reminder of the devastating impact of trade wars on businesses operating in the global aluminum market. The confluence of escalating tariffs, significantly reduced demand, and inadequate financial risk management strategies ultimately led to their demise. The repercussions extended beyond the company itself, highlighting the interconnectedness of the Canadian aluminum industry and its susceptibility to external economic shocks. Understanding the impact of trade wars on Canadian aluminum traders is crucial for future resilience. Further research into proactive risk mitigation strategies and diversification of supply chains and markets is essential for the survival and growth of businesses within this sector.

Featured Posts

-

Alastqlal Rmz Alkramt Walsmwd

May 29, 2025

Alastqlal Rmz Alkramt Walsmwd

May 29, 2025 -

Nba Playoffs Bucks And Pacers Game 5 Ends In Heated Altercation

May 29, 2025

Nba Playoffs Bucks And Pacers Game 5 Ends In Heated Altercation

May 29, 2025 -

Mena Lw Ansf Alqwmu Fy Syaq Dhkra Alastqlal

May 29, 2025

Mena Lw Ansf Alqwmu Fy Syaq Dhkra Alastqlal

May 29, 2025 -

Diploma Europeo Para Zaragoza Un Reconocimiento A Su Patrimonio Y Valores

May 29, 2025

Diploma Europeo Para Zaragoza Un Reconocimiento A Su Patrimonio Y Valores

May 29, 2025 -

July Oil Production Opec Gathering For Key Quota Decision

May 29, 2025

July Oil Production Opec Gathering For Key Quota Decision

May 29, 2025