How To Decide If Refinancing Federal Student Loans Is Best

Table of Contents

Understanding the Pros and Cons of Refinancing Federal Student Loans

Refinancing federal student loans is a major financial decision. Before you jump in, it's crucial to understand both the potential benefits and the significant drawbacks.

Potential Benefits of Refinancing:

- Lower monthly payments: Refinancing can lower your interest rate, leading to significantly reduced monthly payments. This extra cash flow can improve your overall financial health. A lower interest rate on your student loan refinancing can free up budget for other important financial goals.

- Shorter repayment term: You might be able to shorten your loan term, paying off your debt faster. This means you'll pay less interest overall, saving you money in the long run. A shorter repayment period through student loan refinancing can be highly beneficial.

- Simplified repayment: Consolidating multiple loans into one simplifies the repayment process. Managing one payment instead of several can make budgeting easier and reduce the risk of missed payments. Refinancing your student loans can streamline your financial management.

- Fixed interest rate: Lock in a fixed interest rate to protect against future interest rate hikes. This provides predictability and security in your monthly payments, shielding you from fluctuating interest rates. Fixed interest rates through federal student loan refinance are a major advantage for many borrowers.

- Potential for better terms: Some lenders offer better customer service and more flexible repayment options than the federal government. This could include things like hardship programs or the ability to easily change your payment plan. Consider these features when choosing a lender for your student loan refinance.

Potential Drawbacks of Refinancing:

- Loss of federal student loan benefits: Refinancing typically means losing access to income-driven repayment plans (like IBR, PAYE, REPAYE), loan forgiveness programs (like Public Service Loan Forgiveness or PSLF), and deferment/forbearance options. This is a critical consideration for those who may qualify for these programs in the future. Before refinancing federal student loans, carefully weigh the potential loss of these benefits.

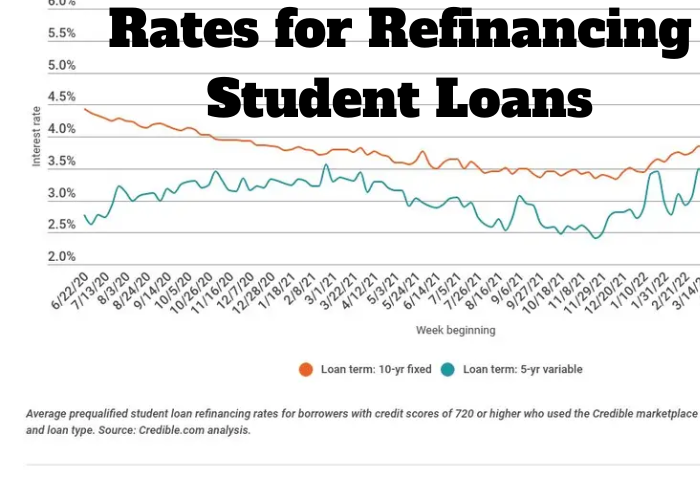

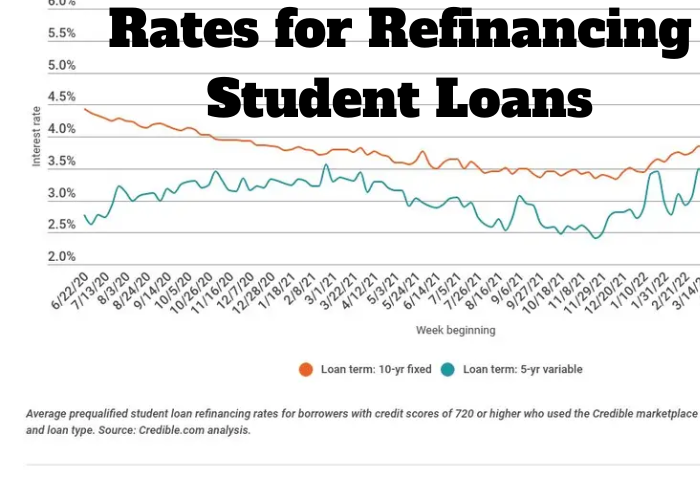

- Higher interest rates (in some cases): While refinancing often leads to lower rates, it's crucial to compare rates carefully. A higher rate would negate the benefits. Always shop around and compare offers from multiple lenders. Interest rates for student loan refinancing can vary significantly depending on your credit score and other factors.

- Prepayment penalties: Some lenders impose prepayment penalties. Understand these terms before refinancing. Be sure to thoroughly review the loan agreement before signing. Avoid lenders who include prepayment penalties in their refinance offers.

- Impact on credit score: The hard inquiry from a loan application can slightly impact your credit score. However, this impact is typically temporary and overshadowed by the long-term benefits of a lower interest rate. The short-term impact on your credit score from a refinance inquiry is usually negligible compared to the advantages of refinancing federal student loans.

Evaluating Your Financial Situation Before Refinancing

Before you apply for student loan refinancing, take the time to assess your financial health. This will help you determine if refinancing is the right move for you and help you secure the best possible terms.

Assess Your Credit Score:

A good credit score is essential for securing a favorable interest rate. Check your score before applying. A higher credit score will increase your chances of qualifying for the best student loan refinance rates.

Calculate Your Debt-to-Income Ratio:

Understand your current debt burden to determine if a lower monthly payment is achievable and sustainable. A high debt-to-income ratio may make it difficult to qualify for refinancing or may result in less favorable terms.

Compare Interest Rates from Multiple Lenders:

Shop around and compare offers from several lenders to find the best deal. Don't settle for the first offer. This allows you to find the most competitive interest rates for your student loan refinancing.

Consider Your Future Financial Goals:

Will refinancing impact your ability to save for retirement, a down payment on a house, or other significant financial goals? Carefully consider the long-term implications of refinancing before making a decision.

Choosing the Right Lender for Refinancing Federal Student Loans

Selecting the right lender is crucial for a successful student loan refinance. Consider these factors when comparing lenders.

Research and Compare Lenders:

Look for lenders with competitive interest rates, favorable terms, and positive customer reviews. Online reviews can provide valuable insight into the experiences of other borrowers.

Check Lender Reputation and Licensing:

Ensure the lender is reputable and licensed in your state. Verify their credentials through independent sources to avoid scams.

Understand the Loan Terms and Fees:

Carefully review all loan documents before signing anything. Pay attention to hidden fees or prepayment penalties. Understanding all terms and conditions before applying for student loan refinancing is essential.

Consider Customer Service and Support:

Choose a lender that offers excellent customer service and easily accessible support channels. Good customer service can be invaluable if you encounter any problems during the refinancing process.

Conclusion:

Refinancing federal student loans can offer significant benefits, like lower monthly payments and faster debt repayment. However, carefully weighing the pros and cons, especially the loss of federal loan protections, is crucial. By assessing your financial situation, comparing offers from multiple lenders, and understanding the terms, you can make an informed decision about whether refinancing your federal student loans is the best path for your financial future. Don't hesitate to seek professional financial advice before making this important decision. Start exploring your options for refinancing federal student loans today!

Featured Posts

-

Giants Vs Mariners Key Injuries Impacting The April 4 6 Series

May 17, 2025

Giants Vs Mariners Key Injuries Impacting The April 4 6 Series

May 17, 2025 -

Segunda Presidencia De Trump Implicaciones Para Los Deudores De Prestamos Estudiantiles

May 17, 2025

Segunda Presidencia De Trump Implicaciones Para Los Deudores De Prestamos Estudiantiles

May 17, 2025 -

New York Knicks Robinson Back In Action Season Debut Following Ankle Surgery Recovery

May 17, 2025

New York Knicks Robinson Back In Action Season Debut Following Ankle Surgery Recovery

May 17, 2025 -

Final Days 3 Apple Tv 3 Month Subscription Offer

May 17, 2025

Final Days 3 Apple Tv 3 Month Subscription Offer

May 17, 2025 -

Seaweed Innovation Condo Collapse Concerns And Corporate Turmoil News Roundup

May 17, 2025

Seaweed Innovation Condo Collapse Concerns And Corporate Turmoil News Roundup

May 17, 2025

Latest Posts

-

Choosing The Best Crypto Casino In 2025 Jack Bits Features And Benefits

May 17, 2025

Choosing The Best Crypto Casino In 2025 Jack Bits Features And Benefits

May 17, 2025 -

Best Bitcoin Casino 2025 Jack Bit A Comprehensive Review

May 17, 2025

Best Bitcoin Casino 2025 Jack Bit A Comprehensive Review

May 17, 2025 -

Jack Bit Review Is It The Best Crypto Casino For 2025

May 17, 2025

Jack Bit Review Is It The Best Crypto Casino For 2025

May 17, 2025 -

Top Bitcoin Online Casino 2025 Why Jack Bit Is The Best Crypto Casino

May 17, 2025

Top Bitcoin Online Casino 2025 Why Jack Bit Is The Best Crypto Casino

May 17, 2025 -

Find The Best Crypto Casinos In 2025 Compare Top Bitcoin Casinos With Easy Withdrawals

May 17, 2025

Find The Best Crypto Casinos In 2025 Compare Top Bitcoin Casinos With Easy Withdrawals

May 17, 2025