How To Interpret The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is the NAV and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

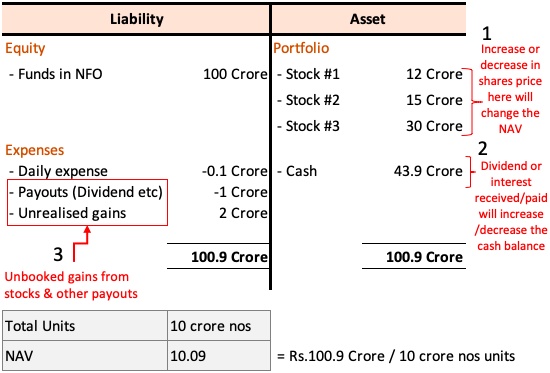

The Net Asset Value (NAV) represents the net worth of an ETF's holdings per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this is calculated daily by subtracting the ETF's total liabilities from its total assets.

- Total Assets: This includes the market value of the ETF's holdings in the 30 companies that comprise the Dow Jones Industrial Average index. These holdings are weighted to reflect the index's composition. It also includes any accrued income like dividends receivable.

- Total Liabilities: This encompasses expenses such as management fees, administrative costs, and any other outstanding obligations.

The formula is simple: NAV = Total Assets - Total Liabilities. This calculation is performed at the close of the market each day, and the NAV is usually published shortly after. Currency fluctuations can impact the NAV, particularly if the ETF holds assets denominated in currencies other than the one in which the NAV is reported. For example, if the Euro strengthens against the US Dollar, the NAV of the ETF (assuming the ETF is denominated in Euros) will reflect the increased value of its US Dollar-denominated holdings. Keywords: NAV calculation, Amundi Dow Jones Industrial Average UCITS ETF assets, ETF liabilities, daily NAV.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

- Market Movements: The performance of the underlying Dow Jones Industrial Average index is the primary driver of the ETF's NAV. A rise in the index generally leads to a higher NAV, and vice versa.

- Dividend Payments: When the companies within the Dow Jones Industrial Average pay dividends, the ETF receives its proportionate share. This increases the ETF's assets and consequently, its NAV.

- Management Fees and Expenses: These costs are deducted from the ETF's assets, reducing the NAV. The expense ratio, typically expressed as a percentage of assets under management, directly impacts the NAV.

- Currency Exchange Rates: As mentioned earlier, fluctuations in exchange rates can affect the NAV, especially if the ETF holds assets in different currencies. Keywords: Dow Jones Industrial Average, market fluctuations, ETF dividends, management fees, currency exchange rates, NAV impact.

How to Use the NAV to Make Informed Investment Decisions

Understanding the NAV is key to making sound investment decisions with the Amundi Dow Jones Industrial Average UCITS ETF:

- Arbitrage Opportunities: Compare the ETF's NAV to its market price. If the market price is significantly lower than the NAV, there might be an arbitrage opportunity. Conversely, a premium (market price exceeding NAV) indicates a potentially overvalued ETF.

- Performance Monitoring: Track the NAV over time to assess the ETF's performance. Consistent upward trends suggest strong growth, while downward trends may indicate underperformance.

- Benchmark Comparison: Compare the NAV's growth to relevant benchmarks, like the Dow Jones Industrial Average itself, to gauge the ETF's performance against its underlying index.

- Risk and Return Evaluation: The NAV, in conjunction with historical data and market analysis, helps investors assess the risk-return profile of their investment. Keywords: investment decisions, ETF performance, market price, arbitrage, risk assessment, return on investment.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Reliable sources for accessing the daily NAV include:

- Amundi's Website: The official website of Amundi is the most accurate source for the NAV.

- Financial News Websites: Many reputable financial news sites provide real-time or delayed NAV data for ETFs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

Remember to pay attention to the currency in which the NAV is reported and be aware that there might be slight delays in NAV reporting. Keywords: NAV data, Amundi website, financial news, brokerage platforms, data interpretation.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Understanding and interpreting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for effective investment management. By monitoring the NAV, comparing it to the market price, and tracking its performance over time, you can make informed decisions and optimize your investment strategy. Learn more about interpreting the NAV and maximize your investment in the Amundi Dow Jones Industrial Average UCITS ETF today! Keywords: NAV interpretation, Amundi Dow Jones Industrial Average UCITS ETF investment, investment management.

Featured Posts

-

Police Chase Ends With Shocking 90mph Refueling Incident

May 24, 2025

Police Chase Ends With Shocking 90mph Refueling Incident

May 24, 2025 -

Marvel The Avengers Crossword Clue Nyt Mini Crossword Answers For May 1st

May 24, 2025

Marvel The Avengers Crossword Clue Nyt Mini Crossword Answers For May 1st

May 24, 2025 -

16 Mart Hangi Burc Burc Oezellikleri Ve Daha Fazlasi

May 24, 2025

16 Mart Hangi Burc Burc Oezellikleri Ve Daha Fazlasi

May 24, 2025 -

Canada Post Strike Averted Details On The New Contract Offers

May 24, 2025

Canada Post Strike Averted Details On The New Contract Offers

May 24, 2025 -

Venezuelan Deportations Spark Mia Farrows Call For Trumps Imprisonment

May 24, 2025

Venezuelan Deportations Spark Mia Farrows Call For Trumps Imprisonment

May 24, 2025