How Will QBTS Stock Perform After The Next Earnings Announcement?

Table of Contents

Analyzing QBTS's Past Earnings Reports and Trends

Understanding QBTS's historical performance is critical for predicting future trends. By analyzing past earnings reports, we can identify patterns and key indicators that may foreshadow the market's reaction to the upcoming announcement.

Key Performance Indicators (KPIs) to Watch:

- Revenue Growth: Consistent and substantial revenue growth signifies a healthy and expanding business. Look for year-over-year (YoY) growth rates and their consistency over multiple quarters. Declining revenue should raise concerns.

- Earnings Per Share (EPS): EPS reflects the company's profitability on a per-share basis. A positive and increasing EPS trend suggests strong financial health. YoY comparisons are vital for spotting improvements or deteriorations.

- Profit Margins: Profit margins illustrate the efficiency of QBTS's operations. Improving profit margins indicate better cost management and increased profitability. Decreasing margins may signal operational inefficiencies or increased competition.

- Guidance: The company's guidance for future quarters provides valuable insight into management's expectations and their outlook for the business. Pay close attention to any changes in the guidance compared to previous forecasts.

Identifying Historical Patterns:

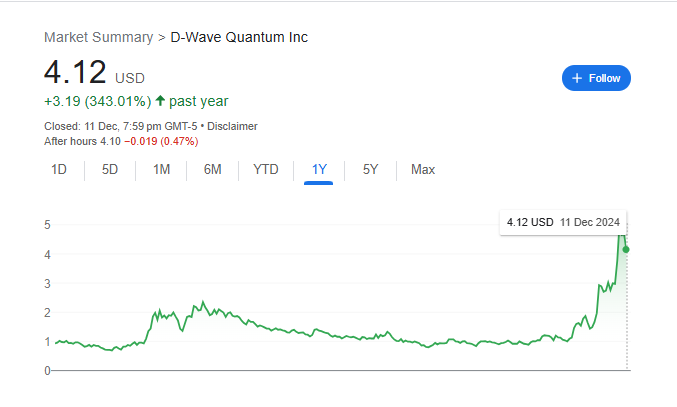

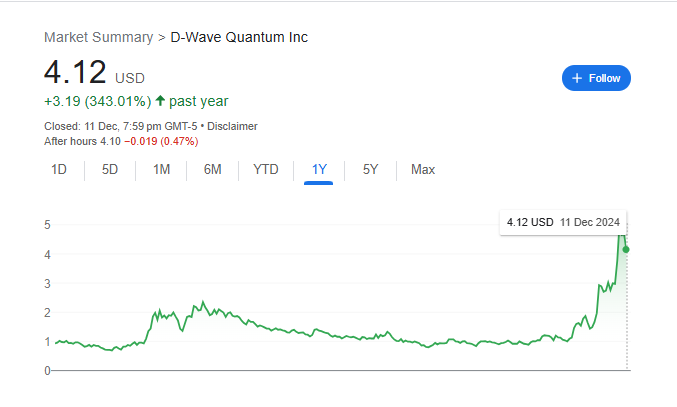

Analyzing the market's response to past QBTS earnings reports is essential. Did the stock price generally rise or fall following these announcements? What was the magnitude of these price changes? Understanding these historical patterns can help you anticipate the potential reaction to the upcoming announcement. We need to examine the stock's performance in the days and weeks immediately following previous earnings releases, paying attention to the volatility and overall trend. Identifying any significant news or events—positive or negative—that coincided with these price movements is also crucial for understanding the context of those past reactions.

- Key Findings (Example): Past QBTS earnings reports reveal a consistent upward trend in revenue but fluctuating EPS due to increased marketing expenditures. The market generally reacted positively to reports exceeding expectations but negatively to those falling short.

Evaluating Current Market Conditions and Their Impact on QBTS

Market forces significantly impact individual stock performance. Analyzing the broader economic climate and the competitive landscape surrounding QBTS is essential for a comprehensive prediction.

Macroeconomic Factors:

- Economic Growth: A robust economy generally benefits most companies, including QBTS. Conversely, an economic downturn or recession can negatively impact performance and stock prices.

- Industry Trends: Analyze the current state of QBTS's industry sector. Are there any significant trends, such as technological advancements or regulatory changes, that may affect the company's prospects?

- Interest Rates: Changes in interest rates influence borrowing costs and investor sentiment. Rising interest rates can increase borrowing costs for QBTS and might negatively impact the valuation of its stock.

Competitive Landscape:

-

Competitor Analysis: Assessing the performance of QBTS's competitors is essential. How are they performing financially? Are they gaining or losing market share?

-

Market Share: Is QBTS gaining or losing market share? This is a critical indicator of its competitive strength and future growth potential.

-

Disruptive Technologies: Are there any emerging technologies or business models that could disrupt QBTS's industry?

-

Significant Market Conditions (Example): The current inflationary environment could put pressure on QBTS's profit margins, while strong competition in the sector could limit its growth prospects.

Assessing the Company's Future Outlook and Growth Potential

Evaluating QBTS's future outlook necessitates reviewing its strategic initiatives and management's guidance.

Strategic Initiatives and Developments:

- New Products/Services: Are there any new products or services in the pipeline that could drive future growth? What is the potential market size for these offerings?

- Expansion Plans: Is QBTS expanding into new markets or geographic regions? What are the potential risks and rewards associated with such expansion?

- Research and Development: Is QBTS investing significantly in R&D? This signifies a commitment to innovation and future growth.

Management's Guidance and Expectations:

Management's guidance provides valuable insights into the company's expectations for the coming quarters. However, it is vital to assess the credibility and track record of this guidance, considering whether past predictions have been accurate. Management's tone and comments on the earnings call can significantly influence investor sentiment.

- Key Factors Influencing Future Growth (Example): QBTS's new software platform launch could be a key driver of future growth, but success depends on successful market penetration and user adoption.

Conclusion: Predicting the Future of QBTS Stock

Predicting QBTS stock performance after the next earnings announcement requires a careful assessment of past performance, current market conditions, and the company's future outlook. Several scenarios are possible, ranging from substantial gains if the results exceed expectations and the market conditions are favorable, to losses if the results disappoint. A neutral scenario is also plausible, where the stock price fluctuates slightly but shows no significant change. Remember that thorough research and a balanced perspective are essential. Don't rely solely on this analysis; conduct your own in-depth research before making any investment decisions. Stay tuned for our next analysis on QBTS stock performance following the release of the upcoming earnings report. Understanding QBTS's post-earnings trends is vital for strategic investment.

Featured Posts

-

Sasol Sol A Deep Dive Into The Updated Corporate Strategy

May 20, 2025

Sasol Sol A Deep Dive Into The Updated Corporate Strategy

May 20, 2025 -

1 231 Billion Recovery Sought From 28 Oil Companies Representatives Pledge

May 20, 2025

1 231 Billion Recovery Sought From 28 Oil Companies Representatives Pledge

May 20, 2025 -

Leclerc Reveals Feelings Towards Hamilton Following Ferrari Team Order Drama

May 20, 2025

Leclerc Reveals Feelings Towards Hamilton Following Ferrari Team Order Drama

May 20, 2025 -

Cote D Ivoire Le Salon International Du Livre D Abidjan Ouvre Ses Portes Pour Sa 15eme Edition

May 20, 2025

Cote D Ivoire Le Salon International Du Livre D Abidjan Ouvre Ses Portes Pour Sa 15eme Edition

May 20, 2025 -

Big Bear Ai Bbai Evaluating This Ai Penny Stocks Potential

May 20, 2025

Big Bear Ai Bbai Evaluating This Ai Penny Stocks Potential

May 20, 2025