Hudson's Bay Brand Acquisition: Toronto Firm Faces Tough Competition

Table of Contents

The Challenges of Acquiring the Hudson's Bay Brand

Integrating a legacy brand like Hudson's Bay presents a unique set of challenges. The firm must overcome hurdles inherent in merging a long-standing, established company with its existing operations. These challenges include:

-

Supply Chain Integration: Harmonizing existing supply chains with Hudson's Bay's established infrastructure requires meticulous planning and execution. Disruptions can lead to stockouts, delays, and ultimately, unhappy customers. Efficient supply chain management will be crucial for success.

-

Maintaining Brand Loyalty: Hudson's Bay boasts a rich history and loyal customer base. The acquiring firm must carefully preserve this customer loyalty while potentially introducing changes to modernize the brand. Alienating existing customers could severely impact sales and profitability.

-

Overcoming Established Competitors: The Canadian retail market is highly competitive, with dominant players like Walmart, Amazon, and other major department stores vying for market share. The Toronto firm needs a robust strategy to differentiate Hudson's Bay and capture market share from these entrenched competitors.

-

Brand Modernization: Hudson's Bay needs a refreshed image to appeal to younger demographics. Brand modernization requires a strategic approach, balancing the brand's heritage with contemporary trends and customer expectations. This includes considering factors such as updating store designs and implementing innovative marketing strategies.

Competitive Landscape: Key Players and Market Share

The Canadian retail market is a crowded space. Major competitors include:

- Walmart: Dominant in discount retail, offering a vast product range and aggressive pricing strategies.

- Amazon: A significant online retailer, boasting unparalleled convenience and a wide selection of goods.

- Other Department Stores: Established players like Simons and other regional department stores also compete for market share.

Analyzing the market share reveals a clear dominance by Walmart and Amazon. This competitive analysis highlights the immense challenge the Toronto firm faces. The acquisition of Hudson's Bay aims to disrupt this balance, though success will hinge on effective strategy and execution. Each competitor possesses strengths (pricing, online presence, brand recognition) and weaknesses (limited product range, customer service issues) which must be carefully considered.

The Toronto Firm's Strategy and Potential Success Factors

The Toronto firm's acquisition strategy for Hudson's Bay likely involves several key components:

- Financial Backing: A strong financial foundation is critical to fund the acquisition, integration, and subsequent modernization efforts.

- Innovative Marketing and E-commerce Strategies: Leveraging e-commerce and creative marketing strategies are paramount to reach broader audiences and compete effectively. This might involve targeted digital campaigns and engaging social media initiatives.

- Effective Supply Chain Management: Optimizing the supply chain will be vital in ensuring efficient operations and avoiding disruptions.

- Understanding the Target Market: A thorough understanding of the target market is crucial for tailoring products, services, and marketing campaigns to resonate with specific customer segments.

Financial Implications and Future Projections

The financial analysis of this Hudson's Bay brand acquisition is complex. The cost of the acquisition, the securing of funding (debt, equity), and projections for return on investment (ROI) are all crucial factors. While the potential for significant market projections exists, there are inherent financial risks. Successful integration, effective cost management, and robust sales growth are essential to generate a positive ROI. Failure to adequately manage costs and integrate operations smoothly could negatively affect the bottom line for both the Toronto firm and the Hudson's Bay brand.

Conclusion: The Future of the Hudson's Bay Brand Under New Ownership

The Hudson's Bay brand acquisition presents a high-stakes gamble for the Toronto firm. Success depends on overcoming numerous challenges, including navigating a competitive landscape, integrating a legacy brand, and implementing a winning strategy. The market impact remains uncertain, though a cautiously optimistic outlook suggests potential for success if the Toronto firm executes its plan effectively. The future of the Hudson's Bay brand in the Canadian retail sector will depend greatly on the firm's capacity for innovation, its ability to manage financial risks, and its strategic prowess in this highly competitive industry.

What are your thoughts on this significant Hudson's Bay brand acquisition? Share your predictions in the comments below!

Featured Posts

-

Shrove Tuesday Origins Customs And Why We Celebrate Pancake Day

May 03, 2025

Shrove Tuesday Origins Customs And Why We Celebrate Pancake Day

May 03, 2025 -

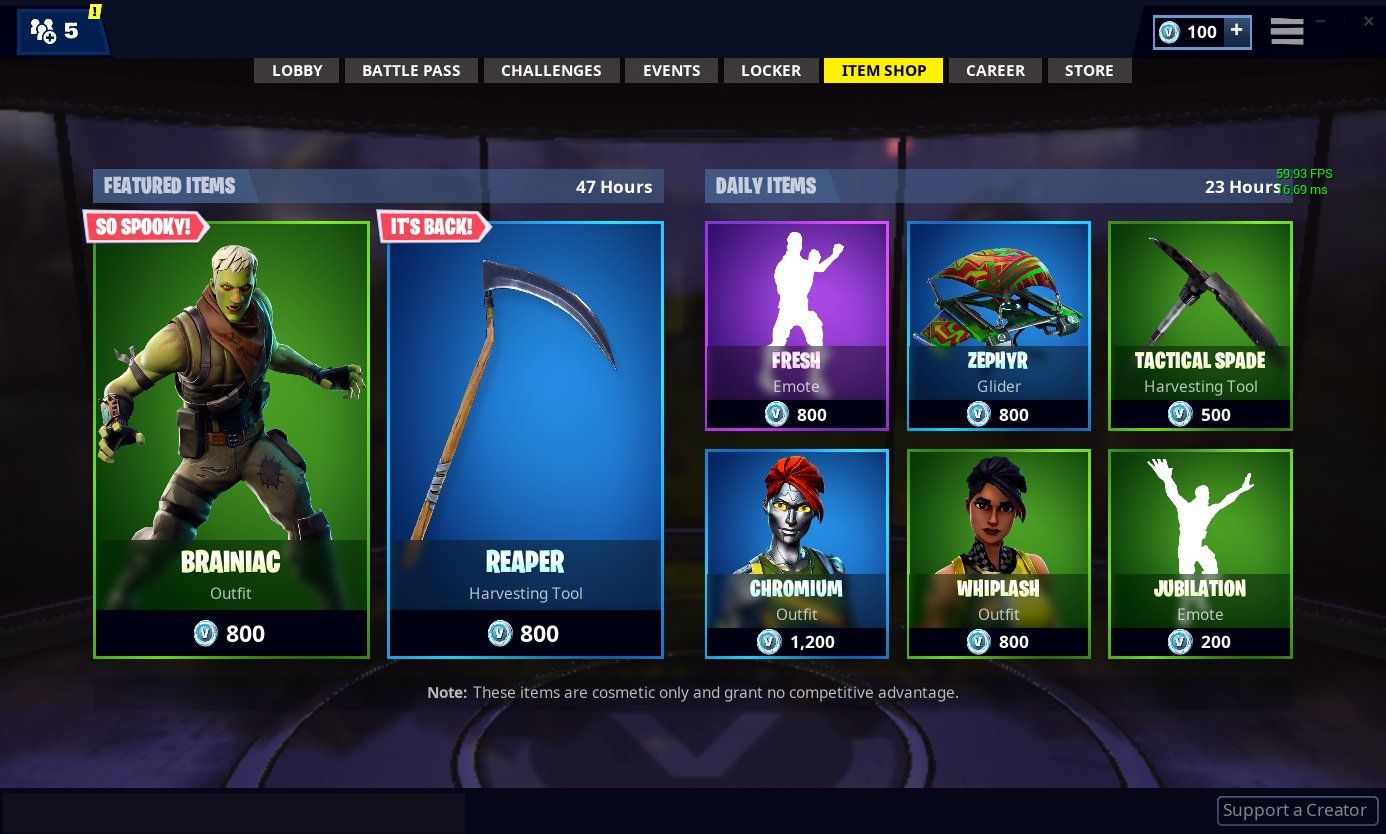

Fortnite Item Shop Enhanced With Helpful New Feature

May 03, 2025

Fortnite Item Shop Enhanced With Helpful New Feature

May 03, 2025 -

This Country A Travelers Diary

May 03, 2025

This Country A Travelers Diary

May 03, 2025 -

Understanding The Recent Decline In Riot Platforms Riot Stock

May 03, 2025

Understanding The Recent Decline In Riot Platforms Riot Stock

May 03, 2025 -

Hl Ant Msted Lblay Styshn 6 Kl Ma Thtaj Merfth

May 03, 2025

Hl Ant Msted Lblay Styshn 6 Kl Ma Thtaj Merfth

May 03, 2025