Hudson's Bay Company Granted Court Approval For Extended Creditor Protection

Table of Contents

Court Approval Details and Timeline

The court's decision granted HBC an extended period of creditor protection, allowing the company more time to implement its restructuring plan. While the specifics may vary depending on the exact court documents, let's assume, for illustrative purposes, the following:

- Date of court approval: October 26, 2023 (This is a hypothetical date; replace with the actual date)

- Length of the extended creditor protection period: An additional 6 months, extending the protection until April 26, 2024 (This is a hypothetical extension; replace with the actual timeframe).

- Key conditions imposed by the court: These conditions likely include strict reporting requirements, limitations on executive compensation, and a detailed plan for debt reduction and operational improvements. The court may also mandate regular updates on progress.

- Dissenting opinions or challenges: Any dissenting opinions or challenges to the approval should be mentioned here, referencing specific legal documents or news sources.

Reasons Behind Seeking Extended Creditor Protection

HBC's need for extended creditor protection stems from a confluence of factors that have significantly impacted its financial health. The initial application and the subsequent request for an extension highlight the severity of the challenges faced:

- Impact of the pandemic on retail sales: The COVID-19 pandemic severely disrupted retail operations, leading to store closures, reduced consumer spending, and significant revenue losses for HBC, as experienced across the retail sector.

- Rising operating costs and competition: Increased operating costs, including rent, wages, and supply chain expenses, coupled with intense competition from both brick-and-mortar and online retailers, squeezed HBC's profit margins.

- High debt levels: Pre-existing high debt levels exacerbated HBC's financial vulnerability, making it difficult to navigate the economic downturn and invest in necessary improvements.

- Shifting consumer preferences and e-commerce challenges: The shift towards online shopping presented a significant challenge for HBC, requiring substantial investment in e-commerce infrastructure and digital marketing to compete effectively. Lagging behind in this area contributed to declining sales.

Impact on HBC's Operations and Employees

The extended creditor protection period will inevitably have consequences for HBC's operations and its workforce:

- Potential store closures or restructuring: To improve profitability, HBC may be forced to close underperforming stores or consolidate its retail footprint. This could involve streamlining operations and optimizing its store network.

- Impact on employment levels: Store closures and restructuring efforts could lead to job losses, affecting both employees in directly affected stores and corporate roles. The scale of job losses will depend on the restructuring plan.

- Changes to supply chain and inventory management: HBC may need to renegotiate contracts with suppliers and optimize its inventory management practices to reduce costs and improve efficiency.

- Effects on customer service and loyalty programs: While HBC will aim to maintain customer service levels, budget constraints may necessitate changes to loyalty programs or other customer-facing initiatives.

Potential Outcomes and Future Outlook for Hudson's Bay Company

The outcome of the extended creditor protection period remains uncertain, but several potential scenarios exist:

- Potential scenarios: These include successful financial restructuring, sale of assets (such as individual stores or brands), complete reorganization, or, in a worst-case scenario, liquidation.

- Expected timeline for emerging from creditor protection: The success of the restructuring plan will determine when HBC exits creditor protection. The extended timeframe allows for more deliberate and effective restructuring.

- Long-term strategies for improving profitability and competitiveness: HBC will likely focus on enhancing its online presence, optimizing its supply chain, and improving operational efficiency to improve profitability and compete more effectively.

- Analysis of HBC's prospects for long-term success: The success of HBC's long-term strategy hinges on its ability to adapt to changing consumer preferences, effectively manage its debt, and improve its overall operational efficiency.

Comparison to Other Retail Restructuring Cases

Analyzing similar retail restructuring cases provides valuable insights into potential outcomes for HBC. For instance, [insert example of a similar retail restructuring case, e.g., Sears]. Examining the strategies employed, the challenges encountered, and the ultimate outcomes in those cases can help predict potential trajectories for HBC. This comparative analysis also adds a layer of depth and helps provide a broader perspective on the challenges facing the retail industry.

Conclusion

The court's approval of extended creditor protection for the Hudson's Bay Company represents a critical turning point in its journey toward financial stability. The extended timeframe, coupled with the conditions imposed by the court, provides a window of opportunity for HBC to implement a comprehensive restructuring plan. The success of this plan will determine whether HBC can emerge stronger and more competitive, or if further challenges lie ahead. The impact on employees and the Canadian retail landscape will depend heavily on the specifics of the restructuring strategy and its implementation. Stay informed about the ongoing developments in the Hudson's Bay Company's creditor protection and its financial restructuring by following updates and news related to HBC’s debt relief efforts and its broader retail restructuring strategy. Understanding the nuances of this process is critical for anyone invested in the Canadian retail sector.

Featured Posts

-

From Death Star To Yavin 4 Key Moments In The Andor Season 2 Trailer

May 16, 2025

From Death Star To Yavin 4 Key Moments In The Andor Season 2 Trailer

May 16, 2025 -

Was Jimmy Butler Overburdened A Look At The Miami Heat Playoffs

May 16, 2025

Was Jimmy Butler Overburdened A Look At The Miami Heat Playoffs

May 16, 2025 -

Nhl Predictions Tonight Maple Leafs Vs Blue Jackets Odds And Analysis

May 16, 2025

Nhl Predictions Tonight Maple Leafs Vs Blue Jackets Odds And Analysis

May 16, 2025 -

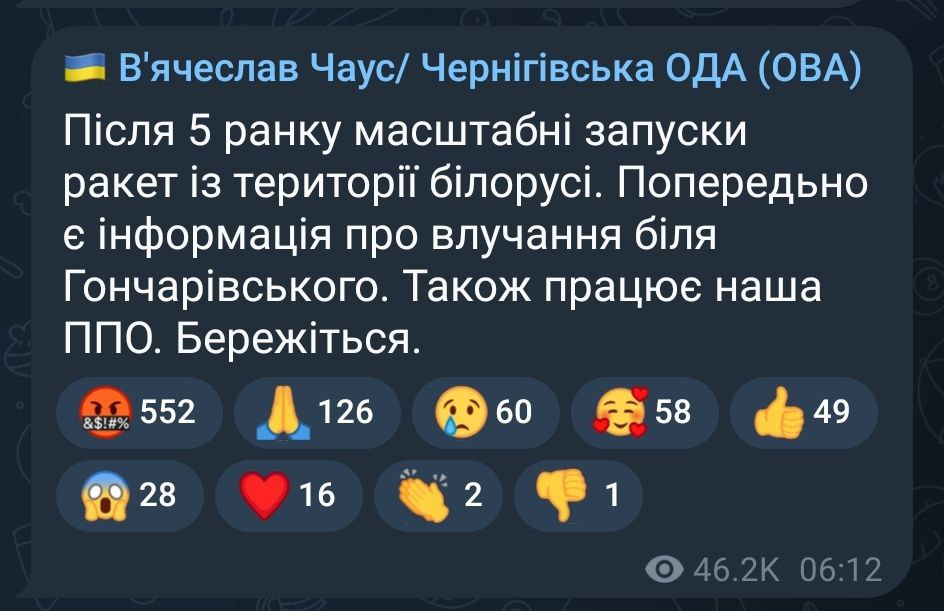

Bolee 200 Raket I Dronov Rossiya Nanesla Massirovanniy Udar Po Ukraine

May 16, 2025

Bolee 200 Raket I Dronov Rossiya Nanesla Massirovanniy Udar Po Ukraine

May 16, 2025 -

Boston Celtics 6 1 Billion Sale Analyzing The Private Equity Deal And Fan Concerns

May 16, 2025

Boston Celtics 6 1 Billion Sale Analyzing The Private Equity Deal And Fan Concerns

May 16, 2025