Hudson's Bay Lease Portfolio: Strong Interest In 65 Properties

Table of Contents

The Scope of the Hudson's Bay Lease Portfolio

The sheer size and breadth of the Hudson's Bay lease portfolio are impressive. The 65+ properties represent a substantial asset class, offering significant diversification potential for investors. These properties are strategically located across major urban centers and suburban areas throughout [List major cities/regions, e.g., Canada, the United States]. The portfolio encompasses a diverse range of property types, including prime retail spaces, office buildings, and mixed-use developments, catering to a wide array of investment strategies. The current tenant mix demonstrates the portfolio's stability and long-term earning potential, with key tenants including [List examples of major tenants, e.g., well-known retailers, established businesses]. This diverse tenant base mitigates risk and ensures a consistent stream of rental income.

- Number of properties: 65+

- Geographic distribution: Major cities across [mention countries/regions] including Toronto, Montreal, Vancouver, Calgary, New York, and other key urban centers.

- Property types: Retail, Office, Mixed-Use, and potentially other specialized commercial spaces.

- Key Tenants: A mix of national and international brands, showcasing the portfolio's strength and stability.

Reasons for Strong Investor Interest in the Hudson's Bay Lease Portfolio

The strong investor interest in the Hudson's Bay lease portfolio stems from several key factors. Firstly, the properties are situated in prime locations, often in high-traffic areas with excellent accessibility and visibility. This ensures high occupancy rates and strong rental income potential. Historically high occupancy rates further bolster the portfolio's appeal. Many properties boast long-term lease agreements with established tenants, providing a stable and predictable income stream. Furthermore, the potential for rental income growth and property appreciation in the long term makes this a highly attractive investment. The portfolio's strategic value for diversification within a larger real estate portfolio is also a significant draw for investors.

- Prime locations in high-traffic areas: Ensuring high visibility and accessibility for tenants and customers.

- Strong historical occupancy rates: Demonstrating the portfolio's consistent appeal and rental income generation.

- Potential for rental income growth: Due to prime location and potential for lease renewals at increased rates.

- Long-term lease agreements: Providing stable and predictable cash flow for investors.

- Strategic value for portfolio diversification: Reducing overall investment risk through a diverse range of properties.

Potential Investment Strategies for the Hudson's Bay Lease Portfolio

Investors have several avenues to explore when considering the Hudson's Bay lease portfolio. Direct property acquisition of individual assets offers a high degree of control and potential for customized management. Joint ventures with HBC or other investors could provide access to a larger portion of the portfolio while sharing risk and expertise. Participating in a real estate investment trust (REIT) focused on this portfolio is another alternative, offering diversified exposure and professional management. Regardless of the chosen strategy, robust portfolio management will be crucial for long-term success. This would include proactive tenant management, capital improvements, and strategic adjustments to market conditions.

- Direct property acquisition: Provides maximum control and potential for customization.

- Joint ventures with HBC or other investors: Allows for shared risk and access to larger portions of the portfolio.

- Participation in a real estate investment trust (REIT): Offers diversified exposure and professional management.

- Portfolio management strategies for long-term growth: Essential for maximizing returns and mitigating risk.

The Future of the Hudson's Bay Lease Portfolio

The future prospects for the Hudson's Bay lease portfolio are positive, driven by the underlying strength of the assets and the ongoing evolution of the commercial real estate market. While changes in the retail landscape may necessitate strategic adjustments, the prime locations of the properties provide a buffer against potential headwinds. HBC's long-term strategic plan for its real estate holdings will influence the pace and method of portfolio disposition or management, making it vital to stay abreast of their announcements. Overall, the long-term value of this portfolio is expected to appreciate, providing robust returns for investors.

- Expected long-term appreciation potential: Due to prime locations and ongoing demand for commercial real estate.

- Impact of evolving retail landscape: Requires adaptable portfolio management strategies.

- HBC's long-term strategic plan for real estate: Will shape the future of the portfolio and its availability to investors.

Conclusion:

The Hudson's Bay Company's lease portfolio represents a compelling investment opportunity for those seeking prime commercial real estate assets. The strong investor interest underscores the attractive features of these 65+ properties, including their strategic locations, high occupancy rates, and significant potential for future returns. The diverse range of investment strategies available caters to various risk profiles and investment goals.

Call to Action: Learn more about the Hudson's Bay lease portfolio and explore the potential investment opportunities available. Contact us today to discuss your interest in the Hudson's Bay lease portfolio and discover how you can benefit from this exceptional investment prospect.

Featured Posts

-

Chinese Stocks Rally In Hong Kong Trade War Optimism Fuels Gains

Apr 24, 2025

Chinese Stocks Rally In Hong Kong Trade War Optimism Fuels Gains

Apr 24, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase

Apr 24, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase

Apr 24, 2025 -

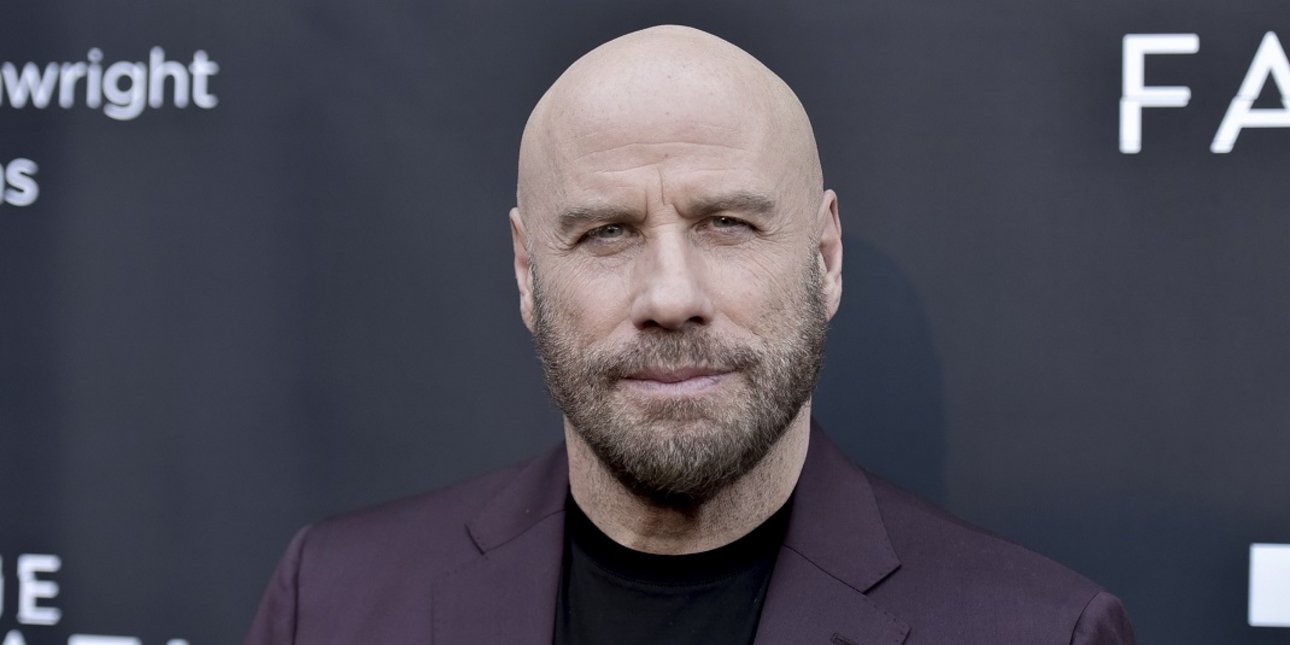

Tzin Xakman O Tzon Travolta Apoxaireta Ton Thryliko Ithopoio

Apr 24, 2025

Tzin Xakman O Tzon Travolta Apoxaireta Ton Thryliko Ithopoio

Apr 24, 2025 -

24 Year Old Ella Bleu Travolta A Fashion Cover Stars Dramatic Makeover

Apr 24, 2025

24 Year Old Ella Bleu Travolta A Fashion Cover Stars Dramatic Makeover

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025