IBM Software Fuels Deutsche Bank's Digital Acceleration

Table of Contents

Enhanced Cybersecurity with IBM Security Solutions

In the financial services sector, cybersecurity is paramount. Protecting sensitive customer data and maintaining regulatory compliance are non-negotiable. Deutsche Bank leverages IBM's comprehensive security portfolio to fortify its defenses and mitigate risks. This includes the implementation of cutting-edge technologies like IBM QRadar and IBM Guardium.

- IBM QRadar: This advanced security intelligence platform provides real-time threat detection and response capabilities, enabling Deutsche Bank to proactively identify and neutralize potential security breaches. It analyzes security data from various sources to pinpoint anomalies and vulnerabilities, significantly improving threat detection efficiency.

- IBM Guardium: This data security solution protects sensitive financial data both in transit and at rest, ensuring compliance with stringent regulations like GDPR and CCPA. It offers comprehensive data loss prevention (DLP) capabilities, preventing unauthorized access and data exfiltration.

The impact of these IBM Security solutions is quantifiable: Deutsche Bank has experienced a significant reduction in security incidents, improved compliance posture, and enhanced confidence in the security of its vast data ecosystem. Keywords: IBM Security, cybersecurity, data security, threat detection, compliance, financial data security.

Streamlined Operations with IBM Cloud and AI

Optimizing operational efficiency is crucial for any large financial institution. Deutsche Bank uses IBM Cloud and AI solutions to streamline processes, reduce costs, and enhance decision-making.

- Cloud Computing for Scalability: Migrating to IBM Cloud provides Deutsche Bank with the scalability and flexibility needed to handle fluctuating workloads and ever-growing data volumes. This reduces infrastructure costs and improves resource utilization.

- AI-Powered Fraud Detection: IBM's AI and machine learning capabilities are integrated into Deutsche Bank's fraud detection systems, significantly improving the accuracy and speed of identifying fraudulent transactions. This leads to reduced financial losses and improved customer protection.

- AI-Driven Risk Management: AI algorithms analyze vast datasets to identify and assess risks more effectively than traditional methods, providing Deutsche Bank with a more proactive and data-driven approach to risk management.

The integration of IBM Cloud and AI has resulted in measurable improvements in operational efficiency, cost savings, and enhanced risk management capabilities. Keywords: IBM Cloud, AI, machine learning, cloud computing, operational efficiency, risk management, fraud detection.

Improved Customer Experience through IBM Hybrid Cloud

Providing seamless and personalized customer experiences is vital for success in the competitive financial services industry. Deutsche Bank's adoption of IBM Hybrid Cloud solutions allows for enhanced application performance and availability, directly impacting customer satisfaction.

- Improved Application Performance: The hybrid cloud infrastructure ensures that Deutsche Bank's applications are highly available and perform optimally, regardless of location or workload demands. This results in faster transaction processing and a more responsive user experience.

- Scalable IT Infrastructure: The flexible nature of IBM's hybrid cloud solution allows Deutsche Bank to quickly scale its IT infrastructure to meet fluctuating demands, ensuring optimal performance even during peak periods. This contributes to uninterrupted service and improved customer satisfaction.

- Enhanced Customer Service: Improved application performance and availability translate directly into better customer service. Customers experience fewer disruptions and enjoy faster response times, leading to increased satisfaction and loyalty.

By leveraging IBM Hybrid Cloud, Deutsche Bank has enhanced its agility and responsiveness, delivering a superior customer experience. Keywords: IBM Hybrid Cloud, customer experience, application performance, scalability, cloud infrastructure, customer service.

Modernized Data Management with IBM Db2

Effective data management is the cornerstone of successful decision-making in the financial sector. Deutsche Bank relies on IBM Db2 database solutions for secure, reliable, and accessible data management.

- Enhanced Data Accessibility: IBM Db2 ensures that critical data is readily accessible to authorized personnel, enabling faster and more informed decision-making. This improves business agility and responsiveness.

- Robust Data Security: IBM Db2's advanced security features protect sensitive data from unauthorized access and breaches, maintaining the integrity and confidentiality of Deutsche Bank's information assets.

- Scalable Database Solution: IBM Db2’s scalability allows Deutsche Bank to handle ever-increasing data volumes without compromising performance or reliability.

IBM Db2's robust capabilities contribute to better business intelligence, improved decision-making, and a more secure data management environment. Keywords: IBM Db2, data management, database solutions, data security, data accessibility, business intelligence.

Conclusion: Accelerating Digital Growth with IBM Software

The collaboration between Deutsche Bank and IBM showcases the transformative power of strategic technology partnerships. By implementing IBM software solutions across its operations, Deutsche Bank has achieved significant improvements in cybersecurity, operational efficiency, customer experience, and data management. This demonstrates how IBM software fuels digital acceleration within the demanding environment of financial services. The enhanced security posture, streamlined operations, improved customer experiences, and modernized data management capabilities are testament to the success of this partnership. Discover how IBM software can fuel your digital acceleration. Visit [link to IBM website]. Keywords: IBM software, digital transformation, digital acceleration, financial services, technology solutions.

Featured Posts

-

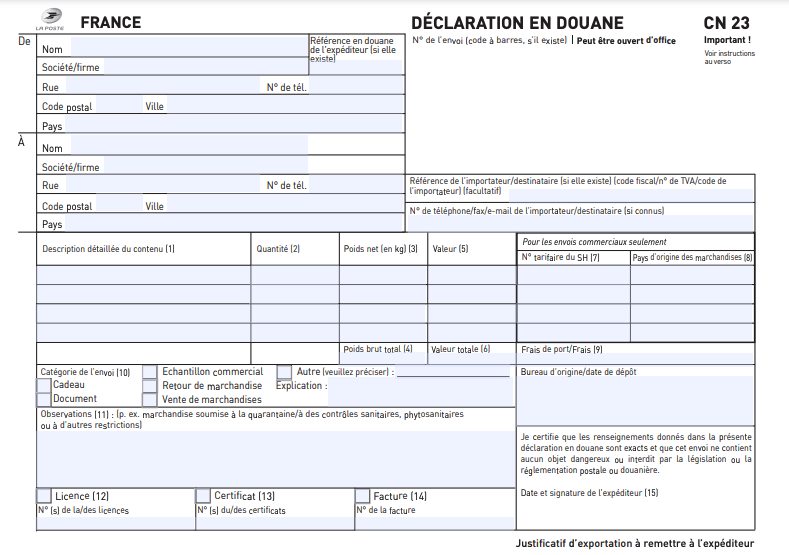

Guide Des Droits De Douane Declaration Et Procedures

May 30, 2025

Guide Des Droits De Douane Declaration Et Procedures

May 30, 2025 -

Iowa High School Track And Field State Meet Results May 22 25

May 30, 2025

Iowa High School Track And Field State Meet Results May 22 25

May 30, 2025 -

Bts 2025 Calendrier Des Epreuves Et Dates De Resultats

May 30, 2025

Bts 2025 Calendrier Des Epreuves Et Dates De Resultats

May 30, 2025 -

Malaysia Feels The Heat Us Imposes Solar Import Duties

May 30, 2025

Malaysia Feels The Heat Us Imposes Solar Import Duties

May 30, 2025 -

Ticketmaster Y Setlist Fm Se Unen Para Optimizar La Experiencia Del Fan

May 30, 2025

Ticketmaster Y Setlist Fm Se Unen Para Optimizar La Experiencia Del Fan

May 30, 2025