Ignoring High Stock Market Valuations: A BofA-Backed Strategy?

Table of Contents

BofA's Rationale for Ignoring High Valuations

Bank of America's stance on market valuation fluctuates, reflecting the dynamic nature of the financial landscape. To understand their current perspective, it's crucial to refer to their most recent reports and analyses. (Note: Specific data and quotes from BofA reports would need to be inserted here, reflecting their current market outlook. This information needs to be obtained from publicly available BofA research.) However, generally speaking, BofA's rationale for potentially overlooking high valuations might center on several key macroeconomic factors.

-

Macroeconomic Factors Justifying Higher Valuations: BofA analysts may point to persistently low interest rates as a justification for higher price-to-earnings (P/E) ratios. Low borrowing costs encourage companies to invest and expand, boosting earnings and supporting higher stock prices. Furthermore, strong corporate earnings growth, particularly in certain sectors, can justify higher valuations, even if overall market metrics suggest overvaluation. Technological advancements and disruptive innovation also play a crucial role, driving future earnings potential and impacting valuations.

-

Favored Sectors and Asset Classes: While overall market valuations may seem high, BofA may identify specific sectors or asset classes that offer relative value or growth potential. These might include technology companies with strong growth prospects, companies benefiting from long-term secular trends, or sectors showing resilience in the face of economic uncertainty. Identifying these sectors requires deep analysis beyond broad market indicators.

-

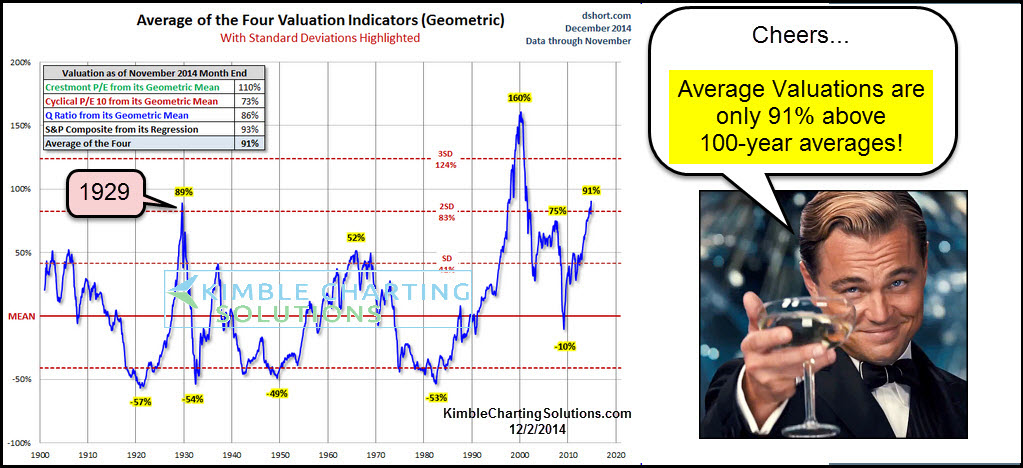

Valuation Metrics Beyond P/E Ratios: BofA likely employs a range of valuation metrics beyond the simple P/E ratio. These might include the Cyclically Adjusted Price-to-Earnings Ratio (Shiller P/E), which smoothes out earnings fluctuations, and Tobin's Q, which compares a company's market value to its asset replacement cost. These alternative metrics provide a more nuanced view of market valuation.

Understanding the Risks of Ignoring High Valuations

While BofA may suggest a strategy that involves potentially overlooking high valuations, it's crucial to acknowledge the inherent risks.

The Potential for Market Corrections

High valuations often precede market corrections. When asset prices are inflated, even a small negative catalyst can trigger a sharp decline.

-

Historical Examples: History provides numerous examples of market corrections following periods of high valuations. The dot-com bubble burst of 2000 and the housing market crash of 2008 are stark reminders of the potential for significant losses when valuations are stretched.

-

Inflation's Impact: High inflation erodes purchasing power and can lead to higher interest rates, negatively impacting asset prices, particularly those of growth stocks with high valuations.

-

Diversification's Importance: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is essential to mitigate the risk of significant losses during a market correction.

Identifying Overvalued Assets

Determining which assets are truly overvalued is challenging, and misjudgment is a real possibility.

-

Limitations of Valuation Metrics: Traditional valuation metrics have limitations. They often fail to capture intangible assets, future growth potential, or the impact of disruptive technologies.

-

Market Sentiment and Speculation: Market sentiment and speculation can significantly inflate asset prices, leading to valuations that are detached from fundamentals.

-

Thorough Due Diligence: Before investing in any asset, particularly in a potentially overvalued market, thorough due diligence is vital. This includes analyzing financial statements, understanding the company's business model, and assessing its competitive landscape.

Alternative Investment Strategies to Consider

If you're uncomfortable with a strategy that potentially ignores high valuations, several alternatives exist:

-

Value Investing: Focus on undervalued companies with strong fundamentals and a margin of safety.

-

Defensive Investing: Prioritize capital preservation over growth by investing in low-risk, high-quality assets like government bonds or dividend-paying stocks.

-

Dollar-Cost Averaging: Spread your investments over time to reduce the risk of investing a large sum at a market peak.

Case Studies and Examples

(Note: This section requires real-world examples of investment strategies that mirror BofA's approach – or similar contrarian strategies – showing both successes and failures. Finding and incorporating these examples is crucial to provide context and illustrate the complexities of the strategy.)

Conclusion

Ignoring high stock market valuations might be a viable strategy under specific circumstances, as suggested by some analysts at Bank of America. However, it carries significant risks. The potential for market corrections, the difficulty in identifying truly overvalued assets, and the impact of unforeseen economic events highlight the importance of a cautious approach. Before making any investment decisions, consult with a qualified financial advisor to discuss your risk tolerance and create a personalized investment strategy that aligns with your financial goals. Don't blindly follow any single strategy, including those seemingly backed by prominent financial institutions. Thoroughly analyze your options and understand the potential consequences before acting on any information regarding ignoring high stock market valuations.

Featured Posts

-

The Future Of Expensive Offshore Wind Energy Projects

May 03, 2025

The Future Of Expensive Offshore Wind Energy Projects

May 03, 2025 -

Lees Acquittal Overturned South Korean Supreme Court Ruling Impacts Presidential Hopes

May 03, 2025

Lees Acquittal Overturned South Korean Supreme Court Ruling Impacts Presidential Hopes

May 03, 2025 -

Another Transfer Fiasco Souness Attacks Man Utds Decision

May 03, 2025

Another Transfer Fiasco Souness Attacks Man Utds Decision

May 03, 2025 -

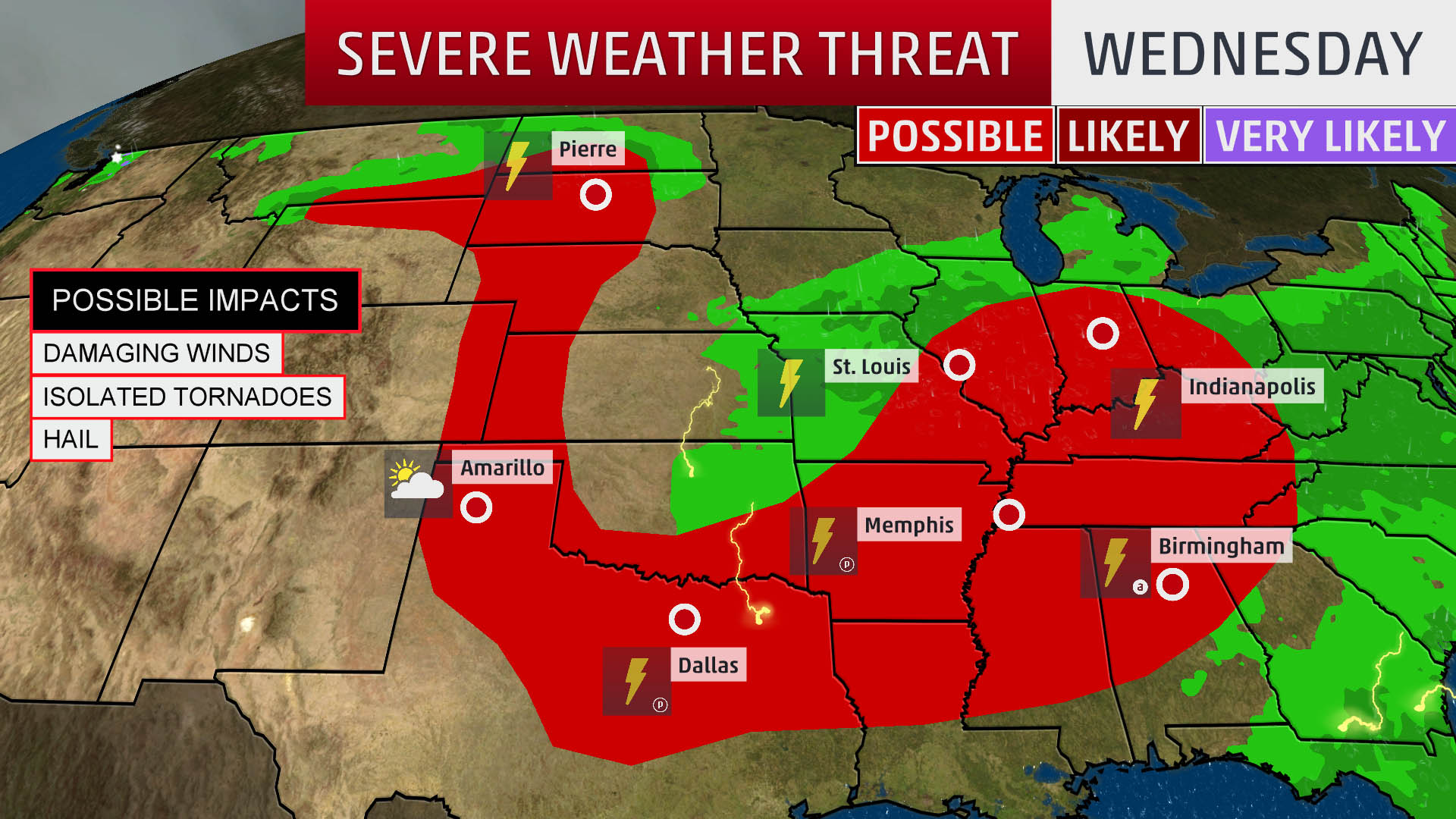

Severe Weather Alert Near Blizzard Conditions Predicted For Tulsa Nws

May 03, 2025

Severe Weather Alert Near Blizzard Conditions Predicted For Tulsa Nws

May 03, 2025 -

Childhood Investment A Foundation For Strong Mental Health

May 03, 2025

Childhood Investment A Foundation For Strong Mental Health

May 03, 2025