Ignoring High Stock Market Valuations: A Case Presented By BofA

Table of Contents

BofA's Argument: Why High Valuations Might Not Matter

BofA's core argument rests on several pillars, suggesting that the current high stock market valuations might not be as concerning as many believe. Their perspective isn't about dismissing the valuations entirely, but rather about considering other factors that could offset the risks. They emphasize the importance of looking beyond simple valuation metrics and focusing on the underlying fundamentals driving corporate performance.

Specific data points and quotes directly from BofA reports would strengthen this section, but lacking access to those, we can illustrate their arguments as follows:

-

Strong corporate earnings growth outweighing valuation concerns: BofA likely points to robust earnings growth across various sectors, suggesting that current prices are justified by strong fundamentals. This growth might be fueled by technological advancements, increased efficiency, and global expansion.

-

Sustained low interest rate environment supporting higher valuations: Low interest rates decrease the cost of borrowing for companies, boosting investment and profits, which, in turn, supports higher stock valuations. This low-rate environment also makes bonds less attractive, pushing investors towards equities.

-

Technological innovation driving future growth despite current valuations: BofA likely highlights the transformative power of technology, arguing that ongoing innovation in sectors like artificial intelligence, biotechnology, and renewable energy justifies higher valuations, even if current price-to-earnings ratios appear high.

-

Potential for further monetary easing: The possibility of central banks continuing to provide monetary stimulus could further support stock prices, softening the impact of high valuations.

Counterarguments: The Risks of Ignoring High Valuations

While BofA presents a compelling case, ignoring the risks associated with high stock market valuations would be imprudent. Several counterarguments challenge their optimistic stance:

-

Increased market vulnerability to negative news or economic shocks: High valuations mean less room for error. Negative news, unexpected economic downturns, or geopolitical instability could trigger disproportionately large market corrections.

-

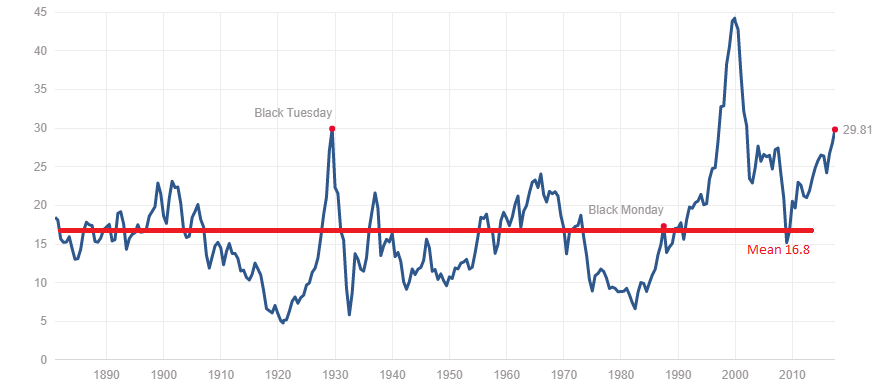

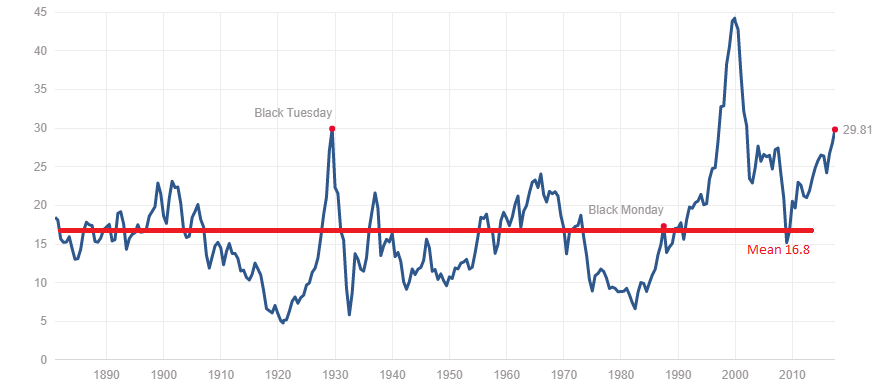

Higher probability of significant corrections or crashes: Historically, periods of high valuations have often been followed by significant market corrections or even crashes. This is not a guarantee, but it's a risk that cannot be ignored.

-

Limited upside potential compared to lower valuation markets: While earnings growth can support high valuations, the potential for further significant price appreciation might be limited compared to markets with lower valuations, offering potentially better risk-adjusted returns.

-

Potential for inflation to erode returns: Unexpected inflation could significantly erode the real returns from investments, especially in a high-valuation market where price gains may not fully compensate for the loss of purchasing power. This risk is especially pertinent in the current economic climate.

Analyzing the BofA Case: A Critical Perspective

BofA's argument has both strengths and weaknesses. Their emphasis on fundamental factors like earnings growth and technological innovation is crucial. However, relying solely on these factors without considering the historical context and potential risks of high valuations presents an incomplete picture.

-

Strengths of BofA's argument: Focus on strong earnings growth, the impact of low interest rates, and the potential for ongoing technological disruption.

-

Weaknesses of BofA's argument: Underestimation of market vulnerability to negative shocks, neglecting historical precedents of high valuations leading to corrections, and insufficient consideration of inflation risks.

-

Overall assessment of the risk/reward ratio: The risk/reward ratio in a high-valuation market is inherently skewed towards higher risk. While potential rewards exist, the potential for losses is significantly increased. Sophisticated investors will need to carefully weigh these factors.

Diversification and Risk Management Strategies

In a market characterized by high stock market valuations, diversification and robust risk management become paramount.

-

Diversify across asset classes: Reducing reliance on equities alone and incorporating other asset classes like bonds, real estate, or alternative investments can cushion the impact of potential market downturns.

-

Utilize stop-loss orders: Stop-loss orders can help limit potential losses by automatically selling a security when it reaches a predetermined price.

-

Consider value investing opportunities: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns compared to chasing high-growth, high-valuation stocks.

Conclusion: Navigating High Stock Market Valuations: A Call to Action

BofA's perspective on high stock market valuations offers a valuable, albeit optimistic, viewpoint. However, investors must carefully consider both sides of the argument. While strong corporate earnings and low interest rates provide support, the historical risks associated with high valuations, increased vulnerability to negative news, and the potential for inflation cannot be ignored. Understanding BofA's perspective on high stock market valuations is crucial. Before investing, conduct thorough research, consider diversifying your portfolio to mitigate potential risks associated with high valuations, and implement a robust risk management strategy. Remember, informed decision-making based on thorough research and a realistic assessment of risk is key to navigating the complexities of high stock market valuations.

Featured Posts

-

Manfaatkan Cangkang Telur Nutrisi Alami Untuk Pertumbuhan Tanaman Dan Kesehatan Hewan

May 04, 2025

Manfaatkan Cangkang Telur Nutrisi Alami Untuk Pertumbuhan Tanaman Dan Kesehatan Hewan

May 04, 2025 -

Convicted Paedophile Force Collaboration Ensures Justice For Victims

May 04, 2025

Convicted Paedophile Force Collaboration Ensures Justice For Victims

May 04, 2025 -

Navigating The Chinese Market The Bmw And Porsche Case Study

May 04, 2025

Navigating The Chinese Market The Bmw And Porsche Case Study

May 04, 2025 -

Bmw Porsche And The Evolving Chinese Automotive Landscape

May 04, 2025

Bmw Porsche And The Evolving Chinese Automotive Landscape

May 04, 2025 -

Athy Artist Launches Powerful New Art Exhibition

May 04, 2025

Athy Artist Launches Powerful New Art Exhibition

May 04, 2025