Ignoring High Stock Market Valuations: BofA's Rationale

Table of Contents

BofA's Focus on Earnings Growth and Future Prospects

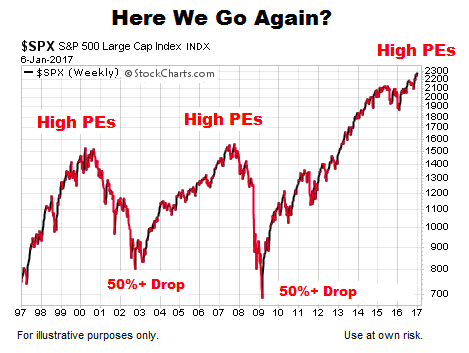

BofA's investment strategy prioritizes long-term earnings growth over short-term valuation metrics like the Price-to-Earnings ratio (P/E). They argue that robust corporate earnings growth can justify even seemingly high valuations when compared to historical averages. Their analysis focuses on projected future earnings, emphasizing the potential for continued expansion and the power of compounding returns.

- Future Earnings Projections are Key: BofA's analysts meticulously project future earnings, considering factors such as technological advancements, global economic trends, and industry-specific growth drivers. This forward-looking perspective is crucial in assessing the long-term value of a company.

- Growth Stocks as a Focus: This approach suggests a focus on identifying companies poised for significant future growth, even if their current P/E ratio might seem elevated. The underlying belief is that these companies’ future earnings will justify their current prices.

- Beyond the Simple P/E: This method deviates from solely relying on historical P/E ratios, which can be misleading in rapidly evolving markets. BofA's approach incorporates a more nuanced understanding of growth potential.

The Role of Low Interest Rates and Monetary Policy

BofA's assessment of stock market valuations also incorporates the impact of prevailing macroeconomic conditions, particularly low interest rates and central bank monetary policy. Low interest rates influence the attractiveness of different asset classes.

- Equities vs. Bonds: Low interest rates make equities comparatively more attractive than bonds, potentially supporting higher stock valuations. Investors searching for yield are often drawn to higher-growth assets like stocks.

- Federal Reserve Influence: BofA's analysis likely considers the Federal Reserve's monetary policy and its effect on interest rate environments. Expectations regarding future interest rate changes significantly affect stock valuations.

- Risk Appetite: Sustained low interest rates can encourage investors to take on more risk, further driving demand for equities and potentially justifying higher valuations.

Sector-Specific Analysis and Stock Selection

Rather than focusing solely on broad market indices, BofA emphasizes a granular, bottom-up approach, identifying undervalued sectors and individual stocks despite the overall high market valuations.

- Targeted Sector Analysis: Their research involves a deep dive into different sectors, recognizing that valuations can vary significantly across industries. Opportunities may exist in specific sectors even when the overall market appears overvalued.

- Company-Specific Due Diligence: They likely focus on companies with strong competitive advantages, experienced management teams, and healthy balance sheets. This focus on fundamental strength is crucial in mitigating risks associated with high valuations.

- Active Management Strategy: This approach contrasts with passive investment strategies that simply track market indices. BofA's active management approach aims to identify and capitalize on undervalued opportunities within an overvalued market.

Conclusion

BofA's rationale for overlooking high stock market valuations rests on a robust, multi-faceted approach. They prioritize future earnings growth, carefully consider macroeconomic influences like low interest rates, and utilize a meticulous, bottom-up stock selection process. While acknowledging the inherent risks associated with high valuations, BofA's perspective emphasizes the importance of looking beyond simplistic valuation metrics to assess the long-term potential of individual companies and sectors. Understanding BofA's perspective on stock market valuations can contribute to a more informed investment strategy. However, remember to conduct thorough due diligence, consider multiple viewpoints, and diversify your portfolio before making any investment decisions. Don't rely solely on a single firm's analysis when evaluating high stock market valuations.

Featured Posts

-

Efl Highlights Goals Saves And Controversies

May 13, 2025

Efl Highlights Goals Saves And Controversies

May 13, 2025 -

Schoduvel 2025 In Braunschweig Alle Infos Zum Tv Und Livestream

May 13, 2025

Schoduvel 2025 In Braunschweig Alle Infos Zum Tv Und Livestream

May 13, 2025 -

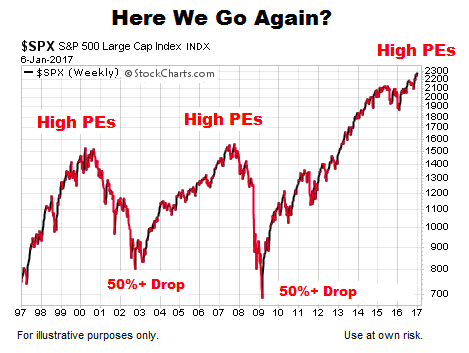

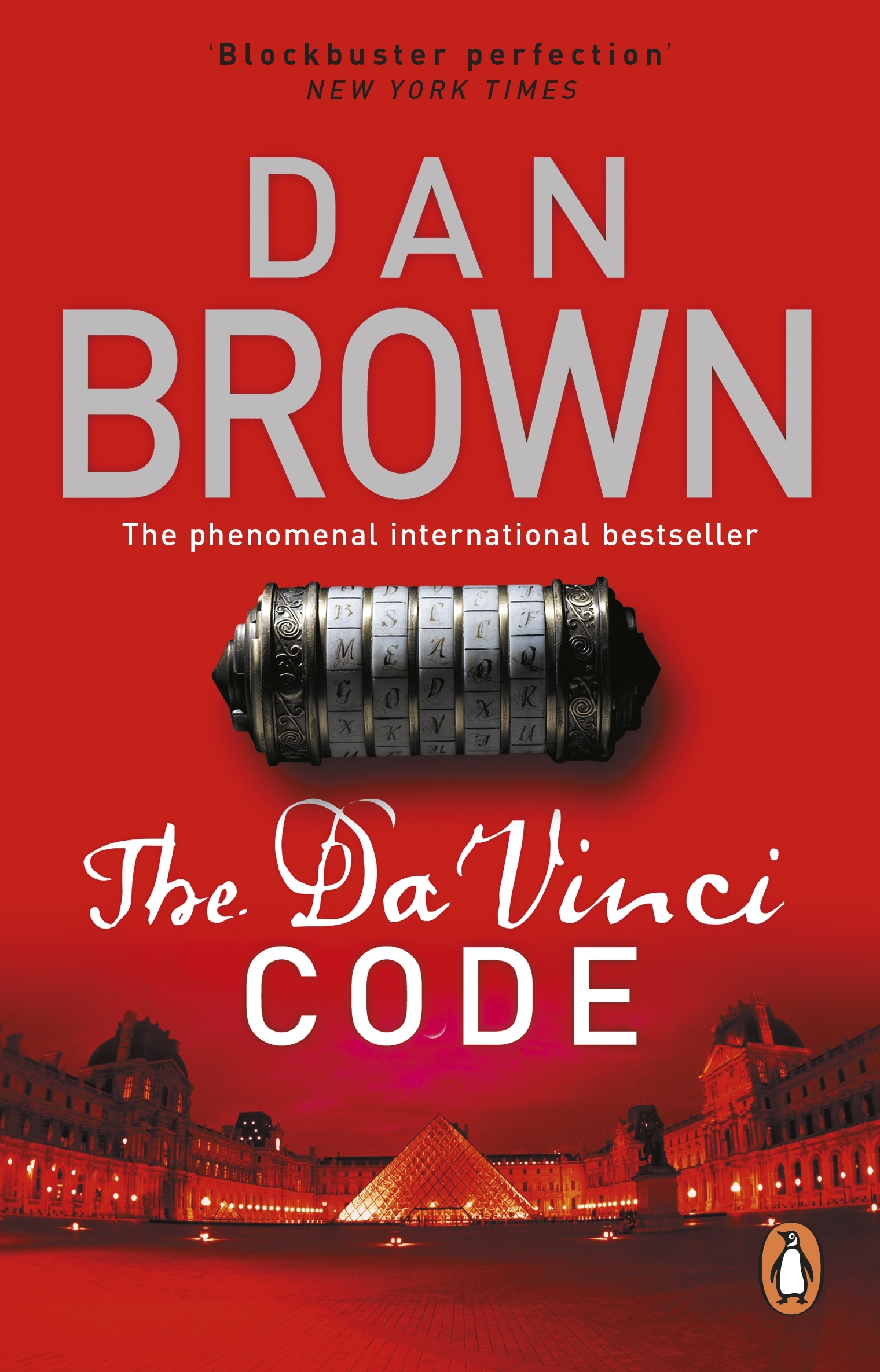

Exploring Dan Browns The Da Vinci Code Symbols History And Controversy

May 13, 2025

Exploring Dan Browns The Da Vinci Code Symbols History And Controversy

May 13, 2025 -

Hostage Fathers Message Of Strength To His Son

May 13, 2025

Hostage Fathers Message Of Strength To His Son

May 13, 2025 -

Doom The Dark Ages Review Embargo Lifted File Size Revealed

May 13, 2025

Doom The Dark Ages Review Embargo Lifted File Size Revealed

May 13, 2025