Impact Of G-7 De Minimis Tariff Discussions On Chinese Goods

Table of Contents

Current De Minimis Thresholds and Their Impact on Chinese Imports

Understanding De Minimis Tariffs

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties and other import taxes. Essentially, they represent a low-value exemption. These thresholds vary significantly across G-7 countries, creating a complex and often uneven playing field for importers. For instance, a low de minimis threshold means that even small shipments of goods from China might be subject to tariffs, while a high threshold allows for the duty-free import of larger quantities. This directly impacts the cost-effectiveness of importing small packages, especially through e-commerce channels.

-

Define de minimis thresholds and their purpose: De minimis thresholds are designed to simplify customs procedures for low-value goods, reducing administrative burdens on both importers and customs authorities. The purpose is to streamline the process for small shipments, particularly those imported through e-commerce platforms.

-

Detail current de minimis levels in various G-7 countries: Current levels vary widely. For example, some countries may have a threshold of $800, while others might have a threshold of $2,000 or even higher. This inconsistency adds complexity for businesses operating across multiple G-7 nations.

-

Illustrate the volume of Chinese goods currently benefiting from these thresholds: A substantial volume of Chinese goods, particularly consumer goods purchased online, currently falls below existing de minimis thresholds. This makes online retail from China a significantly cheaper option for consumers in G-7 countries.

-

Discuss the existing challenges with current thresholds: The inconsistencies across G-7 nations create an uneven playing field and can lead to administrative challenges for importers. They can also potentially facilitate unfair trade practices.

Proposed Changes to De Minimis Thresholds and Their Potential Effects

G-7 Proposals and Their Rationale

The G-7 is currently discussing potential changes to de minimis thresholds. Proposals range from raising thresholds to lower them, depending on the individual nation’s priorities and concerns. The rationale behind these proposals is multifaceted.

-

Summarize the arguments for raising or lowering thresholds: Arguments for raising thresholds often center on promoting e-commerce and reducing administrative burdens. Lowering thresholds, on the other hand, is often motivated by concerns about lost revenue, unfair competition, and the potential for increased volumes of counterfeit goods.

-

Explain the potential motivations behind these proposed changes: Besides revenue generation, these changes are intended to address concerns about fair trade practices, particularly concerning the potential for tax avoidance and the influx of counterfeit products.

-

Highlight any disagreements or conflicting viewpoints within the G-7: Reaching a consensus within the G-7 on de minimis threshold levels is proving challenging due to differing national interests and economic priorities. Some nations may prioritize revenue generation, while others focus on fostering e-commerce growth.

Impact on Businesses Importing Chinese Goods

Increased Costs and Reduced Competitiveness

Higher de minimis thresholds would increase import costs for businesses, significantly impacting their competitiveness.

-

Impact on small and medium-sized enterprises (SMEs): SMEs are particularly vulnerable to increased import costs as they have fewer resources to absorb additional expenses.

-

Changes in import costs and pricing strategies: Businesses may be forced to raise prices, potentially leading to a loss of market share.

-

Potential shifts in sourcing strategies away from China: Some businesses might explore alternative sourcing options to mitigate the increased costs associated with importing from China.

-

Increased administrative burden for customs clearance: Even with higher thresholds, complexities in customs procedures remain a significant challenge for businesses dealing with imports from China.

Impact on Consumers

Price Increases and Reduced Choice

Changes to de minimis thresholds will likely translate to higher prices for consumers and potentially a reduced selection of goods.

-

Potential rise in the price of imported goods from China: Increased tariffs on Chinese goods will inevitably lead to higher consumer prices.

-

Reduced variety and selection of consumer goods: Some businesses might opt to stop importing certain goods due to the increased costs.

-

Impact on online retail and e-commerce businesses: E-commerce businesses that rely heavily on low-cost imports from China will be particularly affected.

The Wider Geopolitical Implications

Trade Relations and Global Competition

Changes to de minimis thresholds have far-reaching geopolitical implications, impacting trade relations and global competition.

-

Impact on US-China trade relations: These discussions could further strain already tense US-China trade relations.

-

Potential repercussions for other trading partners: Changes in the G-7 approach to de minimis tariffs could influence trade policies of other nations.

-

Effects on global supply chains: The changes may lead to shifts in global supply chains, potentially impacting the efficiency and cost-effectiveness of international trade.

Conclusion

The G-7's de minimis tariff discussions are poised to significantly impact the import of Chinese goods, with substantial consequences for businesses, consumers, and international relations. Higher thresholds can lead to increased import costs for businesses, potentially reducing their competitiveness and driving up consumer prices. Lower thresholds may stifle e-commerce growth and increase administrative burdens. Understanding these potential impacts is crucial for stakeholders to adapt and navigate the changing landscape of international trade.

Call to Action: Stay informed about the evolving G-7 de minimis tariff discussions to mitigate potential risks and capitalize on opportunities presented by these changes affecting the import of Chinese goods. Follow developments concerning G-7 de minimis tariffs and their impact on the global trade of Chinese goods.

Featured Posts

-

80

May 24, 2025

80

May 24, 2025 -

Joy Crookes Drops Emotional New Single I Know You D Kill

May 24, 2025

Joy Crookes Drops Emotional New Single I Know You D Kill

May 24, 2025 -

Los Angeles Wildfires And The Gambling Industry A Concerning Trend

May 24, 2025

Los Angeles Wildfires And The Gambling Industry A Concerning Trend

May 24, 2025 -

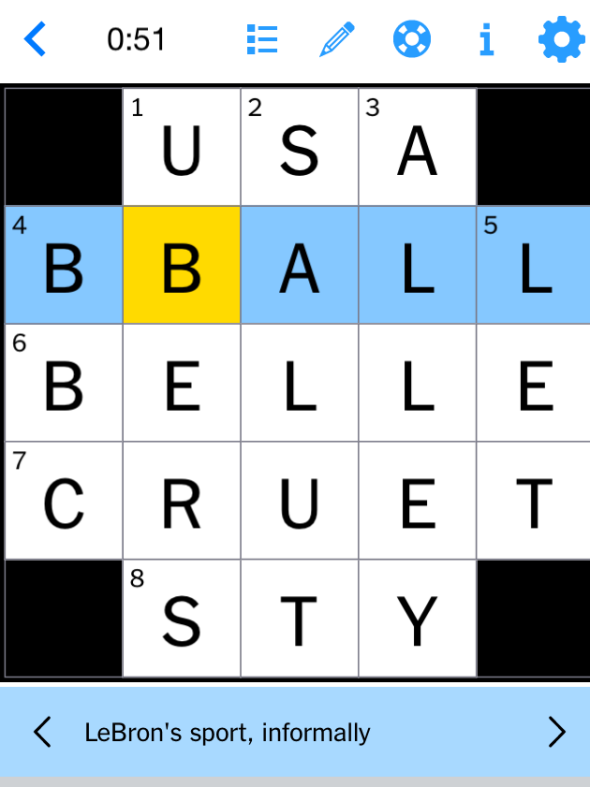

Todays Nyt Mini Crossword Answers March 12 2025

May 24, 2025

Todays Nyt Mini Crossword Answers March 12 2025

May 24, 2025 -

Billie Jean King Cup Kazakhstan Defeats Australia In Qualifier

May 24, 2025

Billie Jean King Cup Kazakhstan Defeats Australia In Qualifier

May 24, 2025