Impact Of Potential China-US Trade Deal On Copper Market

Table of Contents

China's Role as a Major Copper Consumer

China's voracious demand for copper is a cornerstone of the global market. Its booming economy, particularly in key sectors, drives significant copper consumption.

Copper Demand in Key Chinese Industries (Construction, Manufacturing, etc.)

China's massive infrastructure projects, including high-speed rail lines and expansive urban development, are huge copper consumers. Similarly, the manufacturing sector, particularly in electronics and electric vehicles (EVs), relies heavily on copper wiring and components.

- Construction: Copper is vital for electrical wiring, plumbing, and roofing in buildings. The ongoing urbanization in China fuels continuous demand.

- Manufacturing: The electronics industry, including smartphones and computers, uses substantial amounts of copper. The rise of EVs further increases demand due to their complex electrical systems.

- Renewable Energy: China's substantial investments in renewable energy, such as solar and wind power, also require significant copper for infrastructure and components.

China's copper imports consistently rank among the highest globally, reflecting its immense consumption. Any significant slowdown in its economic growth could directly translate to reduced copper demand.

Government Policies and their Influence on Copper Consumption in China

Chinese government policies directly influence copper consumption. Stimulus packages focusing on infrastructure development or industrial upgrades can significantly boost copper demand. Conversely, policies aimed at curbing pollution or promoting energy efficiency might lead to more targeted copper usage. Analyzing these policy shifts is crucial for predicting future demand.

The US's Influence on Global Copper Prices

While China is the largest consumer, the US plays a significant role in influencing global copper prices. Its production capacity, trade policies, and market influence are key factors.

US Copper Production and its Global Market Share

The US is a significant copper producer, although its market share is not as dominant as it once was. Changes in US copper production, influenced by factors like mining regulations and technological advancements, can impact global supply and prices. The US's refining capacity also significantly influences the global copper market.

Impact of US Tariffs and Trade Policies on Copper Prices

Past US tariffs and trade disputes have directly impacted copper prices. Increased tariffs on imported goods, including those containing copper, can raise prices for consumers and potentially affect demand. Future trade agreements could significantly shift the dynamics of copper supply chains.

Potential Scenarios of a China-US Trade Deal and their Effects on the Copper Market

The outcome of a China-US trade deal holds significant implications for the copper market. Let's examine several potential scenarios:

Scenario 1: A Comprehensive Trade Agreement

A comprehensive trade deal could lead to increased trade between the two nations, potentially boosting copper demand. However, increased competition could also put downward pressure on prices for some producers.

Scenario 2: A Limited Trade Agreement

A limited agreement might have a less pronounced impact on copper prices compared to a comprehensive deal. Some aspects of trade might improve while others remain strained.

Scenario 3: No Trade Agreement

A failure to reach a trade deal could lead to continued trade tensions, negatively impacting global economic growth and potentially depressing copper demand. Supply chain disruptions could also lead to price volatility.

Investment Implications for the Copper Market

The uncertainty surrounding a China-US trade deal creates both opportunities and risks for investors.

Opportunities and Risks for Investors

Investors need to carefully assess the risks and opportunities in the copper market based on the potential trade deal outcomes. Price volatility is likely, making diversification crucial.

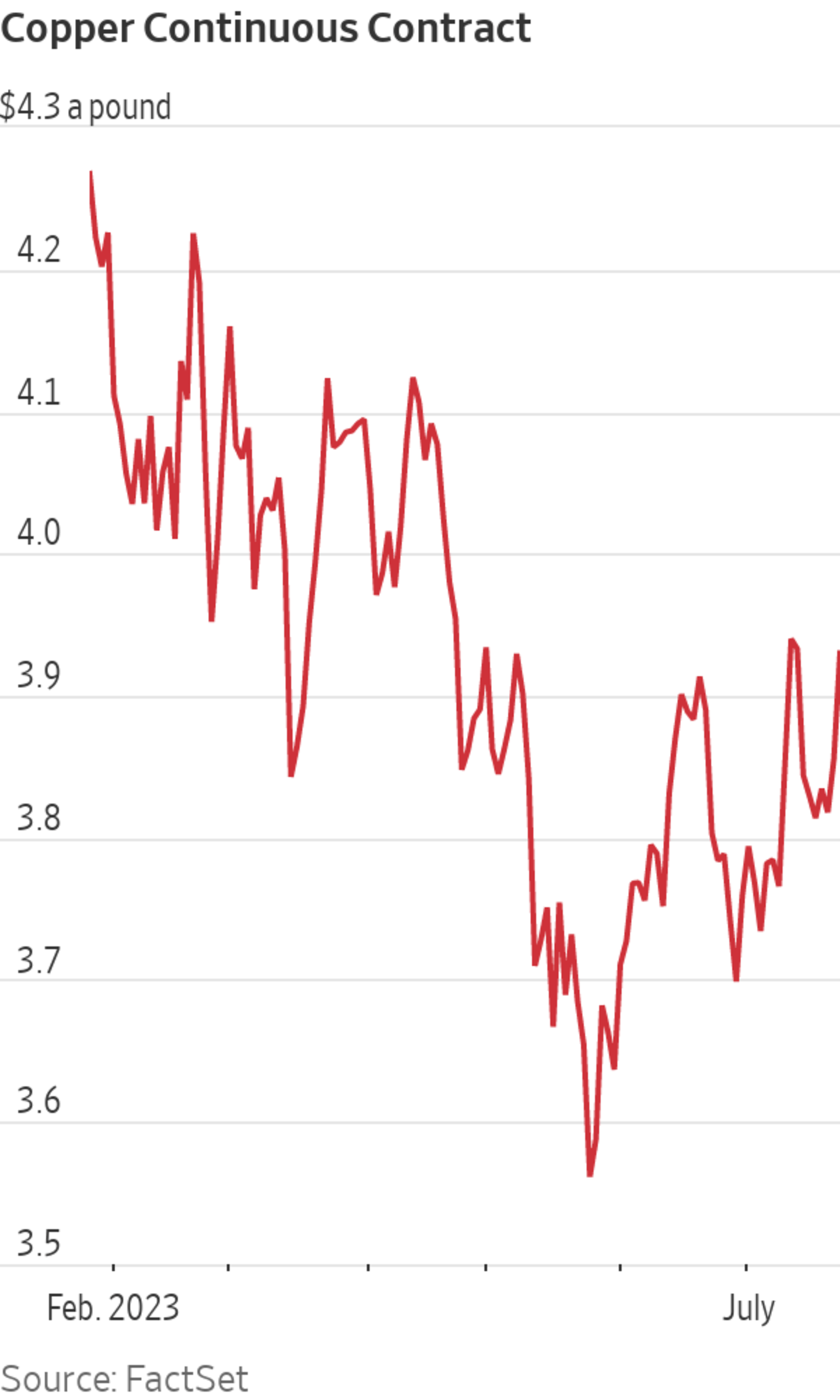

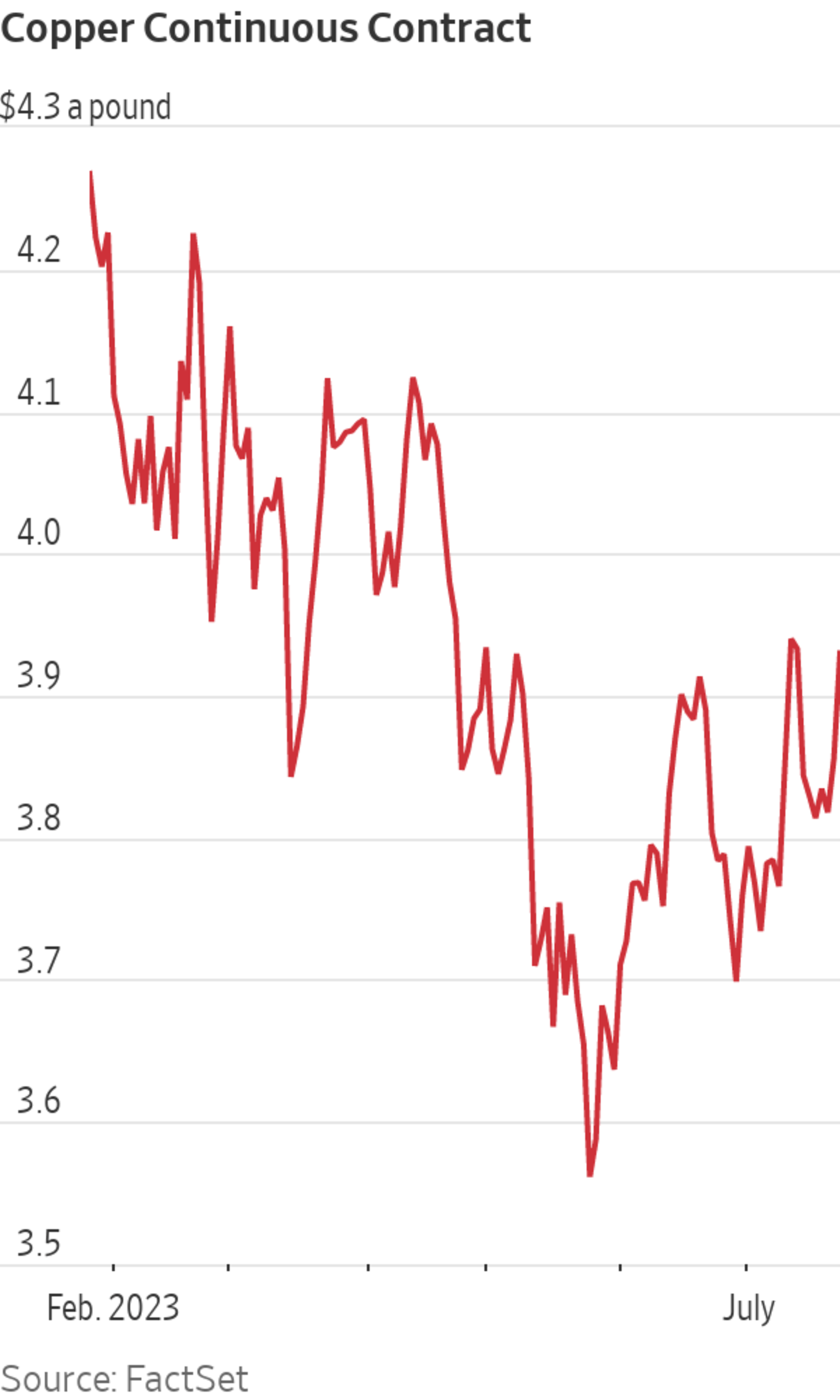

Copper Futures and their Sensitivity to Trade Negotiations

Copper futures markets are highly sensitive to news and developments related to China-US trade negotiations. Monitoring futures contracts can provide insights into market sentiment and potential price movements.

Conclusion: Navigating the Uncertainties: The Future of Copper in a Changing Trade Landscape

The impact of a potential China-US trade deal on the copper market is multifaceted and uncertain. While a comprehensive agreement could boost demand, a limited agreement or no agreement could lead to decreased demand or price volatility. Understanding China's role as a major consumer, the US's influence on global prices, and the potential scenarios outlined above is crucial for navigating the copper market's complexities during this period of trade uncertainty. Stay updated on the latest developments in the China-US trade relationship and its impact on the copper market to make informed investment decisions.

Featured Posts

-

Rihannas Wedding Night Inspiration The Savage X Fenty Lingerie Collection

May 06, 2025

Rihannas Wedding Night Inspiration The Savage X Fenty Lingerie Collection

May 06, 2025 -

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025 -

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025 -

Getting All Sabrina Carpenter Skins In Fortnite

May 06, 2025

Getting All Sabrina Carpenter Skins In Fortnite

May 06, 2025 -

Gypsy Rose Blanchard Challenging The Narrative On Loose Women

May 06, 2025

Gypsy Rose Blanchard Challenging The Narrative On Loose Women

May 06, 2025