Impact Of Recession Fears On Canadian Housing Market: A BMO Survey

Table of Contents

BMO Survey Key Findings on Consumer Sentiment

The BMO survey, conducted between [Start Date] and [End Date], polled [Sample Size] Canadians across various demographics, including homeowners, prospective buyers, and renters. The aim was to gauge consumer sentiment regarding the impact of potential recession on their housing decisions.

- Widespread Recessionary Concerns: A significant [Percentage]% of respondents expressed concerns that a recession would negatively impact their housing situation, highlighting a palpable anxiety within the Canadian population.

- Eroding Confidence: Confidence in the Canadian economy showed a marked decline, with only [Percentage]% of homeowners and [Percentage]% of potential buyers expressing strong confidence in the short-term economic outlook. This diminished confidence directly translates into hesitation within the housing market.

- Interest Rate Sensitivity: Rising interest rates are significantly impacting purchase intentions. [Percentage]% of respondents indicated that higher interest rates would either postpone or prevent them from purchasing a home, showcasing the sensitivity of the housing market to monetary policy changes. This is directly impacting affordability for many Canadians.

- Increased Consideration of Selling: A considerable [Percentage]% of homeowners are considering selling their properties due to economic uncertainty, suggesting a potential increase in housing supply, although this is likely to be offset by reduced buyer demand.

The significance of these findings is amplified by existing economic indicators. The current inflation rate of [Insert Current Inflation Rate]% and the [mention current employment rate/job losses] are adding to the prevailing sense of economic uncertainty, further impacting the Canadian housing market recession outlook.

Impact on Home Prices and Sales Activity

Recession fears are expected to significantly impact both home prices and sales activity in the Canadian housing market.

- Price Predictions: Short-term predictions point towards a potential [Increase/Decrease/Stagnation] in home prices, largely dependent on the severity and duration of any recession. Long-term forecasts suggest a more [positive/negative] outlook, contingent upon factors like government intervention and economic recovery.

- Sales Volume Slowdown: A decrease in sales volume is anticipated, with fewer listings and slower sales transactions expected. This reduction in market activity is a direct consequence of the reduced buyer confidence and increased economic uncertainty.

- Regional Variations: The impact will likely vary regionally. Markets like Toronto and Vancouver, traditionally characterized by higher price points and intense competition, might experience a more pronounced slowdown compared to other Canadian cities. This is due to higher average property costs making these markets more susceptible to interest rate changes.

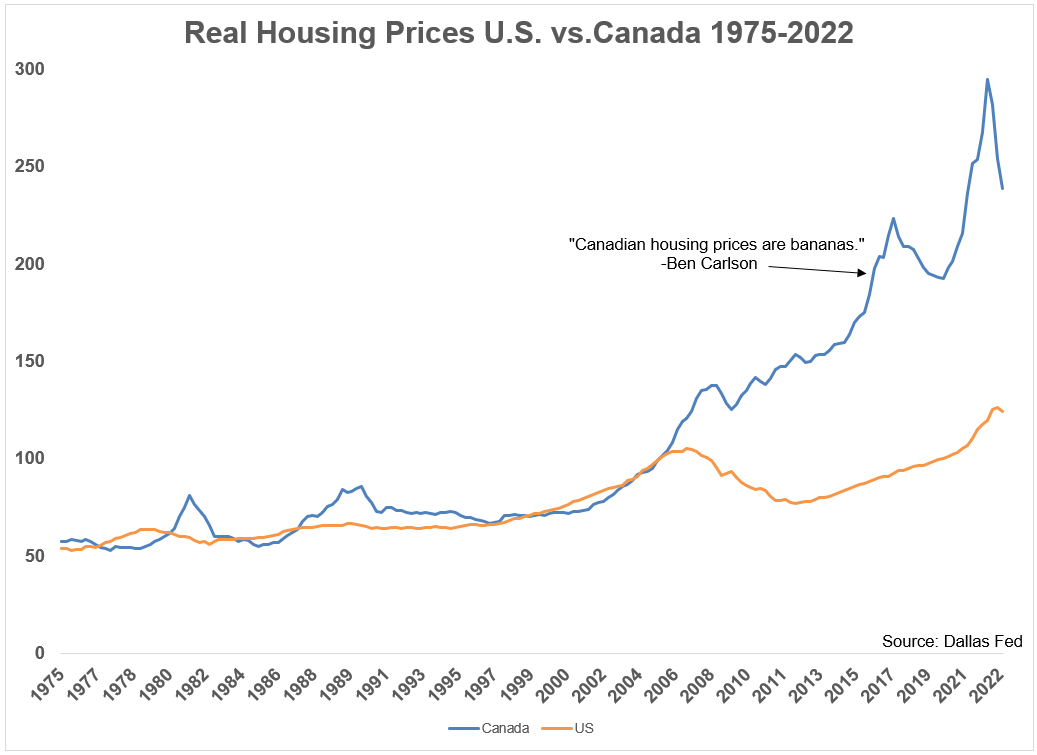

The interplay between weakening consumer sentiment, higher borrowing costs, and the overall supply and demand dynamics will be crucial in determining the extent of price adjustments and the speed of the market slowdown. A visual representation of these predicted changes, using charts and graphs derived from the BMO survey data, would provide a clearer understanding of the potential scenarios.

Strategies for Navigating the Uncertain Market

The current economic climate requires careful navigation for all participants in the Canadian housing market.

- Homeowners: Those considering selling should carefully assess market conditions and potentially adjust their pricing strategies. Refinancing options should be explored to potentially lower monthly payments, thus reducing financial vulnerability.

- Potential Buyers: Potential buyers need to carefully manage their budgets, secure pre-approval for mortgages, and realistically assess their affordability limits in light of higher interest rates.

- Investors: Real estate investors need to adopt a more cautious approach, diversifying their portfolios and carefully analyzing risk-adjusted returns before making any investments.

Seeking professional financial advice is crucial. A certified financial planner can provide personalized guidance based on individual circumstances, ensuring informed decision-making in this period of uncertainty. Strategies concerning mortgage rates, financial planning, and risk management are particularly important considerations.

Long-Term Outlook for the Canadian Housing Market

Predicting the long-term outlook for the Canadian housing market remains challenging, given the complex interplay of economic and political factors.

- Expert Predictions: Experts offer varying predictions, with some suggesting a prolonged period of adjustment and others predicting a relatively swift recovery once the recessionary pressures ease.

- Potential Policy Changes: Government interventions, such as adjustments to mortgage rules or fiscal stimulus packages, could significantly influence the market trajectory.

- Exacerbating/Mitigating Factors: Factors like global economic conditions, technological advancements in the construction industry, and demographic shifts will play a significant role in shaping the long-term outlook.

The long-term implications of the current situation include the potential for market corrections, the sustainability of current price levels, and the overall health of the Canadian economy. Identifying potential risks and opportunities for different market participants is crucial for strategic decision-making.

Conclusion

The BMO survey highlights significant concerns regarding the impact of recession fears on the Canadian housing market. Reduced consumer confidence, rising interest rates, and potential price adjustments are creating a challenging environment for homeowners, buyers, and investors alike. Understanding the nuances of a potential Canadian housing market recession is critical. While the short-term outlook appears uncertain, a careful consideration of the factors discussed in this article, along with professional financial guidance, can help navigate the complexities of this period.

Call to Action: Stay informed about the evolving situation in the Canadian housing market. Regularly review updates and analyses to make informed decisions regarding your own financial situation. Understanding the impact of the Canadian housing market recession is crucial for navigating this period of uncertainty. Continue your research on the Canadian Housing Market Recession and related keywords to best prepare for the future.

Featured Posts

-

Kumingas Return Currys And Kerrs Milestones Highlight Warriors Kings Victory

May 07, 2025

Kumingas Return Currys And Kerrs Milestones Highlight Warriors Kings Victory

May 07, 2025 -

Understanding The 2025 Nhl Draft Lottery Implications For The Utah Hockey Club

May 07, 2025

Understanding The 2025 Nhl Draft Lottery Implications For The Utah Hockey Club

May 07, 2025 -

Las Vegas John Wick Live The Baba Yaga Story

May 07, 2025

Las Vegas John Wick Live The Baba Yaga Story

May 07, 2025 -

Dozivite Songkran Vodna Zabava Na Ulicah Tajske

May 07, 2025

Dozivite Songkran Vodna Zabava Na Ulicah Tajske

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special High Stakes Gameplay And Charitable Giving

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special High Stakes Gameplay And Charitable Giving

May 07, 2025