Impact Of Trump's Statement On Canadian Dollar Exchange Rate

Table of Contents

Trade Tensions and the CAD

How did Trump's trade policies affect the Canadian dollar? The answer is multifaceted, primarily centered around tariffs and the renegotiation of NAFTA (North American Free Trade Agreement).

-

Tariffs on Canadian Exports: Trump's imposition of tariffs on various Canadian goods, from lumber to dairy products, directly impacted Canadian exports to the US. This reduced demand for Canadian goods, leading to decreased export revenue and putting downward pressure on the CAD. The uncertainty surrounding these tariffs created a climate of fear and uncertainty, further impacting the exchange rate.

-

NAFTA Renegotiation: The renegotiation of NAFTA, resulting in the USMCA (United States-Mexico-Canada Agreement), caused significant uncertainty in the markets. Trump's frequent threats to withdraw from NAFTA, coupled with his unpredictable negotiating tactics, created considerable volatility in the USD/CAD exchange rate. Investor confidence wavered as the future of this crucial trade agreement remained unclear.

-

Specific Instances: Several instances showcased a direct correlation between Trump's statements and CAD movements. For example, a particularly harsh tweet criticizing Canada's trade practices could be followed by a noticeable dip in the CAD's value against the US dollar. Conversely, positive statements regarding trade relations could lead to a temporary strengthening of the CAD.

-

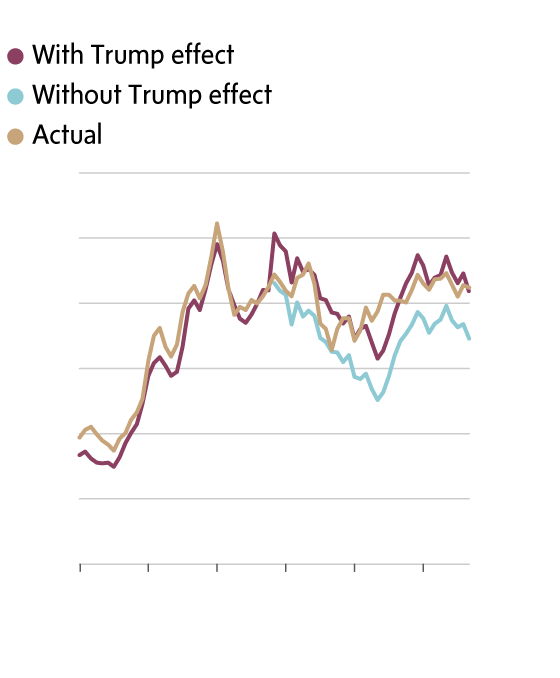

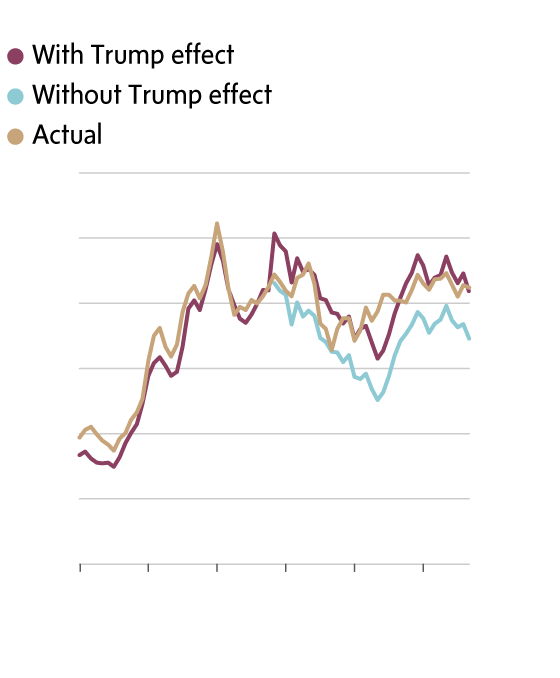

Visual Representation: [Insert chart or graph here illustrating the correlation between specific Trump statements/actions and subsequent changes in the CAD exchange rate]. This visual data reinforces the significant impact of his rhetoric on the Canadian dollar. Keywords: US-Canada trade, NAFTA, USMCA, tariffs, Canadian exports, trade war, lumber tariffs, dairy tariffs.

The Psychological Impact of Trump's Statements on the CAD

Beyond tangible trade policies, Trump's unpredictable nature significantly impacted market sentiment and the CAD.

-

Market Uncertainty and Volatility: Trump's penchant for impulsive statements and shifting positions created a climate of constant uncertainty. This uncertainty fueled market volatility, making it difficult for investors to predict CAD movements with confidence. The USD/CAD exchange rate became highly sensitive to any news or statement related to Trump's stance on US-Canada relations.

-

Investor Sentiment and Risk Aversion: Negative statements from Trump often triggered investor risk aversion, leading to capital flight away from the CAD and into safer haven assets like the US dollar. Conversely, periods of relative calm and positive statements could boost investor confidence, resulting in a strengthening CAD.

-

Media Influence: The media's coverage of Trump's statements played a crucial role in shaping market reactions. Negative headlines and widespread reporting of trade tensions amplified the impact on investor sentiment and the CAD. Keywords: market sentiment, investor confidence, political risk, currency volatility, USD/CAD exchange rate, risk aversion, safe haven assets.

How Macroeconomic Factors Interplay with Trump's Influence on the CAD

While Trump's statements played a significant role, it's vital to acknowledge that macroeconomic factors also influenced the CAD. These factors often interacted with Trump's influence in complex ways.

-

Interest Rate Differentials: Interest rate differentials between the US and Canada influenced the CAD. If US interest rates rose relative to Canadian rates, it could attract capital away from Canada, weakening the CAD. This effect could be amplified or mitigated by Trump's statements on monetary policy.

-

Oil Prices: As a major exporter of oil, Canada's economy is sensitive to oil price fluctuations. Changes in global oil prices directly impacted the CAD, often independent of Trump's statements. However, Trump's policies regarding energy and environmental regulations could indirectly affect oil prices and, consequently, the CAD.

-

Other Economic Indicators: Other macroeconomic indicators like inflation and GDP growth also influenced the CAD. These factors, in conjunction with Trump's statements on the US and Canadian economies, contributed to the overall volatility of the CAD. Keywords: interest rates, oil prices, inflation, GDP growth, economic indicators, Canadian economy, monetary policy, energy policy.

Conclusion: Navigating the Impact of Trump's Statements on the Canadian Dollar

Trump's statements significantly impacted the Canadian dollar exchange rate. This influence stemmed from both direct effects, like trade policies, and indirect effects, like the creation of market uncertainty and shifts in investor sentiment. Understanding this complex interplay between Trump's rhetoric, macroeconomic factors, and market psychology is vital for navigating the US-Canada economic landscape. The CAD's future remains tied to various domestic and international factors, including the ongoing relationship between the US and Canada. Staying informed about Trump's pronouncements and their potential Impact of Trump's Statements on Canadian Dollar Exchange Rate is crucial for making informed financial decisions. Consult reputable financial news sources and economic analysis for up-to-date information on the CAD and US-Canada trade relations.

Featured Posts

-

Check The Bbc Two Hd Schedule For Newsround

May 03, 2025

Check The Bbc Two Hd Schedule For Newsround

May 03, 2025 -

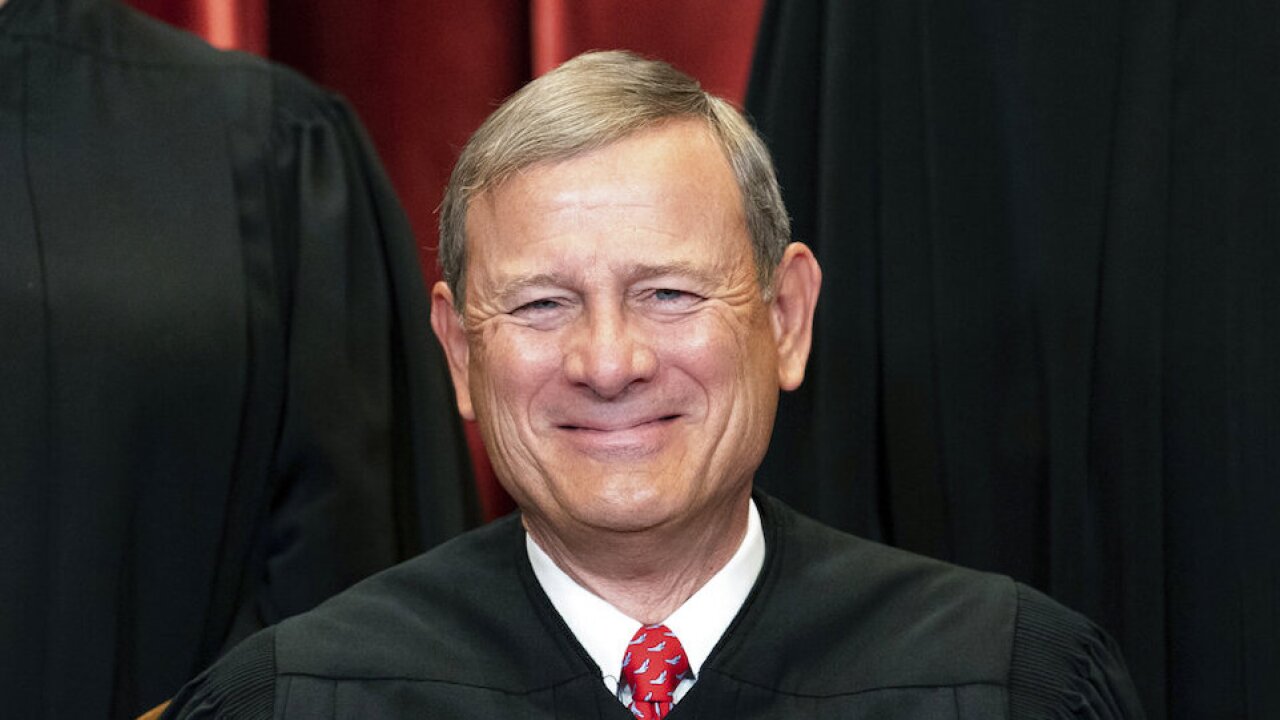

Chief Justice Roberts Three Cases Chipping Away At Church State Separation

May 03, 2025

Chief Justice Roberts Three Cases Chipping Away At Church State Separation

May 03, 2025 -

Negative Feedback On Fortnites Reversed Music Feature

May 03, 2025

Negative Feedback On Fortnites Reversed Music Feature

May 03, 2025 -

Belgium Vs England On Tv Kick Off Time Channel And How To Watch The Lionesses

May 03, 2025

Belgium Vs England On Tv Kick Off Time Channel And How To Watch The Lionesses

May 03, 2025 -

Loblaw And The Buy Canadian Movement Current Status And Future Outlook

May 03, 2025

Loblaw And The Buy Canadian Movement Current Status And Future Outlook

May 03, 2025