Increased Canadian Oil Exports To China: A Response To US Trade Disputes

Table of Contents

The Impact of US Trade Policies on Canadian Energy Exports

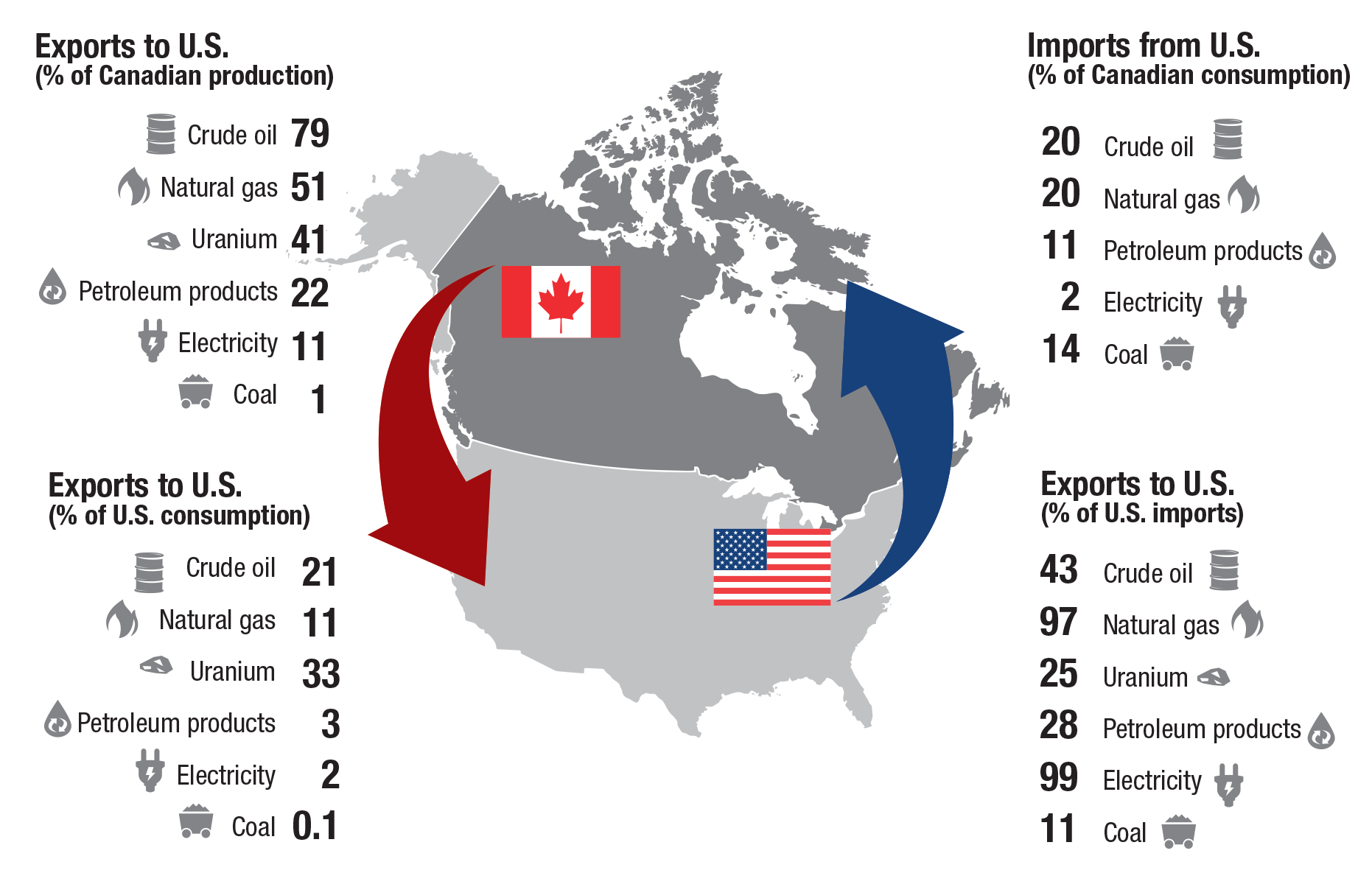

US tariffs and trade restrictions on Canadian oil have significantly impacted Canadian producers, creating a need for alternative markets. These policies have effectively reduced access to the historically dominant US market, forcing Canada to increase its reliance on alternative export destinations, including China. The pressure on Canadian oil prices resulting from these restrictions has also incentivized the exploration of new markets and trade partnerships.

- Reduced access to the US market: US trade policies, including Section 232 tariffs, have imposed significant barriers to Canadian oil exports, reducing the volume of oil shipped south.

- Increased reliance on alternative export destinations: This diminished access to the US market has pushed Canadian energy companies to actively seek new export partners, leading to a significant increase in shipments to China.

- Pressure on Canadian oil prices: Reduced US demand has exerted downward pressure on Canadian oil prices, making alternative markets, even those requiring longer transportation distances, more economically viable.

- Incentivization for exploring new markets: The uncertainty and challenges presented by US trade policies have directly motivated Canadian energy companies to diversify their export strategies and actively cultivate relationships with other countries, such as China.

Specific US trade policies, like the imposition of tariffs under Section 232 of the Trade Expansion Act of 1962, citing national security concerns, have directly contributed to this shift. Data shows a significant decrease in US oil imports from Canada since the implementation of these measures.

China's Growing Energy Demand and Diversification Strategy

China's rapid economic growth has fueled a massive increase in its energy consumption, creating a substantial demand for oil imports. Simultaneously, China is proactively diversifying its energy sources to reduce its reliance on traditional suppliers in the Middle East, seeking more stable and reliable alternatives. This strategy has created a significant opportunity for Canadian oil producers.

- Rapid economic growth fueling higher energy consumption: China's ongoing industrialization and expanding population continue to drive a relentless demand for energy resources.

- Desire to diversify away from reliance on Middle Eastern oil: Geopolitical considerations and concerns about supply security have prompted China to actively seek alternative energy sources to mitigate risks associated with dependence on a single region.

- Investment in infrastructure to facilitate oil imports from Canada: China has invested heavily in port facilities and transportation infrastructure to handle the increased volume of oil imports from Canada.

- Geopolitical considerations driving the search for alternative suppliers: Securing a stable supply of oil is a key aspect of China's national security strategy, and diversification of suppliers is a core element of this strategy.

Statistics demonstrate China's rapidly growing oil consumption and its increasing imports from countries like Canada, reflecting this diversification strategy. Chinese government initiatives focused on energy security further underpin this shift.

The Infrastructure and Logistics of Increased Canadian Oil Exports to China

Transporting Canadian oil to China presents both challenges and opportunities. This involves overcoming significant logistical hurdles related to pipeline infrastructure, tanker shipments, and port capabilities. While substantial investment is required, the potential rewards are significant.

- Expansion of existing pipeline networks or development of new ones: Existing pipeline infrastructure may need upgrades or expansion to handle the increased volume of oil destined for export to China. New pipeline projects might also be necessary.

- Increased use of tanker shipping routes: Tanker shipments across the Pacific Ocean are becoming increasingly important for transporting Canadian oil to China.

- Investment in port infrastructure to handle larger volumes of oil: Canadian ports require upgrades to handle the increased volume of oil exports, including improved storage and loading facilities.

- Potential environmental concerns and mitigation strategies: Increased tanker traffic and pipeline development raise environmental concerns that need to be addressed through robust environmental regulations and mitigation strategies.

The costs associated with these infrastructure improvements are substantial, but the benefits, in terms of economic growth and enhanced energy security, are potentially far-reaching. Stringent environmental regulations play a key role in minimizing the environmental impact of these developments.

Economic Benefits for Canada

Increased Canadian oil exports to China translate into significant economic benefits for Canada. This includes job creation, increased government revenue, and a more diversified economy.

- Job growth in the oil and gas sector and related industries: The expansion of the oil and gas sector to meet China's demand creates numerous jobs across the value chain.

- Increased government revenue through taxes and royalties: Higher oil exports lead to increased tax revenue and royalties for the Canadian government.

- Strengthened economic ties between Canada and China: Increased trade strengthens economic relationships and fosters further collaboration between the two countries.

- Reduced dependence on the US market: Diversifying export markets reduces Canada's vulnerability to US trade policies and market fluctuations.

These economic gains contribute to a healthier and more resilient Canadian economy.

Geopolitical Implications

The increased flow of Canadian oil to China has significant geopolitical implications, impacting US-Canada relations and the global energy landscape.

- Shift in global energy dynamics: This shift alters the balance of global energy supply and demand, influencing prices and strategic alliances.

- Potential impact on the North American energy market: Increased exports to Asia may affect oil prices and supply within North America.

- Implications for Canada's relationship with the US: The shift in export focus may impact the Canada-US relationship, particularly concerning energy trade.

- Impact on global energy prices: Increased supply from Canada could influence global oil prices, creating both opportunities and challenges.

Careful consideration of these geopolitical factors is essential for navigating this evolving landscape.

Conclusion

The rise in Canadian oil exports to China is a multifaceted phenomenon driven by a confluence of factors. US trade policies have created opportunities for Canada to diversify its export markets, while China's growing energy needs and diversification strategy have created a strong demand for Canadian oil. Substantial infrastructure development is required to facilitate these increased exports, leading to substantial economic benefits for Canada, including job creation and increased government revenue. However, the geopolitical implications of this shift are significant and warrant careful monitoring and strategic planning.

The increasing reliance of China on Canadian oil presents both opportunities and challenges. Continued monitoring of this evolving relationship and further investment in infrastructure are crucial to ensuring the long-term success of increased Canadian oil exports to China. Further research and analysis are needed to fully understand the long-term implications of this significant shift in the global energy market. (Keywords: Increased Canadian Oil Exports to China, Canadian oil exports)

Featured Posts

-

Posthaste The Economic Realities Facing Canadian Households After Trumps Tariffs

Apr 23, 2025

Posthaste The Economic Realities Facing Canadian Households After Trumps Tariffs

Apr 23, 2025 -

Diamondbacks Stage Ninth Inning Comeback To Defeat Brewers

Apr 23, 2025

Diamondbacks Stage Ninth Inning Comeback To Defeat Brewers

Apr 23, 2025 -

Michael Lorenzen A Comprehensive Look At His Baseball Career

Apr 23, 2025

Michael Lorenzen A Comprehensive Look At His Baseball Career

Apr 23, 2025 -

Royals Dominant 11 1 Victory In Brewers Home Opener

Apr 23, 2025

Royals Dominant 11 1 Victory In Brewers Home Opener

Apr 23, 2025 -

Cortes Stellar Performance Reds Suffer 1 0 Defeat Extending Losing Streak

Apr 23, 2025

Cortes Stellar Performance Reds Suffer 1 0 Defeat Extending Losing Streak

Apr 23, 2025

Latest Posts

-

Edmonton Oilers Leon Draisaitls Expected Playoff Return Boosts Teams Chances

May 09, 2025

Edmonton Oilers Leon Draisaitls Expected Playoff Return Boosts Teams Chances

May 09, 2025 -

Leon Draisaitl Injury Update Oilers Star Expected For Playoffs

May 09, 2025

Leon Draisaitl Injury Update Oilers Star Expected For Playoffs

May 09, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Picks

May 09, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Picks

May 09, 2025 -

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025 -

Oilers Vs Kings Nhl Playoffs Game 1 Predictions Picks And Best Bets

May 09, 2025

Oilers Vs Kings Nhl Playoffs Game 1 Predictions Picks And Best Bets

May 09, 2025