India Fund Manager DSP Sounds Caution, Raises Cash Despite Strong Performance

Table of Contents

DSP's Strong Performance and Recent Market Trends

DSP Investment Managers has showcased impressive fund performance in recent times. Several of its flagship funds have delivered significant returns, fueled by positive trends in the Indian market. This success is partly attributable to the robust growth witnessed in specific sectors and the overall positive sentiment surrounding the Indian economy.

- Specific fund performance figures: For example, the DSP XXX fund might have shown a 25% return in the last year, while the DSP YYY fund achieved a 18% return over the same period. (Note: Replace XXX and YYY with actual fund names and insert accurate data.)

- Key market drivers: Strong economic growth, supportive government policies focusing on infrastructure development and digitalization, and a burgeoning middle class have all contributed to the positive market sentiment.

- Specific indices/sectors: The Nifty 50 index has performed strongly, with significant contributions from sectors like IT, pharmaceuticals, and financials. These sectors have been major beneficiaries of DSP's investment strategies.

Reasons Behind DSP's Cautious Stance and Cash Raise

While DSP's performance has been commendable, the fund manager is adopting a cautious approach, evidenced by its decision to increase cash reserves. This strategic move reflects an anticipation of potential headwinds and risks in the Indian market.

- Geopolitical risks: The ongoing war in Ukraine, persistent global inflation, and geopolitical instability are creating uncertainty in global markets, indirectly impacting the Indian economy.

- Domestic economic concerns: Rising interest rates aimed at curbing inflation, potential supply chain disruptions, and fluctuations in the rupee's value represent significant domestic challenges.

- Potential market corrections or volatility: The current positive market trend may not be sustainable, and corrections or increased market volatility are possibilities. Holding more cash allows DSP to capitalize on potential dips in the market.

- Strategic allocation: Increasing cash reserves isn't solely about risk aversion; it's also a strategic move. By having more liquidity, DSP is better positioned to take advantage of attractive investment opportunities that might arise due to market corrections.

Expert Opinions and Market Analysis

Financial analysts offer varying perspectives on DSP's decision. Some applaud the cautious approach, viewing it as prudent risk management in a volatile global environment. Others suggest that the move might represent a missed opportunity to capitalize on further market gains. This strategy contrasts with some other fund managers in the Indian market who are maintaining a more aggressive stance.

- Quotes from experts: (Insert quotes from relevant financial analysts and market experts regarding DSP's decision and the overall outlook for the Indian market).

- Comparison with other fund managers: While some fund managers are continuing with aggressive investment strategies, DSP's more conservative approach highlights the differing risk appetites and investment philosophies within the Indian fund management landscape.

- Overall market sentiment: The market sentiment is currently mixed, with some optimism about long-term growth counterbalanced by concerns about short-term volatility.

Implications for Investors

DSP's move has significant implications for investors in its funds. While the strong past performance is reassuring, investors should understand the underlying rationale behind the increase in cash reserves.

- Advice for investors regarding risk management: Investors should review their own risk tolerance and consider diversifying their portfolios to mitigate potential market downturns.

- Recommendations on diversification strategies: A diversified approach, incorporating assets across different asset classes and geographies, can help to reduce overall portfolio risk.

- Importance of long-term investment goals: Investors with a long-term perspective might find this a relatively minor adjustment. The decision to hold more cash might be a short-term strategic repositioning rather than a fundamental shift in investment philosophy.

Conclusion: India Fund Manager DSP's Cautious Approach – What it Means for You

In summary, while India fund manager DSP has demonstrated strong performance, its decision to increase cash reserves reflects a cautious outlook on the Indian market. This strategy is driven by concerns regarding global geopolitical risks, domestic economic headwinds, and the potential for market corrections. The move highlights the importance of risk management and diversification for investors.

Key Takeaways: DSP's cautious stance emphasizes the unpredictable nature of the market, the need for prudent risk management, and the importance of considering diverse investment strategies. While the Indian market presents attractive opportunities, careful consideration of potential risks is crucial.

Call to Action: Stay updated on the latest moves by India fund manager DSP and other key players in the Indian market. Consult with a financial advisor to create a well-diversified investment strategy that aligns with your risk tolerance and financial goals. Understanding the strategies of leading India fund managers like DSP is crucial for informed investment decisions.

Featured Posts

-

The Scarcity Of Dysprosium And Its Implications For The Future Of Electric Vehicles

Apr 29, 2025

The Scarcity Of Dysprosium And Its Implications For The Future Of Electric Vehicles

Apr 29, 2025 -

Traffic Stop Turns Deadly Georgia Deputy Killed Another Officer Shot

Apr 29, 2025

Traffic Stop Turns Deadly Georgia Deputy Killed Another Officer Shot

Apr 29, 2025 -

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025 -

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025 -

Zombie Buildings In Chicago A Deep Dive Into The Office Real Estate Crisis

Apr 29, 2025

Zombie Buildings In Chicago A Deep Dive Into The Office Real Estate Crisis

Apr 29, 2025

Latest Posts

-

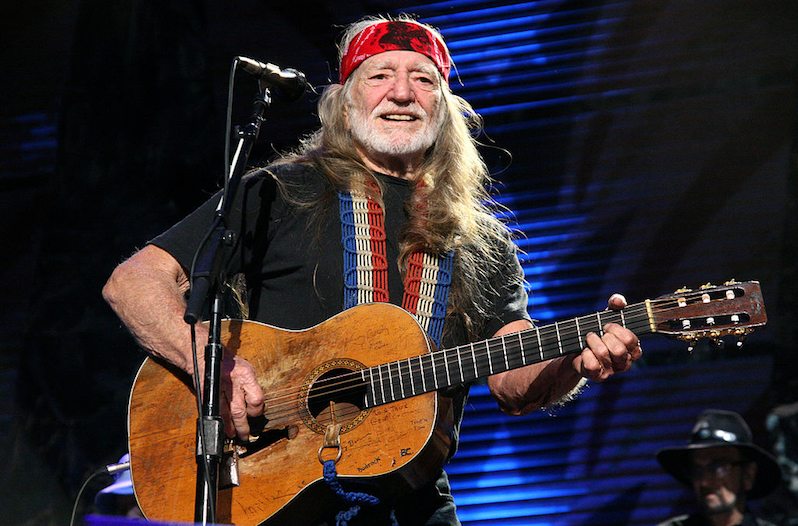

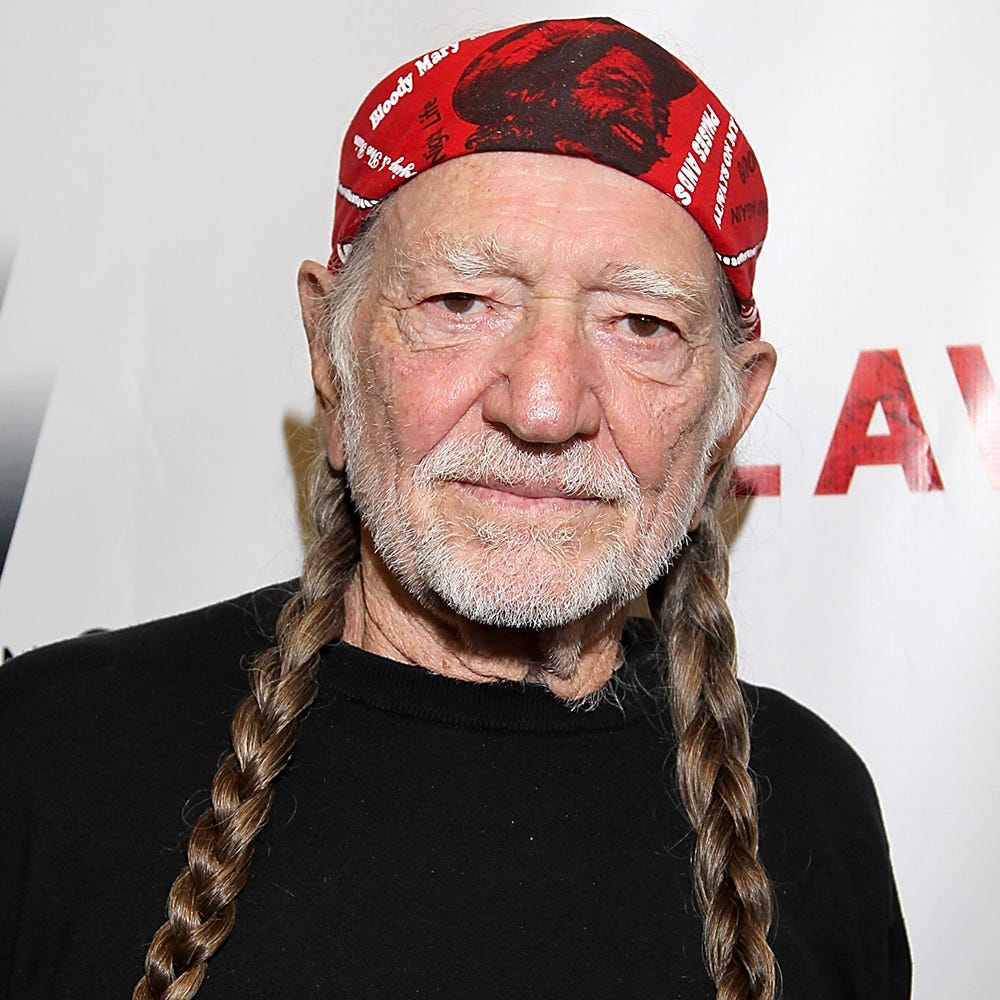

Quick Facts About Willie Nelson Life Career And Legacy

Apr 29, 2025

Quick Facts About Willie Nelson Life Career And Legacy

Apr 29, 2025 -

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025 -

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025 -

Willie Nelson Fast Facts And Little Known Details

Apr 29, 2025

Willie Nelson Fast Facts And Little Known Details

Apr 29, 2025 -

Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025