India Stock Market Today: Sensex And Nifty 50 Close Flat Amidst Volatility

Table of Contents

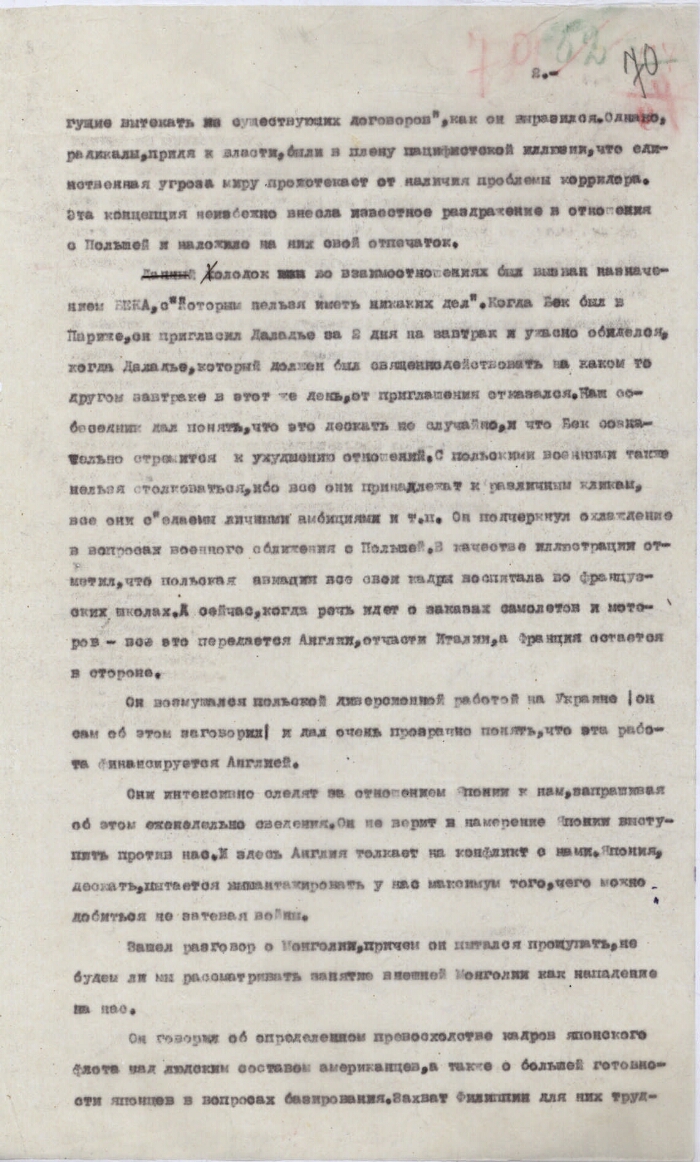

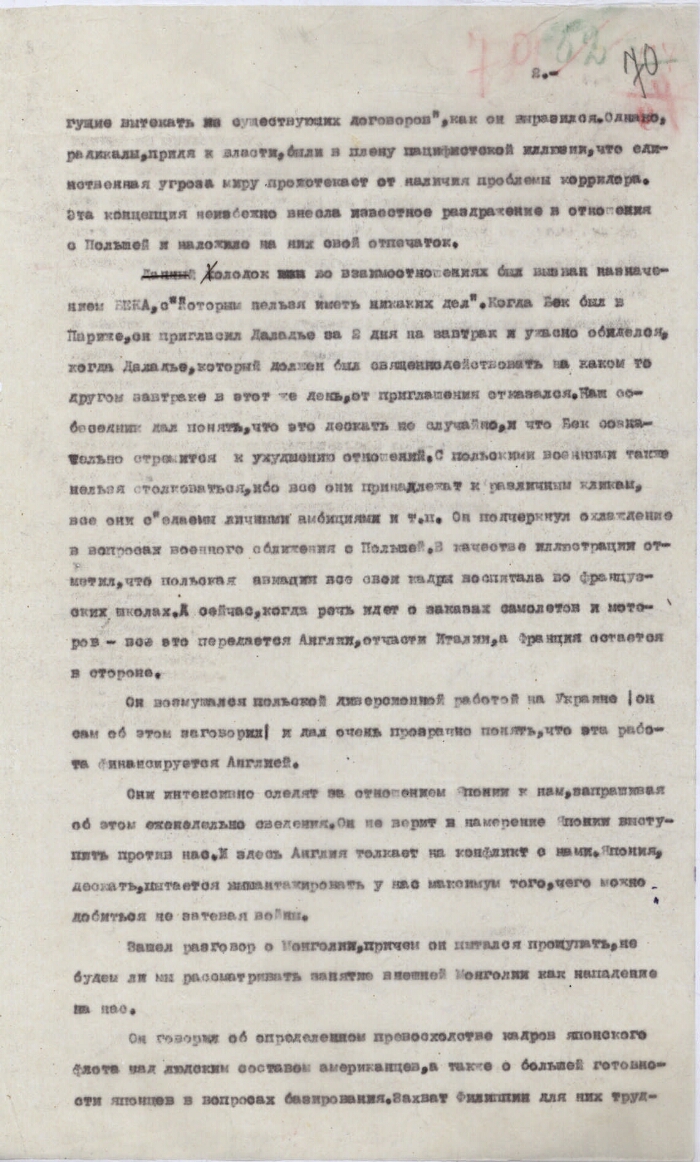

Sensex and Nifty 50 Performance

Today's trading session on the Indian stock market showcased significant volatility. Let's examine the performance of the Sensex and Nifty 50:

-

Sensex: Opened at 65,200, reached a high of 65,450, and saw a low of 64,900 before closing at 65,205, a negligible change of +0.01%.

-

Nifty 50: Opened at 19,400, reached a high of 19,475, and a low of 19,350, eventually closing at 19,402, exhibiting a marginal gain of +0.01%.

-

Significant Intraday Swings: The indices witnessed several sharp intraday swings, reflecting the uncertainty in the market. These fluctuations were particularly noticeable in the mid-afternoon session.

-

Closing Values vs. Previous Day: Both Sensex and Nifty 50 closed almost exactly where they ended yesterday, indicating a consolidation phase after recent gains.

-

Trading Volume: Today's trading volume was slightly lower than the average, suggesting a degree of caution among investors despite the volatility. This could be interpreted as a period of consolidation before the next major market movement.

Sectoral Performance Analysis

Analyzing the performance of individual sectors provides a granular view of the forces shaping the overall market sentiment.

Banking Sector

The banking sector displayed a mixed performance, with some major players contributing to the overall flat closure.

- Specific Stocks: HDFC Bank saw a marginal increase of 0.2%, while ICICI Bank remained relatively unchanged. However, SBI witnessed a slight dip of 0.5%.

- Reasons for Performance: The recent RBI policy announcement and speculations around upcoming interest rate changes had a noticeable impact on investor sentiment within this sector.

IT Sector

The IT sector, often a key driver of the Indian stock market, showed relatively subdued performance today.

- Global Tech Trends and Currency Fluctuations: Global tech sector uncertainty and recent fluctuations in the rupee against the dollar had a dampening effect on the performance of several major IT stocks.

- Specific Stocks: TCS remained largely flat, while Infosys showed a slight decline of 0.3%.

Other Key Sectors

Other significant sectors, including FMCG, energy, and automobiles, presented a mixed bag, with some showing slight gains while others experienced minor corrections.

- Notable Trends: The FMCG sector remained relatively stable, reflecting its resilience to market fluctuations. The energy sector saw slight gains due to recent global crude oil price movements. The automobile sector saw a moderate increase, driven by positive sales figures.

Factors Influencing Market Volatility

Several factors contributed to the observed volatility in the India stock market today.

Global Market Trends

Global uncertainties significantly impacted domestic markets.

- US Fed Rate Hikes and Geopolitical Tensions: The anticipation of further US Federal Reserve interest rate hikes and ongoing geopolitical tensions created a sense of unease among global investors, influencing the Indian stock market.

- Correlation with Global Indices: The Sensex and Nifty 50 exhibited a negative correlation with certain global indices, reflecting the interconnectedness of global financial markets.

Domestic Economic Indicators

Recent economic data releases also played a role in shaping investor sentiment.

- Inflation Figures and Industrial Production: The latest inflation figures and industrial production data, while showing mixed signals, contributed to the uncertainty in the market.

- Government Announcements and Policy Changes: Any major government policy changes or announcements could have influenced trading activity.

Investor Sentiment and Trading Activity

Investor sentiment remained cautious amidst the volatility.

- Buying and Selling Activity: The observed patterns suggested a balanced approach by investors, with neither aggressive buying nor intense selling dominating the day's trade.

- News Events Impacting Sentiment: Any significant news events or announcements related to specific companies or sectors would have likely swayed investor sentiment.

Conclusion

Today's trading session in the India stock market saw the Sensex and Nifty 50 close virtually flat despite significant intraday volatility. Global market trends, domestic economic indicators, and sectoral performances all played a part in this dynamic market day. The relatively low trading volume indicates a cautious approach by many investors. Monitoring the India stock market, specifically the Sensex and Nifty 50, remains crucial for understanding the market’s direction. Stay informed about the India stock market today and its impact on Sensex and Nifty 50 with our daily updates.

Featured Posts

-

Sensex Nifty

May 09, 2025

Sensex Nifty

May 09, 2025 -

Champions League Inter Milan Secures Crucial Win Against Bayern Munich

May 09, 2025

Champions League Inter Milan Secures Crucial Win Against Bayern Munich

May 09, 2025 -

Canadian Billionaire A Contender For Warren Buffetts Legacy

May 09, 2025

Canadian Billionaire A Contender For Warren Buffetts Legacy

May 09, 2025 -

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025 -

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025 -

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025 -

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025