Indian Insurers Push For Relaxed Bond Forward Regulations

Table of Contents

Current Bond Forward Regulations in India and Their Impact

The current regulatory framework governing bond forwards for insurance companies in India is characterized by several restrictions that limit investment strategies. These regulations, primarily aimed at mitigating risk, often inadvertently stifle growth and innovation. The Bond Forward Regulations India currently in place impose significant constraints on:

- Specific types of bonds: Insurers may face limitations on investing in certain types of bonds, such as corporate bonds with lower credit ratings, thereby reducing their diversification options.

- Investment strategies: Restrictions on hedging strategies using bond forwards limit insurers' ability to manage interest rate risk effectively. This conservative approach can lead to lower returns compared to global counterparts.

- Leverage: Regulations often restrict the amount of leverage insurers can employ, hindering their capacity to amplify returns and potentially limiting their participation in larger market opportunities.

The impact of these restrictions is quantifiable. Studies suggest that the current regulatory environment has resulted in a significant reduction in the overall investment returns of Indian insurers, limiting their ability to compete effectively on a global scale. For example, missed opportunities in the high-growth corporate bond market due to regulatory constraints represent a significant potential loss for the sector. The inability to fully participate in dynamic markets directly affects the insurers' ability to offer competitive products and maximize returns for policyholders.

Arguments for Relaxed Bond Forward Regulations

Indian insurers present compelling arguments for relaxing the current Bond Forward Regulations India. They contend that loosening these restrictions would unlock substantial benefits for both the insurance sector and the broader Indian economy:

- Increased Investment Capacity and Diversification: Relaxed regulations would allow insurers to diversify their investment portfolios, reducing their exposure to any single asset class and improving risk management. This would translate into greater investment capacity, enabling them to support more infrastructure projects and other vital economic activities.

- Improved Returns for Policyholders: By allowing insurers greater flexibility in their investment strategies, the potential for higher returns increases. This translates directly into better payouts and improved benefits for insurance policyholders, strengthening their trust and confidence in the sector.

- Stimulation of the Indian Bond Market and Economic Growth: Increased insurer participation in the bond market would inject much-needed liquidity, fostering greater development and growth within the market itself. This, in turn, contributes to broader economic expansion in India.

- Enhanced Competitiveness with Global Insurance Markets: Easing regulations would bring the Indian insurance sector more in line with global standards, allowing domestic insurers to compete more effectively with international players. This heightened competition can drive innovation and efficiency within the sector.

Potential Risks and Challenges of Deregulation

While the potential benefits of relaxed Bond Forward Regulations India are significant, it's crucial to acknowledge the associated risks and challenges. A premature or poorly managed deregulation could lead to:

- Increased Exposure to Market Risks: Reduced regulatory oversight could increase insurers' vulnerability to market volatility and potentially lead to significant losses.

- Potential for Speculative Trading and Market Manipulation: Relaxed regulations could create opportunities for speculative trading and market manipulation, threatening the stability of the financial system.

- Need for Robust Regulatory Oversight: Effective deregulation requires robust and adaptable regulatory oversight to mitigate emerging risks. This includes continuous monitoring, timely intervention, and a clear framework for addressing unforeseen consequences.

- Concerns Regarding Financial Stability within the Insurance Sector: A sudden influx of investment capital, without sufficient regulatory safeguards, could create vulnerabilities within the insurance sector, potentially impacting the broader financial system.

IRDAI's Stance and Future Outlook

The IRDAI (Insurance Regulatory and Development Authority of India) plays a crucial role in shaping the future of bond forward regulations in India. While the IRDAI has expressed a willingness to consider amendments, their official stance remains cautious, emphasizing the importance of balancing growth with financial stability.

- IRDAI's official statements often highlight the need for a phased approach to deregulation, allowing for careful monitoring and adaptation of regulatory frameworks.

- Potential policy changes are likely to be incremental rather than revolutionary, reflecting a pragmatic approach to managing the risks associated with greater flexibility in investment strategies.

- Predictions on the impact of any changes are largely dependent on the specific nature and pace of deregulation. A carefully planned and executed reform could significantly benefit the insurance sector and the economy, while a poorly managed approach could lead to negative consequences.

Conclusion

The debate surrounding relaxed bond forward regulations in India is complex and multifaceted. While the potential benefits – increased investment, improved returns, and stimulated economic growth – are substantial, careful consideration of the associated risks, including increased market exposure and the need for robust regulatory oversight, is crucial. The IRDAI's role in guiding this process will be paramount in ensuring a balanced approach that promotes growth while safeguarding financial stability. The future of the Indian insurance sector and its contribution to the nation’s economic growth hinges on the careful consideration and implementation of changes to Indian Insurers’ access to Bond Forward Regulations. Stay informed on developments in this crucial area to better understand the evolving landscape of the Indian insurance market.

Featured Posts

-

Bundesliga 2 Matchday 27 Overview Cologne Now Leads

May 10, 2025

Bundesliga 2 Matchday 27 Overview Cologne Now Leads

May 10, 2025 -

Jazz Cash K Trade Collaboration Easier Stock Investment For Everyone

May 10, 2025

Jazz Cash K Trade Collaboration Easier Stock Investment For Everyone

May 10, 2025 -

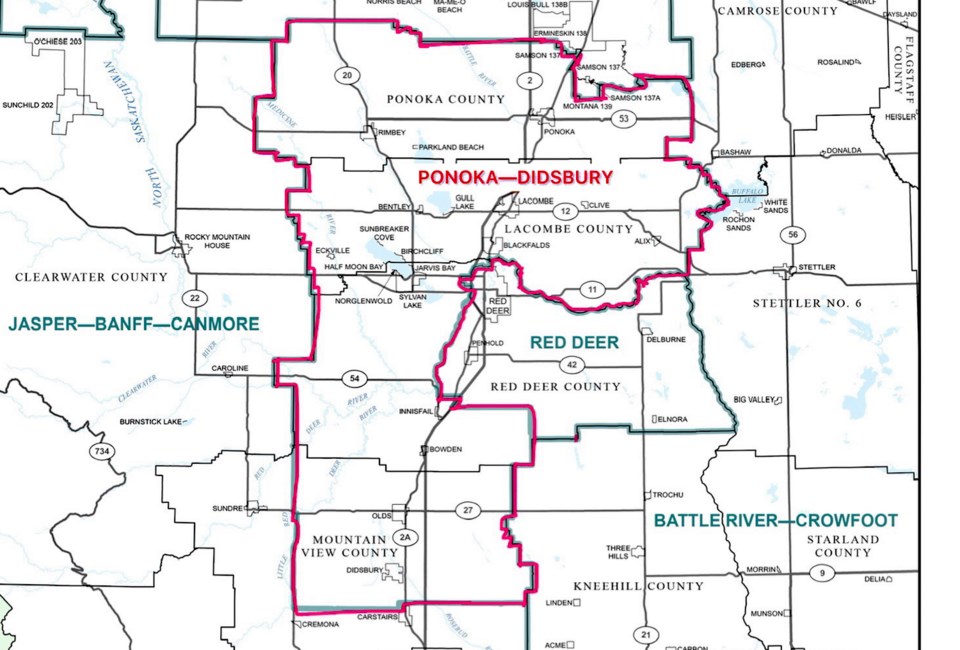

Edmonton Federal Electoral Boundaries Understanding The Impact On Voters

May 10, 2025

Edmonton Federal Electoral Boundaries Understanding The Impact On Voters

May 10, 2025 -

Boss Of Troubled Nhs Trust To Cooperate Fully With Nottingham Attack Inquiry

May 10, 2025

Boss Of Troubled Nhs Trust To Cooperate Fully With Nottingham Attack Inquiry

May 10, 2025 -

Three Countries Targeted In Uks New Asylum Crackdown Policy

May 10, 2025

Three Countries Targeted In Uks New Asylum Crackdown Policy

May 10, 2025