Indian Insurers Seek Regulatory Easing For Bond Forwards

Table of Contents

Current Regulatory Landscape for Bond Forwards in India

The existing regulatory framework governing bond forwards for insurance companies in India is relatively restrictive. While not explicitly prohibiting their use, several regulations pose significant challenges. These limitations hinder insurers' ability to fully utilize bond forwards for effective risk mitigation.

- Current restrictions on notional limits for bond forward contracts: Current regulations often impose strict limits on the notional value of bond forward contracts that insurers can enter into. This restricts the scale of risk management strategies that insurers can implement.

- Capital adequacy requirements related to bond forward positions: The capital charges associated with bond forward positions can be substantial, impacting insurers' capital adequacy ratios and potentially limiting their investment capacity. This is particularly relevant given the already stringent capital requirements imposed on insurance companies.

- Reporting and disclosure requirements for bond forward transactions: The current reporting requirements can be complex and burdensome, adding administrative costs and increasing compliance challenges for insurers. Greater clarity and simplification are needed.

- Lack of clarity on certain aspects of the regulations: Ambiguity in some aspects of the regulations leads to uncertainty and potentially inhibits insurers from fully leveraging bond forwards. This lack of clarity increases compliance risk.

Arguments for Regulatory Easing

Easing regulations surrounding bond forwards would offer significant advantages to Indian insurers and the broader financial market. The benefits extend beyond improved risk management, impacting investment efficiency and attracting foreign investment.

- Enhanced risk management capabilities leading to improved portfolio stability: Greater flexibility in utilizing bond forwards would allow insurers to more effectively hedge against interest rate risk and credit risk, leading to a more stable investment portfolio and reduced volatility in profits.

- Greater efficiency in managing liabilities matched with bond portfolio assets: Bond forwards can be instrumental in aligning the duration and maturity profiles of insurers' assets and liabilities, leading to improved asset-liability management (ALM) and reduced risks associated with mismatches.

- Potential for increased investment returns through optimized risk management strategies: By mitigating risks effectively, insurers can take on higher-yielding investments, potentially increasing overall investment returns without increasing overall risk.

- Attracting more foreign investment in the Indian bond market: A more liberal regulatory environment would make India a more attractive destination for foreign investment in the bond market, potentially boosting liquidity and reducing borrowing costs for the entire economy.

Potential Risks and Mitigation Strategies

While regulatory easing offers substantial benefits, it is crucial to acknowledge and mitigate potential risks associated with increased bond forward usage. A balanced approach, prioritizing risk mitigation, is essential.

- Implementation of sophisticated risk models for bond forward positions: Utilizing advanced quantitative models to assess and manage the risks associated with bond forward portfolios is critical. This includes developing comprehensive VaR (Value at Risk) and stress testing methodologies.

- Regular stress testing and scenario analysis of bond forward portfolios: Regularly simulating various market scenarios, including extreme events, allows for a proactive identification and assessment of potential losses and informs risk management strategies.

- Strong internal controls to prevent fraud and operational errors: Robust internal controls and independent audits are essential to ensure the integrity of bond forward transactions and prevent fraud or operational errors.

- Enhanced transparency and reporting to regulatory bodies: Improved transparency in reporting to the IRDAI and other regulatory bodies would strengthen oversight and enhance market confidence.

IRDAI's Role and Potential Actions

The IRDAI plays a vital role in shaping the regulatory environment for bond forwards. Proactive steps to ease regulations, while mitigating potential risks, would significantly benefit the Indian insurance sector.

- Reviewing and amending existing regulations on bond forward usage: A comprehensive review of the existing regulations is necessary to identify and address outdated or overly restrictive provisions.

- Providing clearer guidelines and interpretations of existing rules: Issuing clearer guidelines and interpretations would reduce ambiguity and facilitate better compliance by insurers.

- Facilitating industry consultations to gather feedback and address concerns: Engaging in open dialogue with the insurance industry would ensure that regulatory changes are well-informed and address industry-specific challenges.

- Possibly introducing a phased approach to regulatory easing: A phased approach would allow for a gradual implementation of changes, allowing for monitoring and adjustments along the way.

Conclusion

Easing regulations for bond forwards in India offers substantial benefits for Indian insurers, improving their risk management capabilities, enhancing investment efficiency, and attracting foreign investment. While potential risks exist, robust risk mitigation strategies can effectively manage these. The IRDAI's proactive role in reviewing and amending regulations, providing clear guidelines, and facilitating industry consultations is crucial. We urge the IRDAI to consider the arguments presented and take necessary steps to facilitate Easing Regulations for Bond Forwards in India, enabling Indian insurers to better manage their investments and contribute to a more stable and robust financial market. This regulatory reform for Indian insurers’ bond forward usage is essential for the future growth and stability of the Indian insurance sector.

Featured Posts

-

Experiences Of Transgender People Under Trump Executive Orders A Call For Stories

May 10, 2025

Experiences Of Transgender People Under Trump Executive Orders A Call For Stories

May 10, 2025 -

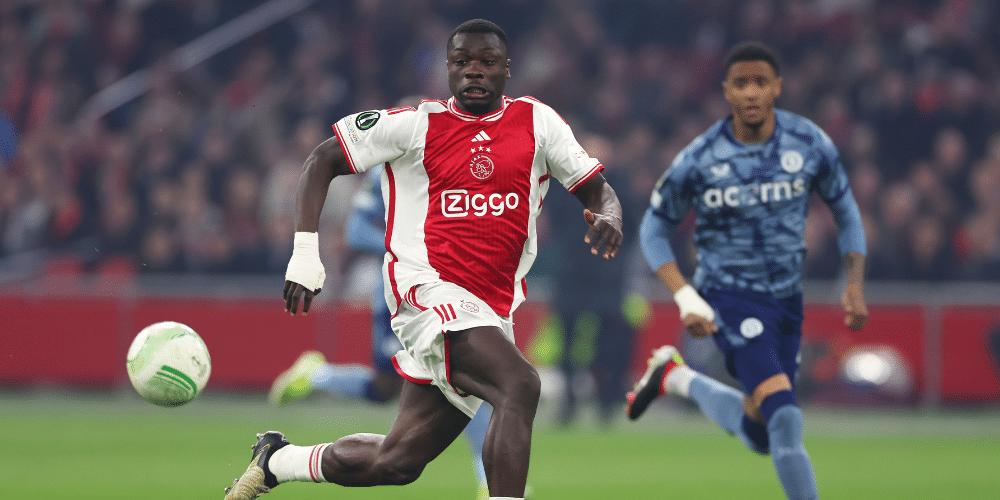

How Brian Brobbeys Strength Will Impact The Europa League

May 10, 2025

How Brian Brobbeys Strength Will Impact The Europa League

May 10, 2025 -

Pam Bondis Claims Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025

Pam Bondis Claims Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025 -

Punjab Government Announces Skill Development Programme For Transgender Community

May 10, 2025

Punjab Government Announces Skill Development Programme For Transgender Community

May 10, 2025 -

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025