Indian Real Estate Market Sees 47% Investment Boom In January-March

Table of Contents

Factors Driving the Investment Boom in Indian Real Estate

Several factors have converged to create this unprecedented boom in the Indian real estate market. These can be broadly categorized into government initiatives, economic recovery, and favorable financing conditions.

Government Initiatives and Policies

The Indian government has implemented several pro-growth policies that have significantly boosted investor sentiment. These initiatives have instilled confidence and encouraged greater participation in the real estate sector.

- Affordable Housing Schemes: Initiatives like the Pradhan Mantri Awas Yojana (PMAY) have made homeownership more accessible to a larger segment of the population, driving demand and increasing investment in affordable housing projects.

- Infrastructure Development: Massive investments in infrastructure projects, including metro rail expansion in major cities and the development of smart cities, have significantly increased property values in surrounding areas. The improved connectivity and infrastructure are major attractions for both residential and commercial investors.

- Tax Incentives: Tax benefits for homebuyers and investors, including deductions under Section 80C and other provisions, have made real estate investment more attractive from a financial perspective.

Economic Recovery and Increased Disposable Income

India's economic recovery has played a crucial role in fueling the real estate investment boom. The rise in disposable incomes has directly translated into increased purchasing power and a greater capacity for property investment.

- GDP Growth: Sustained GDP growth has led to higher salaries and improved employment prospects, boosting consumer confidence and willingness to invest in real estate.

- Salary Increases: Significant salary hikes across various sectors have enhanced the financial capacity of individuals to invest in higher-value properties.

- Consumer Confidence Index: The rising consumer confidence index reflects a positive outlook on the economy, fueling demand for property and driving up investment.

Low Interest Rates and Easy Financing Options

Lower interest rates on home loans have significantly improved affordability, making homeownership more accessible and consequently boosting investment in the real estate sector.

- Home Loan Interest Rates: Currently low interest rates on home loans compared to previous years have dramatically reduced the cost of borrowing, stimulating demand.

- Increased Accessibility to Mortgages: Easier access to mortgages and various financing options have made property investment more feasible for a wider range of individuals.

Investment Trends in Different Property Segments

The investment boom is not limited to a single segment; it's visible across residential and commercial real estate.

Residential Real Estate

The residential segment has witnessed robust growth across various price points.

- Affordable Housing: This segment has experienced phenomenal growth, fueled by government initiatives and increased demand from the burgeoning middle class.

- Luxury Housing: High-end properties in prime locations are also witnessing strong investment, demonstrating the resilience of the luxury segment.

- Tier II Cities: Investment is not confined to metros; Tier II cities are also attracting significant investment, driven by improved infrastructure and affordability.

Commercial Real Estate

The commercial real estate sector also shows considerable activity, with different sub-segments displaying unique characteristics.

- Office Spaces: While the work-from-home trend initially impacted demand, the return to offices and the demand for flexible workspaces have revitalized this segment.

- Retail Spaces: Retail spaces in high-traffic areas continue to attract strong investment, particularly those integrated with residential developments.

- Warehousing and Logistics: The growth of e-commerce has fueled significant investment in warehousing and logistics spaces, making it one of the fastest-growing sectors.

Future Outlook and Predictions for the Indian Real Estate Market

While the current surge is impressive, understanding the sustainability of this growth and anticipating future trends is crucial.

Sustained Growth or a Potential Correction?

While the outlook remains largely positive, certain factors could influence future growth.

- Inflation: Rising inflation could potentially impact affordability and dampen demand, creating a correction.

- Interest Rate Hikes: Future interest rate hikes, while not anticipated in the immediate future, could affect the cost of borrowing and cool down the market.

- Market Forecasts: Most experts anticipate continued growth, albeit potentially at a moderated pace, throughout the year.

Emerging Trends Shaping the Indian Real Estate Landscape

Several emerging trends are shaping the Indian real estate landscape.

- PropTech: The integration of technology is revolutionizing the real estate industry, improving efficiency and transparency.

- Sustainable Construction: There's an increasing focus on sustainable and green building practices, reducing environmental impact and improving energy efficiency.

- Smart Homes: The demand for smart homes with integrated technology is rapidly growing, creating new investment opportunities.

Conclusion

The 47% investment boom in the Indian real estate market during Q1 2024 is a testament to the sector's resilience and growth potential. Government initiatives, economic recovery, and favorable financing conditions have created a perfect storm for significant investment. While potential challenges exist, the overall outlook remains positive, with emerging trends shaping a dynamic and exciting future for the Indian real estate sector. Invest wisely in the booming Indian real estate market and capitalize on the current surge in Indian property investment. Explore profitable opportunities in this dynamic sector by researching various investment options and seeking professional advice.

Featured Posts

-

Veteran Springfield Councilman Appointed To Missouri Education Board

May 17, 2025

Veteran Springfield Councilman Appointed To Missouri Education Board

May 17, 2025 -

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025 -

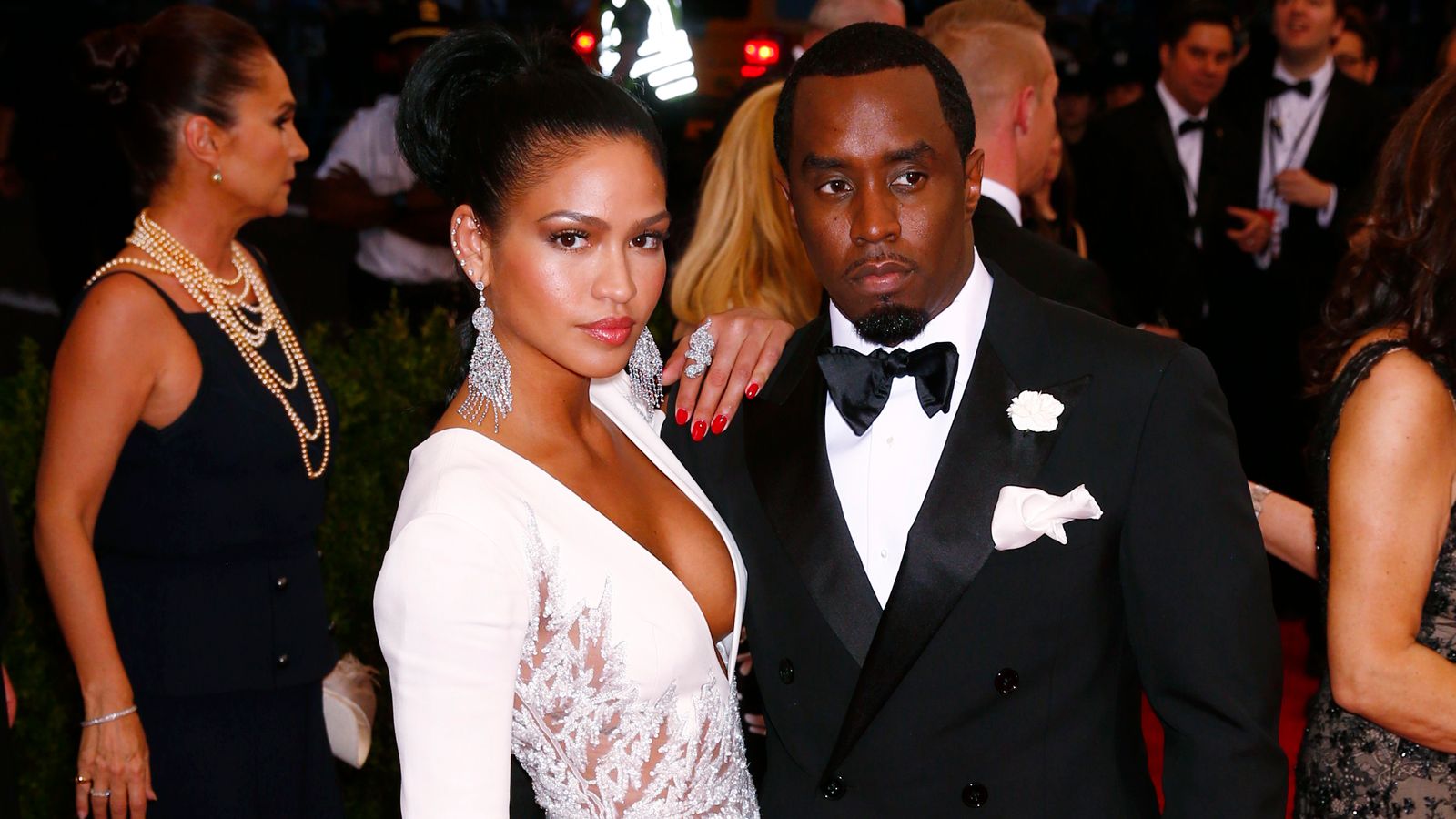

Diddy Trial What Cassie Venturas Cross Examination Revealed

May 17, 2025

Diddy Trial What Cassie Venturas Cross Examination Revealed

May 17, 2025 -

Mikal Bridges On Knicks Starters Minutes A Request To Coach Thibodeau

May 17, 2025

Mikal Bridges On Knicks Starters Minutes A Request To Coach Thibodeau

May 17, 2025 -

The Knicks Future Brunsons Comments On Thibodeaus Job

May 17, 2025

The Knicks Future Brunsons Comments On Thibodeaus Job

May 17, 2025

Latest Posts

-

Emirates Id Application Fees For Newborns In The Uae March 2025

May 17, 2025

Emirates Id Application Fees For Newborns In The Uae March 2025

May 17, 2025 -

Nba Playoffs Magic Johnsons Take On The Knicks Pistons Matchup

May 17, 2025

Nba Playoffs Magic Johnsons Take On The Knicks Pistons Matchup

May 17, 2025 -

Knicks Vs Pistons Magic Johnsons Bold Prediction

May 17, 2025

Knicks Vs Pistons Magic Johnsons Bold Prediction

May 17, 2025 -

Applying For An Emirates Id For Your Newborn In The Uae Fees In March 2025

May 17, 2025

Applying For An Emirates Id For Your Newborn In The Uae Fees In March 2025

May 17, 2025 -

Magic Johnson Weighs In Who Wins The Knicks Pistons Series

May 17, 2025

Magic Johnson Weighs In Who Wins The Knicks Pistons Series

May 17, 2025