Individual Investors' Response To Market Volatility: A Deeper Look

Table of Contents

The Psychology of Market Volatility for Individual Investors

Navigating market volatility requires understanding the psychological forces at play. Our emotional responses significantly impact our investment choices.

Fear and Greed

Fear and greed are powerful emotions that drive many investment decisions during volatile periods. These powerful emotions often override rational analysis, leading to poor choices.

- Fear-driven selling: Panic selling during market downturns, often resulting in significant losses and missed recovery opportunities.

- Greed-driven over-investment: Chasing high returns in a bull market, potentially leading to substantial losses when the market corrects.

- Herd behavior: Mimicking the actions of other investors, without independent analysis, can exacerbate market swings.

These behaviors are often fueled by cognitive biases:

- Loss aversion: The pain of a loss is felt more strongly than the pleasure of an equivalent gain, prompting risk-averse behavior.

- Confirmation bias: Seeking out information that confirms pre-existing beliefs, ignoring contradictory evidence. This can lead to poorly informed investment decisions. Understanding behavioral finance is key to mitigating these biases.

The Impact of Personal Circumstances

Individual financial situations significantly influence reactions to market volatility.

- Retirement nearing: Investors close to retirement may be forced to sell assets during a downturn to meet living expenses, potentially locking in losses.

- Unexpected expenses: Unforeseen events, like medical bills or job loss, can necessitate selling investments at inopportune times.

Having a robust financial plan is essential:

- Emergency fund: A well-funded emergency fund provides a buffer against unexpected expenses, reducing the need to liquidate investments during market downturns.

- Diversified portfolio: A portfolio spread across various asset classes (stocks, bonds, real estate) reduces overall risk and mitigates the impact of any single asset class underperforming. Your risk tolerance should dictate your asset allocation.

Common Responses to Market Volatility

Individual investors exhibit various responses to market volatility. Some are more beneficial than others.

Panic Selling

Panic selling is a common, but highly detrimental, reaction to market downturns.

- Significant losses: Selling low locks in losses and eliminates the potential for future gains.

- Missed recovery opportunities: Markets typically recover after downturns, and those who sell miss out on this growth.

A long-term investment strategy is crucial to avoid panic selling:

- Long-term perspective: Focus on your long-term financial goals, rather than short-term market fluctuations.

Holding Steady

A buy-and-hold strategy, characterized by emotional discipline and a long-term perspective, often proves advantageous.

- Historical evidence: Historically, markets have consistently trended upwards over the long term, despite short-term volatility.

- Emotional discipline: Requires resisting the urge to react to every market fluctuation. Dollar-cost averaging helps mitigate emotional decision-making.

Market Timing Attempts

Trying to time the market—predicting market highs and lows to buy and sell accordingly—is notoriously difficult and often unsuccessful.

- Unpredictability: Accurately predicting market tops and bottoms is extremely challenging, even for professional investors.

- Missed opportunities: Attempts at market timing frequently result in missing out on significant market gains.

Strategies for Managing Volatility

Effective strategies can help individuals navigate market volatility more successfully.

Diversification

A well-diversified portfolio is crucial for risk mitigation.

- Asset classes: Diversify across stocks, bonds, real estate, and other asset classes to reduce the impact of any single asset's underperformance.

- International diversification: Investing in assets from different countries reduces exposure to any single country's economic or political risks. Proper asset allocation minimizes portfolio volatility.

Long-Term Investing

A long-term investment horizon is essential for weathering market fluctuations.

- Ignore short-term noise: Focus on your long-term financial goals and resist the urge to react to short-term market movements.

- Financial planning: Develop a detailed financial plan outlining your goals, timeline, and investment strategy. Retirement planning is a key component.

Seeking Professional Advice

Seeking guidance from a qualified financial advisor can provide invaluable support.

- Personalized strategies: A financial advisor can help develop a personalized investment strategy tailored to your individual needs, risk tolerance, and financial goals.

- Objective perspective: An advisor can provide an objective perspective, helping you make rational investment decisions, free from emotional bias.

Conclusion

Understanding individual investors' response to market volatility is paramount for long-term financial success. Fear and greed significantly influence investment decisions, often leading to poor outcomes. However, by employing strategies such as diversification, long-term investing, and seeking professional advice, individual investors can better navigate market fluctuations and achieve their financial goals. Remember, a well-defined investment strategy, coupled with emotional discipline, is key to successfully managing your response to market volatility. Develop a comprehensive understanding of your risk tolerance and create a well-defined investment strategy to effectively manage your response to individual investors' response to market volatility. Learn how to navigate market fluctuations more confidently and achieve your financial goals.

Featured Posts

-

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025 -

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 28, 2025

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 28, 2025 -

The End Of An Era Orioles Hit Streak And The Announcer Jinx

Apr 28, 2025

The End Of An Era Orioles Hit Streak And The Announcer Jinx

Apr 28, 2025 -

Yukon Mine Manager Faces Contempt After Refusal To Answer Questions

Apr 28, 2025

Yukon Mine Manager Faces Contempt After Refusal To Answer Questions

Apr 28, 2025 -

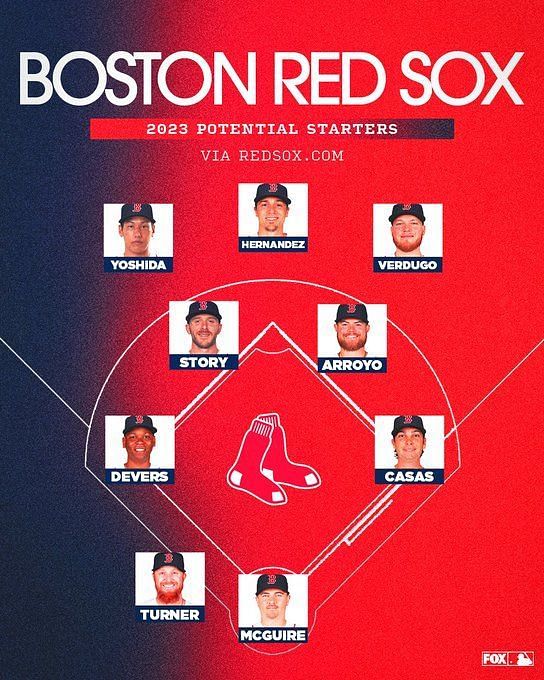

Red Sox Adjust Lineup Casas Lowered Outfielders Return Impacts Roster

Apr 28, 2025

Red Sox Adjust Lineup Casas Lowered Outfielders Return Impacts Roster

Apr 28, 2025

Latest Posts

-

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025