Indonesia's Foreign Exchange Reserves Plunge: Rupiah Weakness Takes Toll

Table of Contents

Factors Contributing to the Decline in Indonesia's Foreign Exchange Reserves

Several interconnected factors have contributed to the recent plunge in Indonesia's foreign exchange reserves. These include global economic uncertainties, the weakening Rupiah, and the impact of government spending and fiscal policies.

Global Economic Headwinds

The global economic environment has presented significant challenges to Indonesia's reserves. Rising US interest rates, persistent inflation, and the ongoing war in Ukraine have created a perfect storm of negative impacts.

- Decreased Global Demand: Reduced global demand for Indonesian exports, particularly commodities, has decreased foreign currency inflows.

- Capital Flight: Investors seeking safer havens amidst global uncertainty have withdrawn capital from emerging markets like Indonesia, further depleting reserves.

- Increased Import Costs: Higher global prices for essential imports have widened the current account deficit, putting pressure on foreign exchange reserves. The cost of importing vital goods has increased significantly, necessitating greater use of foreign currency reserves.

Data from Bank Indonesia (BI) – insert specific data and statistics on reserve changes here if available – reveals the extent of this decline.

Rupiah Depreciation

The weakening Rupiah is directly correlated with the decline in foreign exchange reserves. Bank Indonesia (BI) has intervened repeatedly in the foreign exchange market to support the currency, but these interventions have significantly depleted reserves.

- Impact on Current Account Deficit: A weaker Rupiah increases the cost of imports, widening the current account deficit and placing further pressure on reserves.

- Speculation and Exchange Rate Volatility: Speculation in the foreign exchange market, driven by uncertainty and the global economic climate, has fueled Rupiah depreciation. Charts illustrating the Rupiah's performance against the US dollar and other major currencies would further demonstrate this correlation. (Insert relevant chart here)

Government Spending and Fiscal Policies

Government spending and fiscal policies also play a role. Increased government borrowing, subsidies, and other expenditures can increase the demand for foreign currency, putting additional pressure on reserves.

- Government Borrowing: Increased government borrowing, particularly in foreign currency, can directly draw down reserves.

- Subsidies: Large government subsidies, while necessary to protect the population from price shocks, can strain foreign exchange reserves.

- Impact on Foreign Exchange Reserves: The combined effect of these factors can significantly impact the availability of foreign exchange reserves. Insert relevant economic data and government reports here.

Consequences of the Falling Reserves

The dwindling foreign exchange reserves have several significant consequences for Indonesia's economy.

Impact on the Rupiah

The continued decline in reserves further weakens the Rupiah, leading to:

- Increased Import Prices: A weaker Rupiah makes imports more expensive, contributing to inflation.

- Inflation: Higher import costs lead to increased consumer prices, impacting the purchasing power of Indonesian citizens.

- Potential for Further Depreciation: The ongoing decline in reserves increases the risk of further Rupiah depreciation, creating a vicious cycle.

Economic Growth Concerns

The falling reserves raise concerns about Indonesia's economic growth trajectory:

- Reduced Investor Confidence: The weakening Rupiah and declining reserves can erode investor confidence, leading to reduced foreign direct investment (FDI).

- Impact on FDI: Decreased FDI can hinder economic expansion and job creation.

- Slower Economic Expansion: The combination of these factors may result in slower economic growth than anticipated.

Debt Servicing Challenges

The dwindling reserves also pose challenges to Indonesia's ability to service its external debt:

- Increased Cost of Servicing Dollar-Denominated Debt: A weaker Rupiah increases the cost of servicing dollar-denominated debt.

- Potential Risk of Debt Distress: If the trend continues, Indonesia might face increasing challenges in servicing its external debt, potentially leading to debt distress.

Potential Mitigation Strategies

Addressing the decline in Indonesia's foreign exchange reserves requires a multi-pronged approach involving monetary and fiscal policy adjustments, as well as a focus on export diversification.

Monetary Policy Adjustments

Bank Indonesia (BI) can employ several monetary policy tools:

- Interest Rate Hikes: Raising interest rates can attract foreign investment and support the Rupiah.

- Interventions in the Foreign Exchange Market: Strategic interventions can help stabilize the Rupiah, but these need to be carefully managed to avoid further depleting reserves.

Fiscal Policy Reforms

Fiscal policy reforms are crucial for long-term sustainability:

- Controlling Government Spending: Implementing measures to control government spending and improve efficiency is essential.

- Improving Tax Collection: Strengthening tax collection efforts can increase government revenue and reduce reliance on foreign borrowing.

Diversification of Export Markets

Reducing dependence on specific trading partners is vital:

- Exploring New Markets: Actively seeking new export markets can lessen the impact of decreased demand from existing partners.

- Promoting Non-Commodity Exports: Diversifying exports beyond commodities can strengthen Indonesia's economic resilience.

Conclusion

The plunge in Indonesia's foreign exchange reserves is a serious concern, driven by a combination of global economic headwinds, Rupiah weakness, and government spending pressures. The consequences could include further Rupiah depreciation, slower economic growth, and challenges in servicing external debt. Addressing this requires a coordinated effort involving monetary and fiscal policy adjustments, coupled with a proactive strategy to diversify export markets. Understanding the dynamics of Indonesia's foreign exchange reserves is crucial for investors and businesses operating within the Indonesian economy. Stay updated on the latest developments to make informed decisions related to Indonesia's economic future. (Insert link to relevant resources here)

Featured Posts

-

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 09, 2025

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 09, 2025 -

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025 -

Suncor Production Record High Output Slower Sales Inventory Rise

May 09, 2025

Suncor Production Record High Output Slower Sales Inventory Rise

May 09, 2025 -

Madeleine Mc Cann Case Polish Woman Julia Wandelt Arrested In The United Kingdom

May 09, 2025

Madeleine Mc Cann Case Polish Woman Julia Wandelt Arrested In The United Kingdom

May 09, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 09, 2025

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 09, 2025

Latest Posts

-

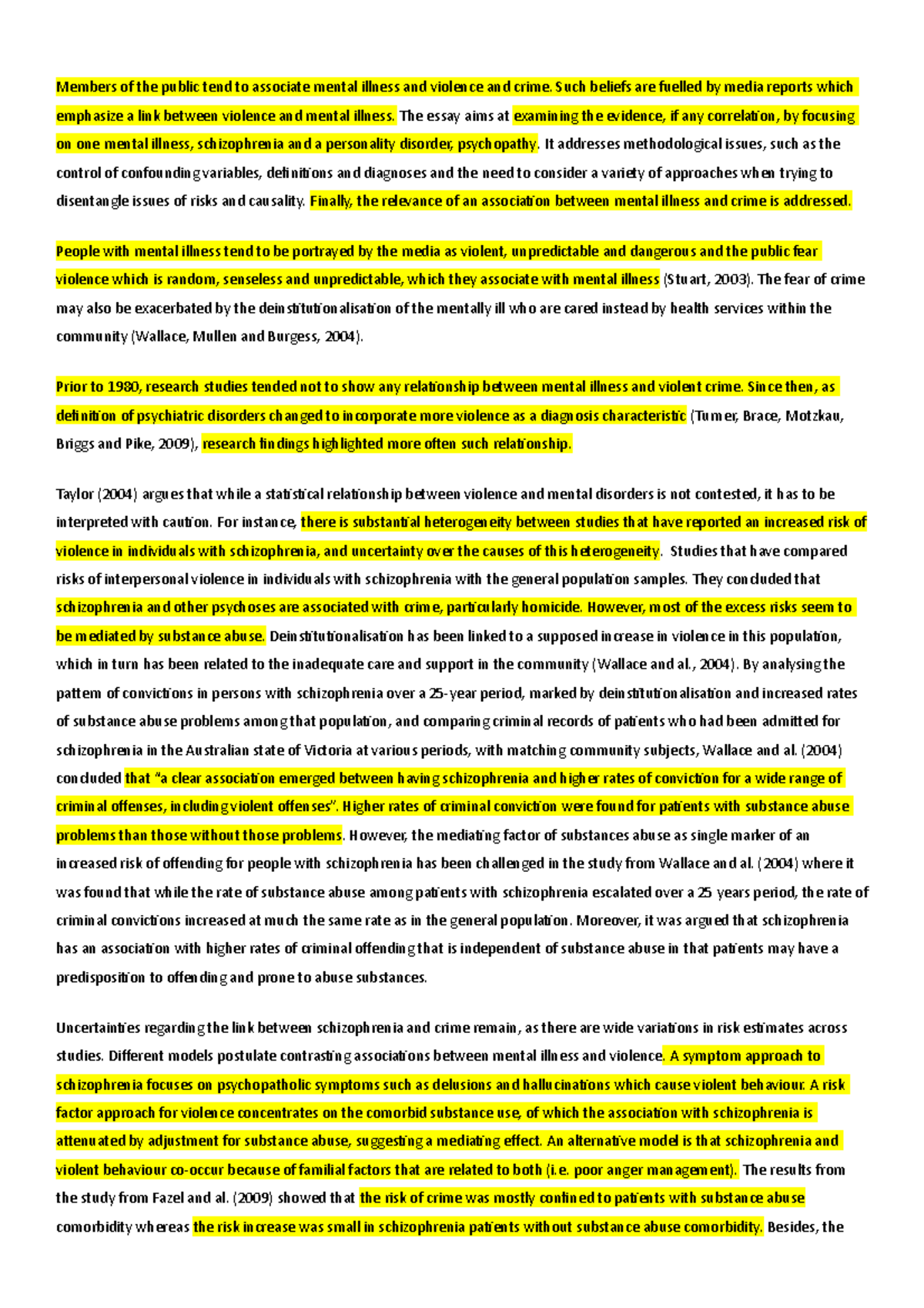

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025 -

Mental Health Violence And The Media Deconstructing The Monster Narrative

May 09, 2025

Mental Health Violence And The Media Deconstructing The Monster Narrative

May 09, 2025 -

Severe Mental Illness And Violence Addressing The Academic Failures In Understanding

May 09, 2025

Severe Mental Illness And Violence Addressing The Academic Failures In Understanding

May 09, 2025 -

The Misrepresentation Of Mentally Ill Killers A Critical Analysis

May 09, 2025

The Misrepresentation Of Mentally Ill Killers A Critical Analysis

May 09, 2025 -

Nottingham Attack Survivors Break Silence Recount Ordeal

May 09, 2025

Nottingham Attack Survivors Break Silence Recount Ordeal

May 09, 2025