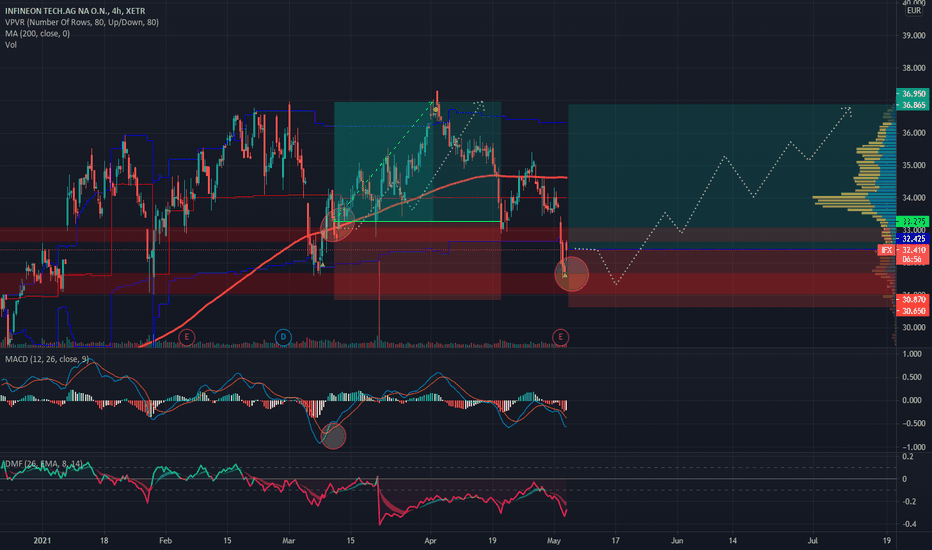

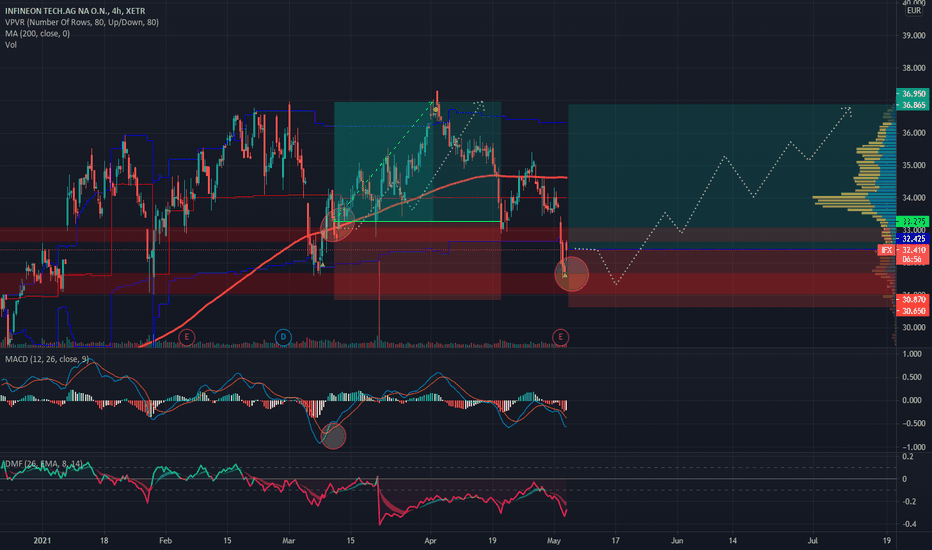

Infineon (IFX) Sales Forecast Misses Mark: Impact Of Trump-Era Tariffs

Table of Contents

Infineon's Q[Quarter] Sales Report and the Forecast Miss

Infineon's [Quarter, e.g., Q3 2024] sales report revealed a significant shortfall in its sales forecast. While the company projected [Projected Sales Figure in Euros], actual sales reached only [Actual Sales Figure in Euros]. This represents a [Percentage]% decrease from the predicted figures, translating to a substantial financial impact. This underperformance was observed across several key product segments, though the automotive sector, usually a strong performer for Infineon, showed a more pronounced dip.

- Specific sales figures: Projected sales: €[Projected Figure]; Actual sales: €[Actual Figure].

- Percentage difference: [Percentage]% decrease.

- Impact on earnings per share (EPS): A decline of [Percentage]% or [Specific amount] in EPS is expected.

- Analyst reactions: Many analysts have downgraded their price targets for IFX stock following the disappointing results, citing concerns about the ongoing impact of tariffs and weakening global demand.

The Lingering Impact of Trump-Era Tariffs on Infineon

The Trump-era tariffs, particularly those targeting certain components sourced from [Specific Countries], significantly hampered Infineon's operations. These tariffs resulted in increased costs for raw materials and crucial components, squeezing profit margins. This directly affected Infineon's ability to maintain competitive pricing, impacting its market share and overall competitiveness. The impact was most pronounced in regions heavily reliant on imports of tariff-affected materials.

- Specific examples of tariff-affected components: [List specific components, e.g., certain types of silicon wafers, specific rare earth metals].

- Percentage increase in costs due to tariffs: Estimates suggest a [Percentage]% increase in costs due to tariffs on key components.

- Impact on profit margins: A reduction of [Percentage]% in profit margins has been observed as a direct consequence of increased input costs.

- Infineon's strategies to mitigate the tariff impact: Infineon is exploring strategies such as reshoring production, diversifying its supply chains, and negotiating with suppliers to offset some of the increased costs.

Global Semiconductor Market Dynamics and Their Influence on Infineon (IFX) Sales Forecast

The global semiconductor market experienced a slowdown during [Time Period], driven by several macroeconomic factors. A global economic slowdown coupled with persistent inflation dampened consumer demand for electronics and automobiles, impacting sales across the semiconductor sector. Increased competition also played a role, putting downward pressure on prices and profitability.

- Key industry trends: Weakening global demand, increased inventory levels, and price competition are major factors impacting the semiconductor market.

- Market share analysis: While Infineon maintains a strong position, its market share has faced slight erosion due to increased competition from [Competitor Names].

- Impact of supply chain disruptions: Beyond tariffs, supply chain disruptions related to [mention specific issues, e.g., geopolitical instability, natural disasters] have further complicated the situation.

- Analysis of consumer demand: Reduced consumer spending on discretionary electronics and automobiles directly impacts demand for Infineon's products.

Future Outlook and Potential Recovery Strategies for Infineon (IFX)

The outlook for Infineon remains uncertain in the short term, given the lingering effects of tariffs and the weak global economy. However, the company's long-term growth prospects remain promising, fueled by the ongoing growth of the automotive and industrial sectors. To recover from this sales forecast miss, Infineon may pursue several strategies:

- Possible scenarios for future sales growth: A cautious recovery is projected, contingent upon improvements in global economic conditions and the easing of supply chain pressures.

- Potential cost-cutting measures: Infineon might streamline its operations and focus on optimizing its manufacturing processes to improve efficiency.

- Investment in research and development: Investing in new technologies and innovative products will be critical for future growth and market leadership.

- Expansion into new markets or product segments: Diversification into new, high-growth markets could help offset the impact of the current slowdown.

Conclusion

Infineon's [Quarter, e.g., Q3 2024] sales forecast miss highlights the significant and lasting impact of Trump-era tariffs on the semiconductor industry. While macroeconomic factors also played a role, the increased costs associated with these tariffs significantly impacted Infineon's profitability and market competitiveness. The sales shortfall has significant implications for investors and underscores the challenges faced by semiconductor companies in a volatile global market. Stay updated on the evolving situation with Infineon (IFX) and monitor future sales reports to understand how the company navigates these challenges and recovers from this sales forecast miss. Regularly check financial news sources for the latest developments on Infineon’s performance and strategies to overcome the impacts of the Trump-era tariffs. Careful monitoring of the Infineon (IFX) sales forecast and related news will be crucial for making informed investment decisions.

Featured Posts

-

Is A Large Down Payment Preventing You From Buying A Home In Canada

May 10, 2025

Is A Large Down Payment Preventing You From Buying A Home In Canada

May 10, 2025 -

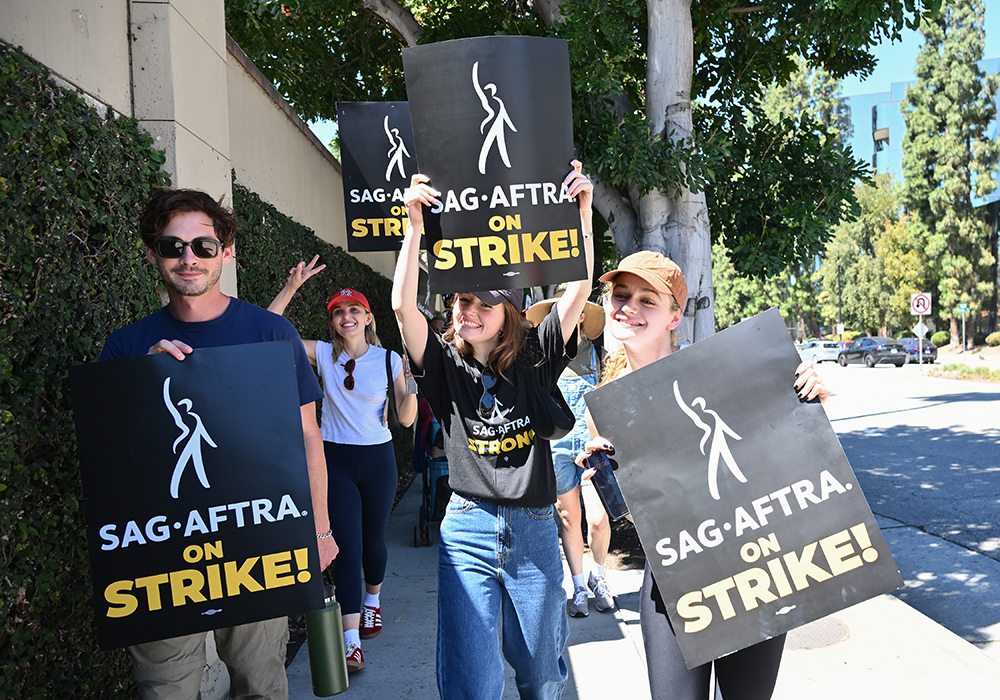

Wga And Sag Aftra Strike The Complete Guide To Hollywoods Shutdown

May 10, 2025

Wga And Sag Aftra Strike The Complete Guide To Hollywoods Shutdown

May 10, 2025 -

The Countrys Evolving Business Landscape A Regional Overview

May 10, 2025

The Countrys Evolving Business Landscape A Regional Overview

May 10, 2025 -

Dijon Un Boxeur Convoque Au Tribunal Pour Des Faits De Violences Conjugales

May 10, 2025

Dijon Un Boxeur Convoque Au Tribunal Pour Des Faits De Violences Conjugales

May 10, 2025 -

Transgender Mouse Research And Us Funding An Examination Of Scientific Spending

May 10, 2025

Transgender Mouse Research And Us Funding An Examination Of Scientific Spending

May 10, 2025