Infineon (IFX) Sales Forecast Misses Mark: Uncertainty Around Tariffs

Table of Contents

Infineon's Disappointing Sales Figures

Q3 2024 Sales Results

Infineon reported significantly lower-than-expected sales figures for Q3 2024. While the exact numbers will be inserted here upon release of the official report (replace bracketed information with actual data), the revenue fell short of both the previous quarter's performance and the company's own projections. Earnings per share (EPS) also experienced a decline. This underperformance represents a substantial deviation from the anticipated growth trajectory.

Analysis of the Shortfall

The sales forecast miss was substantial, representing a [insert percentage]% shortfall compared to the projected figures. The automotive segment, a key driver of Infineon's revenue, experienced the most significant downturn, followed by the industrial sector. This indicates a weakening demand across crucial market segments.

- Specific numbers illustrating the sales miss: [Insert actual revenue figures, EPS, and comparison to previous quarter and forecast].

- Comparison to analyst expectations: [Insert details on how the results compared to consensus analyst estimates].

- Short-term vs. long-term impact: The immediate impact is a negative revision of short-term earnings expectations. The long-term impact depends on the duration and severity of the underlying issues.

The Impact of Tariffs on Infineon's Performance

Trade Wars and Supply Chain Disruptions

The ongoing impact of global trade wars, particularly the US-China trade conflict, significantly affects Infineon's operations. Tariffs on various components and finished goods increase manufacturing costs, impacting profitability and competitiveness. These tariffs disrupt established supply chains, forcing Infineon to explore more expensive alternatives or face delays in production. Specific tariffs on [mention specific products affected by tariffs] directly contribute to the higher production costs and reduced margins.

Geopolitical Uncertainty and its Influence on IFX

Beyond specific tariffs, broader geopolitical uncertainty creates instability. The ongoing conflict in [mention relevant geopolitical instability] creates ripple effects impacting raw material sourcing, transportation costs, and overall market demand. This instability makes accurate forecasting exceptionally challenging for Infineon and other companies in the sector.

- Examples of specific tariffs affecting Infineon's products: [List specific examples and their impact].

- Increased transportation costs due to trade barriers: [Quantify the increased costs where possible].

- Impact on sourcing raw materials and components: [Explain the difficulties in sourcing specific materials].

- Disruption of production and delivery schedules: [Explain delays and their impact on sales].

Other Contributing Factors to the Sales Miss

Global Economic Slowdown

The global economic slowdown plays a significant role in dampening demand for semiconductors. Reduced consumer spending and decreased investment in capital goods directly translate to lower orders for Infineon's products. The automotive and industrial sectors, particularly sensitive to economic downturns, are experiencing weakened demand, contributing to the sales shortfall.

Competition in the Semiconductor Industry

Intense competition within the semiconductor industry also contributes to the sales miss. [Mention key competitors] are vying for market share, putting pressure on pricing and profitability. Rapid technological advancements also lead to shorter product lifecycles, forcing companies like Infineon to constantly innovate and adapt, adding to the pressure.

- Impact of reduced consumer spending: [Explain the effect on demand].

- Increased competition from other semiconductor manufacturers: [Discuss the competitive landscape].

- Changes in technological demands affecting product sales: [Explain how technological shifts impact sales].

- Supply chain challenges beyond tariffs: [Mention other challenges like material shortages].

Investor Implications and Future Outlook for Infineon (IFX)

Stock Price Reaction

The market reacted negatively to Infineon's missed sales forecast, with the IFX stock price experiencing a [insert percentage]% decline immediately following the announcement. Investor sentiment reflects concerns about the company's ability to navigate the current challenges and return to its previous growth trajectory.

Analyst Ratings and Forecasts

Following the sales report, several analysts revised their ratings and forecasts for Infineon. [Insert details on changes in ratings and forecasts]. The overall outlook remains cautious, with many analysts emphasizing the uncertainty surrounding the global economic climate and the semiconductor market.

Long-Term Growth Potential for IFX

Despite the current challenges, Infineon retains significant long-term growth potential. Its strong position in key sectors like automotive and industrial automation, combined with ongoing investments in research and development, provides a foundation for future growth. However, successfully navigating the current headwinds posed by tariffs, geopolitical uncertainty, and economic slowdown will be critical to realizing this potential.

- Stock price changes post-announcement: [Provide details on the stock price fluctuation].

- Updated EPS estimates from analysts: [Summarize updated EPS estimates].

- Infineon's strategy for navigating current challenges: [Discuss the company's strategies].

- Potential for recovery and future growth: [Assess the likelihood of recovery].

Conclusion: Infineon (IFX) Sales Forecast Misses Mark: Uncertainty Around Tariffs

Infineon's missed sales forecast underscores the significant challenges facing the semiconductor industry. Tariffs, geopolitical instability, a global economic slowdown, and intense competition all contribute to this disappointing performance. While the short-term outlook remains uncertain, Infineon’s long-term prospects depend on its ability to effectively manage these challenges and capitalize on future opportunities. It's crucial for investors and stakeholders to stay informed about Infineon (IFX) and its performance by monitoring news, financial reports, and analyst updates related to the company and the wider semiconductor industry to better understand the evolving implications of the "Infineon (IFX) Sales Forecast Misses Mark: Uncertainty Around Tariffs" situation. Stay updated on the latest developments to make informed decisions.

Featured Posts

-

Brekelmans En India Een Analyse Van De Samenwerking

May 09, 2025

Brekelmans En India Een Analyse Van De Samenwerking

May 09, 2025 -

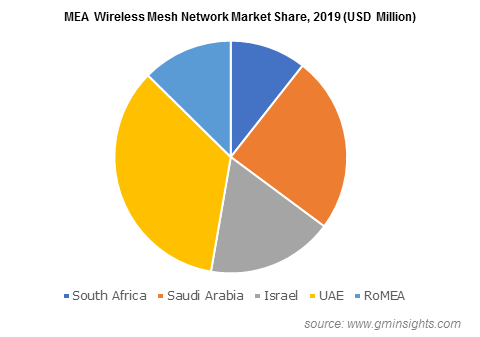

Wireless Mesh Network Market To Expand At A 9 8 Compound Annual Growth Rate

May 09, 2025

Wireless Mesh Network Market To Expand At A 9 8 Compound Annual Growth Rate

May 09, 2025 -

Chat Gpt Developer Open Ai Under Ftc Investigation Examining The Issues

May 09, 2025

Chat Gpt Developer Open Ai Under Ftc Investigation Examining The Issues

May 09, 2025 -

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025 -

Vozdushnaya Gavan Permi Zakryta Prichiny I Posledstviya Snegopada

May 09, 2025

Vozdushnaya Gavan Permi Zakryta Prichiny I Posledstviya Snegopada

May 09, 2025

Latest Posts

-

Star Stylist Elizabeth Stewart And Lilysilks Spring Collaboration A Luxurious New Collection

May 09, 2025

Star Stylist Elizabeth Stewart And Lilysilks Spring Collaboration A Luxurious New Collection

May 09, 2025 -

Dozens Of Cars Broken Into Elizabeth City Apartment Complex Crime Spree

May 09, 2025

Dozens Of Cars Broken Into Elizabeth City Apartment Complex Crime Spree

May 09, 2025 -

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 09, 2025

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 09, 2025 -

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 09, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 09, 2025 -

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025