Infineon (IFX): Sales Guidance Misses Estimates Amid Trump Tariff Uncertainty

Table of Contents

Infineon's Disappointing Sales Guidance

Infineon's (IFX) recent sales guidance significantly missed analyst expectations. While projections remained undisclosed publicly prior to the official announcement, post-announcement analysis revealed a considerable shortfall. The company attributed this primarily to weaker-than-anticipated demand in certain key sectors, coupled with ongoing supply chain complexities.

- Revenue Figures: While precise figures varied depending on the reporting currency and accounting methods, the shortfall represented a double-digit percentage decrease compared to projections.

- Revenue Breakdown: The automotive sector, typically a major revenue driver for Infineon, experienced a steeper decline than other segments like industrial automation and power supplies. This highlights the vulnerability of the company to cyclical downturns within specific market segments.

- Comparison to Previous Periods: This represents a considerable setback compared to the previous quarter and year-over-year growth, raising concerns about sustained future performance.

The company's explanation cited a confluence of factors beyond their immediate control, emphasizing the challenging macroeconomic environment and the lingering effects of global supply chain disruptions. However, the lack of specific details surrounding the revenue shortfall left many analysts and investors wanting a more transparent explanation.

The Role of Trump-Era Tariffs on Infineon's Performance

The lingering effects of Trump-era tariffs continue to cast a long shadow over Infineon's (IFX) performance. These tariffs, particularly those impacting semiconductors and related components, have created a complex web of challenges for the company.

- Increased Costs: Tariffs directly increased the cost of raw materials and components, squeezing profit margins and reducing competitiveness.

- Supply Chain Disruptions: Tariffs have also complicated global supply chains, leading to delays, increased transportation costs, and logistical headaches. This has had a knock-on effect on production schedules and delivery times.

- Reduced Demand: The resulting price increases for Infineon's products have, in turn, reduced demand in price-sensitive markets.

Specific tariffs on certain semiconductor components imported to key markets significantly impacted Infineon’s pricing strategy and profitability. The ripple effects across the global supply chain are still being felt. The uncertainty surrounding future trade policies adds further complexity to long-term planning and investment decisions for Infineon.

Investor Reaction and Market Analysis

The market reacted negatively to Infineon's (IFX) missed sales guidance. The stock price experienced a noticeable drop immediately following the announcement, reflecting investor concern. Analyst ratings were downgraded by several firms, further emphasizing the seriousness of the situation.

- Stock Price Fluctuations: A significant drop in IFX's stock price was observed following the release of the disappointing sales figures.

- Analyst Ratings: Several financial analysts lowered their rating and price target for Infineon's stock, reflecting a less optimistic view of the company's short-term prospects.

- Investor Commentary: News reports and investor commentary revealed widespread concern about the sustainability of Infineon's current business model in the face of these headwinds.

Infineon's Outlook and Future Strategies

Infineon (IFX) has outlined strategies to address the challenges it faces. These include streamlining operations to reduce costs, focusing on higher-margin product segments, and investing in research and development to enhance competitiveness.

- Cost-cutting Measures: Infineon is actively pursuing cost optimization initiatives across various departments, aiming to improve efficiency and profitability.

- Strategic Focus: The company is shifting its strategic focus towards higher-margin product segments, leveraging its strengths in specialized technologies.

- R&D Investment: Continued investment in research and development is crucial for developing innovative technologies to maintain a competitive edge in the evolving semiconductor market.

However, the success of these strategies remains to be seen. The global economic outlook, future trade policy developments, and ongoing supply chain challenges all represent significant uncertainties.

Navigating the Uncertainties Facing Infineon (IFX)

Infineon's (IFX) missed sales guidance underscores the impact of external factors, particularly lingering tariff uncertainty, on the semiconductor industry. The company's response, while proactive, faces a complex interplay of economic and geopolitical considerations. Understanding this relationship is critical to assessing Infineon's future performance. Staying informed about Infineon's strategic adjustments and the evolving global trade landscape will be crucial for investors and industry observers alike. Stay updated on Infineon (IFX) developments and learn more about the effects of trade policy on Infineon (IFX) and the broader semiconductor industry to gain a comprehensive understanding of this dynamic sector.

Featured Posts

-

Stiven King Rezko Vyskazalsya O Trampe I Maske

May 09, 2025

Stiven King Rezko Vyskazalsya O Trampe I Maske

May 09, 2025 -

Vu Bao Hanh Tre O Tien Giang Loi Khai Day Du Cua Bao Mau

May 09, 2025

Vu Bao Hanh Tre O Tien Giang Loi Khai Day Du Cua Bao Mau

May 09, 2025 -

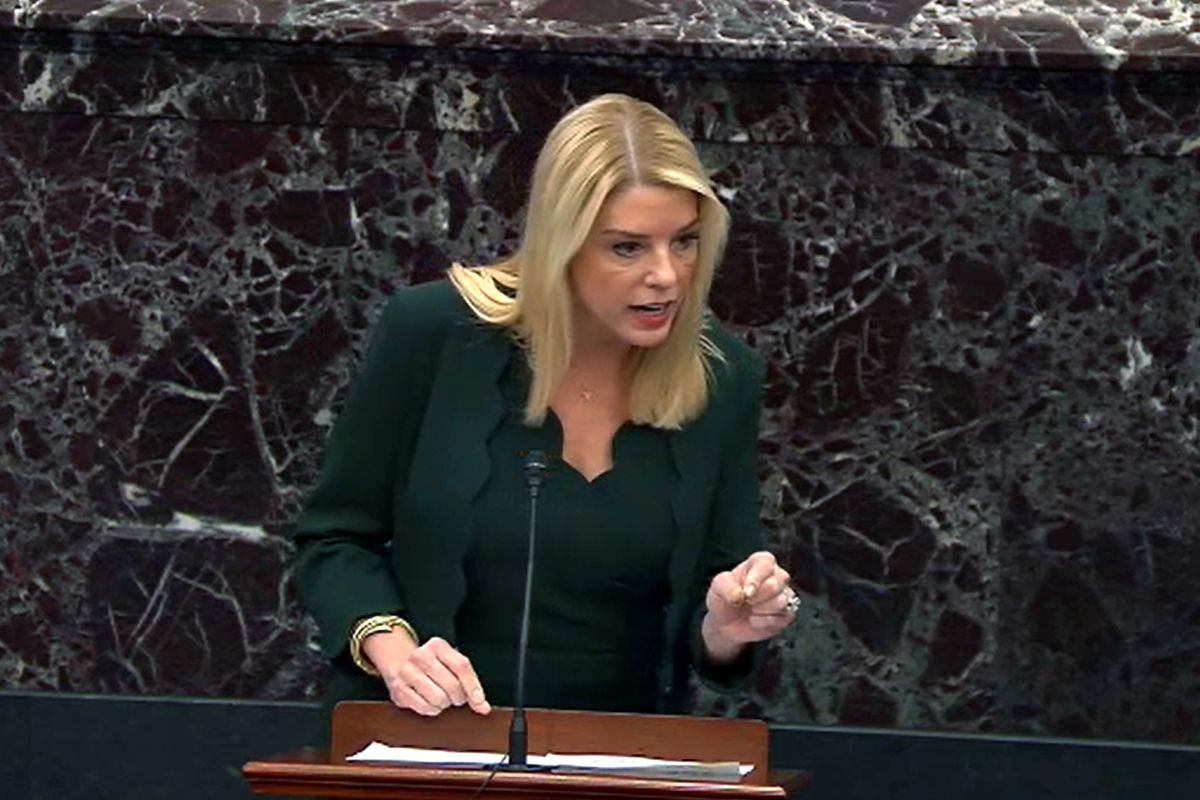

Public Reaction To Pam Bondis Statements On Killing American Citizens

May 09, 2025

Public Reaction To Pam Bondis Statements On Killing American Citizens

May 09, 2025 -

Rio Ferdinand Reverses Champions League Final Prediction Psg Vs Arsenal

May 09, 2025

Rio Ferdinand Reverses Champions League Final Prediction Psg Vs Arsenal

May 09, 2025 -

Stiven King Povernuvsya Ta Prokomentuvav Trampa Ta Maska

May 09, 2025

Stiven King Povernuvsya Ta Prokomentuvav Trampa Ta Maska

May 09, 2025

Latest Posts

-

9 Maya V Kieve Kto Priekhal A Kto Otkazalsya Makron Starmer Merts Tusk

May 09, 2025

9 Maya V Kieve Kto Priekhal A Kto Otkazalsya Makron Starmer Merts Tusk

May 09, 2025 -

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev Prichiny I Posledstviya

May 09, 2025

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev Prichiny I Posledstviya

May 09, 2025 -

Les Ecologistes Et Les Municipales 2026 A Dijon

May 09, 2025

Les Ecologistes Et Les Municipales 2026 A Dijon

May 09, 2025 -

France Poland Friendship Treaty Macron Announces Signing Next Month

May 09, 2025

France Poland Friendship Treaty Macron Announces Signing Next Month

May 09, 2025 -

Municipales Dijon 2026 Un Programme Ecologique Pour La Ville

May 09, 2025

Municipales Dijon 2026 Un Programme Ecologique Pour La Ville

May 09, 2025