Interest Rate Cuts: Why The Fed Is Different

Table of Contents

The Fed's Dual Mandate: A Key Differentiator

Unlike many central banks that primarily focus on price stability (controlling inflation), the Fed operates under a dual mandate. This means its primary goals are to promote maximum employment and price stability. This seemingly simple difference dramatically shapes its approach to interest rate cuts. When considering whether to cut interest rates, the Fed weighs the potential impact on both employment levels and inflation. A central bank focused solely on inflation might be more reluctant to cut rates, even if unemployment is high, fearing inflationary pressures. The Fed, however, might prioritize job creation, even if it risks slightly higher inflation in the short term.

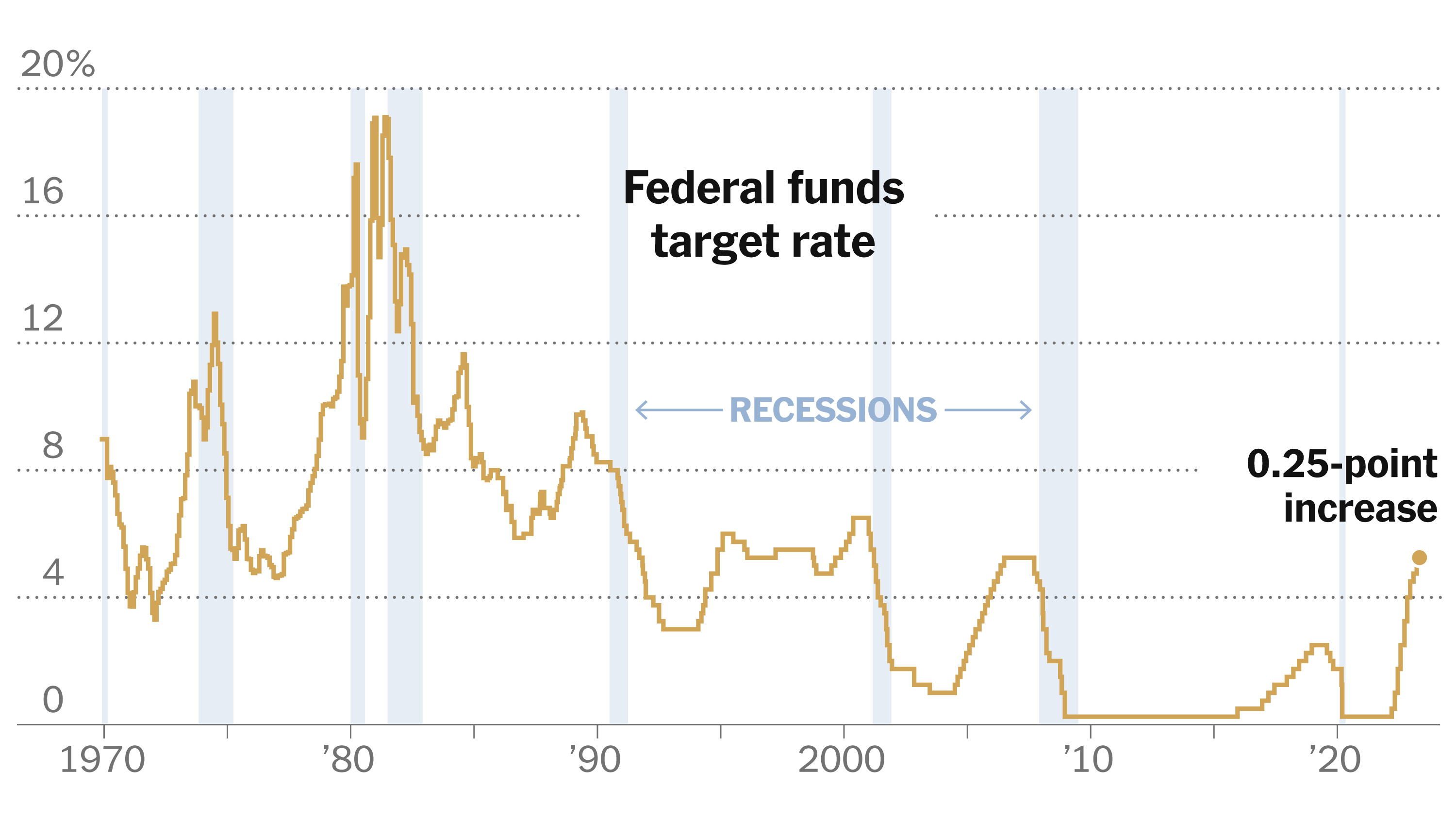

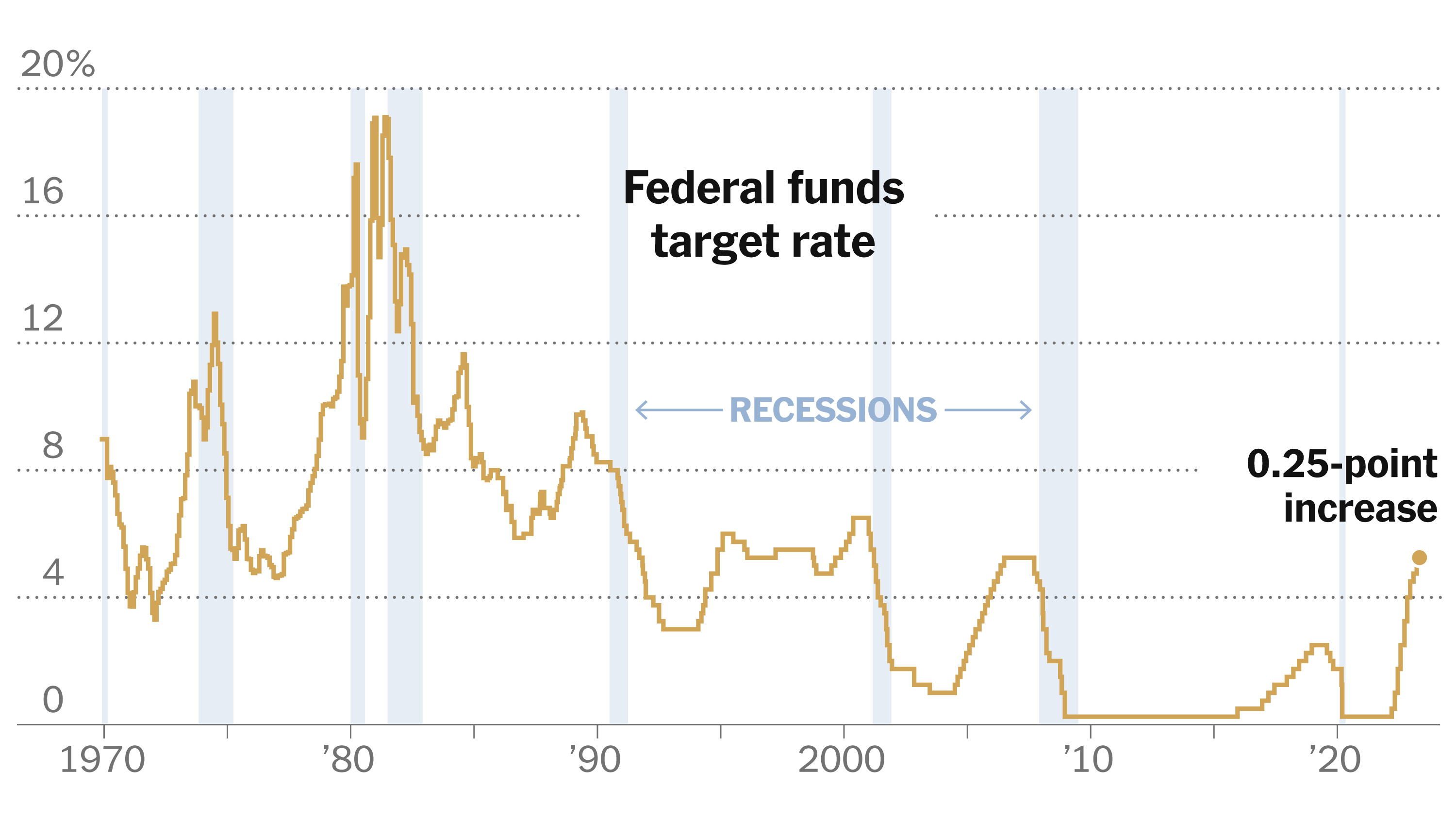

- Impact of inflation on interest rate decisions: High inflation typically leads the Fed to raise interest rates to cool down the economy. However, if inflation is moderate and unemployment is high, the Fed might cut rates to stimulate economic growth, even if it means a small increase in inflation.

- Importance of employment data in the Fed's approach: The non-farm payroll report and unemployment rate are crucial indicators for the Fed. Strong employment numbers might lead them to maintain or even raise rates, whereas weak employment data might prompt interest rate cuts.

- Examples of situations where the Fed prioritized one aspect of its mandate over the other: The response to the 2008 financial crisis is a prime example. The Fed aggressively cut interest rates and implemented quantitative easing, prioritizing employment and economic stability even at the risk of higher inflation in the long run.

The Dollar's Global Role and its Impact on Fed Policy

The US dollar's status as the world's reserve currency significantly amplifies the global impact of the Fed's decisions on interest rate cuts. When the Fed cuts rates, it influences global capital flows, exchange rates, and international trade. Other countries' economies are deeply intertwined with the US economy, and therefore, sensitive to changes in US monetary policy.

- The ripple effect of US interest rate cuts on global capital flows: Lower interest rates in the US can lead to capital outflows from other countries as investors seek higher returns in US assets. This can put pressure on other currencies and impact their economies.

- The influence on exchange rates and international trade: A reduction in US interest rates can weaken the dollar, making US exports more competitive and imports more expensive. This can affect trade balances and global economic dynamics.

- Examples of how other countries react to Fed interest rate cut announcements: Emerging market economies, particularly, are vulnerable to capital flight following Fed rate cuts. Their central banks may need to respond with their own monetary policy adjustments to mitigate the impact.

Transparency and Communication: The Fed's Approach

The Fed is known for its relatively transparent communication strategy. This transparency, while not always perfect, is a key differentiator. The Federal Open Market Committee (FOMC) meetings, press conferences, and regular statements provide the market with insights into the Fed's thinking and future policy intentions. This helps to manage market expectations and reduce volatility in response to interest rate cuts. Many other central banks are less transparent, leading to greater uncertainty and potential market turmoil.

- The role of the Federal Open Market Committee (FOMC) meetings: These meetings are where the Fed sets monetary policy, including interest rate decisions. Minutes from these meetings are later released, offering a window into the decision-making process.

- The impact of press conferences and statements on market sentiment: Statements from the Fed Chair and other officials shape market expectations and influence investor behavior. Clear and consistent communication can help to stabilize markets.

- Analysis of the Fed's communication strategies and their effectiveness: While the Fed's communication has improved over time, challenges remain in effectively conveying complex economic concepts to a broad audience.

Quantitative Easing (QE) and Other Non-Traditional Tools

Beyond traditional interest rate cuts, the Fed has employed unconventional monetary policies, most notably quantitative easing (QE). QE involves the Fed purchasing long-term government bonds and other securities to inject liquidity into the financial system and lower long-term interest rates. This tool was extensively used during and after the 2008 financial crisis. While QE can stimulate economic activity, its long-term effects are still debated.

- Explanation of how QE works: By purchasing assets, the Fed increases the money supply, lowering borrowing costs and encouraging investment and lending.

- Comparison of QE used by the Fed versus other central banks: Many other central banks have also employed QE, but the scale and implementation have varied significantly.

- Analysis of the long-term effects of QE on the economy: While QE helped to prevent a deeper recession in 2008, concerns remain about potential inflationary pressures and asset bubbles in the long run.

Conclusion: Navigating the Nuances of Interest Rate Cuts with the Fed

The Federal Reserve's approach to interest rate cuts is distinct due to its dual mandate, the global influence of the US dollar, and its emphasis on transparent communication. Understanding these nuances is essential for investors and businesses alike. The Fed's actions have far-reaching consequences, impacting everything from employment levels and inflation to global capital flows and exchange rates. Stay informed about Federal Reserve interest rate cuts by following financial news closely, subscribing to reputable economic newsletters, and following leading economists' analysis. This will allow you to better understand the implications for your investments and your business in the ever-changing global economic landscape.

Featured Posts

-

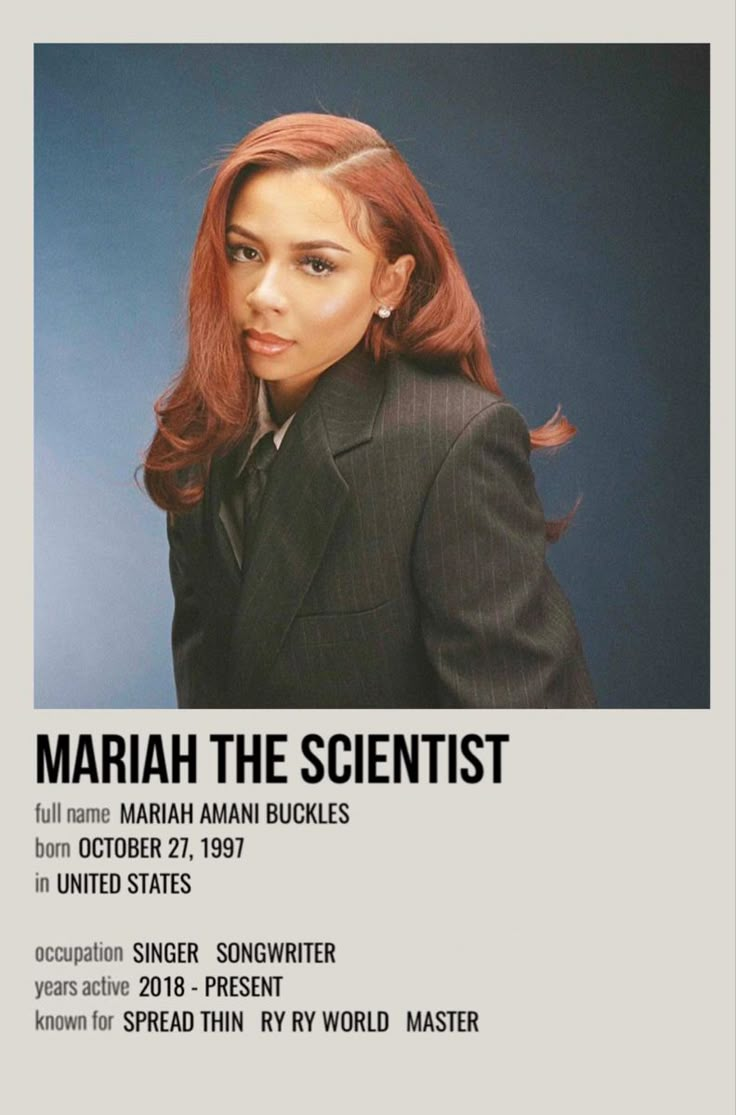

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025 -

Madeleine Mc Cann Search 108 000 Funding For Investigation

May 09, 2025

Madeleine Mc Cann Search 108 000 Funding For Investigation

May 09, 2025 -

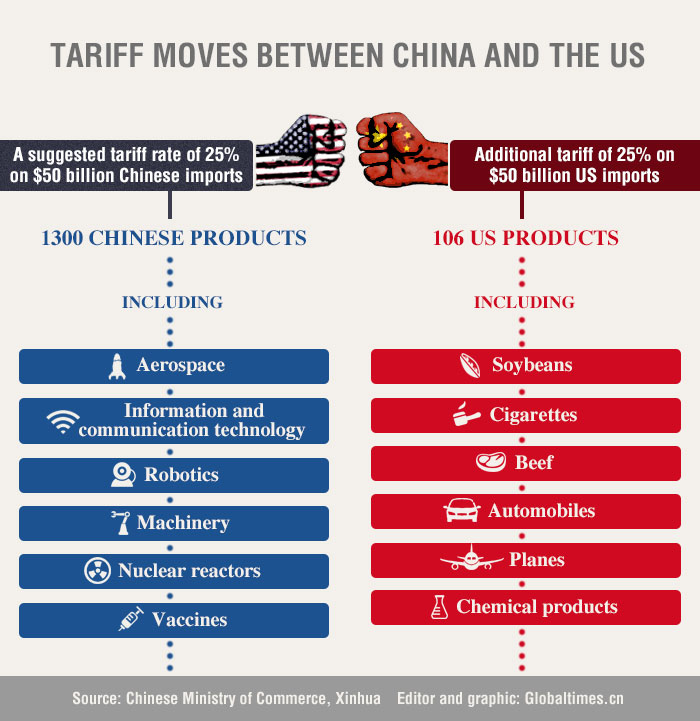

The Ripple Effect How Trade Chaos Impacts The Production And Distribution Of Chinese Goods Including Bubble Blasters

May 09, 2025

The Ripple Effect How Trade Chaos Impacts The Production And Distribution Of Chinese Goods Including Bubble Blasters

May 09, 2025 -

Suncors Record Production Impact Of Inventory Buildup On Sales Volumes

May 09, 2025

Suncors Record Production Impact Of Inventory Buildup On Sales Volumes

May 09, 2025 -

Putra Heights 10 Inisiatif Bantuan Pas Selangor Untuk Mangsa Tragedi

May 09, 2025

Putra Heights 10 Inisiatif Bantuan Pas Selangor Untuk Mangsa Tragedi

May 09, 2025

Latest Posts

-

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025 -

Stiven King Povernuvsya Ta Prokomentuvav Trampa Ta Maska

May 09, 2025

Stiven King Povernuvsya Ta Prokomentuvav Trampa Ta Maska

May 09, 2025 -

King Protiv Maska Pisatel Vernulsya V X S Rezkoy Kritikoy

May 09, 2025

King Protiv Maska Pisatel Vernulsya V X S Rezkoy Kritikoy

May 09, 2025 -

Stiven King Novi Zayavi Pro Trampa Ta Maska

May 09, 2025

Stiven King Novi Zayavi Pro Trampa Ta Maska

May 09, 2025 -

Stiven King Vernulsya V X I Naekhal Na Ilona Maska

May 09, 2025

Stiven King Vernulsya V X I Naekhal Na Ilona Maska

May 09, 2025