Investigating The Reasons Behind D-Wave Quantum (QBTS)'s Monday Stock Decline

Table of Contents

Market Sentiment and Wider Tech Sector Performance

The performance of D-Wave Quantum (QBTS) is inextricably linked to the broader technology market. Monday's decline in QBTS stock may have been influenced by a general downturn in the tech sector. Assessing the overall market sentiment on that day is crucial to understanding the context of the D-Wave stock price fall.

- Market Indices: A review of major market indices such as the Nasdaq Composite is essential. If the Nasdaq experienced a significant drop on that Monday, it could explain a portion of the QBTS stock drop, as many tech stocks tend to move in correlation.

- Economic News: Any negative economic news impacting the technology sector, such as revised interest rate forecasts or concerns about inflation, could have contributed to increased risk aversion among investors, leading to a sell-off across the sector, including QBTS.

- Investor Sentiment: A shift in investor sentiment, perhaps driven by broader macroeconomic concerns or geopolitical events, could create a climate of uncertainty impacting even robust companies like D-Wave. Increased risk aversion often leads to investors shedding assets perceived as riskier, potentially explaining a portion of the D-Wave stock price fall.

Company-Specific News and Announcements

Internal factors within D-Wave Quantum itself could also have triggered the QBTS stock drop. Any negative news or announcements released by the company requires careful scrutiny.

- Press Releases and Statements: A thorough examination of any press releases or official statements issued by D-Wave Quantum on or around Monday is necessary. Did they announce any delays in project timelines, disappointing financial results, or changes in leadership that might have spooked investors?

- Negative Press Coverage: Negative media coverage, even if not directly related to the company's fundamentals, could influence investor confidence and contribute to the D-Wave stock price fall.

- Analyst Reports and Ratings Downgrades: Changes in analyst ratings or the publication of negative reports from financial analysts could negatively affect investor perceptions and explain the QBTS stock drop. A sudden downgrade could trigger a wave of selling.

Competition and Industry Dynamics

The quantum computing industry is highly competitive. Analyzing the competitive landscape and any significant announcements from rival companies can shed light on the D-Wave stock price fall.

- Key Competitors: Identifying and analyzing the actions of key competitors, such as IBM, Google, and IonQ, is crucial. Any significant breakthroughs or announcements from these competitors might have impacted investor sentiment towards D-Wave.

- Competitive Advantages and Disadvantages: Evaluating D-Wave's competitive position relative to its rivals is vital. Any perceived weakening of its competitive advantages could cause a reassessment by investors.

- Market Growth Trajectory: While the quantum computing market is experiencing rapid growth, the pace and trajectory of this growth can fluctuate. Any perceived slowing down of growth could affect investor confidence and explain the D-Wave stock price fall.

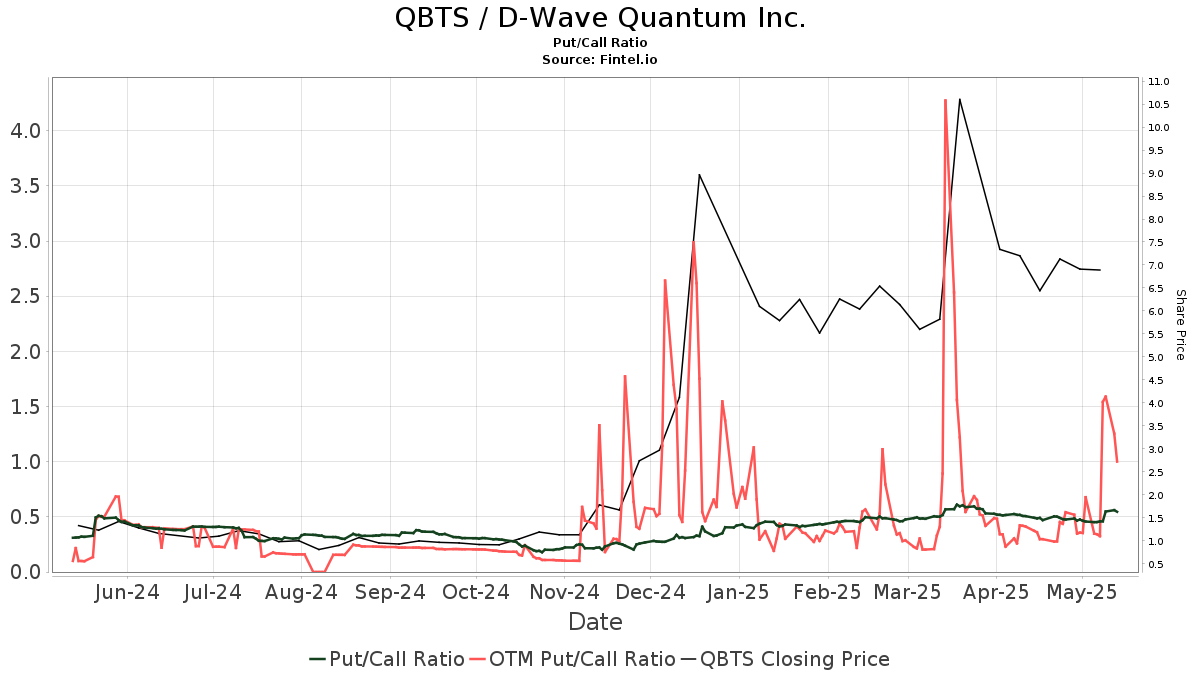

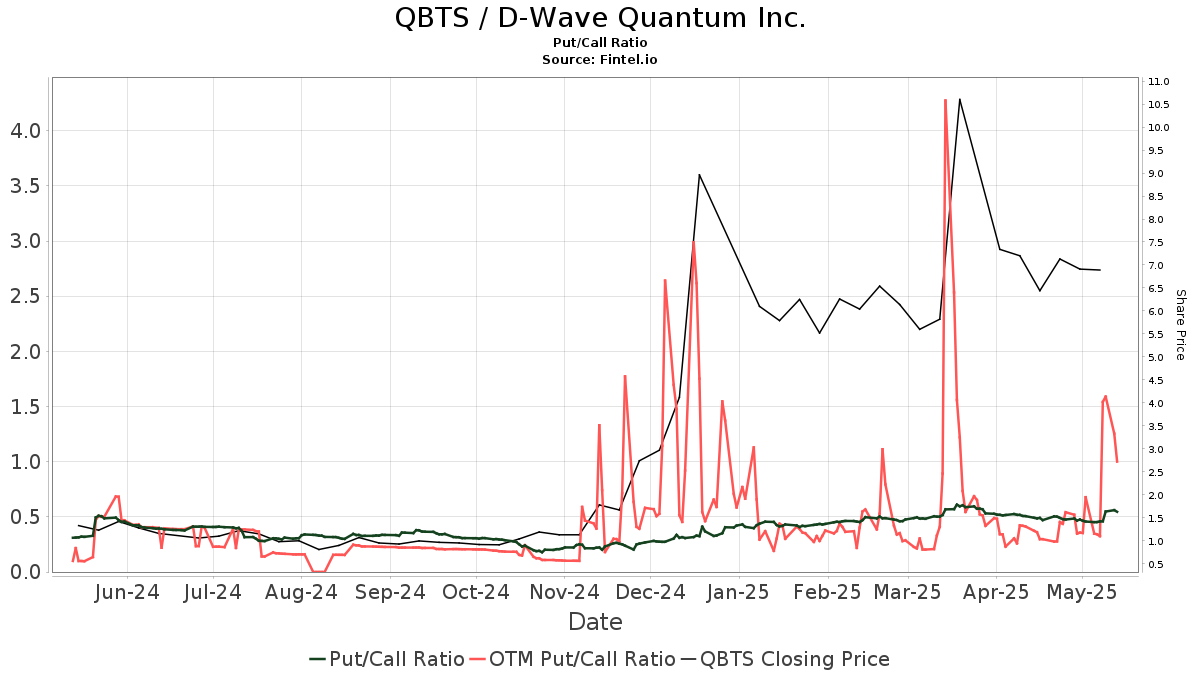

Technical Analysis of QBTS Stock Charts

Examining the technical aspects of the QBTS stock chart can offer valuable insights into the D-Wave stock price fall, irrespective of fundamental factors.

- Chart Patterns and Indicators: A detailed examination of the QBTS stock chart, including trading volume, support and resistance levels, moving averages, and other technical indicators, can reveal potential reasons behind the decline. Certain chart patterns may signal bearish trends.

- Trading Volume: High trading volume accompanying the decline suggests significant selling pressure, whereas low volume might indicate a more minor correction.

- Short-Selling Activity: A surge in short-selling activity could contribute to the downward pressure on the QBTS stock price.

Conclusion: Understanding the Factors Behind D-Wave Quantum (QBTS)'s Stock Movement

D-Wave Quantum (QBTS)'s Monday stock decline likely resulted from a combination of factors. The overall performance of the tech sector, company-specific news (or lack thereof), competitive pressures, and technical indicators all played a role in influencing the D-Wave stock price fall. Understanding these interconnected elements is key to interpreting stock market movements in this dynamic sector. To gain a comprehensive understanding of future QBTS stock price movements and the trajectory of D-Wave Quantum, it is crucial to stay updated on QBTS stock, monitor D-Wave's progress, and follow the future of D-Wave Quantum (QBTS) closely by tracking market trends, company announcements, and competitive developments within the rapidly evolving quantum computing industry.

Featured Posts

-

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kehitys Ja Potentiaali

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kehitys Ja Potentiaali

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025 -

Is D Wave Quantum Inc Qbts The Best Quantum Computing Stock

May 20, 2025

Is D Wave Quantum Inc Qbts The Best Quantum Computing Stock

May 20, 2025 -

France Eurovision 2024 La Chanson De Louane Revelee

May 20, 2025

France Eurovision 2024 La Chanson De Louane Revelee

May 20, 2025 -

The Kite Runner In A Nigerian Context A Study Of Pragmatism And Its Consequences

May 20, 2025

The Kite Runner In A Nigerian Context A Study Of Pragmatism And Its Consequences

May 20, 2025