Investing In 2025: MicroStrategy Stock Or Bitcoin? A Detailed Analysis

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, a business intelligence company, has become synonymous with its aggressive Bitcoin acquisition strategy. Understanding this strategy is crucial to evaluating its stock as an investment.

MicroStrategy's Business Model and Bitcoin Adoption

MicroStrategy's core business lies in providing business analytics and mobile software. However, its foray into Bitcoin has dramatically reshaped its profile. The company's rationale centers around:

- Long-term vision for Bitcoin: MicroStrategy views Bitcoin as a superior long-term store of value, exceeding traditional assets like gold. Their significant Bitcoin holdings reflect this conviction.

- Treasury reserve strategy: A substantial portion of MicroStrategy's treasury reserves are now allocated to Bitcoin, a unique strategy among publicly traded companies.

- Impact of Bitcoin price fluctuations: The price volatility of Bitcoin significantly impacts MicroStrategy's financial statements, creating both opportunities and risks for investors. Their business intelligence software revenue and overall financial performance interact with Bitcoin's price movements.

Keywords: MicroStrategy Bitcoin strategy, MicroStrategy stock price, Bitcoin treasury reserves, business intelligence software

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique risk-reward profile intricately linked to Bitcoin's price.

- Risks: The primary risk is the direct correlation to Bitcoin's price volatility. A significant drop in Bitcoin's value could severely impact MicroStrategy's stock price. Over-reliance on a single asset also poses a considerable risk.

- Rewards: If Bitcoin appreciates significantly, MicroStrategy's stock price could experience substantial growth. Furthermore, successful integration of Bitcoin into their business model could lead to increased market share and profitability.

Factors influencing MicroStrategy's stock price include:

- Overall market conditions

- Bitcoin's price performance

- MicroStrategy's financial performance (excluding Bitcoin holdings)

- Investor sentiment towards Bitcoin and MicroStrategy's strategy.

Keywords: MicroStrategy stock investment, MicroStrategy risk analysis, MicroStrategy return on investment (ROI), stock market volatility

Bitcoin's Potential in 2025 and Beyond

Bitcoin's future remains a subject of much debate, but its potential impact on the global financial system is undeniable.

Bitcoin's Technological Advantages and Market Adoption

Bitcoin's decentralized nature, limited supply (21 million coins), and growing acceptance as a store of value are key factors driving its potential.

- Growing institutional interest: Major corporations and financial institutions are increasingly incorporating Bitcoin into their investment strategies.

- Cross-border payments: Bitcoin's potential for facilitating faster and cheaper cross-border payments is gaining traction.

- Regulatory developments: The evolving regulatory landscape will significantly influence Bitcoin's future adoption and price.

Keywords: Bitcoin price prediction 2025, Bitcoin adoption rate, cryptocurrency investment, decentralized finance (DeFi)

Risks Associated with Direct Bitcoin Investment

Investing directly in Bitcoin carries substantial risks:

- Extreme volatility: Bitcoin's price is notoriously volatile, experiencing significant swings in short periods.

- Regulatory uncertainty: The regulatory environment for cryptocurrencies is still evolving and varies significantly across jurisdictions.

- Security risks: The risk of exchange hacks and theft remains a concern for Bitcoin holders.

To mitigate these risks:

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio.

- Risk tolerance: Only invest what you can afford to lose.

- Secure storage: Use secure hardware wallets or reputable exchanges for storing your Bitcoin.

Keywords: Bitcoin volatility, Bitcoin risks, cryptocurrency security, Bitcoin regulation

MicroStrategy Stock vs. Bitcoin: A Comparative Analysis

Choosing between MicroStrategy stock and direct Bitcoin investment requires a careful comparison of their respective risk profiles and potential returns.

Comparing Risk Profiles

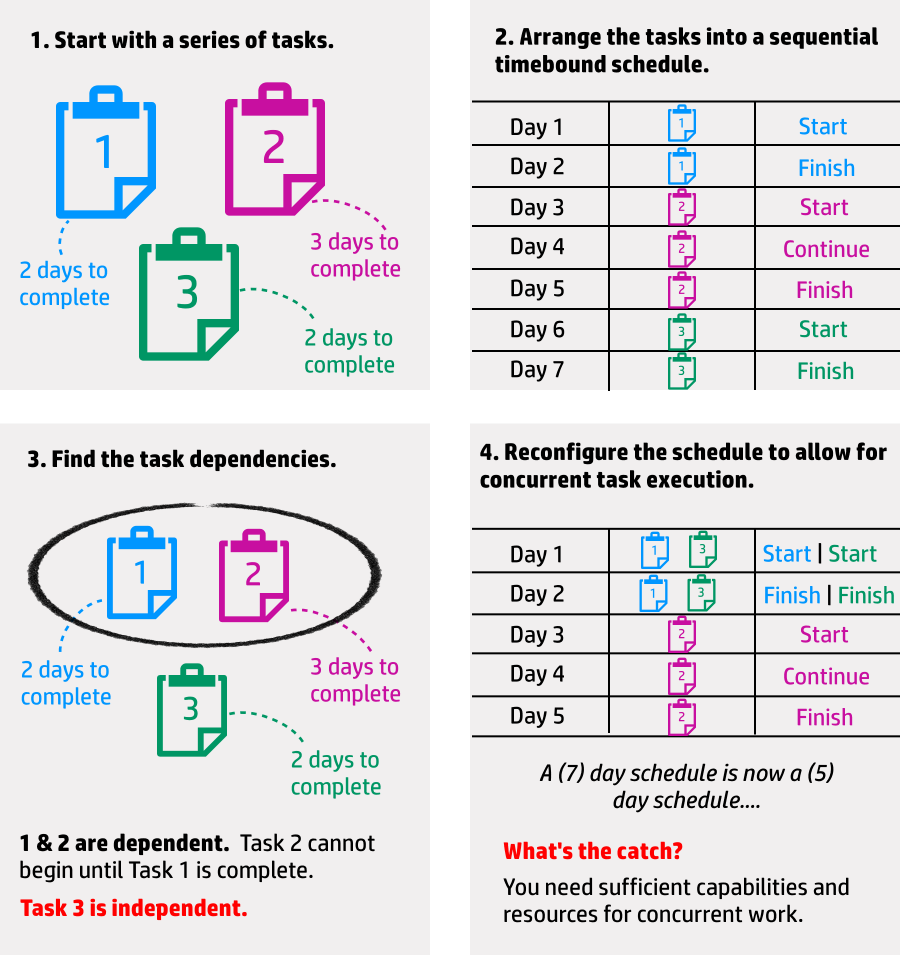

Both options are considerably volatile, but the nature of the volatility differs. MicroStrategy stock incorporates the volatility of Bitcoin and the volatility of the company's core business. Direct Bitcoin investment exposes you solely to the cryptocurrency's price fluctuations. Visual aids (charts and graphs comparing historical price volatility) would greatly enhance this section if data were available.

Keywords: Risk assessment, investment strategy, portfolio diversification, asset allocation

Considering Investment Goals and Time Horizon

Your investment goals and time horizon are crucial factors:

- Short-term gains: Bitcoin might offer higher potential for short-term gains, but also carries significantly higher risk. MicroStrategy stock might be less volatile in the short-term, but its growth is still largely dependent on Bitcoin’s price.

- Long-term growth: Both options could offer long-term growth potential, but this depends on several unpredictable factors.

It's crucial to align your investment choices with your personal risk tolerance and financial objectives.

Keywords: Long-term investment, short-term investment, investment goals, financial planning

Conclusion: Investing in 2025: MicroStrategy Stock or Bitcoin? The Verdict

Investing in either MicroStrategy stock or Bitcoin in 2025 presents both significant opportunities and considerable risks. MicroStrategy stock offers exposure to Bitcoin's potential but adds the layer of risk associated with a publicly traded company. Direct Bitcoin investment offers potentially higher returns but with correspondingly higher volatility and security concerns.

Before making a decision, carefully consider:

- Your risk tolerance

- Your investment timeline

- Current market conditions

- Your understanding of both Bitcoin and MicroStrategy's business model

Conduct thorough research, consult with a financial advisor, and make an informed decision based on your unique circumstances. Remember, Investing in 2025: MicroStrategy Stock or Bitcoin? is a personal choice that requires careful consideration of your financial goals and risk appetite. Don't hesitate to explore further resources and gain a deeper understanding before committing your capital. Investing in either asset requires a clear understanding of the inherent risks.

Featured Posts

-

Inter Milan Eyeing De Ligt Loan With Option To Buy From Manchester United

May 09, 2025

Inter Milan Eyeing De Ligt Loan With Option To Buy From Manchester United

May 09, 2025 -

Understanding Elon Musks Wealth A Comprehensive Look At His Business Ventures

May 09, 2025

Understanding Elon Musks Wealth A Comprehensive Look At His Business Ventures

May 09, 2025 -

Expanding Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025

Expanding Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025 -

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025 -

Policia Britanica Prende Mulher Que Alega Ser Madeleine Mc Cann

May 09, 2025

Policia Britanica Prende Mulher Que Alega Ser Madeleine Mc Cann

May 09, 2025

Latest Posts

-

Nicolas Cages Lawsuit Update Dismissal But Sons Case Continues

May 09, 2025

Nicolas Cages Lawsuit Update Dismissal But Sons Case Continues

May 09, 2025 -

Edmontons Tech And Innovation Sector Edmonton Unlimiteds Growth Plan

May 09, 2025

Edmontons Tech And Innovation Sector Edmonton Unlimiteds Growth Plan

May 09, 2025 -

Edmonton Unlimiteds New Strategy Scaling Tech Innovation For Global Impact

May 09, 2025

Edmonton Unlimiteds New Strategy Scaling Tech Innovation For Global Impact

May 09, 2025 -

Edmonton Unlimited A New Strategy For Global Tech And Innovation Scaling

May 09, 2025

Edmonton Unlimited A New Strategy For Global Tech And Innovation Scaling

May 09, 2025 -

Speedy Construction 14 Edmonton Area School Projects On The Fast Track

May 09, 2025

Speedy Construction 14 Edmonton Area School Projects On The Fast Track

May 09, 2025