Investing In 2025: MicroStrategy Stock Vs. Bitcoin - A Detailed Analysis

Table of Contents

Understanding MicroStrategy's Business Model and its Bitcoin Holdings

MicroStrategy's involvement in Bitcoin significantly impacts its stock performance, making it a complex investment. Understanding its core business and Bitcoin strategy is crucial for any potential investor.

MicroStrategy's Core Business

MicroStrategy is primarily known for its business intelligence, analytics, and mobile software. They develop and sell enterprise software solutions, primarily targeting large organizations needing data analysis and visualization tools. Their financial performance fluctuates, influenced by the overall tech sector and the success of their software sales. Understanding their revenue streams and profit margins independent of Bitcoin is vital to evaluating their stock. Keywords: business intelligence, analytics software, enterprise software, MicroStrategy revenue, MicroStrategy profit margin.

MicroStrategy's Bitcoin Strategy

MicroStrategy's bold move to heavily invest in Bitcoin as part of its corporate treasury strategy has significantly shaped its narrative. Their rationale involves believing in Bitcoin's long-term potential as a store of value and a hedge against inflation. However, this strategy carries inherent risks due to Bitcoin's price volatility. Keywords: Bitcoin investment, corporate treasury strategy, digital asset holdings, MicroStrategy Bitcoin holdings.

- Potential Benefits: Diversification of assets, potential for significant returns if Bitcoin's price appreciates.

- Drawbacks: Significant exposure to Bitcoin price fluctuations, potentially leading to substantial losses if the market declines.

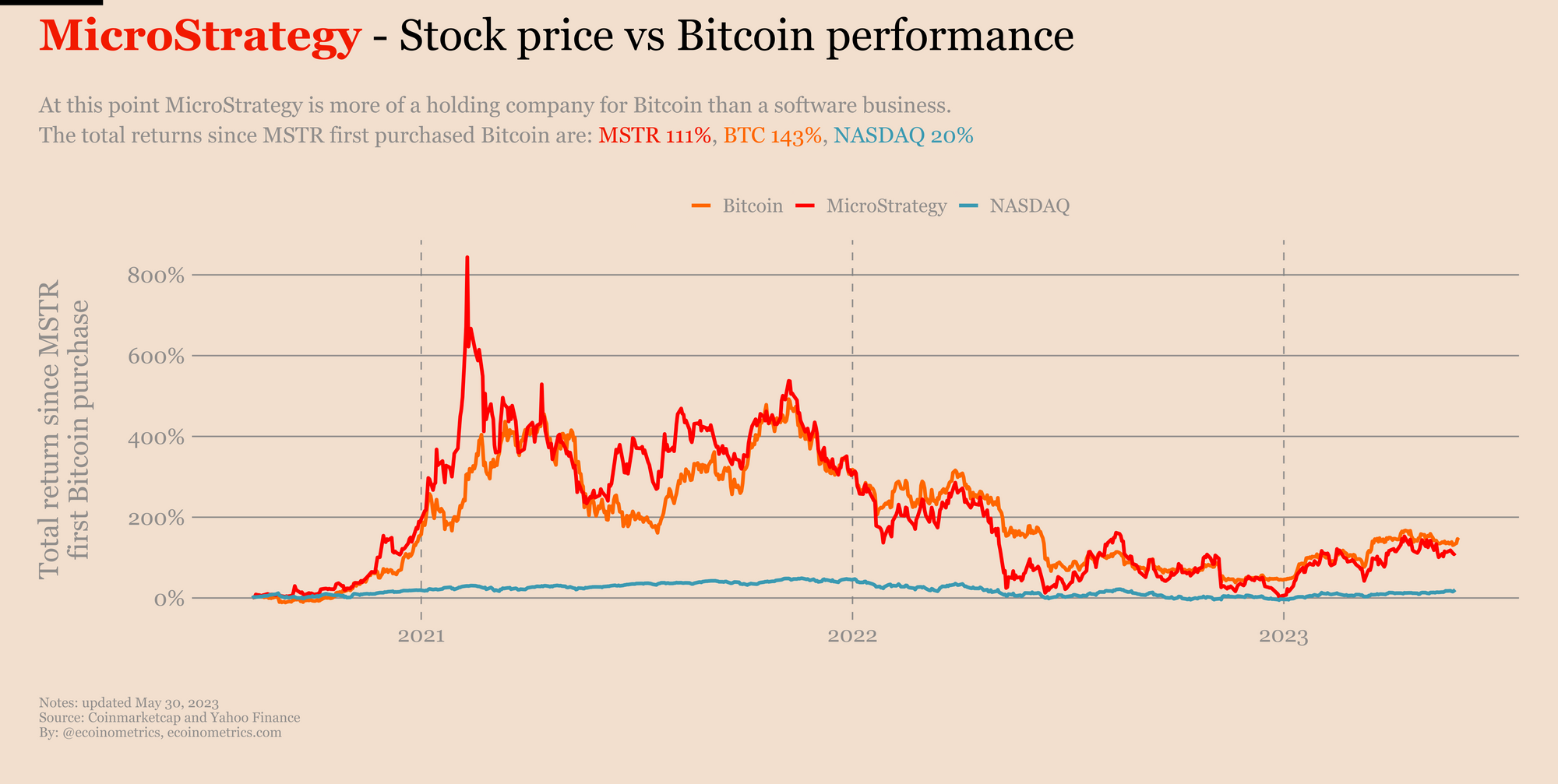

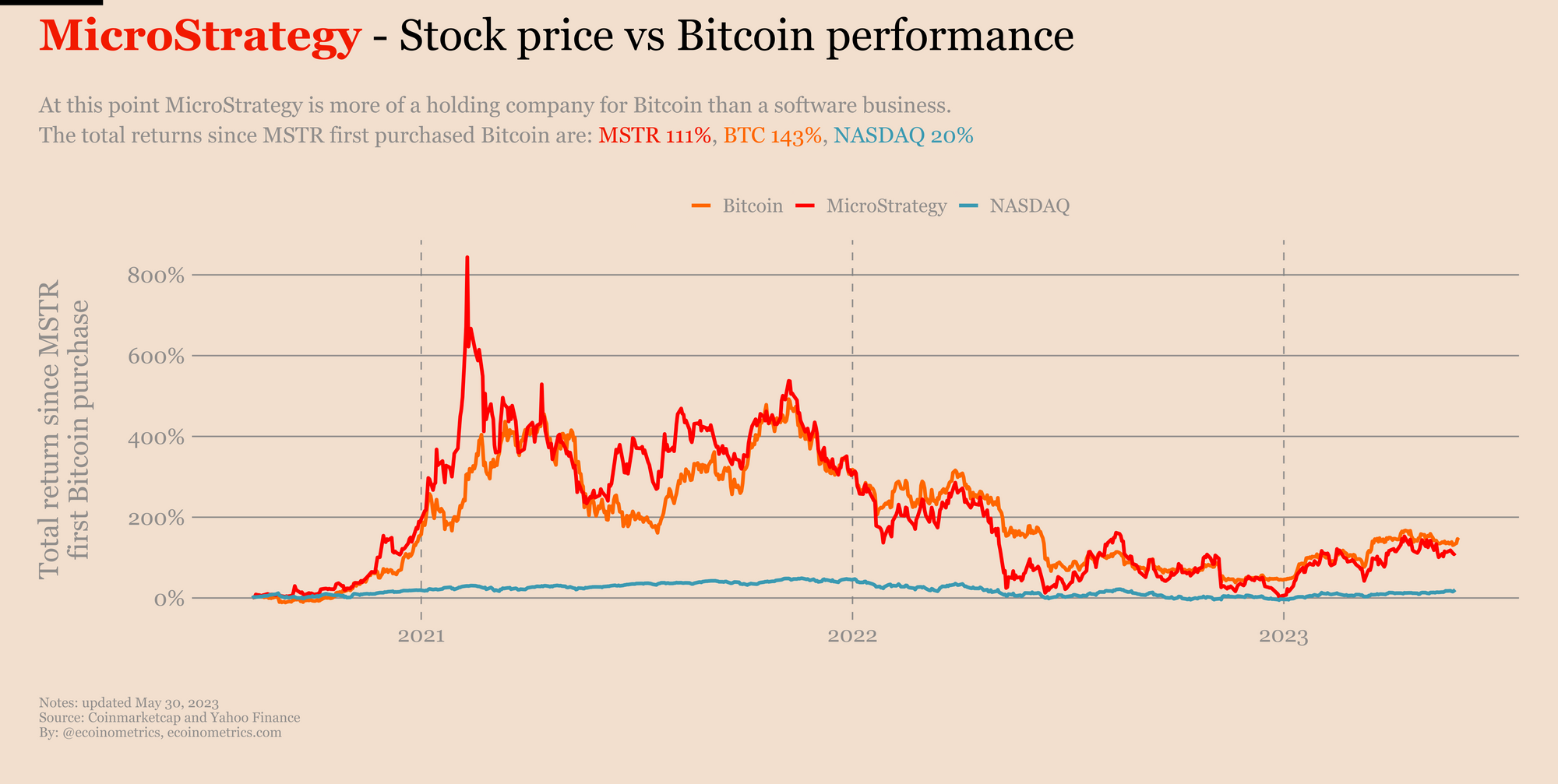

- Impact of Bitcoin Price Fluctuations: MicroStrategy's stock price is highly correlated with Bitcoin's price. A Bitcoin price surge can boost their stock, while a crash can severely impact it.

- Financial Health: While MicroStrategy has substantial Bitcoin holdings, their overall financial health and ability to withstand market volatility are still important considerations for investors.

Bitcoin's Market Position and Future Predictions

Bitcoin, the original and largest cryptocurrency, occupies a unique position in the global financial landscape. However, its future remains subject to several factors.

Bitcoin's Volatility and Market Sentiment

Bitcoin's price is notoriously volatile, influenced by news, regulation, market sentiment, and technological advancements. These fluctuations create both opportunities and significant risks for investors. Predicting Bitcoin's price with certainty is impossible, but analyzing market trends and understanding the factors influencing its price is crucial. Keywords: cryptocurrency market, Bitcoin price prediction, market capitalization, Bitcoin volatility.

Adoption and Institutional Investment

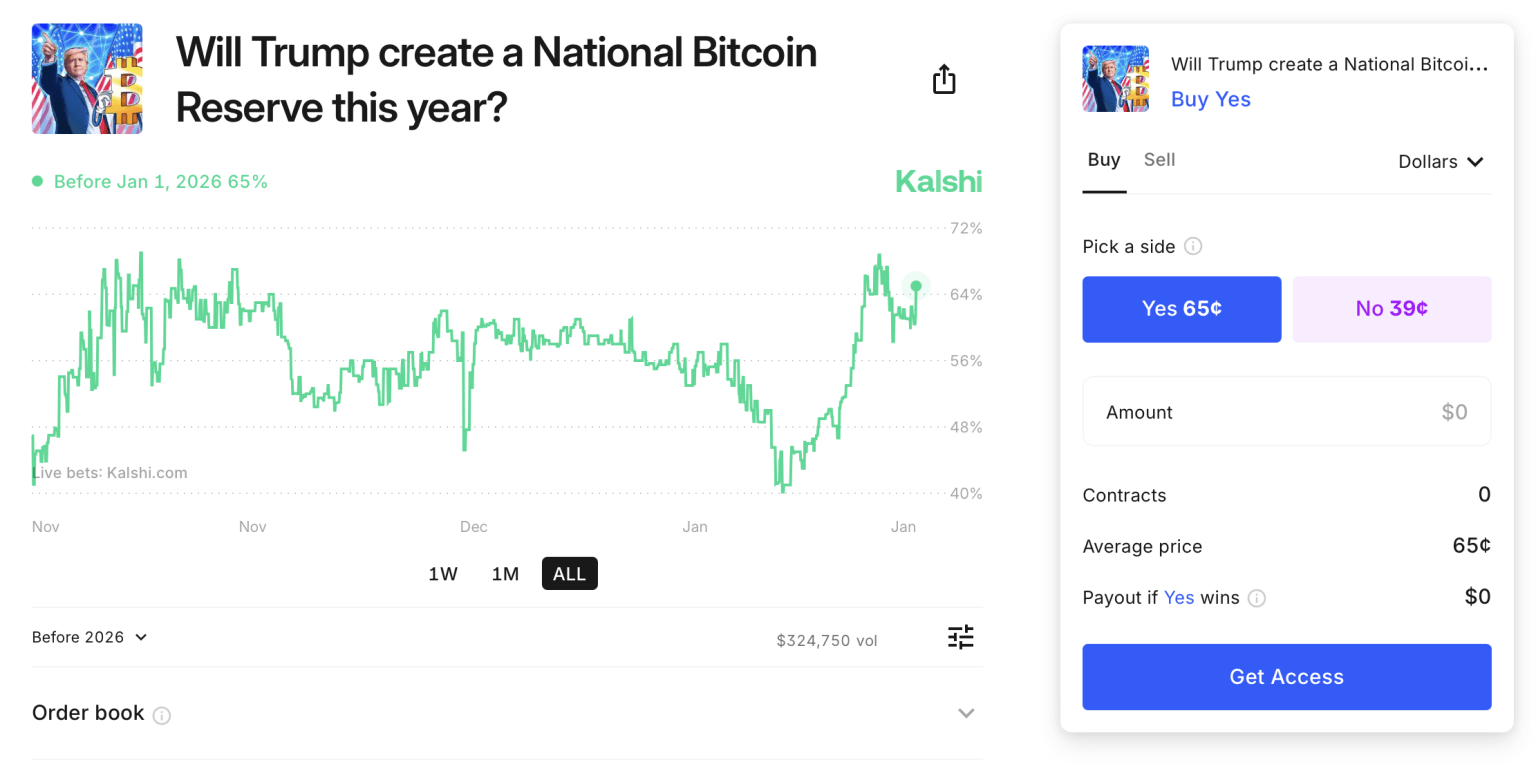

The growing adoption of Bitcoin by institutional investors, including large corporations and investment firms, signals increasing legitimacy and potential for long-term growth. The potential approval of a Bitcoin ETF (Exchange-Traded Fund) could further increase institutional interest and liquidity. However, regulatory uncertainty remains a significant risk factor. Keywords: institutional adoption, Bitcoin ETF, crypto regulation, Bitcoin institutional investment.

- Future Price Scenarios: Potential scenarios range from continued price appreciation to significant corrections, depending on factors like technological advancements, regulatory clarity, and overall market demand.

- Risks Associated with Bitcoin: Security risks (hacks, theft), regulatory uncertainty (government bans or restrictions), and potential market manipulation are all important considerations.

- Mainstream Asset Class Potential: Bitcoin's potential to become a widely accepted mainstream asset class is a key driver of its long-term value proposition.

Direct Comparison: MicroStrategy Stock vs. Bitcoin in 2025

Choosing between MicroStrategy stock and Bitcoin in 2025 requires a careful assessment of your risk tolerance and investment goals.

Risk Tolerance and Investment Goals

Investors with a higher risk tolerance and a longer-term investment horizon might find Bitcoin more appealing, despite its volatility. Those seeking a less volatile investment with exposure to Bitcoin might prefer MicroStrategy stock. Your investment strategy should align with your risk profile and financial goals. Keywords: investment strategy, risk assessment, portfolio diversification, risk tolerance, investment goals.

Potential Returns and Risks

Both MicroStrategy stock and Bitcoin offer the potential for high returns, but also carry substantial risks. Bitcoin's potential returns are potentially higher, but its volatility is much greater. MicroStrategy stock offers a more diversified exposure to Bitcoin, but its returns are also tied to the company's overall performance. The time horizon significantly impacts the risk-return profile. Keywords: return on investment, risk management, long-term investment, short-term investment.

- Comparison Table:

| Feature | MicroStrategy Stock | Bitcoin |

|---|---|---|

| Volatility | Moderate (influenced by Bitcoin) | High |

| Potential Return | Moderate to High (correlated to Bitcoin) | High (potentially very high) |

| Risk | Moderate to High | High |

| Liquidity | High | High (but can be affected by market conditions) |

| Correlation | Highly correlated with Bitcoin price | N/A |

| Tax Implications | Subject to capital gains tax | Subject to capital gains tax |

- Correlation: MicroStrategy's stock price is strongly correlated with Bitcoin's price. This is a significant risk factor to consider.

- Tax Implications: Both investments are subject to capital gains taxes, the exact rate depending on your jurisdiction and holding period.

Diversification and Portfolio Management

A well-diversified portfolio is crucial for mitigating risk. Both MicroStrategy stock and Bitcoin can play a role, but should be considered within a broader investment strategy.

Building a Balanced Portfolio

Including MicroStrategy and/or Bitcoin in a diversified portfolio can offer potential benefits, but only if carefully considered. Diversification reduces the overall portfolio's volatility and risk. It's crucial to allocate assets according to your risk tolerance and investment objectives. Keywords: portfolio allocation, asset allocation, diversification strategy, portfolio diversification.

Considering Alternative Investments

Other investment options, such as traditional stocks, bonds, real estate, and alternative investments like hedge funds, can complement investments in MicroStrategy or Bitcoin. A balanced portfolio incorporating various asset classes is often the most prudent approach. Keywords: alternative investments, hedge funds, real estate investment.

- Diversified Portfolio Examples: A balanced portfolio might include a small percentage allocation to Bitcoin and/or MicroStrategy stock, alongside other established asset classes.

- Professional Advice: It's crucial to seek professional financial advice before making significant investment decisions.

Conclusion: Investing in 2025: MicroStrategy Stock vs. Bitcoin – Your Decision

This analysis highlights the key differences between investing in MicroStrategy stock and Bitcoin in 2025. Both offer substantial potential returns but also carry significant risks. MicroStrategy provides a more indirect, less volatile exposure to Bitcoin, while direct investment in Bitcoin offers potentially higher rewards but with much greater volatility. The optimal choice depends heavily on your individual risk tolerance, investment goals, and understanding of the underlying assets.

Key Takeaways:

- Bitcoin offers higher potential returns but significantly higher risk.

- MicroStrategy stock provides exposure to Bitcoin but with less volatility (still subject to market forces).

- Diversification is crucial to mitigate risk.

Call to Action: Before investing in either MicroStrategy stock or Bitcoin, conduct thorough research, assess your risk tolerance, and consider consulting with a qualified financial advisor. Remember, this analysis is for informational purposes only and not financial advice. Consider your own circumstances and goals when crafting your 2025 investment strategies, whether that involves Investing in MicroStrategy or Investing in Bitcoin. Learn more about risk management and portfolio diversification to make well-informed decisions about your investment journey.

Featured Posts

-

Lyon Psg Victoria Parisina En El Estadio De Lyon

May 08, 2025

Lyon Psg Victoria Parisina En El Estadio De Lyon

May 08, 2025 -

Could Trumps Policies Send Bitcoin To 100 000 A Price Prediction Analysis

May 08, 2025

Could Trumps Policies Send Bitcoin To 100 000 A Price Prediction Analysis

May 08, 2025 -

Psg Launches Research Facility In Doha Expanding Global Reach

May 08, 2025

Psg Launches Research Facility In Doha Expanding Global Reach

May 08, 2025 -

Indias Boldest Military Action Against Pakistan In Decades

May 08, 2025

Indias Boldest Military Action Against Pakistan In Decades

May 08, 2025 -

Arsenali Akuzohet Per Shkelje Te Rregullave Te Uefa S Ne Ndeshjen Me Psg

May 08, 2025

Arsenali Akuzohet Per Shkelje Te Rregullave Te Uefa S Ne Ndeshjen Me Psg

May 08, 2025

Latest Posts

-

Saturday Night Live A Pivotal Platform For Counting Crows Success 1995

May 08, 2025

Saturday Night Live A Pivotal Platform For Counting Crows Success 1995

May 08, 2025 -

The Mr Jones Snl Moment Analyzing Counting Crows 1995 Breakthrough

May 08, 2025

The Mr Jones Snl Moment Analyzing Counting Crows 1995 Breakthrough

May 08, 2025 -

Counting Crows And Saturday Night Live The 1995 Performance That Changed Everything

May 08, 2025

Counting Crows And Saturday Night Live The 1995 Performance That Changed Everything

May 08, 2025 -

Counting Crows 2025 Tour Predicted Setlist And Song Possibilities

May 08, 2025

Counting Crows 2025 Tour Predicted Setlist And Song Possibilities

May 08, 2025 -

Understanding The Context And Inspiration Behind Counting Crows Slip Out Under The Aurora

May 08, 2025

Understanding The Context And Inspiration Behind Counting Crows Slip Out Under The Aurora

May 08, 2025