Investing In Apple Stock: A Look At Q2 Financial Performance

Table of Contents

Q2 2024 Financial Highlights: Revenue and Earnings

Apple's Q2 2024 financial results painted a mixed picture, showcasing both strengths and challenges. While the company exceeded analyst expectations in some areas, others fell slightly short, highlighting the complexities of the current economic climate. Let's examine the key figures:

- Total Revenue: [Insert Actual Revenue Figure Here] – representing a [Insert Percentage]% year-over-year growth/decline.

- Earnings Per Share (EPS): [Insert Actual EPS Figure Here] – compared to [Insert Previous Year's EPS] in Q2 of the previous year.

- Year-over-Year Growth: [Insert Percentage]% – demonstrating [positive/negative] momentum.

- Analyst Expectations: Apple [beat/met/missed] analyst expectations for both revenue and EPS. [Cite source for analyst predictions]

- Key Contributing Factors: Strong iPhone sales, particularly the iPhone 14 series, continued to be a major driver of revenue. Growth in the Services segment, including Apple Music, iCloud, and the App Store, also contributed significantly. However, a slight dip in Mac sales might be attributed to the economic slowdown.

Performance of Key Product Segments

Analyzing Apple's Q2 performance by product segment provides a more nuanced understanding of its overall financial health.

- iPhone: Remains the dominant revenue generator, with [Insert Revenue Figure and Percentage Change]. Strong demand for the iPhone 14 series and continued growth in emerging markets fueled this performance.

- Mac: Experienced a [growth/decline] in revenue, totaling [Insert Revenue Figure and Percentage Change]. This could be attributed to [mention specific reasons, e.g., decreased consumer spending on computers, increased competition].

- iPad: Showed [growth/decline] with [Insert Revenue Figure and Percentage Change]. [Explain possible reasons, e.g., new product releases, market saturation].

- Wearables, Home, and Accessories: This segment demonstrated [growth/decline] at [Insert Revenue Figure and Percentage Change], driven by strong sales of [mention specific products, e.g., Apple Watch, AirPods].

- Services: Continues to be a significant growth engine for Apple, reaching [Insert Revenue Figure and Percentage Change]. The expansion of Apple's services ecosystem and increasing user engagement are key drivers.

Impact of Macroeconomic Factors

Global macroeconomic factors played a crucial role in shaping Apple's Q2 performance.

- Inflation: Rising inflation impacted consumer spending, potentially affecting sales across various product categories.

- Supply Chain Issues: While significantly improved from previous quarters, lingering supply chain disruptions could have affected production and availability of certain products.

- Global Economic Conditions: The slowdown in global economic growth likely influenced consumer demand for Apple's products, particularly in certain regions.

- Mitigation Strategies: Apple actively manages its supply chain and has implemented strategies to mitigate the impact of these external factors. These include diversifying suppliers and optimizing production processes.

Future Outlook and Stock Implications

Apple's Q2 results offer a glimpse into the company's potential future performance.

- Apple's Forward-Looking Statements: [Summarize any official statements from Apple regarding future expectations].

- Analyst Predictions: Analysts offer varying predictions for Apple's stock price, with some expecting continued growth while others anticipate some consolidation. [Cite sources and range of predictions].

- Potential Risks: Continued global economic uncertainty, intensifying competition, and potential supply chain disruptions remain key risks.

- Opportunities: Growth in emerging markets, expansion of its services business, and the introduction of innovative new products present significant opportunities for future growth.

Is Now a Good Time to Invest in Apple Stock?

Whether now is a good time to invest in Apple stock depends on individual risk tolerance and investment goals. The Q2 results present a complex picture: strong performance in some areas offset by challenges in others. Thorough due diligence, considering both the positive and negative aspects discussed above, is essential before making any investment decision. The inherent volatility of the stock market must also be taken into account.

Conclusion

Apple's Q2 2024 financial performance showcased a blend of positive and negative trends, reflecting both the company's strengths and the challenges posed by the current macroeconomic environment. While strong iPhone sales and growth in services contributed to overall revenue, some segments experienced slower growth. Whether these results are positive or negative for investors considering investing in Apple stock ultimately depends on individual investment strategies and risk profiles. Remember to conduct thorough due diligence before investing in Apple stock, considering your personal financial situation and risk tolerance to make a well-informed decision.

Featured Posts

-

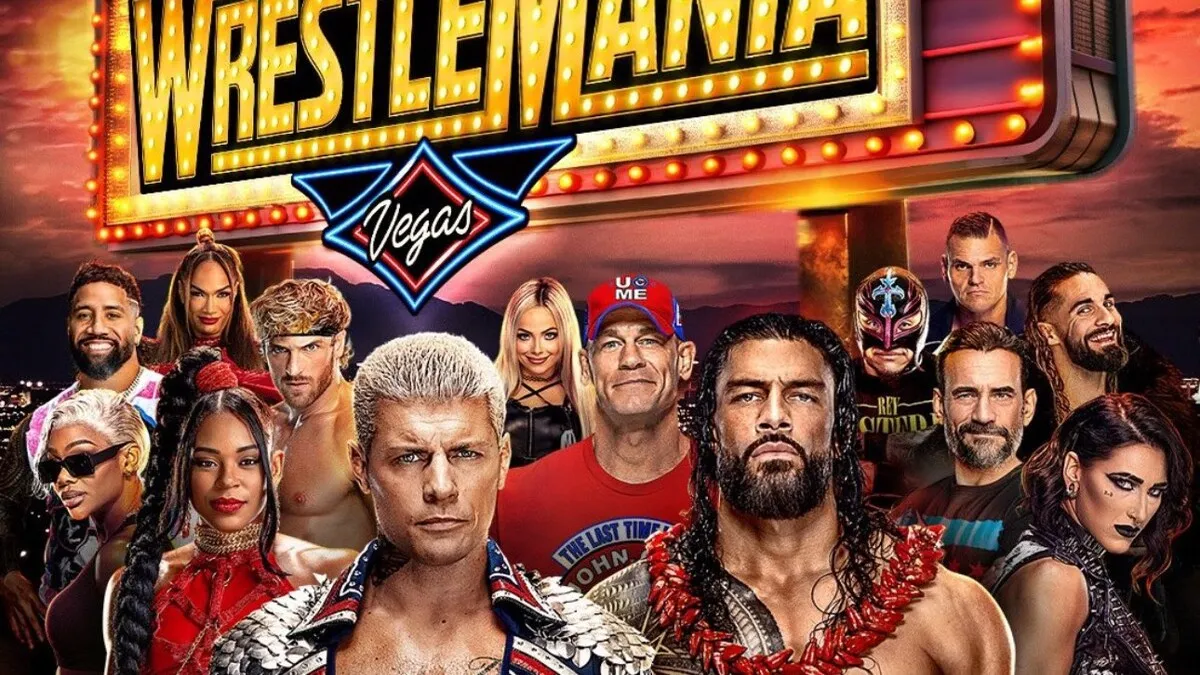

Wwe Wrestle Mania 41 Golden Belt And Ticket Sales This Memorial Day Weekend

May 24, 2025

Wwe Wrestle Mania 41 Golden Belt And Ticket Sales This Memorial Day Weekend

May 24, 2025 -

Inflations Impact Canadian Car Owners Compromising On Security

May 24, 2025

Inflations Impact Canadian Car Owners Compromising On Security

May 24, 2025 -

Skolko Let Personazham V Filme O Bednom Gusare Zamolvite Slovo Razbor Vozrastov Geroev

May 24, 2025

Skolko Let Personazham V Filme O Bednom Gusare Zamolvite Slovo Razbor Vozrastov Geroev

May 24, 2025 -

10 Let Evrovideniya Chto Stalo S Pobeditelyami

May 24, 2025

10 Let Evrovideniya Chto Stalo S Pobeditelyami

May 24, 2025 -

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025