Investing In BigBear.ai: A Detailed Look

Table of Contents

BigBear.ai is a rapidly growing company in the artificial intelligence (AI) sector, attracting significant attention from investors. This comprehensive guide delves into the key aspects of investing in BigBear.ai, providing potential investors with the necessary information to make informed decisions. We will examine its business model, financial performance, market position, and future prospects to determine the viability of BigBear.ai as a worthwhile investment. Understanding the nuances of BigBear.ai's operations and market standing is crucial before considering a BigBear.ai investment.

Understanding BigBear.ai's Business Model

Core Services and Offerings:

BigBear.ai provides advanced AI and data analytics solutions, primarily to government and commercial clients. Their offerings are geared towards solving complex problems using cutting-edge technology.

- AI-powered decision support: BigBear.ai leverages AI and machine learning to provide insights and predictions, aiding clients in making better informed decisions. This includes predictive modeling and scenario planning.

- Data analytics: The company offers comprehensive data analytics services, transforming raw data into actionable intelligence for various sectors. This encompasses data visualization, statistical analysis, and data mining.

- Cybersecurity solutions: BigBear.ai provides advanced cybersecurity solutions, protecting clients' sensitive data and infrastructure from cyber threats. This involves threat detection, incident response, and vulnerability management.

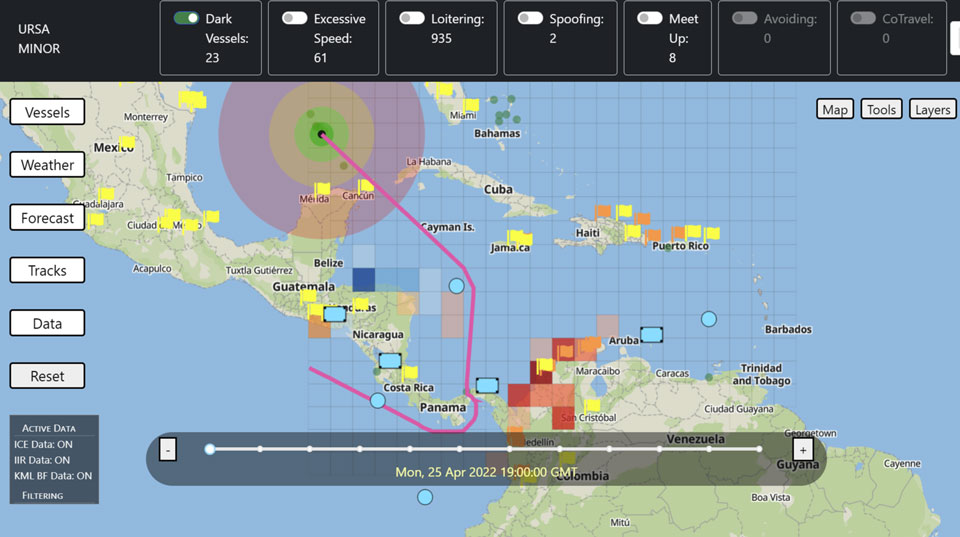

- Geospatial intelligence: Leveraging satellite imagery and other geospatial data, BigBear.ai offers advanced analytics for defense, intelligence, and commercial applications.

Key clients include government agencies and large corporations across various sectors, with numerous successful case studies demonstrating the effectiveness of their solutions. BigBear.ai's competitive advantages stem from its strong team of AI and data science experts, proprietary algorithms, and a focus on delivering high-impact results.

Revenue Streams and Financial Performance:

BigBear.ai's revenue model is primarily based on contracts, including fixed-price and time-and-materials contracts. A portion of their revenue likely comes from recurring services and maintenance agreements. Analyzing the financial performance requires reviewing publicly available financial statements. Key financial metrics such as revenue growth, profitability (or lack thereof in earlier stages), and cash flow should be examined in detail. Comparing these metrics to industry competitors in the AI and data analytics space is crucial for a comprehensive evaluation. Charts and graphs illustrating revenue, profit margins, and debt-to-equity ratios can provide a visual representation of the company's financial health and growth trajectory.

Market Position and Competitive Landscape

Market Opportunity in AI and Data Analytics:

The AI and data analytics markets are experiencing explosive growth, driven by increasing data volumes, advancements in AI technology, and the growing need for data-driven decision-making across various sectors. BigBear.ai is positioned to capitalize on this substantial market opportunity. Assessing its market share and comparing its positioning against competitors like Palantir Technologies or smaller specialized firms is vital. Understanding the market trends – the increasing adoption of cloud-based AI solutions, demand for specialized AI applications, and the expansion into new industries – can help predict BigBear.ai's future growth.

BigBear.ai's Competitive Advantages:

BigBear.ai differentiates itself through its:

- Technological innovation: The company invests heavily in research and development, maintaining a cutting-edge technological advantage. Assessing the strength of its intellectual property portfolio is crucial.

- Strategic partnerships: Collaborations with technology providers and industry leaders enhance BigBear.ai's capabilities and market reach.

- Talent acquisition and retention: Attracting and retaining top talent in the competitive AI field is vital for BigBear.ai's success.

- Government contracts: A significant portion of BigBear.ai's revenue likely comes from government contracts, providing a stable revenue stream but also exposing them to potential delays and changes in government spending. This needs careful analysis of any governmental risk.

Analyzing these aspects thoroughly will help determine BigBear.ai's competitive edge.

Risk Assessment and Future Outlook

Potential Risks and Challenges:

Investing in BigBear.ai involves several potential risks:

- Regulatory risks: Changes in government regulations or policies could impact BigBear.ai's operations and revenue.

- Competition: The AI and data analytics market is highly competitive, and new entrants could pose a challenge.

- Technological disruptions: Rapid technological advancements could render current technologies obsolete.

- Financial risks: The company's financial performance is subject to market fluctuations and economic conditions.

- Dependence on government contracts: Over-reliance on government contracts exposes the company to budgetary constraints and shifts in government priorities.

- Geopolitical factors: International relations and geopolitical instability can influence the company's operations, especially considering its involvement in government contracts.

Growth Projections and Long-Term Potential:

BigBear.ai's future growth prospects depend on several factors, including its ability to:

- Expand into new markets: Exploring new sectors and geographic regions can drive revenue growth.

- Develop new service offerings: Innovation and the development of cutting-edge AI solutions will maintain a competitive edge.

- Attract and retain top talent: Maintaining a skilled workforce is crucial for continued success.

- Effective management team: The quality of leadership significantly influences a company’s direction and ability to execute its strategy.

Analyzing these factors, combined with a deep dive into financial projections and industry trends, allows for better assessment of BigBear.ai's long-term potential.

Conclusion:

This detailed look at BigBear.ai has covered its business model, financial performance, market position, and future outlook. While there are inherent risks in any investment, BigBear.ai's strong position in the rapidly growing AI market presents a potentially lucrative opportunity for investors. However, thorough due diligence is essential before making any investment decisions. Understanding the intricacies of BigBear.ai's operations and the associated risks is crucial before considering a BigBear.ai investment.

Call to Action: Learn more about BigBear.ai and carefully consider the information presented before making any decisions regarding investing in BigBear.ai. Conduct your own thorough research and consult with a financial advisor before investing in BigBear.ai stock or any other security. Remember, this is not financial advice.

Featured Posts

-

Efimereyontes Iatroi Savvatokyriako 12 And 13 Aprilioy Stin Patra

May 20, 2025

Efimereyontes Iatroi Savvatokyriako 12 And 13 Aprilioy Stin Patra

May 20, 2025 -

Analysis Of Broadcoms Proposed 1 050 V Mware Price Hike Impacting At And T

May 20, 2025

Analysis Of Broadcoms Proposed 1 050 V Mware Price Hike Impacting At And T

May 20, 2025 -

Femicide In Focus Colombian Models Death And Mexican Influencers Killing Spark Global Condemnation

May 20, 2025

Femicide In Focus Colombian Models Death And Mexican Influencers Killing Spark Global Condemnation

May 20, 2025 -

Gaza Food Supplies Israel Announces Resumption Of Aid

May 20, 2025

Gaza Food Supplies Israel Announces Resumption Of Aid

May 20, 2025 -

Exploring The World Of Agatha Christies Poirot

May 20, 2025

Exploring The World Of Agatha Christies Poirot

May 20, 2025