Investing In BigBear.ai: A Practical Guide

Table of Contents

Understanding BigBear.ai's Business Model and Financial Performance

BigBear.ai's success hinges on its diverse business model and strong financial performance. Understanding these aspects is crucial for any potential investor.

Revenue Streams and Growth Prospects

BigBear.ai generates revenue from a variety of sources, creating a more resilient business model. These include substantial government contracts, particularly within the defense and intelligence communities, as well as expanding commercial partnerships. Analyzing their past financial performance reveals consistent growth, although profitability may fluctuate. Forecasting future growth requires considering the continued demand for AI solutions and BigBear.ai's ability to secure new contracts and partnerships.

- Key revenue segments: Government contracts (defense, intelligence), commercial partnerships (various industries).

- Historical growth rates: (Insert data with source citations, e.g., "Revenue increased by X% year-over-year from 2021 to 2022, according to BigBear.ai's annual report.")

- Projected growth rates: (Insert projected growth rates with source citations, e.g., "Analysts predict a Y% growth rate for the next 5 years, based on [Source].")

- Significant contracts/partnerships: (List significant contracts and partnerships with brief descriptions.)

Competitive Landscape and Market Position

BigBear.ai operates in a competitive market. Key competitors include established players and emerging startups offering similar AI-driven solutions. BigBear.ai's competitive advantages lie in its unique technology, strong relationships within the government sector, and its ability to integrate AI solutions across various industries. Its market share is growing, and the potential for market expansion is significant, especially with increasing demand for advanced AI solutions.

- Main competitors: (List major competitors with brief descriptions.)

- Competitive advantages: Unique technology, strong government relationships, diverse application across industries.

- Market share analysis: (Include relevant market share data, if available, with source citations.)

- Future market potential: Significant growth expected due to increasing adoption of AI across sectors.

Key Financial Metrics and Ratios

Evaluating BigBear.ai's financial health and valuation requires analyzing key financial metrics and ratios. This includes assessing its Price-to-Earnings ratio (P/E), debt-to-equity ratio, revenue growth, and profit margins. Comparing these figures to industry averages and competitors provides valuable context.

- Important financial ratios to track: P/E ratio, debt-to-equity ratio, revenue growth, profit margin.

- Current values: (Insert current values, obtained from reliable financial sources, with source citations.)

- Comparison to industry averages/competitors: (Compare BigBear.ai's metrics to industry benchmarks and competitors' metrics.)

Assessing the Risks and Rewards of Investing in BigBear.ai

Investing in BigBear.ai presents both significant rewards and potential risks. A thorough understanding of both is paramount.

Risks Associated with Investing in BigBear.ai

Investing in BigBear.ai, like any investment, carries risks. These include:

- Dependence on government contracts: A significant portion of BigBear.ai's revenue comes from government contracts. Changes in government spending or priorities could impact its financial performance.

- Competition: The AI market is highly competitive. New entrants and established players could erode BigBear.ai's market share.

- Technological disruption: Rapid advancements in AI technology could render BigBear.ai's existing solutions obsolete.

- Economic downturns: Economic slowdowns could reduce demand for BigBear.ai's services, especially in the commercial sector.

- Geopolitical factors: Global political instability can affect government spending on defense and intelligence, impacting BigBear.ai's revenue streams.

Potential Returns and Investment Strategies

Despite the risks, BigBear.ai's strong growth prospects and market position offer significant potential returns. Investors should consider their risk tolerance and choose an investment strategy accordingly.

- Possible scenarios for return on investment: (Outline potential scenarios based on different market conditions and BigBear.ai's performance.)

- Risk tolerance levels: Investors should assess their personal risk tolerance before investing.

- Suitable investment timelines: Long-term investors might be better positioned to weather short-term market fluctuations.

Practical Steps for Investing in BigBear.ai

Once you've assessed the risks and rewards, you can decide how to invest.

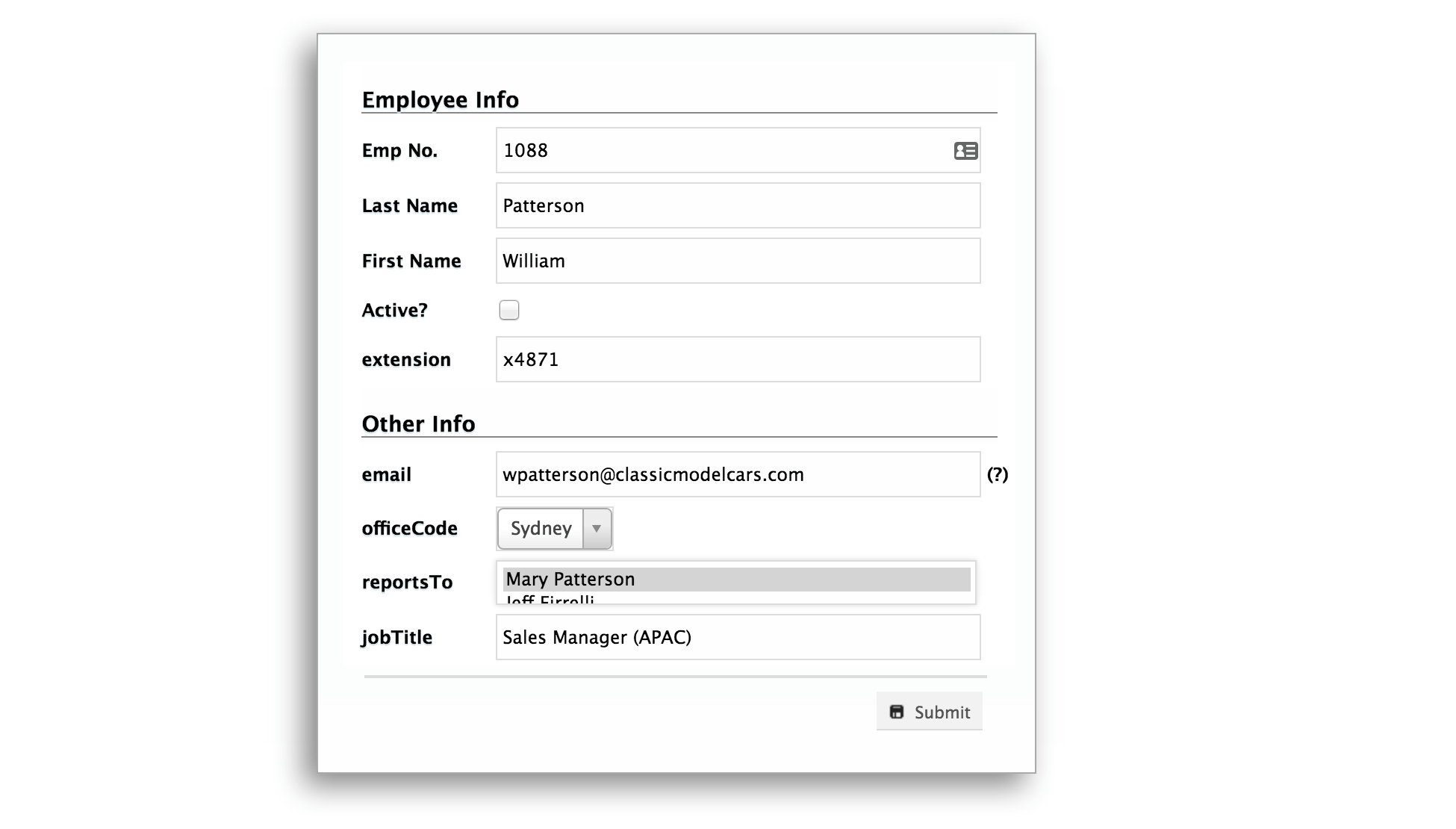

Choosing Your Investment Vehicle

Investing in BigBear.ai can be done through various means:

- Buying shares directly: This offers the potential for higher returns but also carries higher risk.

- Using ETFs or mutual funds: This provides diversification and lower risk but may limit potential returns.

(For each method, specify commission fees, minimum investment requirements, and associated benefits and drawbacks.)

Monitoring Your Investment

Regularly monitoring BigBear.ai's performance is crucial.

- Key metrics to track: Stock price, revenue growth, profit margins, key contracts won/lost, competitive landscape updates.

- Frequency of monitoring: Regular monitoring (e.g., monthly or quarterly) is recommended.

- Adjusting investment strategy based on market changes: Be prepared to adjust your strategy based on changes in the market, BigBear.ai’s performance, and your own financial goals.

Conclusion

Investing in BigBear.ai offers the potential for substantial returns but requires careful consideration of the associated risks. This guide highlights key factors affecting BigBear.ai's performance, enabling you to make informed decisions. Before investing in BigBear.ai or any other company, conduct thorough due diligence, understand your personal risk tolerance, and align your investment strategy with your financial goals. Remember that a well-informed approach is crucial when considering investing in BigBear.ai.

Featured Posts

-

Trans Australia Run Challenging The Existing Record

May 21, 2025

Trans Australia Run Challenging The Existing Record

May 21, 2025 -

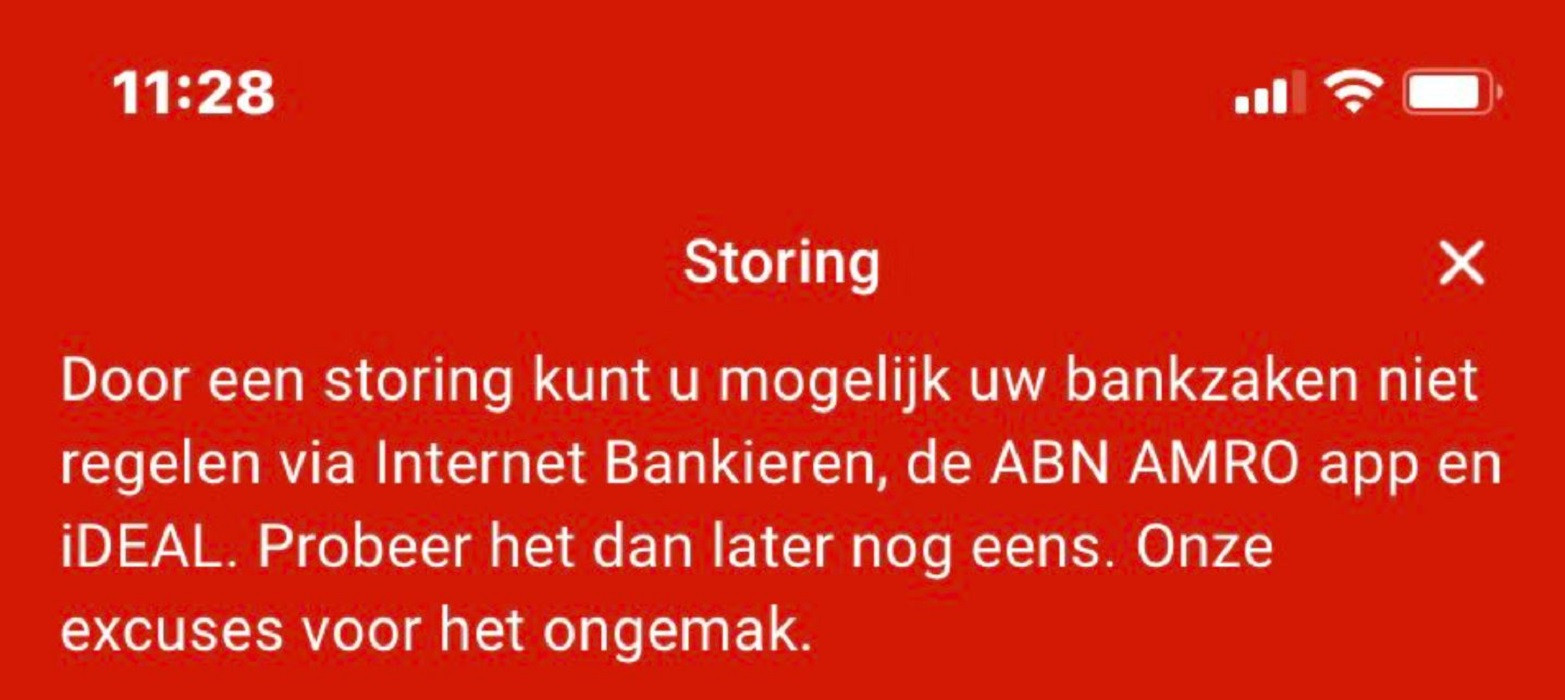

Problemen Met Online Betalingen Naar Abn Amro Opslag

May 21, 2025

Problemen Met Online Betalingen Naar Abn Amro Opslag

May 21, 2025 -

Building Bridges The Sound Perimeter Effect Of Shared Musical Experiences

May 21, 2025

Building Bridges The Sound Perimeter Effect Of Shared Musical Experiences

May 21, 2025 -

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 21, 2025

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 21, 2025 -

New Record Man Runs Fastest Across Australia On Foot

May 21, 2025

New Record Man Runs Fastest Across Australia On Foot

May 21, 2025