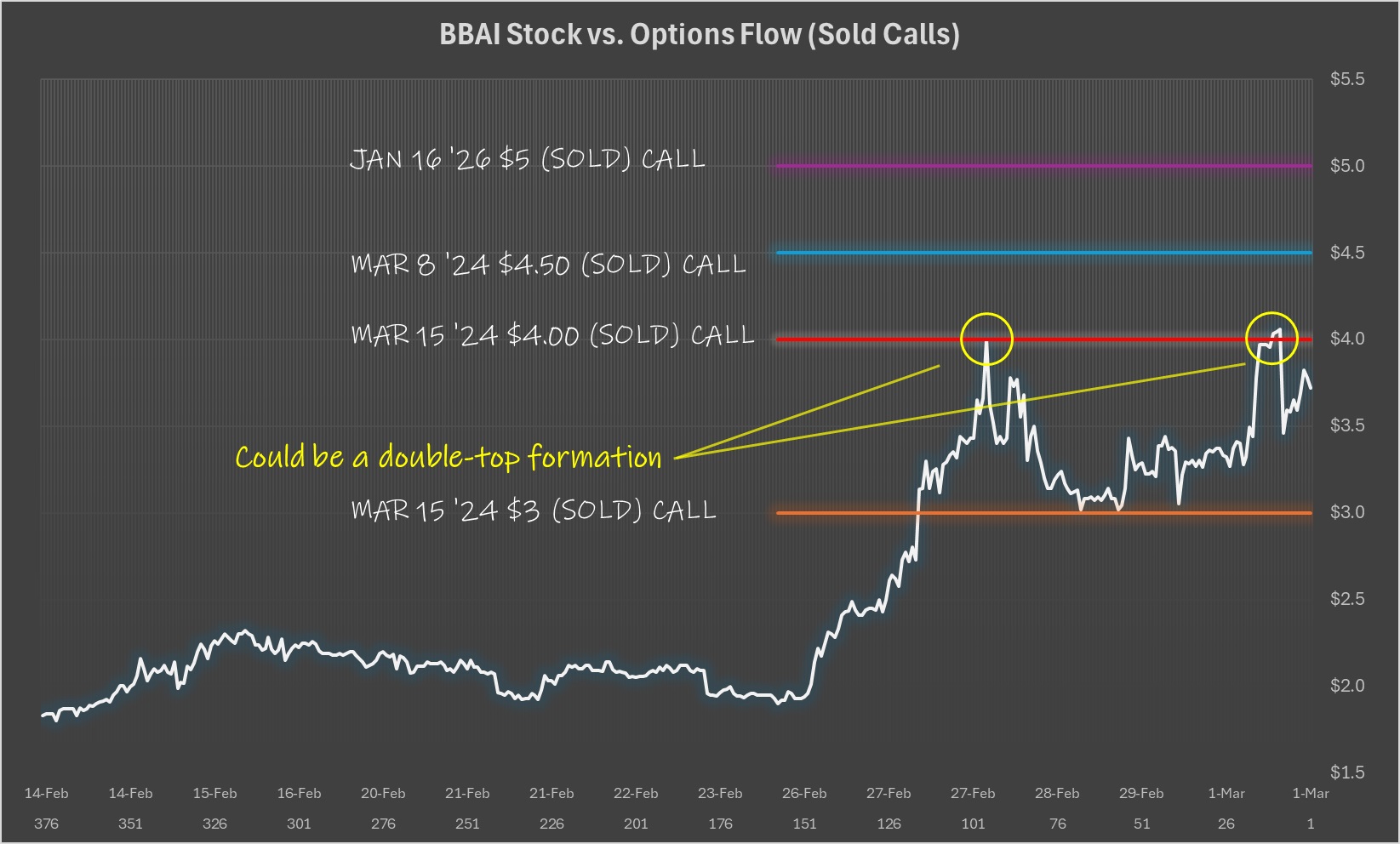

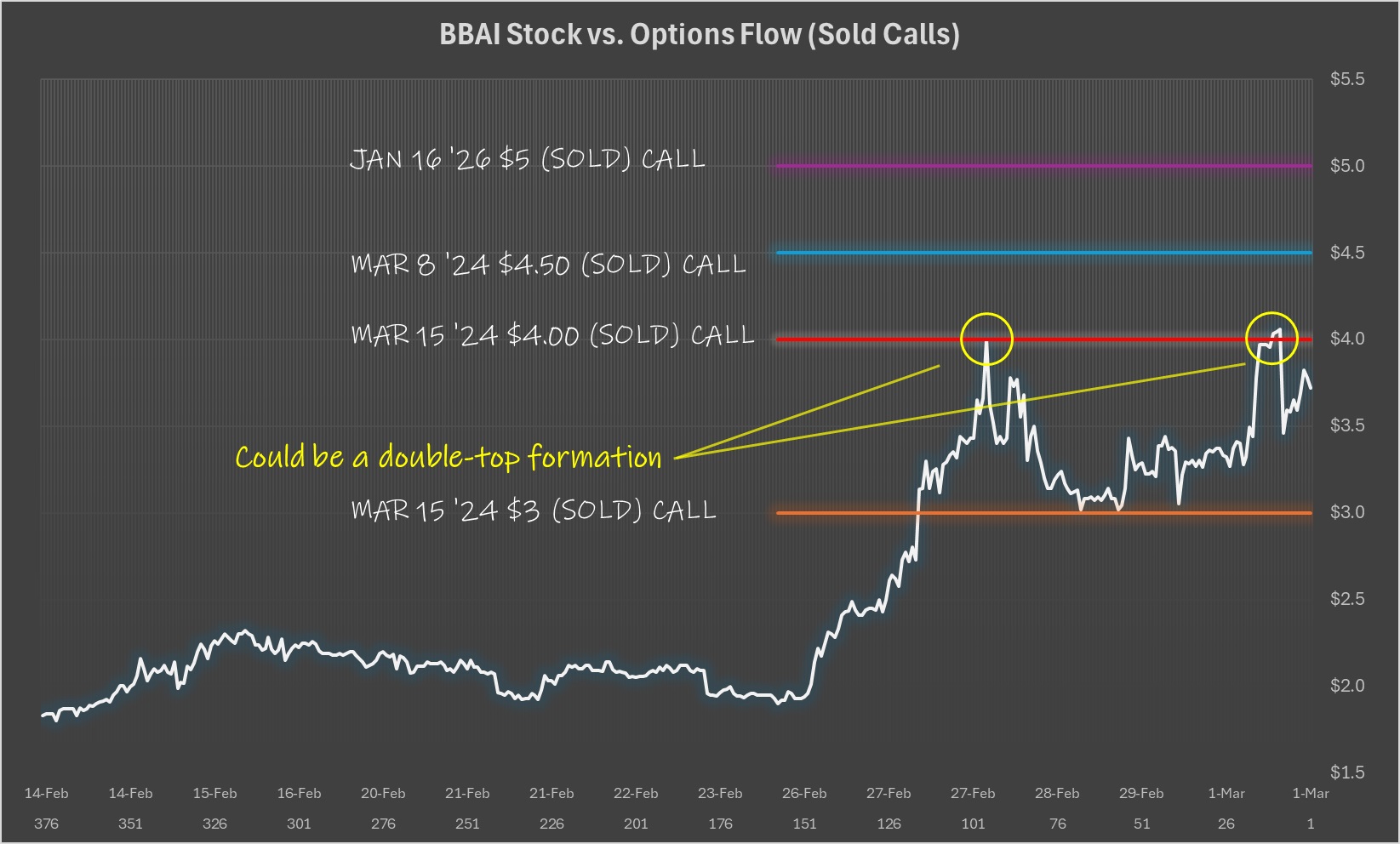

Investing In BigBear.ai (BBAI): A Penny Stock AI Opportunity?

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai (BBAI) offers a range of AI-powered solutions targeting both government and commercial clients. Its business model revolves around providing advanced analytics, data solutions, and cybersecurity services leveraging cutting-edge artificial intelligence technologies. These services are crucial in today's data-driven world, making BBAI a player in a rapidly expanding market.

-

Key Contracts and Partnerships: BBAI has secured several significant contracts with government agencies, focusing on national security and intelligence applications. These contracts provide a stable revenue stream, but also create dependence on government spending. Furthermore, strategic partnerships with technology providers enhance its service offerings and market reach.

-

Competitive Advantages: BBAI's competitive edge lies in its advanced AI algorithms and its ability to integrate diverse data sources for comprehensive analysis. Its specialized expertise in high-stakes environments, like national security, gives it a unique position in the market.

-

Target Market Segments: BBAI's primary target market includes government agencies requiring sophisticated data analysis and cybersecurity solutions, as well as commercial clients in sectors like finance and healthcare needing advanced data analytics capabilities.

-

Recent Acquisitions and Strategic Moves: Monitoring BBAI's acquisition history and strategic partnerships is crucial to understanding its growth strategy and potential for future expansion in the AI market. These actions often indicate a company's ambitions and direction.

Analyzing BBAI's Financial Performance and Growth Prospects

Analyzing BBAI's financial performance requires a careful review of its recent financial statements. Investors should examine key metrics such as revenue growth, profitability (or losses), and debt levels to assess the company's financial health and future potential. Remember that penny stocks are often volatile, so past performance is not necessarily indicative of future results.

-

Key Financial Ratios: While the P/E ratio might not be immediately applicable for a company that's not yet consistently profitable, examining other relevant ratios, such as revenue growth rate and debt-to-equity ratio, is critical. These indicators provide insights into the company's financial stability and growth trajectory.

-

Changes in Financial Performance: Investors need to track BBAI's financial performance over time to identify trends and patterns. Significant shifts in revenue, profitability, or debt levels can signal important changes in the company's operational efficiency and overall financial health.

-

Cash Flow Situation: A strong and positive cash flow is essential for a company's sustainability. Analyzing BBAI's cash flow statements can reveal its ability to generate cash from operations and fund its growth initiatives.

-

Analyst Ratings and Predictions: While analyst opinions should not be the sole basis for investment decisions, it's beneficial to review any available analyst ratings and predictions for BBAI to gain additional perspectives on the company's future prospects.

Assessing the Risks of Investing in BBAI (a Penny Stock)

Investing in BBAI, a penny stock, carries significant risks. Penny stocks are often highly volatile, meaning their prices can fluctuate dramatically in short periods. This volatility stems from factors like market sentiment, news events, and overall market conditions. Low liquidity, meaning it may be difficult to buy or sell shares quickly without significantly impacting the price, further increases the risk.

-

Market Sentiment Impact: BBAI's stock price can be heavily influenced by overall market sentiment and news related to the AI sector. Negative news or broader market downturns can lead to sharp declines in its share price.

-

Government Contract Dependence: BBAI's reliance on government contracts could expose it to the risk of reduced funding or contract cancellations, impacting revenue and profitability.

-

Competition in the AI Industry: The AI industry is fiercely competitive, with established tech giants and numerous startups vying for market share. BBAI faces significant competition, which can affect its growth prospects and profitability.

-

Due Diligence: Thorough due diligence is paramount before investing in any penny stock, including BBAI. This involves carefully analyzing the company's financial statements, business model, competitive landscape, and overall risks.

Comparing BBAI to Other AI Penny Stocks

To gain a better perspective on BBAI's investment potential, it's helpful to compare its performance and prospects to those of other AI-focused penny stocks. This comparative analysis provides context and helps investors assess BBAI's relative attractiveness within the broader AI penny stock market.

-

Comparable Companies: Several other companies operate in the AI sector with similar market capitalization and business models. Identifying these companies allows for a comprehensive analysis of BBAI's standing.

-

Differences in Business Models and Financial Performance: Analyzing the differences in business models, revenue streams, and financial performance among these comparable companies allows for a better understanding of BBAI's unique strengths and weaknesses.

-

Comparative Analysis: A detailed comparison of key financial metrics, growth prospects, and risk profiles across these AI penny stocks can inform investment decisions and help determine whether BBAI presents a compelling investment opportunity relative to its peers.

Conclusion

Investing in BigBear.ai (BBAI) presents a potential opportunity for high returns within the exciting but volatile AI sector. However, the inherent risks associated with penny stocks, including high volatility, low liquidity, and the potential for significant losses, cannot be ignored. BBAI's financial performance, dependence on government contracts, and the competitive nature of the AI market all contribute to the investment risks. A comprehensive understanding of the company's business model, thorough financial analysis, and a careful comparison to other AI penny stocks are crucial before considering an investment.

Call to Action: Investing in BigBear.ai (BBAI) or any other penny stock AI opportunity requires diligent research and a prudent assessment of risk. Conduct your own thorough due diligence, consult with a qualified financial advisor, and carefully consider your personal risk tolerance before making any investment decisions. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Jasmine Paolini Historic Victory In Rome

May 20, 2025

Jasmine Paolini Historic Victory In Rome

May 20, 2025 -

Nyt Mini Crossword March 13 2025 Complete Answers And Solutions

May 20, 2025

Nyt Mini Crossword March 13 2025 Complete Answers And Solutions

May 20, 2025 -

Mangas Disaster Claim Prompts Tourist Trip Cancellations

May 20, 2025

Mangas Disaster Claim Prompts Tourist Trip Cancellations

May 20, 2025 -

Big Bear Ai Stock Potential Risks And Rewards

May 20, 2025

Big Bear Ai Stock Potential Risks And Rewards

May 20, 2025 -

82 Ai

May 20, 2025

82 Ai

May 20, 2025