Investing In Elon Musk's Private Ventures: A Lucrative Side Hustle?

Table of Contents

The Allure and Risks of Investing in Musk's Private Ventures

The allure of investing in Elon Musk's private ventures is undeniable. His track record speaks for itself, with companies like SpaceX and Tesla revolutionizing space travel and the automotive industry, respectively. This success creates the potential for exponential growth and massive returns for early investors. However, the high potential for reward comes hand-in-hand with significant risk.

High Potential Returns vs. High Risk

- High-Reward, High-Risk Examples: Investing in private companies like SpaceX, Neuralink, or The Boring Company presents the opportunity for substantial financial gains if these ventures achieve their ambitious goals. The potential for a massive return on investment (ROI) is a key draw.

- Significant Capital Loss: Conversely, the inherent risk in private investments is considerable. These companies are not publicly traded, meaning there's limited liquidity. If the venture fails, investors could lose a significant portion or all of their investment.

- Lack of Liquidity: Unlike publicly traded stocks, you can't easily sell your stake in a private company. Finding a buyer may be difficult, and the price you receive could be significantly lower than your initial investment.

Understanding Due Diligence in Private Investments

Due diligence is paramount when considering investing in Elon Musk's private ventures or any private company. Unlike publicly traded companies with readily available financial reports, accessing detailed information about private ventures can be challenging.

- Financial Transparency: Obtaining comprehensive financial statements, including revenue, expenses, and profitability, might be difficult or impossible.

- Management Team Assessment: Thoroughly research the experience and expertise of the management team. While Musk's reputation adds credibility, understanding the specific team leading each venture is vital.

- Competitive Landscape: Analyze the competitive environment. What are the company's competitive advantages? Are there significant barriers to entry or strong competitors?

- Regulatory Hurdles: Consider potential regulatory hurdles and compliance risks that could affect the company's growth and profitability.

Accessing Investment Opportunities in Musk's Private Companies

Gaining access to investment opportunities in Musk's private companies is not straightforward. Significant barriers exist, primarily due to the high-risk nature of these ventures and the need to protect accredited investors.

Limited Access and Accreditation Requirements

- Accreditation Requirements: Generally, only accredited investors, those with a high net worth (typically over $1 million excluding primary residence) or high income, can participate in these investments. This significantly restricts access for the average investor.

- Investment Minimums: Investments typically involve substantial minimums, often ranging from tens of thousands to millions of dollars. This further limits participation.

- Investor Networks: Access might be possible through accredited investor networks or funds specializing in early-stage investments in high-growth companies.

Alternative Investment Strategies

If direct investment isn't feasible, alternative strategies exist for those interested in the broader technological themes related to Musk's ventures.

- Investing in Tesla (TSLA): Investing in Tesla, a publicly traded company, provides exposure to Musk's influence and the electric vehicle and clean energy sectors.

- Space Exploration and AI ETFs: Explore exchange-traded funds (ETFs) focused on space exploration, artificial intelligence, or other technologies aligned with Musk's interests.

- Venture Capital Funds: Consider investing in venture capital funds with portfolios that include companies operating in similar technological spaces.

Building a Diversified Investment Portfolio

Investing in Elon Musk's private ventures should be a considered component of a much larger, well-diversified investment portfolio. Concentrating investments in a single, high-risk venture is financially unwise.

The Importance of Diversification

- Risk Mitigation: Diversification across different asset classes (stocks, bonds, real estate, etc.) is essential to mitigate risk. High-risk investments like those in private companies should represent only a small portion of your total portfolio.

- Reduced Volatility: A diversified portfolio reduces the impact of losses in any single investment.

- Long-Term Growth: Diversification promotes long-term growth by balancing potential gains with risk management.

Considering Your Financial Goals and Risk Tolerance

Before considering any investment, especially high-risk ventures, carefully assess your financial situation and risk tolerance.

- Financial Goals: Define your short-term and long-term financial goals. Are you investing for retirement, a down payment, or other specific purposes?

- Risk Tolerance: Honestly evaluate your comfort level with risk. Are you willing to accept potential significant losses in pursuit of potentially high returns? Investing in Musk's private ventures is not suitable for risk-averse investors.

- Professional Advice: Seek advice from a qualified financial advisor who can help you assess your risk tolerance and build a suitable investment portfolio.

Conclusion

While the allure of investing in Elon Musk's private ventures is undeniable, the high potential for returns comes with equally significant risks. Limited access, stringent accreditation requirements, and the inherent volatility of private investments necessitate careful consideration. Thorough due diligence, a well-diversified portfolio, and professional financial advice are crucial for navigating the complexities of this exciting but risky investment landscape. Before making any investment decisions in Elon Musk's private ventures or similar high-growth opportunities, remember to carefully weigh the risks and rewards.

Featured Posts

-

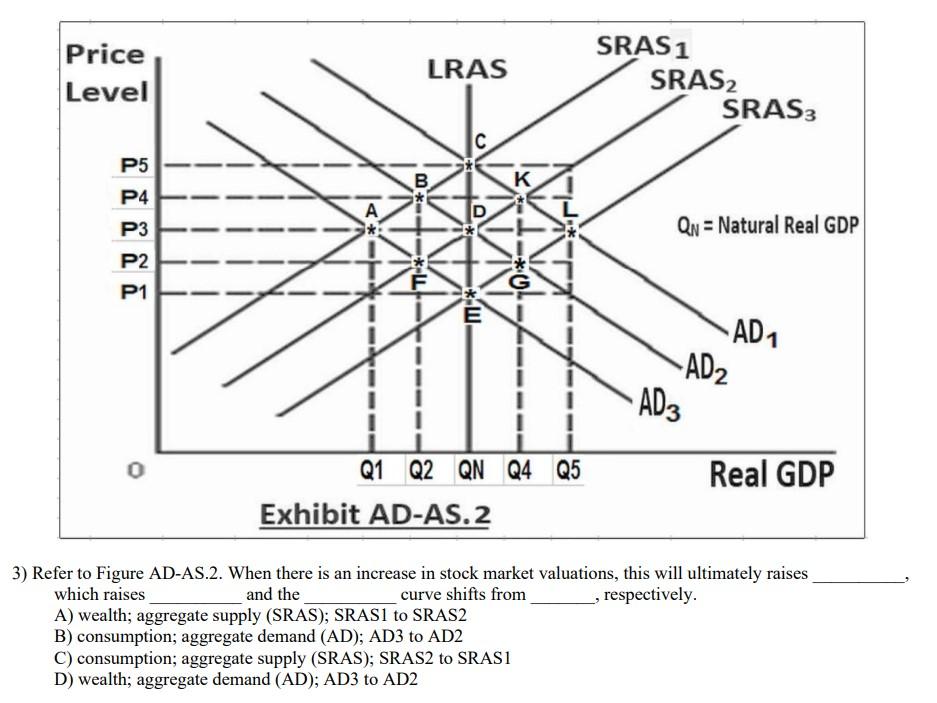

Understanding High Stock Market Valuations Bof As Take

Apr 26, 2025

Understanding High Stock Market Valuations Bof As Take

Apr 26, 2025 -

Nintendos Action Ryujinx Emulator Development Ceases

Apr 26, 2025

Nintendos Action Ryujinx Emulator Development Ceases

Apr 26, 2025 -

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025 -

Securing A Switch 2 Preorder My Game Stop Queuing Story

Apr 26, 2025

Securing A Switch 2 Preorder My Game Stop Queuing Story

Apr 26, 2025 -

Ahmed Hassaneins Improbable Journey On The Cusp Of Nfl History

Apr 26, 2025

Ahmed Hassaneins Improbable Journey On The Cusp Of Nfl History

Apr 26, 2025