Investing In Palantir After A 30% Market Correction

Table of Contents

Analyzing Palantir's Recent Performance and the Market Correction

Understanding the Market Correction

The 30% decline in Palantir's stock price wasn't an isolated event. Several factors contributed to this downturn, reflecting broader market trends and impacting the PLTR stock price.

- Overall Market Sentiment: The broader tech sector experienced a significant sell-off driven by concerns about inflation, rising interest rates, and a potential recession. This negative sentiment heavily impacted growth stocks like Palantir.

- Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes increased borrowing costs, making investments in growth companies like Palantir less attractive to investors seeking higher returns in a lower-risk environment.

- Tech Stock Sell-Off: The technology sector, particularly software companies, faced a widespread correction due to investor concerns about valuations and future growth prospects. This general downturn negatively impacted Palantir's stock price.

- Specific Market Events: Negative news cycles, such as concerns about specific contracts or geopolitical instability, can also contribute to significant stock price fluctuations.

Palantir's Financial Performance

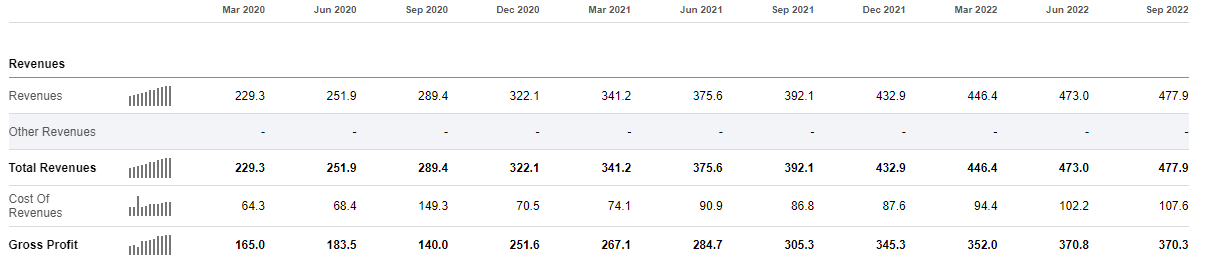

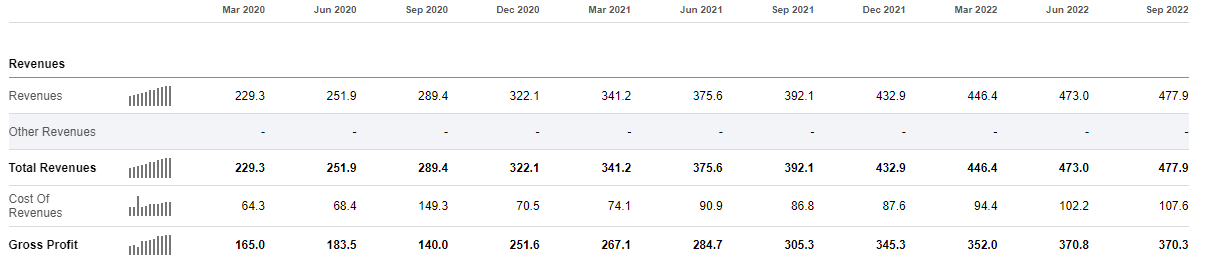

Examining Palantir's recent financial reports provides crucial context for evaluating the current situation. While revenue growth has been impressive, profitability remains a key area of focus for investors.

- Revenue Growth: Palantir has consistently demonstrated strong revenue growth, fueled by its increasing government and commercial contracts. Analyzing the quarterly reports will reveal the trajectory of this growth.

- Earnings: While Palantir hasn't yet achieved consistent profitability, examining the trend in earnings per share (EPS) is vital for understanding the company's progress towards profitability.

- Growth Projections: Analysts' future growth projections for Palantir should be considered, acknowledging that these are estimates and subject to change based on market conditions and company performance.

- Analyst Ratings: Tracking the consensus among financial analysts regarding Palantir's stock provides an additional layer of perspective, though it’s important to remember that analyst opinions vary.

Assessing the Long-Term Growth Potential

Despite the recent correction, Palantir's long-term growth prospects remain significant, particularly given its expertise in data analytics and artificial intelligence.

- Government Contracts: Palantir's substantial government contracts provide a stable revenue stream and demonstrate the value of its technology in critical sectors. Analyzing the pipeline of future contracts provides insight into long-term revenue projections.

- Commercial Partnerships: The expansion of Palantir's commercial partnerships demonstrates the applicability of its technology across various industries, driving future revenue streams.

- Technological Advancements: Palantir's continuous investment in research and development positions it favorably to maintain its competitive edge in the evolving data analytics landscape.

- Competitive Landscape: Assessing Palantir's position relative to competitors like Databricks and AWS is crucial. Analyzing market share and innovative capabilities is essential to evaluate its long-term viability.

Evaluating the Risk and Reward of Investing in Palantir

Assessing the Risks

Investing in Palantir, like any growth stock, involves significant risks.

- High Volatility: Palantir's stock price is known for its volatility, making it susceptible to rapid price swings and potentially large losses in the short term.

- Competition: The data analytics market is intensely competitive, with established players and emerging startups vying for market share. This competition impacts Palantir's ability to maintain its leading position.

- Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's financial performance.

- Profitability Concerns: While Palantir is growing its revenue, achieving consistent profitability remains a significant hurdle. Investors need to assess the company’s path towards sustained profitability.

Weighing the Potential Rewards

Despite the inherent risks, Palantir's potential rewards are considerable.

- High Growth Potential: Palantir operates in a rapidly growing market with significant demand for its data analytics and AI capabilities. This high-growth potential offers substantial returns over the long term.

- Disruptive Technologies: Palantir’s technology offers innovative solutions to complex data challenges, giving it a competitive edge in the market. The potential for future breakthroughs adds further investment appeal.

- First-Mover Advantage: Palantir's early entry into the data analytics market has provided it with valuable experience and a strong customer base. This early mover advantage can provide a sustained competitive advantage.

- Market Share Gains: Palantir’s expansion into new markets and its technological advancements suggest a potential for further market share gains, leading to significant growth.

Comparing Palantir to Competitors

A comparative analysis of Palantir with its key competitors is essential for a complete assessment.

- Key Competitors: Direct and indirect competitors include established companies like Microsoft (Azure), Amazon (AWS), and Google (Cloud), as well as other specialized data analytics firms.

- Comparative Analysis: Comparing revenue growth, profitability, market share, and technological innovation across these competitors provides a broader context for evaluating Palantir's prospects.

Strategies for Investing in Palantir After the Correction

Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps mitigate the risk associated with buying a volatile stock at a high price.

Diversification

Diversifying your investment portfolio across various asset classes and sectors reduces your overall risk. Don’t put all your eggs in one basket.

Long-Term Investment Horizon

Given Palantir's growth potential, a long-term investment strategy is recommended. This approach allows for weathering short-term market fluctuations and benefiting from the company’s long-term growth.

Conclusion: Should You Invest in Palantir Now?

Investing in Palantir after its recent market correction presents both significant risks and potential rewards. The company operates in a high-growth sector with innovative technologies, but faces intense competition and volatility. A thorough due diligence process, including assessing your personal risk tolerance and understanding the company's financials, is crucial. Dollar-cost averaging and diversification are essential risk-management strategies. Consider a long-term investment horizon to benefit from Palantir's growth potential. Before making any Palantir stock investment, remember to consult a qualified financial advisor to determine if this aligns with your individual investment goals and risk tolerance. Further research into the Palantir investment landscape, considering the impact of data analytics market trends and government contracts, is strongly advised.

Featured Posts

-

Dakota Johnson Apuesta Por Hereu La Marca Catalana Que Conquista A Las Celebrities

May 10, 2025

Dakota Johnson Apuesta Por Hereu La Marca Catalana Que Conquista A Las Celebrities

May 10, 2025 -

Trumps Executive Orders Experiences Of Transgender People

May 10, 2025

Trumps Executive Orders Experiences Of Transgender People

May 10, 2025 -

The Jeffrey Epstein Client List Pam Bondis Role And Allegations

May 10, 2025

The Jeffrey Epstein Client List Pam Bondis Role And Allegations

May 10, 2025 -

Analysis How Dangotes Refinery Affects Nnpc Fuel Costs

May 10, 2025

Analysis How Dangotes Refinery Affects Nnpc Fuel Costs

May 10, 2025 -

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya Trampa I Putina

May 10, 2025

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya Trampa I Putina

May 10, 2025