Investing In Palantir Before May 5th: A Risk Assessment

Table of Contents

Palantir's Current Market Position and Recent Performance

Palantir Technologies (PLTR) operates in the big data analytics and software space, serving both government and commercial clients. Analyzing its recent performance is critical before making any investment decisions. Let's look at some key factors:

-

Stock Price Trend Analysis (leading up to May 5th): Tracking PLTR's stock price leading up to May 5th requires monitoring daily fluctuations and identifying potential trends. Factors like news announcements, earnings reports, and overall market sentiment heavily influence the price. A comprehensive analysis would involve reviewing technical indicators and historical price movements. Remember past performance is not indicative of future results.

-

Key Performance Indicators (KPIs): Examining KPIs such as revenue growth, profitability (or lack thereof), and customer acquisition costs provides insights into Palantir's financial health. Analyzing the growth rate of its government contracts versus its commercial sector is crucial to understanding the stability and future potential of the company.

-

Competitive Landscape Analysis: Palantir faces competition from established players like Microsoft, AWS, and Google Cloud. Analyzing Palantir’s market share and competitive advantages, such as its specialized data analytics platforms and strong government relationships, is essential. Understanding its unique selling propositions and how it differentiates itself is crucial for evaluating its long-term viability.

Understanding the Risks Associated with Palantir Investments

Investing in Palantir, like any technology stock, carries inherent risks. Before investing in PLTR before May 5th, carefully assess the following:

-

Volatility Risk Assessment: The technology sector is known for its volatility. Palantir's stock price can experience significant swings based on market sentiment, news events, and earnings reports. Analyzing historical volatility and projecting potential future fluctuations is crucial.

-

Government Contract Risk: A significant portion of Palantir's revenue comes from government contracts. The renewal of these contracts, potential budget cuts, and changes in government priorities pose significant risks. Dependence on a single revenue stream (or a few large clients) creates vulnerability.

-

Financial Risk Assessment: Evaluating Palantir's financial health involves assessing its debt-to-equity ratio, profitability margins, and cash flow. A high debt level or consistent unprofitability represents a considerable financial risk. Understanding its burn rate and runway is also critical.

-

Dilution Risk: Future share offerings to raise capital could dilute existing shareholders' ownership and potentially depress the stock price. Reviewing Palantir's capital structure and potential for future dilution is essential.

Analyzing Potential Catalysts for Palantir Stock Before May 5th

Several potential catalysts could significantly influence Palantir's stock price before May 5th:

-

Upcoming Events and Announcements: Keep an eye out for earnings reports, product launches, new partnerships, or any significant announcements that might impact investor sentiment. Positive news can drive the stock price up, while negative news can cause it to fall.

-

Increased Adoption of Palantir's Solutions: The expansion of Palantir's software solutions into new sectors or increased adoption within existing sectors could positively impact the stock price. Monitoring market penetration and customer adoption rates is key.

-

Macroeconomic Factors: Factors like interest rate hikes, inflation, and overall economic growth can influence investor sentiment and market valuations. A downturn in the broader economy could negatively impact Palantir’s stock price, regardless of its internal performance.

Alternative Investment Strategies

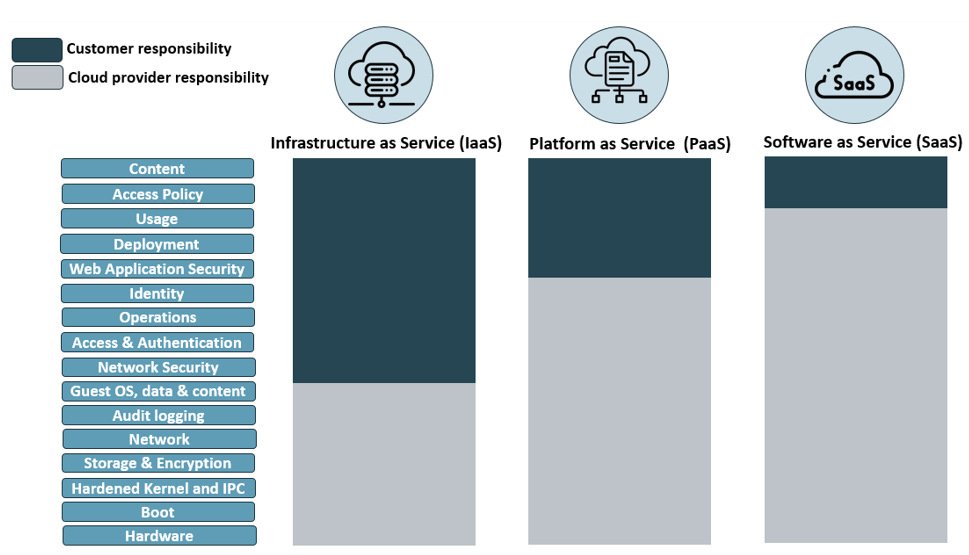

Diversification is key in any investment portfolio. Consider exploring alternative investments within the technology sector (other SaaS companies, cloud computing stocks) or other asset classes like real estate or bonds to mitigate risk. A balanced portfolio helps reduce overall investment volatility.

Conclusion

This risk assessment highlighted the potential upsides and downsides of investing in Palantir before May 5th. While Palantir offers exciting growth potential in the burgeoning big data analytics market, significant risks are associated with its investment. Careful consideration of its market position, financial health, and the potential catalysts affecting its stock price before May 5th is crucial. Before making any investment decisions regarding Palantir, conduct your own thorough due diligence and seek advice from a qualified financial advisor. Remember, this analysis is for informational purposes only and doesn't constitute financial advice. Make informed decisions about your Palantir investment strategy.

Featured Posts

-

Aoc Condemns Trump On Fox News A Critical Analysis

May 10, 2025

Aoc Condemns Trump On Fox News A Critical Analysis

May 10, 2025 -

Singer Wynne Evanss Bbc Meeting Delayed Spends Day With Girlfriend

May 10, 2025

Singer Wynne Evanss Bbc Meeting Delayed Spends Day With Girlfriend

May 10, 2025 -

Solve Nyt Strands Game 357 February 23rd Complete Hints And Answers

May 10, 2025

Solve Nyt Strands Game 357 February 23rd Complete Hints And Answers

May 10, 2025 -

Finding The Real Safe Bet A Practical Approach To Secure Investments

May 10, 2025

Finding The Real Safe Bet A Practical Approach To Secure Investments

May 10, 2025 -

Europes Nuclear Shield A French Ministers Proposal For Shared Responsibility

May 10, 2025

Europes Nuclear Shield A French Ministers Proposal For Shared Responsibility

May 10, 2025