Investing In Quantum Computing Stocks In 2025: A Look At Rigetti (RGTI) And IonQ

Table of Contents

Understanding the Quantum Computing Investment Landscape in 2025

The quantum computing market is poised for explosive growth. Market research firms predict a substantial expansion in the coming years. For example, [Insert reputable source and statistic on market size projection for 2025]. This projected growth fuels the excitement surrounding investing in quantum computing stocks, but it's crucial to understand the inherent risks.

Market Size and Growth Projections

- Exponential Growth: Industry analysts foresee a rapid increase in market size, driven by increasing adoption across various sectors. [Cite another source and statistic].

- Technological Advancements: Continuous breakthroughs in qubit technology are accelerating the development of more powerful and stable quantum computers, further fueling market growth.

- Government Funding & Initiatives: Significant government investment in quantum computing research and development globally is bolstering the sector's progress.

Investment Risks and Rewards

Investing in this nascent technology is inherently high-risk, high-reward.

- Technological Hurdles: Significant technological challenges remain in building scalable and fault-tolerant quantum computers. Setbacks in development could negatively impact stock prices.

- Intense Competition: The quantum computing industry is highly competitive, with numerous companies vying for market share. This competition could pressure profitability.

- Regulatory Uncertainty: The evolving regulatory landscape surrounding quantum computing could impact the growth and profitability of companies in the sector.

- Potential for Exponential Returns: Despite the risks, the potential rewards are enormous. Successful quantum computing companies could generate substantial returns for early investors.

Types of Quantum Computing Investments

While publicly traded stocks like RGTI and IonQ offer a relatively accessible entry point, other investment avenues exist:

- Publicly Traded Stocks: Investing directly in the equity of publicly listed quantum computing companies.

- Private Equity & Venture Capital: Investing in privately held companies through specialized funds, offering higher risk and potential return.

Deep Dive into Rigetti Computing (RGTI)

Rigetti Computing is a leading quantum computing company focused on building and deploying fully-integrated quantum computers based on superconducting qubits.

Company Overview

- Business Model: Rigetti offers both cloud access to its quantum computers and develops quantum-specific algorithms for various applications.

- Technology: Their focus on superconducting qubits is a prominent approach in the industry.

- Target Markets: They target researchers, enterprises, and government agencies seeking access to quantum computing capabilities.

Financial Performance and Key Metrics

Analyzing RGTI's financial reports (available through SEC filings), investors should pay close attention to:

- Revenue Growth: Tracking the company's revenue generation from cloud services and partnerships.

- Research & Development Spending: A significant portion of their expenses will be directed towards R&D; consistent investment indicates commitment to progress.

- Qubit Performance Metrics: Evaluating the performance of their qubits (coherence times, gate fidelities) is essential for assessing technological advancement.

Future Outlook and Potential Catalysts

Several factors could significantly influence RGTI's future:

- Strategic Partnerships: Collaborations with major technology companies or research institutions could boost their market presence and revenue streams.

- Technological Breakthroughs: Improvements in qubit performance and scalability will be critical for future growth.

- Successful Product Launches: The successful launch of new quantum computing systems or software could drive stock prices upward.

In-Depth Analysis of IonQ

IonQ is another significant player in the quantum computing space, employing a different qubit technology: trapped ions.

Company Overview

- Business Model: Similar to Rigetti, IonQ offers cloud access to its quantum computers and collaborates on application development.

- Technology: Trapped ion qubits represent a different technological approach with its own advantages and disadvantages compared to superconducting qubits.

- Target Markets: They also target researchers, enterprises, and government agencies.

Financial Performance and Key Metrics

Investors should analyze IonQ's financials, paying attention to metrics similar to those discussed for RGTI:

- Revenue Growth: Assessing the growth in revenue from cloud services and partnerships.

- Research & Development Spending: Monitoring the investment in R&D to gauge their commitment to advancement.

- Qubit Performance Metrics: Evaluating the key performance indicators of their trapped ion qubits.

Future Outlook and Potential Catalysts

Key factors impacting IonQ's future prospects include:

- Strategic Partnerships: Collaborations that could expand market reach and accelerate technology adoption.

- Technological Breakthroughs: Improvements in qubit performance and scalability remain critical.

- Successful Product Launches: Announcing and delivering new quantum systems and software could drive stock prices.

Comparative Analysis: RGTI vs. IonQ

Comparing Rigetti and IonQ helps investors make informed decisions.

Technology Comparison

- Rigetti (Superconducting Qubits): High qubit counts potential, but faces challenges in scalability and error correction.

- IonQ (Trapped Ions): Known for higher qubit coherence times (longer stability), but potentially lower qubit counts in the near term.

Business Model Comparison

Both companies pursue similar business models, but their strategic focus might differ slightly in terms of partnerships and target market segments.

Investment Considerations

| Metric | Rigetti (RGTI) | IonQ |

|---|---|---|

| Technology | Superconducting | Trapped Ions |

| Market Cap | [Insert Data] | [Insert Data] |

| Revenue | [Insert Data] | [Insert Data] |

| Risk/Reward | High/High | High/High |

Conclusion: Making Informed Decisions on Quantum Computing Stocks in 2025

Investing in quantum computing stocks like Rigetti (RGTI) and IonQ offers immense potential but involves significant risk. This analysis highlights the key factors to consider when evaluating these companies. Remember to conduct thorough due diligence, diversifying your portfolio to mitigate risk. Continue your research on investing in quantum computing stocks in 2025 and beyond, considering the unique characteristics of both Rigetti and IonQ, and exploring other emerging players in this transformative field. The quantum revolution is underway, and smart investment decisions today could yield substantial rewards tomorrow.

Featured Posts

-

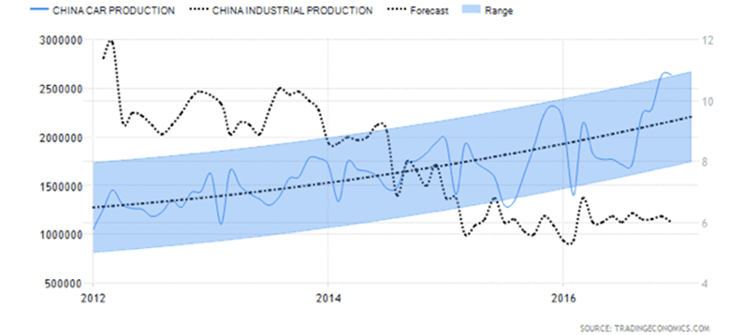

Navigating The Complexities Of The Chinese Automotive Market Case Studies Of Bmw And Porsche

May 21, 2025

Navigating The Complexities Of The Chinese Automotive Market Case Studies Of Bmw And Porsche

May 21, 2025 -

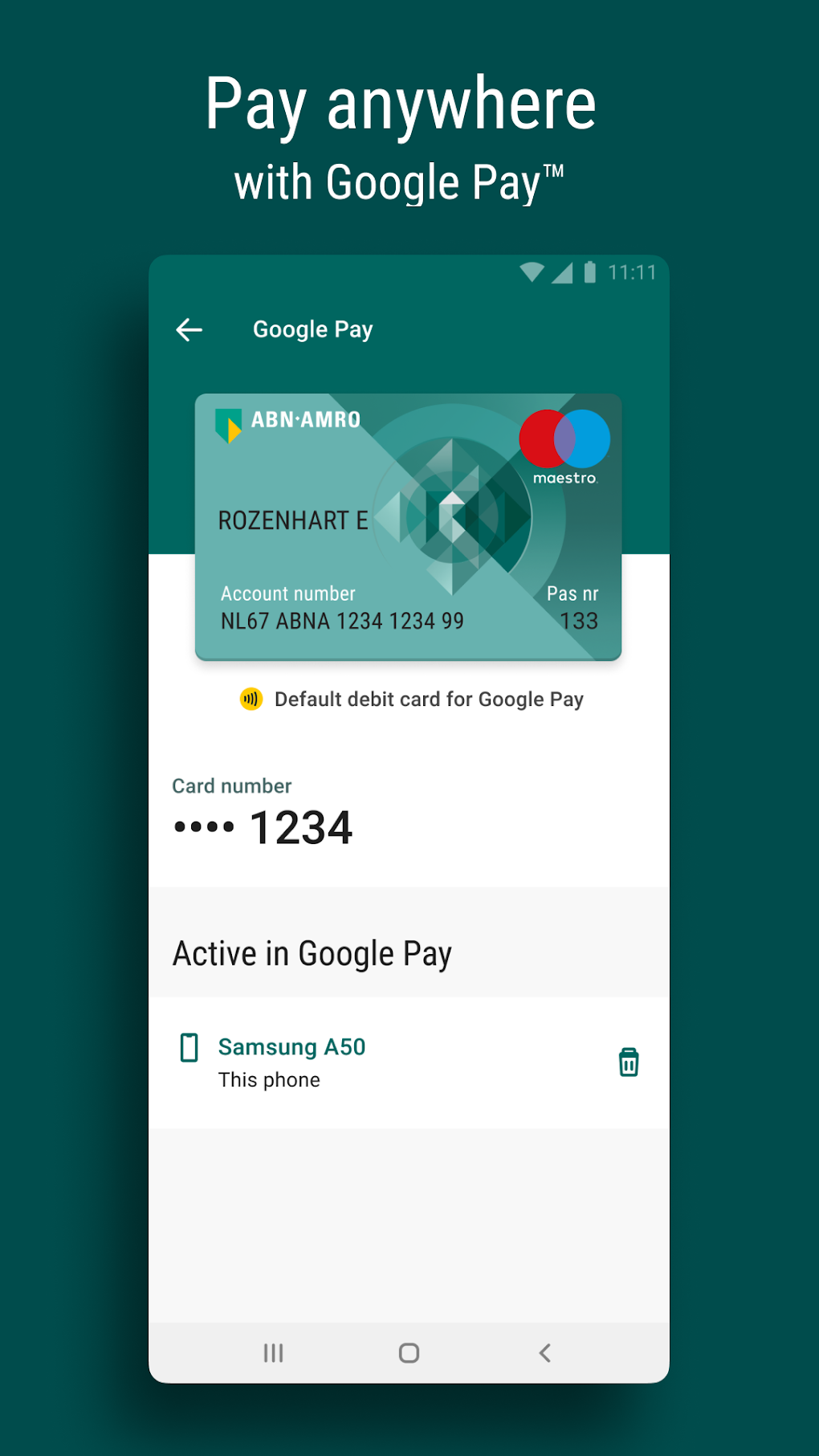

Storing Bij Abn Amro Online Betalen Onmogelijk Oplossingen And Alternatieven

May 21, 2025

Storing Bij Abn Amro Online Betalen Onmogelijk Oplossingen And Alternatieven

May 21, 2025 -

Abn Amro Kamerbrief Certificaten Verkoopstrategieen En Programmas

May 21, 2025

Abn Amro Kamerbrief Certificaten Verkoopstrategieen En Programmas

May 21, 2025 -

Preparing For Drier Weather A Practical Guide

May 21, 2025

Preparing For Drier Weather A Practical Guide

May 21, 2025 -

Will Tariffs Reverse The Buy Canadian Trend In Beauty

May 21, 2025

Will Tariffs Reverse The Buy Canadian Trend In Beauty

May 21, 2025