Investing In Quantum Computing Stocks: Rigetti (RGTI) And Beyond In 2025

Table of Contents

Understanding the Quantum Computing Market in 2025

Market Size and Growth Projections

The quantum computing market is experiencing explosive growth. Predictions vary, but reports suggest the market size could reach tens of billions of dollars by 2025. Research firms like Gartner and IDC offer detailed quantum computing market growth projections, highlighting the immense potential of this emerging technology. The quantum computing industry forecast paints a picture of rapid expansion driven by increasing investment and technological advancements. Analyzing these quantum computing market size estimations is crucial for potential investors seeking to gauge the overall market opportunity.

Key Players and Their Technologies

While Rigetti is a notable player, the quantum computing landscape is crowded with significant companies employing diverse technological approaches. Leading quantum computing firms include:

- IBM: Focusing on superconducting technology, IBM boasts a strong track record in quantum computing research and development and offers cloud-based access to its quantum computers.

- Google: Also utilizing superconducting qubits, Google has achieved significant milestones in quantum supremacy.

- IonQ: Employs trapped ion technology, offering a different approach to qubit control and potentially higher stability.

- Microsoft: Pursues a topological qubit approach, aiming for greater stability and scalability.

- Honeywell: Utilizes trapped ion technology, emphasizing the potential for high-fidelity quantum computation.

These quantum computing companies are engaged in a competitive race, driving innovation and pushing the boundaries of what's possible. Significant partnerships and collaborations further fuel this rapid advancement, creating a dynamic and complex investment environment.

Analyzing Rigetti Computing (RGTI) Stock

Rigetti's Business Model and Technology

Rigetti Computing (RGTI) is a prominent player in the quantum computing space, known for its Rigetti quantum computing architecture based on superconducting qubits. Their business model centers on providing both hardware and software solutions, catering to both research institutions and commercial clients. They offer access to their quantum computers via the cloud, facilitating research and development for a broader range of users. Understanding Rigetti's business model is key to assessing its long-term prospects. Analyzing RGTI stock analysis reports can offer insights into the company's financial health and strategic direction.

RGTI Stock Performance and Valuation

Analyzing RGTI stock price and RGTI stock forecast is essential for potential investors. Past performance (if publicly traded) should be considered, but it's crucial to remember that the quantum computing sector is highly volatile. The Rigetti stock valuation depends on various factors, including technological advancements, market adoption, and overall investor sentiment.

- Key Financial Metrics: Investors should carefully review available financial metrics, including revenue, expenses, and any projected future earnings.

- Significant News and Announcements: Monitoring press releases, financial reports, and industry news is vital for understanding the impact of significant events on RGTI's stock price.

- Risks Associated with RGTI: Investing in RGTI carries considerable risk. Technological hurdles, competition, and the inherent volatility of the quantum computing market all contribute to potential losses.

Investing Strategies for Quantum Computing Stocks

Risk Assessment and Diversification

Investing in quantum computing represents a significant risk due to the nascent nature of the technology. The possibility of technological failures, slower-than-expected market adoption, or intense competition could lead to substantial losses. Quantum computing investment risk is high, making diversifying quantum computing portfolio a critical strategy.

Long-Term vs. Short-Term Investment Horizons

The quantum computing sector is a long-term play. While short-term volatility is expected, the true potential of the technology will likely only be realized over the next decade or more. Long-term quantum computing investment is generally advised over short-term quantum computing trading.

- Investment Approaches: Consider diversifying across multiple companies or investing in ETFs (Exchange Traded Funds) that offer exposure to the quantum computing sector.

- Due Diligence: Thorough research and due diligence are paramount before making any investment decisions. Understand the technology, the companies' business models, and the inherent risks involved.

- High Rewards, High Risks: Investing in quantum computing stocks carries the potential for significant returns, but equally significant losses are possible.

Future Outlook for Quantum Computing and its Investments

Technological Advancements and Their Impact

The future of quantum computing hinges on continued technological breakthroughs. Quantum computing advancements, such as increasing qubit count, improving qubit coherence times, and developing error correction techniques, will significantly impact the market. These advancements will directly influence the performance and valuation of quantum computing stocks.

Potential Applications and Market Disruption

The potential applications of quantum computing are vast, spanning numerous industries. Quantum computing applications in finance (e.g., risk management, portfolio optimization), medicine (e.g., drug discovery, personalized medicine), and materials science (e.g., designing new materials) are particularly promising. Quantum computing disruption has the potential to reshape entire industries, creating new markets and opportunities.

- Industries Impacted: Finance, pharmaceuticals, materials science, energy, and logistics are just a few sectors poised for significant transformation.

- Job Creation and Economic Growth: The quantum computing revolution is likely to generate substantial job creation and contribute to significant economic growth.

- Ethical Considerations: As quantum computing develops, it's crucial to consider the ethical implications, ensuring responsible development and deployment.

Navigating the Quantum Leap: Your Guide to Investing in Quantum Computing Stocks

Investing in quantum computing stocks presents a high-risk, high-reward opportunity. While the potential for long-term growth is significant, thorough research, diversification, and a long-term investment horizon are crucial. Remember that the field is still developing, and significant setbacks are possible. This article has provided an overview of the market, key players like Rigetti (RGTI), and some investment strategies. However, before making any investment decisions, conduct your own in-depth research and consider seeking advice from a qualified financial advisor. Start exploring the potential of investing in quantum computing stocks today, but proceed cautiously and with a well-defined investment strategy.

Featured Posts

-

Angely I Restorany Biznes Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025

Angely I Restorany Biznes Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025 -

Manchester Uniteds Rashford Shines Aston Villa Defeated In Fa Cup

May 20, 2025

Manchester Uniteds Rashford Shines Aston Villa Defeated In Fa Cup

May 20, 2025 -

Dzhennifer Lourens Ta Yiyi Druga Ditina Scho Vidomo Pro Popovnennya V Sim Yi

May 20, 2025

Dzhennifer Lourens Ta Yiyi Druga Ditina Scho Vidomo Pro Popovnennya V Sim Yi

May 20, 2025 -

Escola Da Tijuca Em Chamas Impacto Do Incendio Em Pais E Alunos

May 20, 2025

Escola Da Tijuca Em Chamas Impacto Do Incendio Em Pais E Alunos

May 20, 2025 -

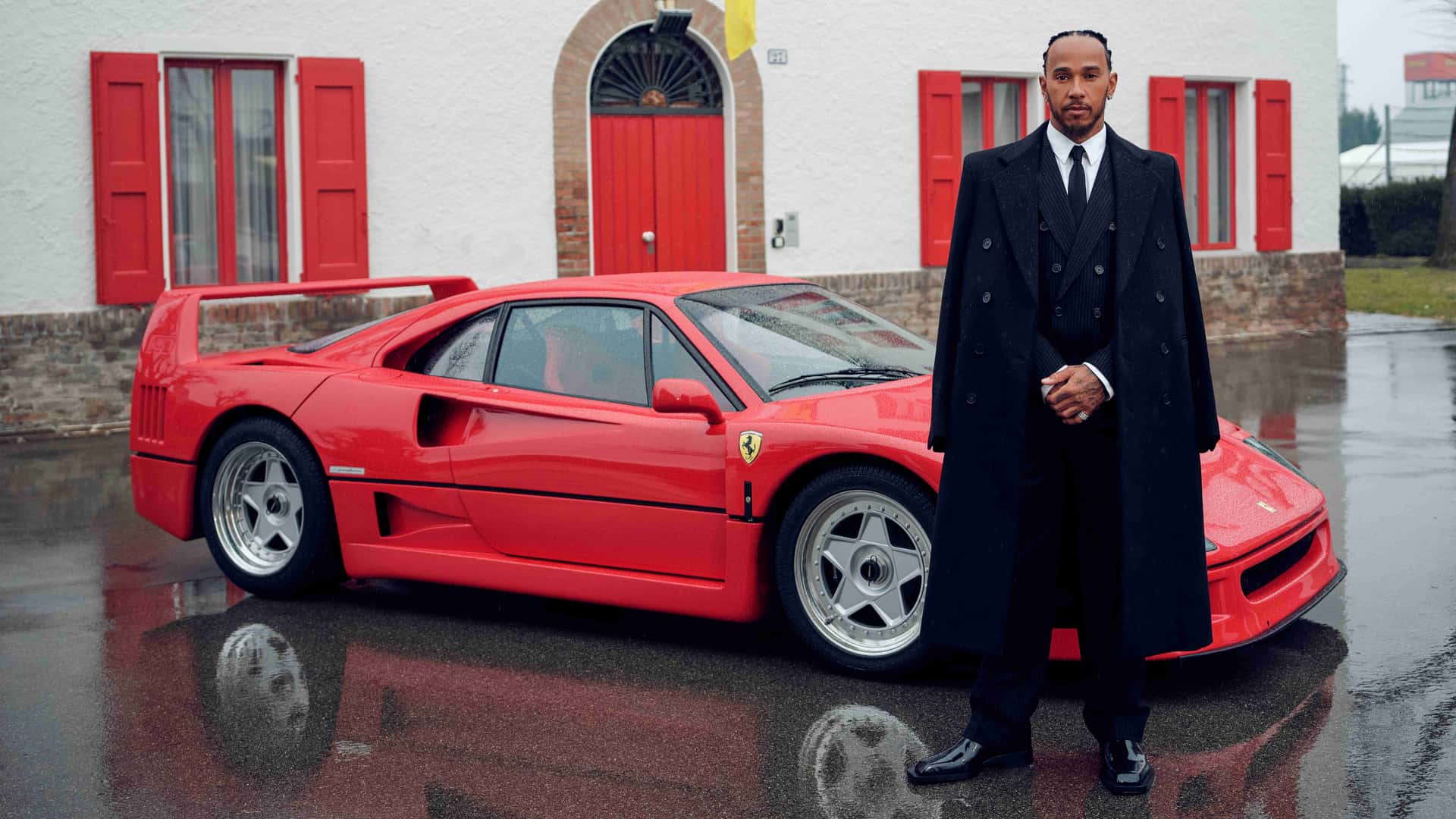

Hamilton Ve Leclerc In Diskalifikasyonu Ferrari Icin Bueyuek Darbe

May 20, 2025

Hamilton Ve Leclerc In Diskalifikasyonu Ferrari Icin Bueyuek Darbe

May 20, 2025