Investing In Ripple (XRP) In 2024: A Realistic Path To Wealth?

Table of Contents

Understanding Ripple (XRP) and its Technology

What is XRP?

XRP is the native cryptocurrency of Ripple, a technology company focused on providing solutions for global financial transactions. Unlike Bitcoin, which uses a proof-of-work consensus mechanism, XRP operates on a unique consensus mechanism designed for speed and efficiency. XRP facilitates faster and cheaper cross-border payments through RippleNet, a network used by financial institutions worldwide. Its speed, typically settling transactions in a matter of seconds, and low transaction fees make it a potentially attractive alternative to traditional banking systems.

RippleNet's Adoption and Global Reach

RippleNet's adoption is steadily increasing, with numerous financial institutions leveraging its technology for faster and more cost-effective cross-border payments. This growing adoption directly impacts XRP's value, as increased demand for transactions on the network often correlates with higher XRP prices. Key partnerships and implementations include:

- Major banks: Several major banks, including Santander and SBI Holdings, utilize RippleNet for their international payment operations.

- Payment providers: Many payment providers are integrating XRP into their platforms to streamline transactions.

- Expanding global reach: RippleNet's global presence continues to expand, covering various regions and markets.

The widespread adoption of RippleNet contributes significantly to the potential for long-term XRP growth, making it an attractive asset for some investors.

The SEC Lawsuit and its Impact

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and market sentiment. The SEC alleges that XRP is an unregistered security, a claim Ripple contests. The outcome of this legal battle is uncertain but could drastically affect the future of XRP.

Potential scenarios and their impact on XRP:

- Positive Outcome (Ripple wins): A favorable ruling could lead to a surge in XRP's price, as it would remove a major regulatory uncertainty.

- Negative Outcome (SEC wins): An unfavorable ruling could severely depress XRP's price and potentially lead to delisting from some exchanges.

Understanding the arguments from both sides is crucial for assessing the risks involved in XRP investment. The SEC's argument centers on the distribution and sale of XRP, claiming it resembles a security offering. Ripple's defense focuses on XRP's utility as a digital asset facilitating transactions on the RippleNet platform.

Analyzing the Ripple (XRP) Market in 2024

Price Prediction and Market Analysis

Predicting the price of XRP in 2024 is inherently speculative. While some analysts offer price predictions, it's crucial to remember that the cryptocurrency market is exceptionally volatile, influenced by numerous factors. These include:

- Adoption rates: Widespread adoption of RippleNet by financial institutions.

- Regulatory developments: The outcome of the SEC lawsuit and other regulatory changes.

- Overall market sentiment: The general mood and investor confidence in the cryptocurrency market.

It's vital to rely on multiple sources and conduct thorough research before making any investment decisions.

Risk Assessment and Diversification

Investing in XRP carries considerable risk. Cryptocurrency prices are highly volatile and can experience significant swings in short periods. It's crucial to:

- Understand your risk tolerance: Only invest money you can afford to lose.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversify your investments across different assets to mitigate risk.

Potential risks associated with XRP investment:

- Price volatility: XRP's price can fluctuate dramatically.

- Regulatory uncertainty: The outcome of the SEC lawsuit remains unknown.

- Market manipulation: The cryptocurrency market is susceptible to manipulation.

- Security risks: Holding XRP on exchanges carries security risks.

Technical Analysis of XRP

While technical analysis (chart patterns, support/resistance levels, trading volume) can offer insights, it's crucial to remember that it's not a foolproof prediction tool and should not be the sole basis for investment decisions. This section serves only as an introductory note and should not be considered financial advice.

Strategies for Investing in Ripple (XRP)

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a risk-mitigation strategy where you invest a fixed amount of money at regular intervals, regardless of the price. This reduces the impact of price volatility.

Setting Realistic Investment Goals

Set realistic, achievable investment goals. Avoid get-rich-quick schemes and focus on long-term growth potential.

Choosing the Right Exchange

Choosing a reputable cryptocurrency exchange is crucial. Consider factors like:

- Security: Prioritize exchanges with strong security measures.

- Fees: Compare transaction fees and withdrawal fees.

- User experience: Choose an exchange with a user-friendly interface.

Conclusion

Investing in Ripple (XRP) in 2024 presents both potential rewards and significant risks. The technology behind XRP is innovative, and the adoption of RippleNet is growing. However, the SEC lawsuit and inherent volatility of the cryptocurrency market remain major considerations. This article highlights the importance of thorough research, risk management, and diversification when considering XRP investment. Investing in Ripple (XRP) in 2024 offers potential rewards but carries significant risks. Conduct thorough research, understand the inherent volatility, and only invest what you can afford to lose. Learn more about XRP investment strategies and make informed decisions for your financial future.

Featured Posts

-

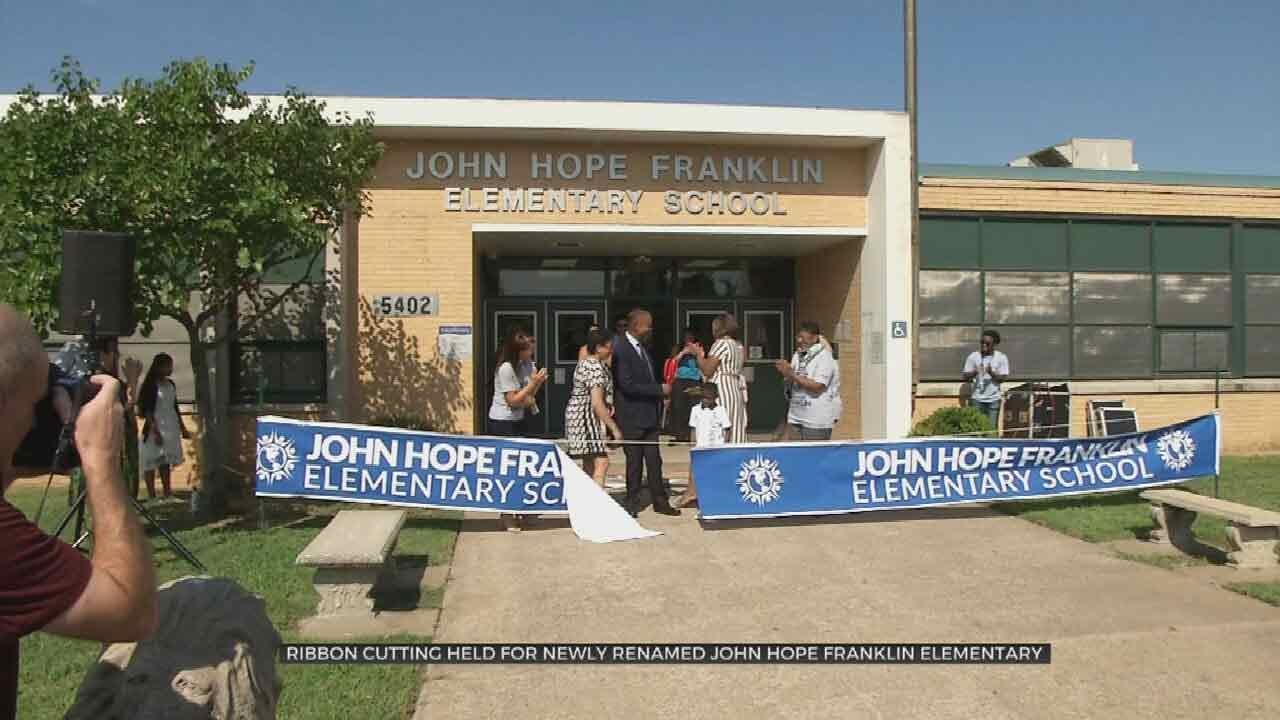

No School Wednesday Tulsa Public Schools Weather Closure

May 02, 2025

No School Wednesday Tulsa Public Schools Weather Closure

May 02, 2025 -

The Negative Impact Of School Suspensions Evidence And Alternatives

May 02, 2025

The Negative Impact Of School Suspensions Evidence And Alternatives

May 02, 2025 -

Russell T Davies On Doctor Who Seasons 4 And 5 Confirmed Following Hiatus Speculation

May 02, 2025

Russell T Davies On Doctor Who Seasons 4 And 5 Confirmed Following Hiatus Speculation

May 02, 2025 -

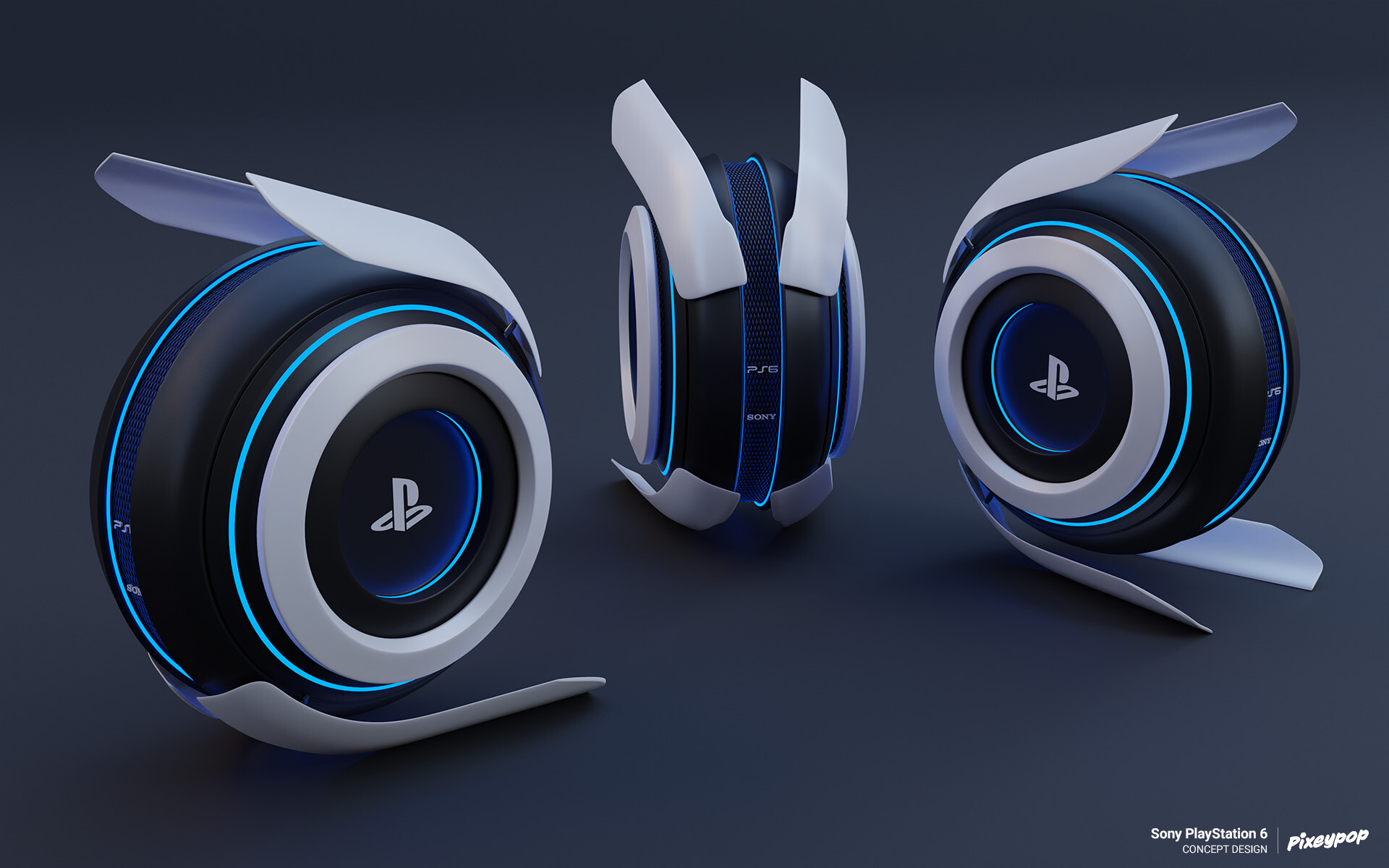

Aleab Blay Styshn 6 Almntzrt

May 02, 2025

Aleab Blay Styshn 6 Almntzrt

May 02, 2025 -

Mental Health Claim Rates High Costs And Stigma Limit Access

May 02, 2025

Mental Health Claim Rates High Costs And Stigma Limit Access

May 02, 2025