Investing In The Future Of Transportation: Uber's Autonomous Vehicle Potential And ETFs

Table of Contents

Uber's Autonomous Driving Technology and its Market Impact

Uber's Advanced Technologies Group (ATG) is at the forefront of autonomous vehicle development. Their research and development efforts, encompassing cutting-edge sensor technology, machine learning algorithms, and sophisticated mapping systems, are paving the way for a future where self-driving cars are commonplace. The successful deployment of Uber's autonomous fleet could dramatically impact the market.

- Cost Reduction: Automated driving could significantly lower operational costs for Uber, translating into cheaper rides for consumers and higher profit margins for the company.

- Efficiency Gains: Optimized routes and reduced idle time could lead to a more efficient use of resources and a greater number of rides per vehicle.

- Job Displacement: While creating new opportunities in software development and maintenance, the widespread adoption of AVs will undeniably displace human drivers, a crucial aspect to consider ethically and economically.

Uber ATG's progress is closely monitored, and partnerships with other autonomous vehicle technology providers are crucial to accelerating its development. The potential market share Uber could capture in the autonomous ride-sharing market is substantial, representing a significant driver of future growth.

Investing in Uber Directly: Stock Market Performance and Risks

Uber's stock performance is intrinsically linked to the success of its autonomous vehicle program. Positive advancements in ATG could translate into higher stock valuations, while setbacks could lead to significant price drops. However, investing directly in Uber stock carries inherent risks.

- Historical Stock Price Performance: Uber's stock has experienced volatility since its IPO, influenced by various factors including the overall market conditions and the company's financial performance.

- Regulatory Hurdles: Navigating the complex regulatory landscape surrounding autonomous vehicles poses a significant risk. Changes in regulations can impact the timeline for deployment and potentially the profitability of Uber's AV initiatives.

- Public Opinion: Public perception of autonomous vehicles and safety concerns can significantly impact Uber's stock price. Negative incidents involving self-driving cars can lead to investor apprehension. The potential for high rewards is accompanied by equally high risks.

Alternative Investment Strategies: Focusing on Autonomous Vehicle ETFs

Investing directly in individual companies like Uber carries inherent risk. A more diversified approach involves utilizing Exchange Traded Funds (ETFs) focused on the autonomous vehicle sector. ETFs offer several advantages:

- Diversification: ETFs spread investment across multiple companies involved in various aspects of the autonomous vehicle ecosystem, reducing the impact of any single company's underperformance.

- Lower Risk (relatively): This diversified approach inherently lowers the overall investment risk compared to focusing solely on a single company like Uber.

Several ETFs offer exposure to the autonomous vehicle market. (Note: Specific ETF tickers and performance data can change rapidly. Always perform your own thorough research before investing.) By comparing the expense ratios, holdings, and historical performance of these ETFs, investors can choose the one that best aligns with their risk tolerance and investment goals. Analyzing the ETF's holdings allows investors to understand which companies within the autonomous driving technology space they are indirectly investing in.

The Future of Autonomous Vehicles and Investment Opportunities

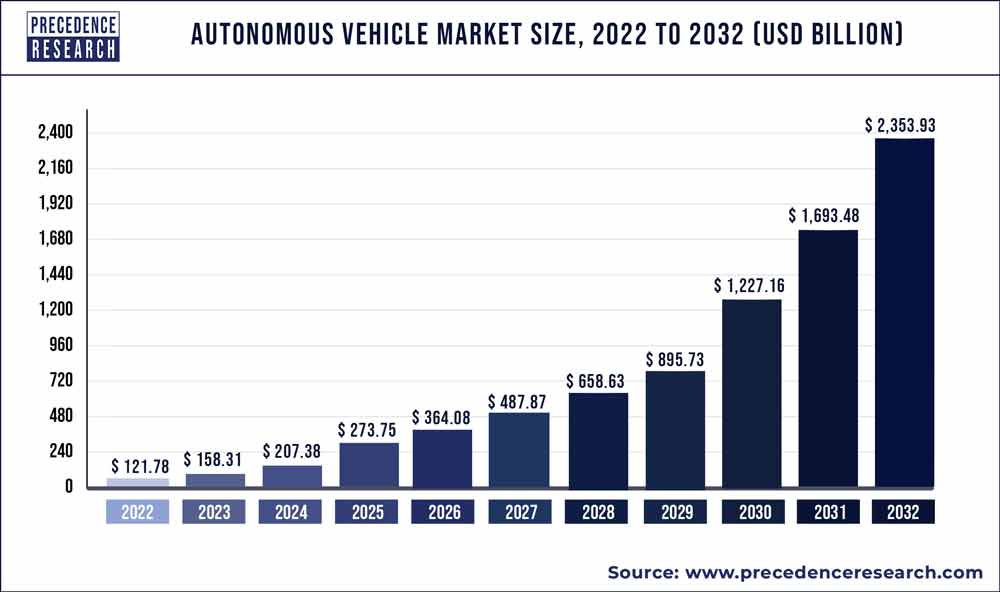

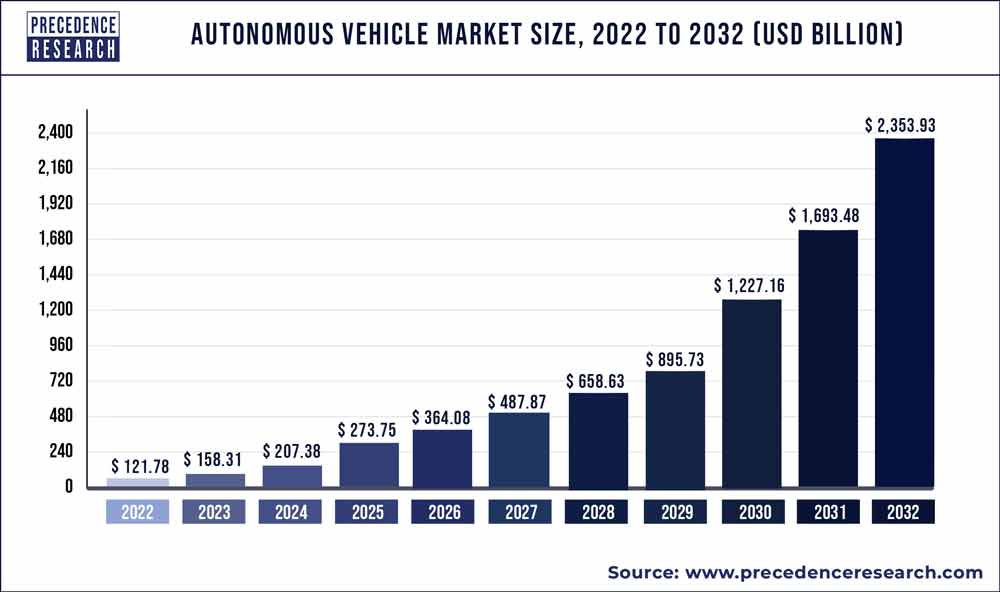

The long-term outlook for autonomous vehicles remains positive. Technological advancements, coupled with supportive regulatory environments and growing consumer acceptance, are expected to drive widespread adoption. This will create significant opportunities beyond ride-sharing.

- Timeline for Widespread Adoption: While predictions vary, experts anticipate significant market penetration within the next decade.

- Impact on Various Industries: Autonomous vehicles will revolutionize logistics, delivery services, and even public transportation.

- Emerging Technologies: Companies developing crucial components like sensors, AI software, and high-definition mapping systems will also benefit from this technological shift.

Driving Your Investment Portfolio Towards the Future: Uber's Autonomous Vehicle Potential and ETFs

Investing in the future of transportation, specifically in Uber's Autonomous Vehicle Potential and ETFs, presents both substantial opportunities and considerable risks. While direct investment in Uber offers high potential returns, it also carries significant volatility. Diversification through autonomous vehicle ETFs offers a potentially less risky approach, allowing investors to participate in this exciting sector while mitigating individual company-specific risks. Remember to conduct thorough due diligence before making any investment decisions. Start your research today and consider adding exposure to Uber's autonomous vehicle potential and ETFs to your investment portfolio.

Featured Posts

-

Iz Moskvy V Dubay Poisk Raboty I Adaptatsiya

May 17, 2025

Iz Moskvy V Dubay Poisk Raboty I Adaptatsiya

May 17, 2025 -

Dubay 2025 Stoit Li Rossiyanam Iskat Tam Rabotu

May 17, 2025

Dubay 2025 Stoit Li Rossiyanam Iskat Tam Rabotu

May 17, 2025 -

Nba Analyst Perkins Criticizes Jalen Brunsons Podcast

May 17, 2025

Nba Analyst Perkins Criticizes Jalen Brunsons Podcast

May 17, 2025 -

Florida School Shootings And Lockdowns A Multi Generational Perspective

May 17, 2025

Florida School Shootings And Lockdowns A Multi Generational Perspective

May 17, 2025 -

Unexpected Leader After A Difficult Opening Round At The Pga Championship

May 17, 2025

Unexpected Leader After A Difficult Opening Round At The Pga Championship

May 17, 2025

Latest Posts

-

Roma Monza Minuto A Minuto En Directo

May 17, 2025

Roma Monza Minuto A Minuto En Directo

May 17, 2025 -

Ver Crystal Palace Nottingham Forest Online Donde Y Como

May 17, 2025

Ver Crystal Palace Nottingham Forest Online Donde Y Como

May 17, 2025 -

Free Live Stream Ny Knicks Vs La Clippers Nba Game On March 26 2025

May 17, 2025

Free Live Stream Ny Knicks Vs La Clippers Nba Game On March 26 2025

May 17, 2025 -

Crystal Palace Nottingham Forest En Directo Alineaciones Y Previa

May 17, 2025

Crystal Palace Nottingham Forest En Directo Alineaciones Y Previa

May 17, 2025 -

How To Watch The Ny Knicks Vs La Clippers Nba Game Online On March 26 2025

May 17, 2025

How To Watch The Ny Knicks Vs La Clippers Nba Game Online On March 26 2025

May 17, 2025